At Davies Wealth Management, we’ve seen firsthand how a sudden influx of money can profoundly impact a person’s psychological well-being.

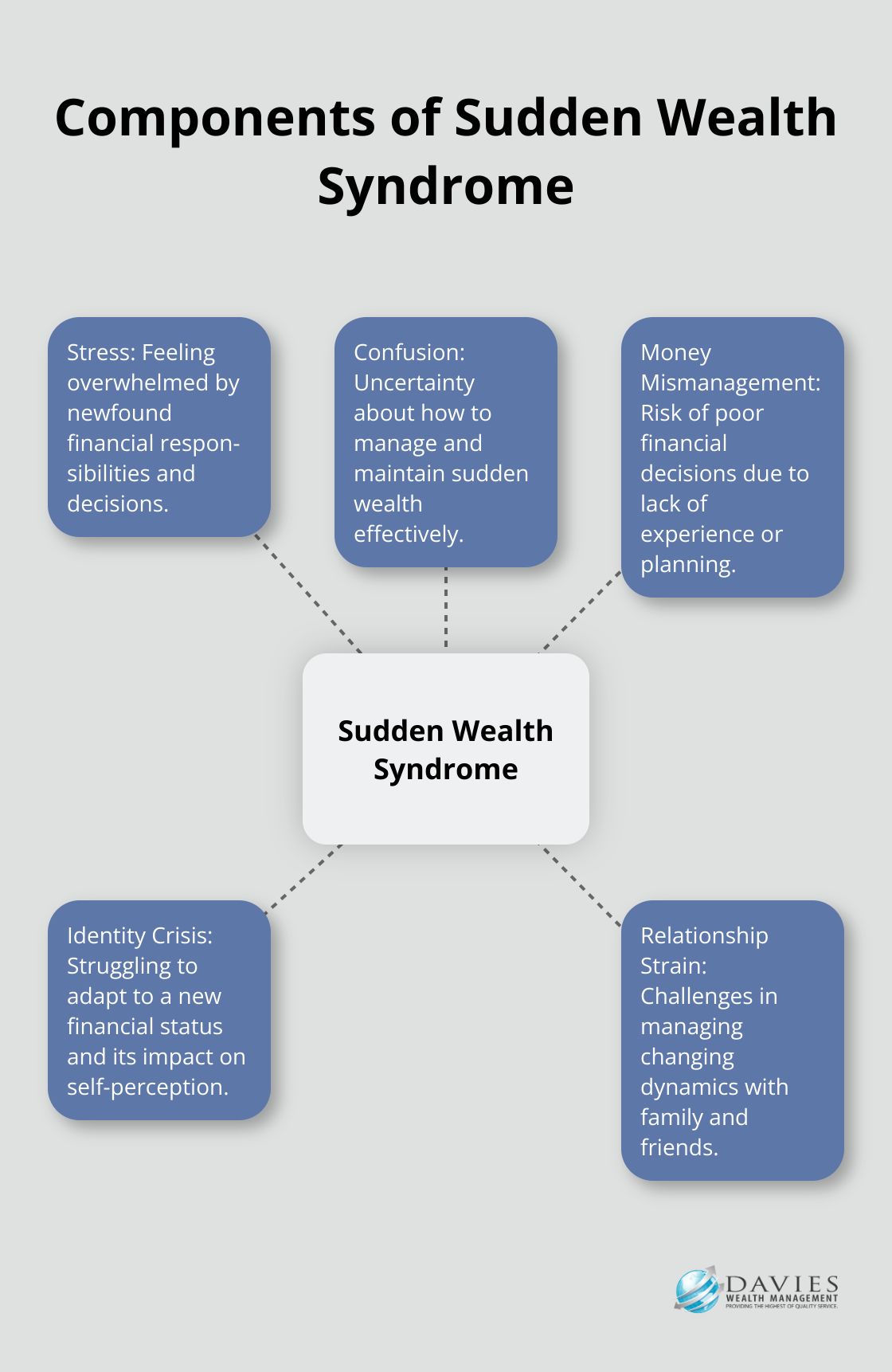

The phenomenon known as Sudden Wealth Syndrome can trigger a range of emotional and behavioral responses, often catching recipients off guard.

Understanding these challenges is crucial for navigating the complex landscape of newfound wealth.

In this post, we’ll explore the psychological effects of sudden wealth acquisition and offer strategies for maintaining wealth mindfulness during this transformative period.

What Is Sudden Wealth Syndrome?

Definition and Causes

Sudden Wealth Syndrome (SWS) is a psychological condition that affects individuals who experience a rapid and significant increase in their financial status. This phenomenon occurs in various scenarios, including lottery wins, inheritances, business sales, and even among professional athletes who sign lucrative contracts.

The Emotional Rollercoaster

The initial euphoria of newfound wealth often transforms into a complex mix of emotions. Many individuals report feeling overwhelmed, anxious, and even guilty about their sudden financial windfall. This statistic highlights the importance of understanding and managing the psychological impact of sudden wealth.

