At Davies Wealth Management, we understand that achieving financial success requires more than just basic money management skills.

Wealth coaching has emerged as a powerful tool for individuals seeking to maximize their financial potential and reach their long-term goals.

This personalized approach goes beyond traditional financial advising, offering a comprehensive strategy tailored to your unique circumstances and aspirations.

What Is Wealth Coaching?

The Essence of Wealth Coaching

Wealth coaching extends beyond traditional financial advising. It focuses on the holistic picture of a client’s financial life. Unlike traditional financial advising, which often emphasizes investment management and product recommendations, wealth coaching explores the client’s values, goals, and behaviors surrounding money. This approach allows for a more comprehensive understanding of the client’s financial situation and aspirations.

Beyond Traditional Financial Advising

Traditional financial advising typically involves recommending specific financial products or investment strategies. In contrast, wealth coaching incorporates elements of financial education, behavioral finance, and personal development. Wealth coaches work closely with their clients to identify and overcome limiting beliefs about money, develop healthy financial habits, and create a clear roadmap for achieving their financial goals.

Key Components of Effective Wealth Coaching

Effective wealth coaching comprises several important elements:

- Thorough Assessment: It starts with a comprehensive evaluation of the client’s current financial situation (including assets, liabilities, income, and expenses). This assessment forms the foundation for developing tailored strategies.

- Goal-Setting and Prioritization: Wealth coaches help clients articulate their short-term and long-term financial objectives. These might include buying a home, funding children’s education, or planning for retirement.

- Ongoing Education and Support: A critical aspect of wealth coaching is empowering clients with the knowledge and skills they need to make informed financial decisions. This might involve explaining complex financial concepts, discussing market trends, or providing guidance on tax-efficient strategies.

- Regular Review and Adjustment: As life circumstances change, so too should financial plans. Wealth coaches maintain open lines of communication with their clients, ensuring their financial strategies remain aligned with their evolving goals and circumstances.

