At Davies Wealth Management, we understand that every investor has a unique approach to risk. Risk profiling is a critical step in creating a successful investment strategy.

This process helps investors understand their risk tolerance and align their portfolios accordingly. In this post, we’ll explore the importance of accurate risk profiling and how it can shape your investment decisions.

What Is Risk Profiling?

Investment profile analysis forms the foundation of effective investment planning. It determines an investor’s ability and willingness to take on financial risk. This process shapes tailored investment strategies that align with each client’s unique financial situation and goals.

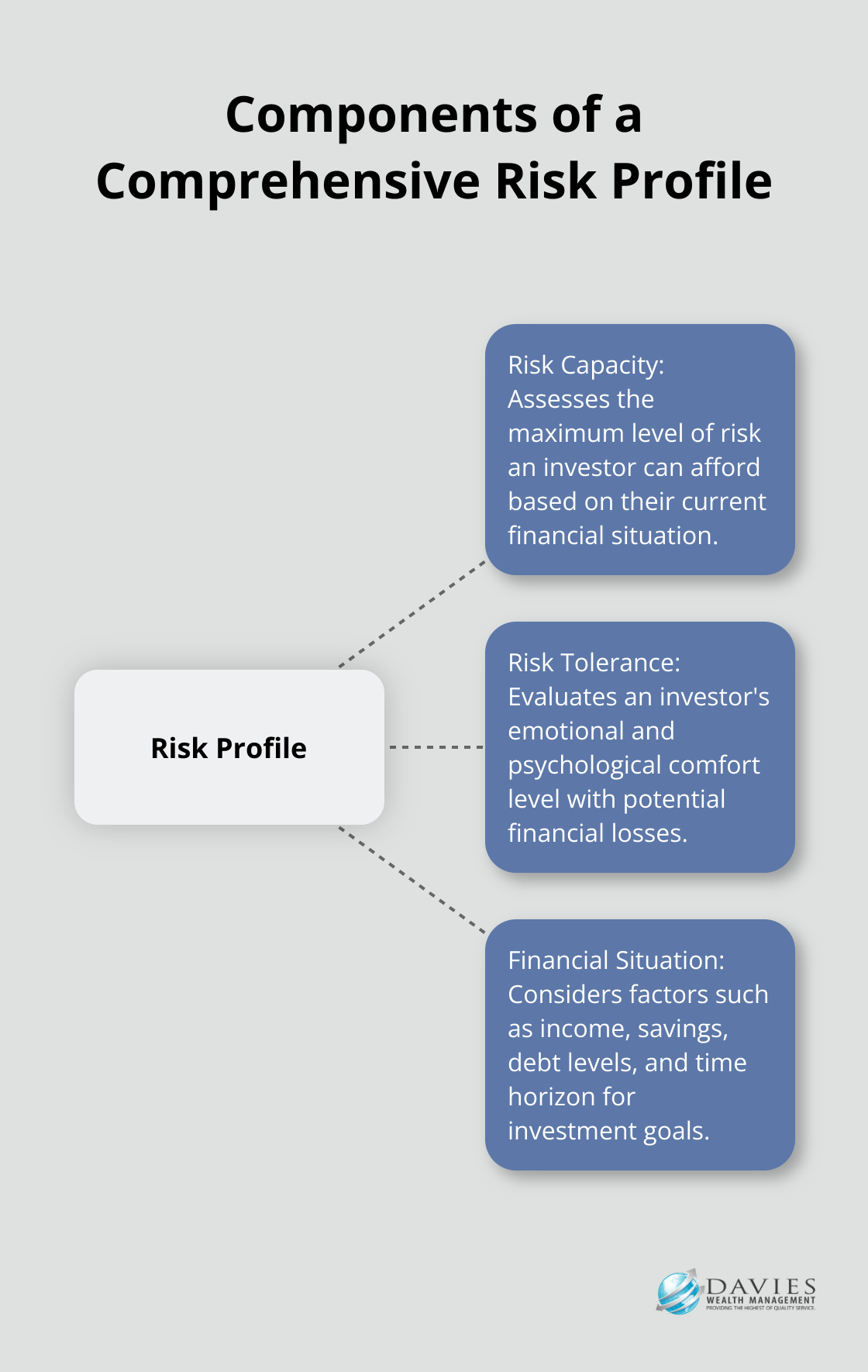

The Components of a Risk Profile

A comprehensive risk profile includes several key elements:

- Risk Capacity: This assesses the maximum level of risk an investor can afford based on their current financial situation. Factors include income, savings, debt levels, and time horizon for investment goals.

- Risk Tolerance: This evaluates an investor’s emotional and psychological comfort level with potential financial losses. A study by the CFA Institute revealed that many investors don’t fully understand the risks associated with their investments, highlighting the need for thorough risk tolerance assessment.