Behavioral Changes and Decision-Making Challenges

One of the most noticeable effects of SWS is the impact on decision-making abilities. Many individuals struggle with “analysis paralysis,” unable to make even simple financial choices due to the pressure of managing their new wealth. This paralysis can lead to missed opportunities or, conversely, impulsive spending decisions.

Some individuals may also experience a shift in their social dynamics. They might become overly suspicious of others’ intentions or isolate themselves from friends and family. These behavioral changes can strain relationships and contribute to feelings of loneliness and depression.

Long-Term Mental Health Implications

The long-term effects of SWS on mental health can be significant if not addressed properly. Research suggests that there is a steady association between larger incomes and greater happiness for most people, but this relationship plateaus at higher income levels.

Strategies for Coping

To navigate these psychological challenges, working with a financial therapist or counselor who specializes in wealth-related issues is recommended. These professionals can provide valuable support in maintaining emotional well-being while adapting to new financial circumstances.

Engaging in purposeful activities and maintaining a sense of identity beyond wealth is also important. Philanthropy, for example, can be a powerful tool for finding meaning and connection while managing substantial assets.

Understanding Sudden Wealth Syndrome is essential for anyone experiencing a rapid increase in wealth. Recognizing the emotional and behavioral symptoms early allows individuals to take proactive steps to protect their mental health and make sound financial decisions. The next section will explore the specific challenges faced by sudden wealth recipients and how to address them effectively.

Navigating the Maze of Sudden Wealth

The Identity Conundrum

Sudden wealth can impose a sense of responsibility, purpose and carefulness, and these individuals struggle least with the transition. People who experience sudden wealth often face challenges in adapting to their new financial situation. When financial constraints disappear overnight, many individuals question their purpose and place in the world.

This identity crisis frequently manifests as a loss of motivation or direction. Without the need to work for financial stability, some struggle to find meaning in their daily activities. To combat this, we recommend clients engage in purposeful goal-setting exercises, focusing on personal growth and community involvement rather than solely financial objectives.

Relationship Strain and Social Dynamics

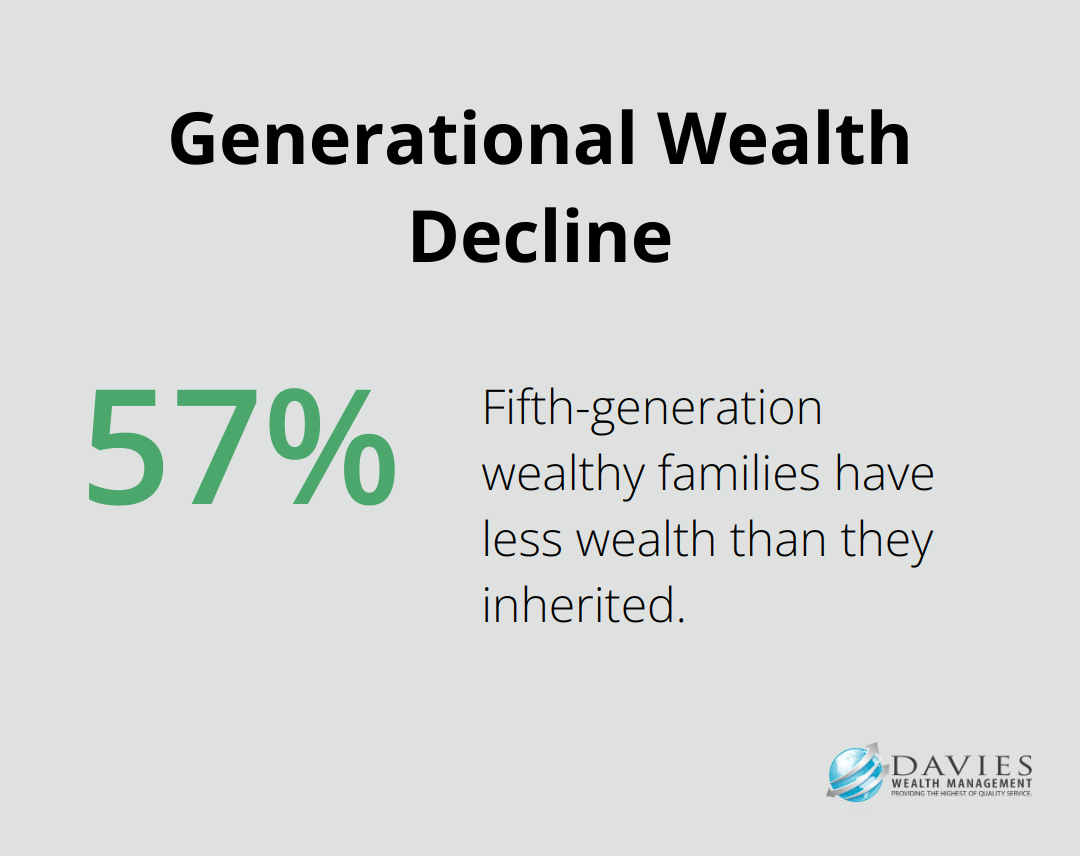

Sudden wealth acts as a magnifying glass on existing relationships, often exacerbating tensions and creating new conflicts. A study found that in the majority of cases (57%), the fifth generation of wealthy families had less wealth than they inherited and had a -2000% average accumulated return.