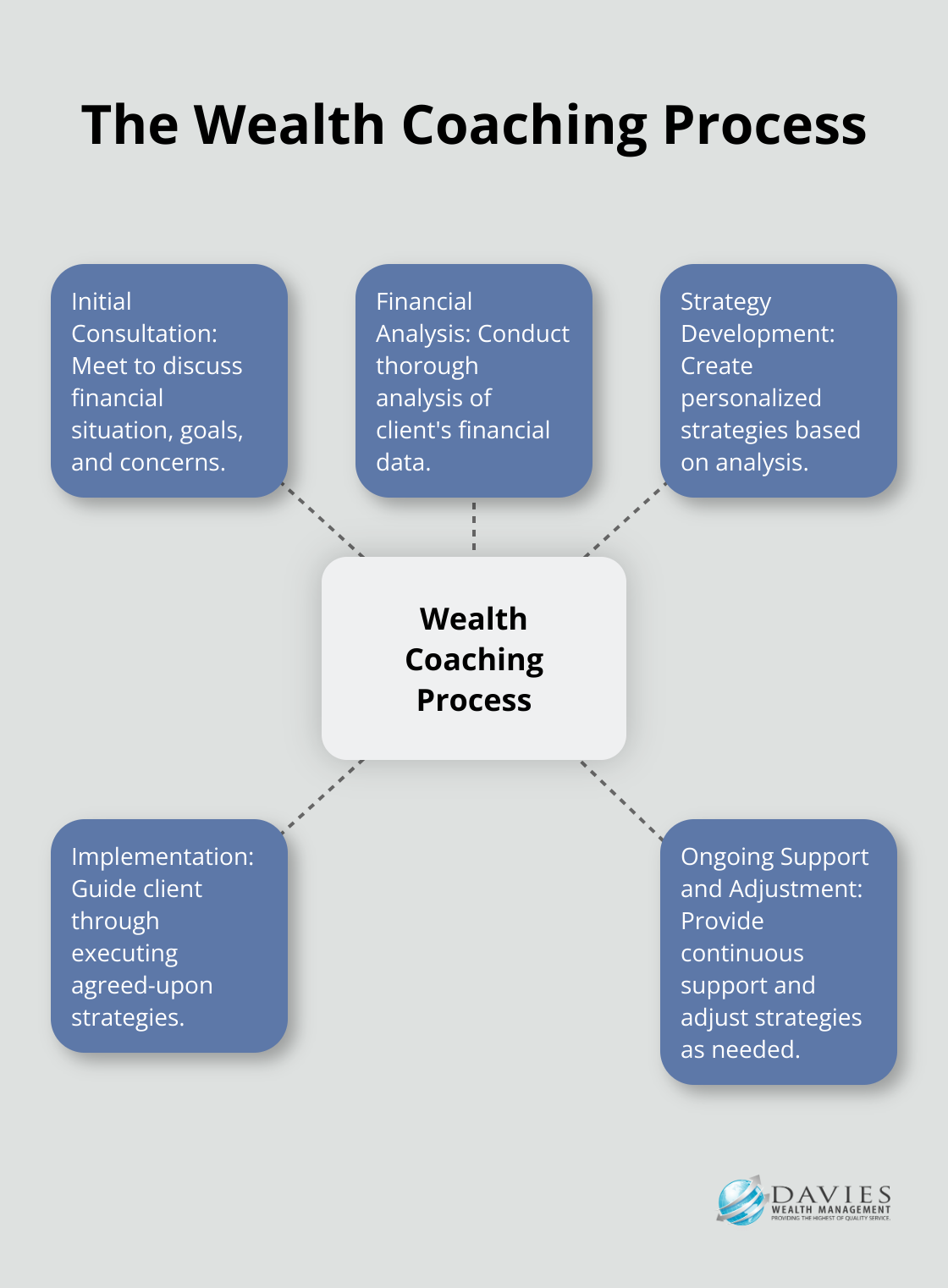

The Wealth Coaching Process

The wealth coaching process typically involves several stages:

- Initial Consultation: The coach and client meet to discuss the client’s financial situation, goals, and concerns.

- Financial Analysis: The coach conducts a thorough analysis of the client’s financial data.

- Strategy Development: Based on the analysis, the coach develops personalized strategies to help the client achieve their goals.

- Implementation: The coach guides the client through implementing the agreed-upon strategies.

- Ongoing Support and Adjustment: The coach provides continuous support and adjusts strategies as needed.

Wealth coaching offers a unique, personalized approach to financial management that can significantly impact a client’s financial success. In the next section, we’ll explore the specific benefits of working with a wealth coach and how this partnership can transform your financial future.

Why Work with a Wealth Coach?

Personalized Financial Strategies

At Davies Wealth Management, we recognize that each client has unique financial goals and circumstances. Wealth coaches don’t offer generic solutions. They create strategies that align perfectly with your specific objectives. For professional athletes (a key client group at Davies Wealth Management), a wealth coach considers factors like short career spans and potentially volatile income when developing financial plans.

Accountability and Goal Achievement

One of the most valuable aspects of working with a wealth coach is the accountability they provide. Setting financial goals is easy, but following through can be challenging. A study by the American Psychological Association found that people using willpower over external commitment strategies are perceived as more trustworthy. Your wealth coach acts as that commitment partner, keeping you motivated and on track towards your financial objectives.

Holistic Approach to Wealth Management

Wealth coaching takes a comprehensive view of your finances. It’s not just about investments or savings; it’s about how all aspects of your financial life interact. This approach ensures a thorough examination of your financial situation in pursuit of success. A wealth coach might help you balance your investment strategy with tax-efficient planning and estate considerations, creating a cohesive financial plan that addresses all areas of your wealth.