The Impact of Risk Profiling on Investment Decisions

Accurate risk profiling significantly affects investment outcomes. Research indicates that low-risk stocks have historically outperformed high-risk stocks, delivering better long-term returns with less volatility. This underscores the importance of precise risk profiling in investment strategy development.

Risk Profiling for Professional Athletes

Professional athletes require a nuanced approach to risk assessment. Their short career spans with high earnings potential add complexity to the process. Factors such as potential career-ending injuries, endorsement deals, and post-career financial needs must be considered when creating risk profiles for athlete clients.

The Dangers of Inaccurate Risk Profiling

Inaccurate risk profiling can lead to suboptimal investment decisions. Poor investment decisions can result in underperformance compared to market benchmarks.

Advanced risk profiling tools and techniques (including behavioral analysis and historical investment behavior assessment) help capture a complete picture of clients’ risk profiles. These methods, combined with traditional questionnaires, provide a robust foundation for creating effective investment strategies.

As we move forward, let’s explore the various methods used to determine risk tolerance, a critical component of the risk profiling process.

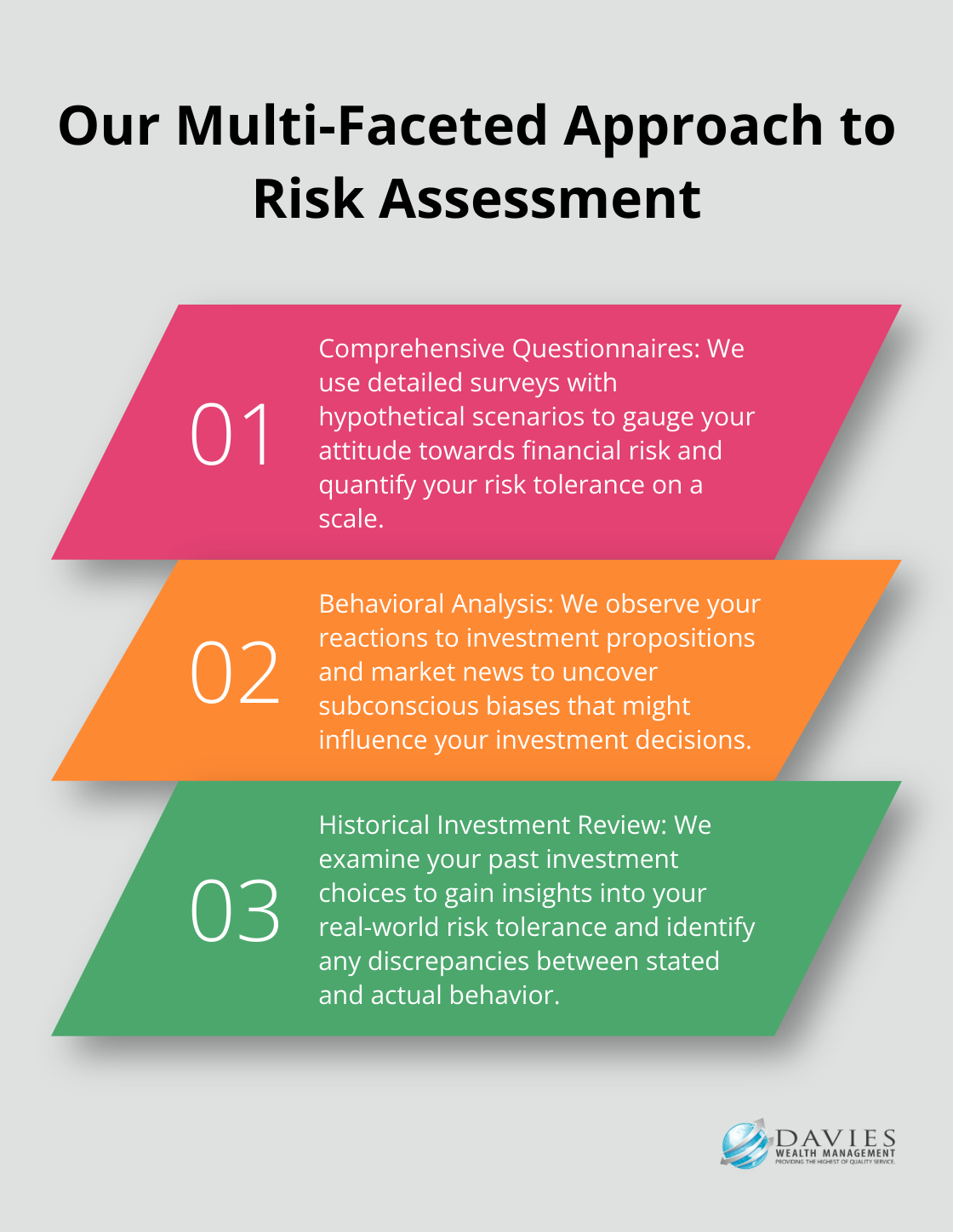

How We Assess Your Risk Tolerance

At Davies Wealth Management, we use a multi-faceted approach to determine your risk tolerance accurately. This process forms the foundation for developing an investment strategy that aligns with your financial goals and comfort level.