Newfound wealth can lead to expectations of financial support from family and friends, creating uncomfortable dynamics and strained relationships. To mitigate these issues, we advise clients to establish clear boundaries and communicate openly about their financial decisions. Some find it helpful to work with a family wealth counselor to navigate these delicate conversations.

Decision Paralysis in Financial Management

The sheer magnitude of sudden wealth can overwhelm even the most financially savvy individuals. “Sudden wealth syndrome” describes the stress, confusion, and often money mismanagement that can accompany a large windfall. This underscores the critical need for sound financial decision-making.

Many initially struggle with “decision paralysis” – the inability to make financial choices due to fear of making mistakes. To combat this, we recommend a structured approach to financial planning, breaking down large decisions into smaller, manageable steps. This method helps clients build confidence in their financial decision-making abilities over time.

Professional Guidance: A Beacon in the Storm

Seeking professional guidance early in the wealth acquisition process proves invaluable. Expert financial advisors (such as those at Davies Wealth Management) provide the necessary support and knowledge to navigate complex financial landscapes. Their expertise ensures that sudden wealth becomes a lasting asset rather than a fleeting windfall.

As we move forward, let’s explore effective strategies for coping with sudden wealth and maintaining financial and emotional well-being in the face of these challenges.

How to Thrive with Sudden Wealth

Build Your Financial Dream Team

The first step in managing sudden wealth involves assembling a team of trusted professionals. This team should include a certified financial planner (CFP), a tax professional, and an estate planning attorney. Athletes and high-profile individuals should also consider adding a publicist to manage media inquiries and public perception.

Working with a Certified Financial Planner offers numerous advantages, from personalized financial strategies to ethical and objective advice.

Embrace a Purpose-Driven Life

Maintaining a sense of purpose becomes essential when financial concerns no longer drive one’s actions. We encourage clients to explore new passions or deepen existing ones. This exploration might involve starting a business, pursuing further education, or engaging in philanthropy.

The Bill and Melinda Gates Foundation exemplifies purpose-driven wealth management. Their strategic approach to philanthropy has not only made a significant global impact but has also provided a sense of purpose and fulfillment for the founders.

Nurture Your Relationships

Sudden wealth can strain relationships, but it can also strengthen them with the right approach. We advise clients to communicate openly and honestly with loved ones about their financial situation. Setting clear boundaries and expectations early prevents misunderstandings and resentment later.

Establishing a family governance structure to manage wealth collectively can prove beneficial. This structure can include regular family meetings to discuss financial decisions and philanthropic efforts, fostering a sense of shared purpose and responsibility.

Invest in Financial Education

Financial literacy serves as the best defense against poor decision-making. We recommend clients dedicate time to understanding basic financial concepts, investment strategies, and market dynamics. This knowledge empowers them to make informed decisions and effectively communicate with their financial advisors.

Financial literacy can help individuals reach their goals by better understanding how to budget and save money, allowing them to create effective financial plans.

Practice Mindful Wealth Management

Mindfulness extends beyond meditation; it becomes a powerful tool in wealth management. We encourage clients to reflect regularly on their financial goals, spending habits, and the emotional impact of their wealth. This practice helps prevent impulsive decisions and maintains a healthy perspective on money.

A study published in the Journal of Financial Therapy found that individuals who practiced mindfulness reported lower levels of financial anxiety and higher levels of financial satisfaction.

Final Thoughts

Sudden wealth acquisition transforms lives, presenting both opportunities and challenges. The psychological impact often leads to emotional turmoil, strained relationships, and decision-making difficulties. Individuals who recognize the symptoms of Sudden Wealth Syndrome early can seek timely intervention and support, preventing long-term negative consequences on mental health and financial well-being.

Wealth mindfulness plays a vital role in maintaining a healthy perspective on finances. This approach, combined with ongoing financial education and a strong support network, sets the foundation for long-term financial success and emotional well-being. Addressing the psychological challenges of sudden wealth acquisition head-on yields significant long-term benefits, leading to better financial decision-making, stronger relationships, and a more fulfilling life overall.

Davies Wealth Management understands the complexities of sudden wealth acquisition, especially for professional athletes and high-net-worth individuals. Our team provides comprehensive wealth management solutions that address both the financial and psychological aspects of sudden wealth. We develop personalized strategies that align with our clients’ goals, helping them navigate their financial journey with confidence and peace of mind.

Leave a Reply