Improved Financial Decision-Making

Working with a wealth coach isn’t just about receiving advice; it’s about learning and growing. Over time, you’ll develop stronger financial decision-making skills. A survey by the National Financial Educators Council found that lacking financial literacy and not knowing how to manage personal finances carried a high cost in 2024. With a wealth coach, you gain the knowledge and confidence to make informed financial decisions (potentially saving you from costly mistakes and enhancing your overall financial well-being).

Long-Term Financial Success

Wealth coaches focus on long-term financial success rather than short-term gains. They help you create a sustainable financial plan that adapts to life changes and market fluctuations. This long-term perspective is particularly valuable for clients with complex financial situations, such as professional athletes or business owners.

As we move forward, let’s explore the specific strategies wealth coaches use to help their clients achieve financial success. These techniques form the backbone of effective wealth management and can significantly impact your financial future.

Effective Wealth Coaching Strategies

Goal Setting and Financial Prioritization

The foundation of effective wealth coaching rests on setting clear, achievable financial goals. We work closely with our clients to identify their short-term and long-term objectives, such as buying a home, funding education, or planning for retirement. A study by the Journal of Financial Planning revealed that individuals who set specific financial goals are more likely to achieve them, with goal-setters saving on average 20% more than non-goal setters.

We use the SMART framework (Specific, Measurable, Achievable, Relevant, Time-bound) to ensure goals are well-defined and actionable. For professional athlete clients, this might involve creating a plan to manage earnings during active career years while also preparing for life after sports.