Comprehensive Questionnaires

We start with detailed questionnaires to gauge your attitude towards financial risk. These surveys extend beyond simple yes-or-no questions and include hypothetical scenarios to understand how you might react in various market conditions. For example, we might ask how you’d respond if your portfolio suddenly dropped 20% in value. Your answers help us quantify your risk tolerance on a scale, providing a baseline for further analysis.

Behavioral Analysis

Our next step involves behavioral analysis to uncover subconscious biases that might influence your investment decisions. We observe your reactions to different investment propositions and market news. By understanding how investors and markets behave, it may be possible to modify or adapt to these behaviors in order to improve economic outcomes. Investors often display inconsistencies between their stated risk tolerance and their actual behavior. By identifying these discrepancies, we can better tailor our advice to your true risk profile.

Historical Investment Review

We also examine your past investment choices (if available). This historical data provides valuable insights into your real-world risk tolerance. For instance, if you’ve consistently chosen conservative investments despite claiming a high risk tolerance, we’ll factor this into our assessment.

Professional Consultation

Lastly, we conduct in-depth consultations to discuss your financial goals, life circumstances, and any concerns you may have. This personal interaction allows us to capture nuances that might be missed in questionnaires or data analysis. For our professional athlete clients, these consultations are particularly important as we address unique factors such as career longevity and post-retirement planning.

The combination of these methods creates a comprehensive risk profile that serves as the foundation for your personalized investment strategy. Risk tolerance isn’t static – it can change with life events or market conditions. That’s why we regularly reassess your risk profile to ensure your investment strategy remains aligned with your current situation and goals.

As we move forward, we’ll explore how these risk profiles translate into concrete investment strategies, tailored to different levels of risk tolerance.

Tailoring Investment Strategies to Your Risk Profile

At Davies Wealth Management, we believe that successful investing requires alignment between your investment strategy and your unique risk profile. This approach ensures that your portfolio not only tries to meet your financial goals but also provides peace of mind.

Conservative Approaches for Risk-Averse Investors

For those with a low risk tolerance, we typically recommend a portfolio heavily weighted towards fixed-income securities. This might include a mix of high-quality corporate bonds, government securities, and municipal bonds. A conservative portfolio with 20% stocks and 80% bonds has historically provided relatively low volatility.

We also consider certificates of deposit (CDs) and money market accounts for our most conservative clients. These instruments offer lower returns but provide capital preservation and steady, predictable income. As of June 2025, some online banks offer CD rates as high as 4.5% for a 1-year term (an attractive option for risk-averse investors seeking stability).

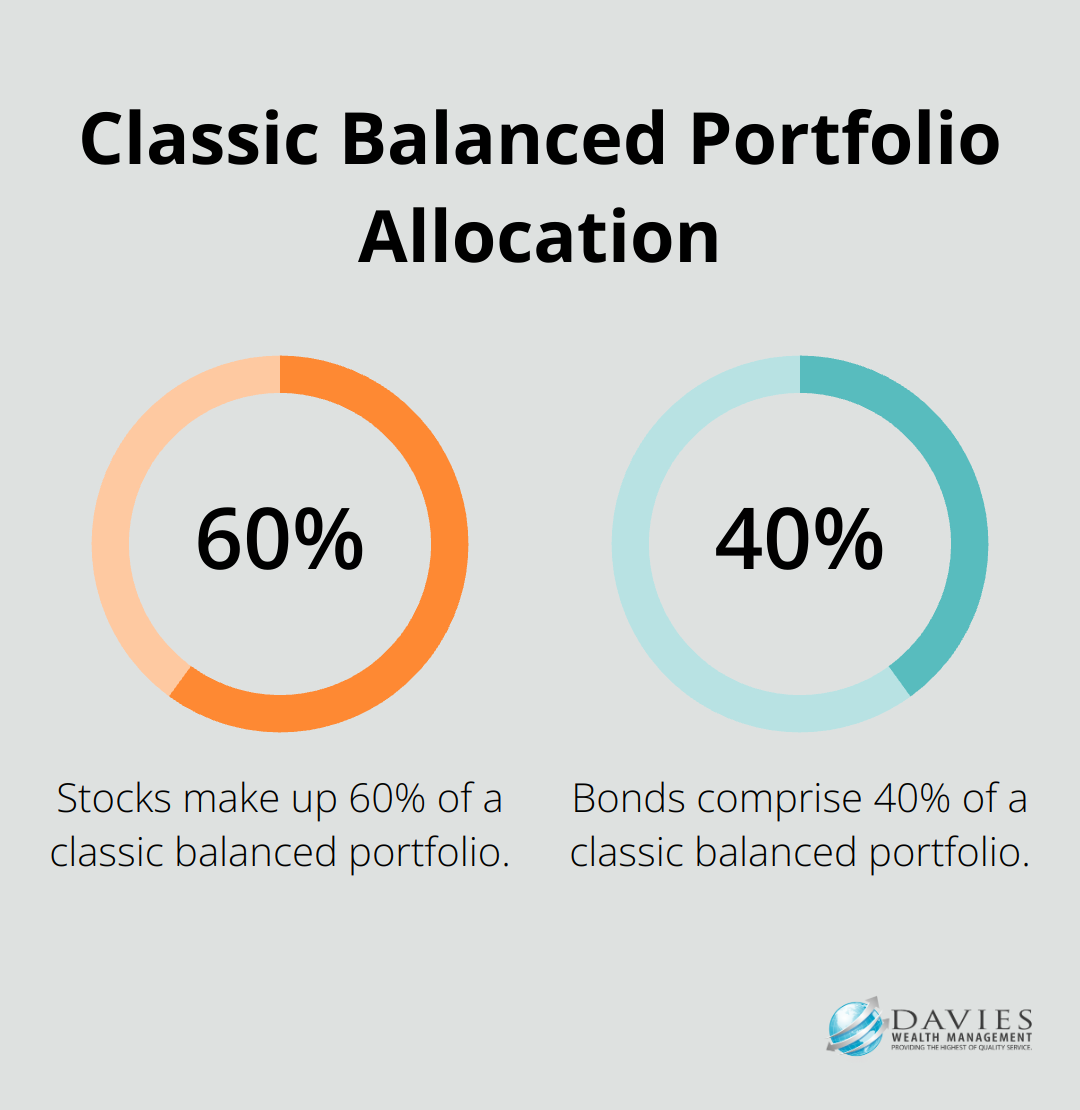

Balanced Strategies for Moderate Risk Takers

Investors with a moderate risk tolerance often benefit from a more balanced approach. A classic balanced portfolio might consist of 60% stocks and 40% bonds.

Since 1997, this allocation has provided an average annualized return of 6.8%, with the interquartile range of 10-year returns between 5.6% to 7.6%.

We often recommend a mix of large-cap, dividend-paying stocks for stability and growth potential, combined with a diversified bond portfolio. Exchange-traded funds (ETFs) can efficiently achieve this balance. For example, broad market ETFs provide exposure to the U.S. equity market, while bond ETFs offer diversified bond exposure.

Aggressive Tactics for High-Risk Tolerances

For clients with a high risk tolerance, we explore more aggressive investment strategies. This might include a higher allocation to stocks, potentially 80% or more of the portfolio. We may also consider small-cap stocks, emerging markets, and sector-specific investments that offer higher growth potential but come with increased volatility.

Alternative investments can also play a role in aggressive portfolios. For instance, real estate investment trusts (REITs) have historically provided strong returns and diversification benefits. The FTSE Nareit All Equity REITs Index has delivered an average annual total return of 10.5% over the past 25 years.

The Importance of Regular Portfolio Review

Regardless of your risk profile, regular portfolio review and rebalancing are essential. Market movements can shift your asset allocation away from your target, potentially exposing you to more or less risk than intended. We recommend reviewing your portfolio at least annually, or more frequently during periods of significant market volatility.

For example, if your target allocation is 60% stocks and 40% bonds, but after a strong year in the stock market your portfolio has shifted to 70% stocks and 30% bonds, we would recommend selling some stocks and buying bonds to return to your target allocation. This disciplined approach helps manage risk and can potentially improve long-term returns.

Final Thoughts

Risk profiling forms the foundation of successful investing. We at Davies Wealth Management have observed how accurate risk profiling transforms investment outcomes for our clients. Our thorough understanding of risk tolerance, financial goals, and unique circumstances allows us to create investment strategies that try to optimize returns and provide peace of mind.

Tailored investment strategies based on precise risk profiles offer numerous benefits. They prevent emotional decision-making during market volatility and ensure portfolio alignment with long-term objectives. For our professional athlete clients, this personalized approach addresses the specific challenges of their careers and financial situations.

Risk profiling requires regular updates as life changes and market conditions evolve. We encourage periodic reassessment of risk tolerance to adjust investment strategies accordingly. At Davies Wealth Management, we provide comprehensive wealth management solutions tailored to your unique risk profile (whether you’re a professional athlete, business owner, or individual investor).

Leave a Reply