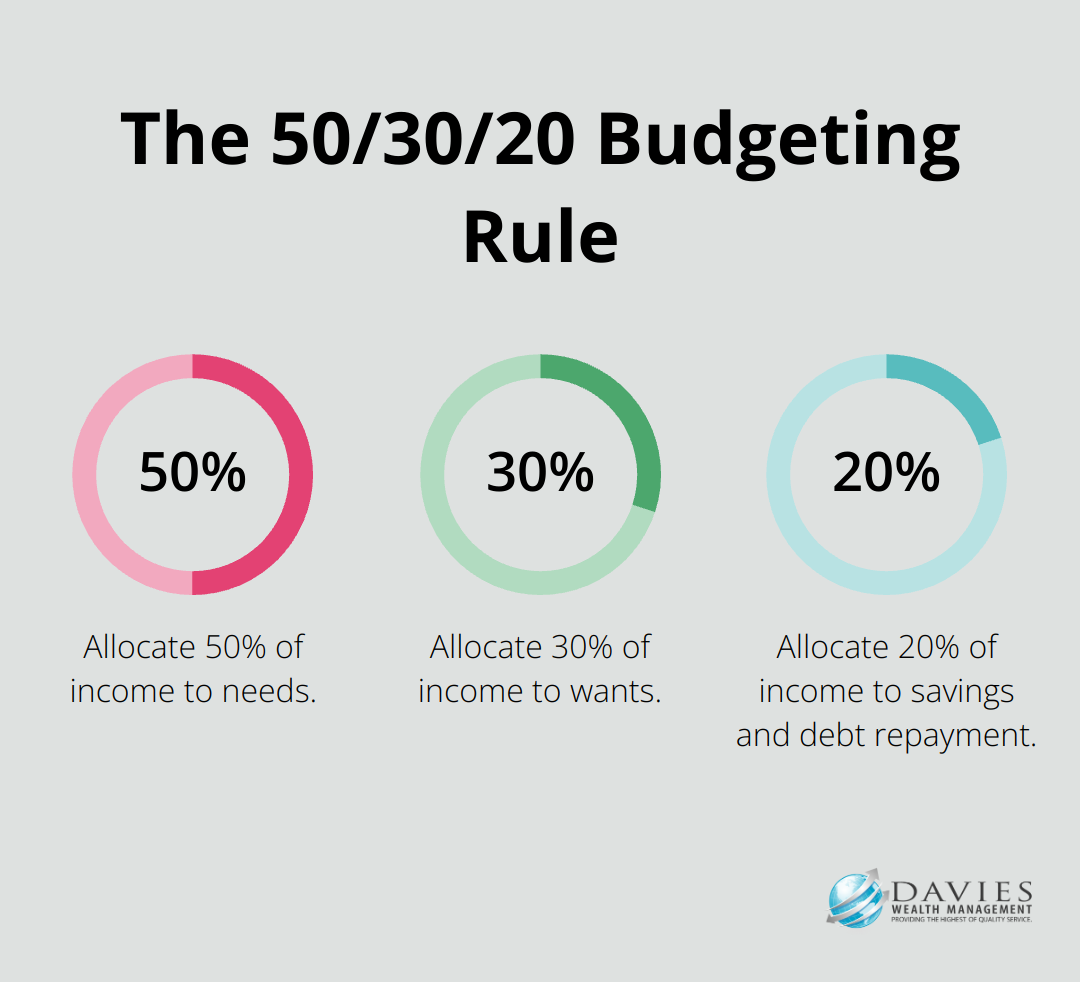

Cash Flow Management and Budgeting

Effective cash flow management plays a vital role in building and maintaining wealth. We help clients develop comprehensive budgets that align with their financial goals. This involves tracking income and expenses, identifying areas for potential savings, and creating strategies to increase cash flow.

For example, we might recommend the 50/30/20 budgeting rule (where 50% of income goes to needs, 30% to wants, and 20% to savings and debt repayment). However, we always tailor this approach to each client’s unique situation. For high-income earners like professional athletes, we might suggest a more aggressive savings rate to capitalize on their peak earning years.

Investment Planning and Risk Assessment

Investment planning forms a critical component of wealth coaching. We develop personalized investment strategies based on each client’s risk tolerance, time horizon, and financial goals. This involves diversifying portfolios across various asset classes to balance risk and potential returns.

A key aspect of our approach is regular risk assessment. We use sophisticated tools to analyze potential risks and adjust investment strategies accordingly. For instance, we might use Monte Carlo simulations to convert investment chances into choices by factoring in a range of values for various inputs, ensuring our clients’ investments remain resilient to market volatility.

Tax Optimization Strategies

Tax efficiency forms a crucial element of wealth accumulation and preservation. We implement various tax optimization strategies to help clients keep more of what they earn. This might include maximizing contributions to tax-advantaged accounts (like 401(k)s and IRAs), utilizing tax-loss harvesting in investment portfolios, or structuring income in tax-efficient ways.

For professional athlete clients, we might recommend strategies like setting up charitable foundations or utilizing deferred compensation plans to manage their tax liabilities effectively.

Estate Planning and Wealth Transfer

We focus on estate planning and wealth transfer strategies to ensure our clients’ assets are protected and distributed according to their wishes. This involves creating comprehensive estate plans, including wills, trusts, and power of attorney documents.

We also help clients navigate complex wealth transfer strategies, such as gifting strategies to minimize estate taxes or setting up family limited partnerships for business owners. For high-net-worth individuals, we might recommend advanced techniques like grantor retained annuity trusts (GRATs) or intentionally defective grantor trusts (IDGTs) to transfer wealth tax-efficiently.

Final Thoughts

Wealth coaching empowers individuals to achieve their financial goals and secure long-term success. It provides personalized strategies, accountability, and a holistic approach to wealth management. Clients learn to make informed decisions and navigate complex financial landscapes with confidence.

The benefits of wealth coaching extend beyond simple financial advice. These professionals offer tailored solutions that address unique circumstances, whether for professional athletes managing short-term careers or individuals planning for retirement. They provide knowledge and support to optimize cash flow, make smart investments, minimize taxes, and protect estates for future generations.

At Davies Wealth Management, we specialize in comprehensive wealth coaching services tailored to individual needs. Our team understands the unique challenges faced by various client groups (including professional athletes) and commits to helping you achieve your financial goals. If you want to take control of your financial future, consider exploring the wealth coaching services offered by Davies Wealth Management.

Leave a Reply