At Davies Wealth Management, we understand that financial health is a cornerstone of overall well-being. The concept of wealth wellness extends far beyond mere numbers in a bank account.

In this post, we’ll explore the profound connection between your financial situation and personal health, examining how financial stress can impact various aspects of your life. We’ll also provide practical strategies to improve your financial health and, by extension, your overall wellness.

Understanding Financial Health

Defining Financial Well-being

Financial health extends beyond a simple bank balance. It represents a state of financial well-being that plays a significant role in influencing an individual’s overall well-being and satisfaction with life. Understanding your financial health forms the foundation for achieving overall wellness.

Key Indicators of Financial Health

Several metrics help assess your financial health:

- Debt-to-income ratio

- Emergency savings

- Retirement contributions

- Overall net worth

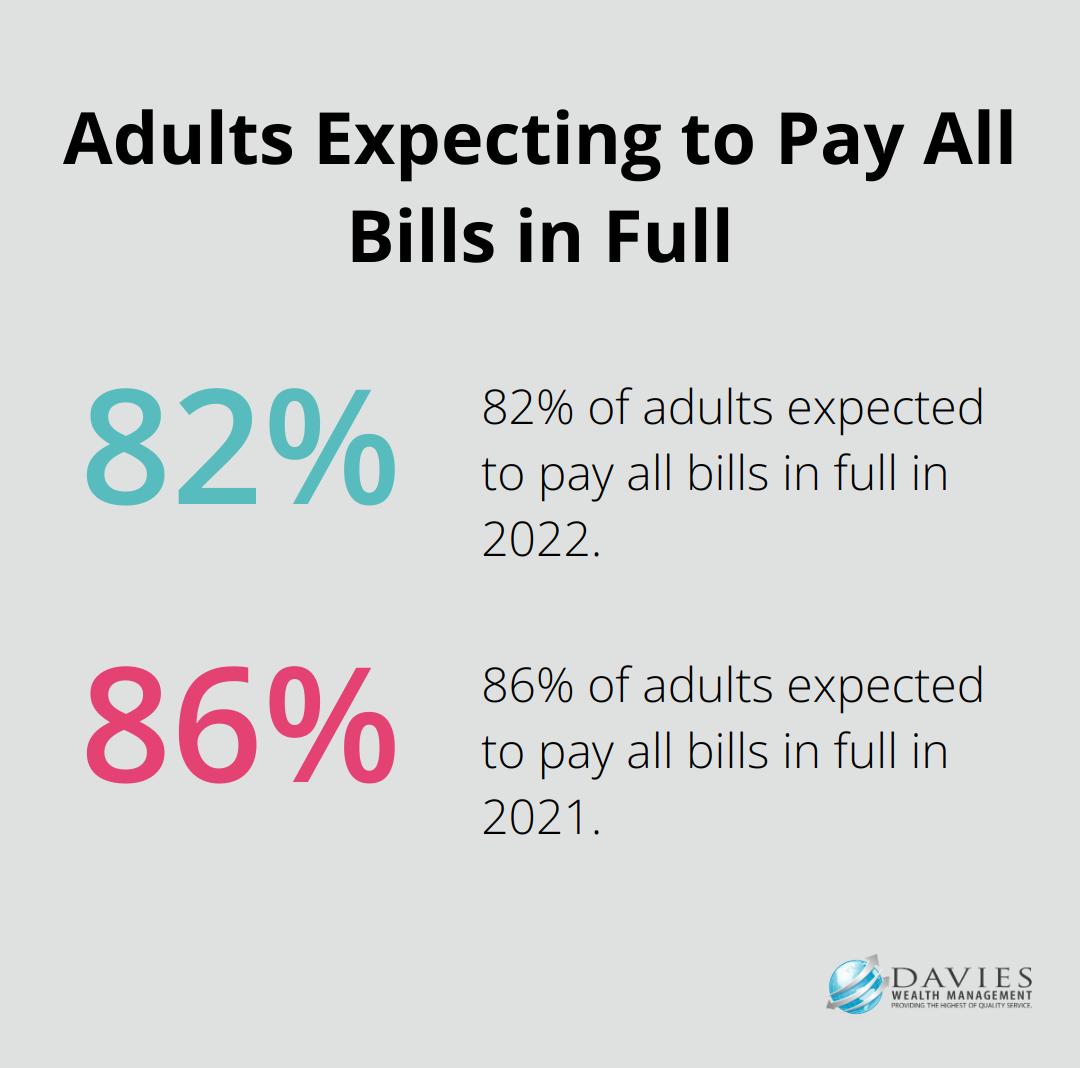

A 2022 Federal Reserve report revealed that 82 percent of adults said they expected to be able to pay all their bills in full that month-down 4 percentage points from the previous year. This statistic underscores the importance of maintaining a robust emergency fund as a cornerstone of financial health.

The Role of Income in Financial Well-being

While income contributes to financial health, it doesn’t solely determine it. A study by the Financial Health Network found that 17% of people earning over $100,000 annually still struggle financially. This finding highlights the importance of effective money management, regardless of income level.

Common Financial Stressors

Financial stress originates from various sources. A 2023 survey by the American Psychological Association revealed that money was one of the top significant sources of stress reported among the 18 to 34 age cohort (82%). Common stressors include:

- High levels of debt

- Inadequate savings

- Job insecurity: The fear of job loss or income reduction significantly impacts financial well-being.

- Healthcare costs

Understanding these stressors proves essential for developing strategies to improve your financial health. Financial advisors (like those at Davies Wealth Management) work with clients to address these concerns and create personalized plans for financial stability and growth.

As we move forward, we’ll explore how these financial stressors can impact various aspects of your personal well-being, from physical health to relationships and beyond.

How Financial Stress Impacts Your Life

The Physical Toll of Financial Worry

Financial stress can manifest in physical symptoms that affect your daily life. A study by the American Psychological Association found that 72% of Americans reported feeling stressed about money at least some of the time. This stress often leads to headaches, muscle tension, and digestive issues. More alarmingly, chronic financial stress can contribute to serious health problems such as high blood pressure, heart disease, and diabetes.

Research published in the American Heart Association journal Circulation revealed that the economic burden of cardiovascular risk factors and overt cardiovascular disease in the United States is projected to increase substantially in the coming years. This underscores the importance of managing your financial health to protect your physical well-being.

Mental Health and Financial Struggles

The impact of financial stress on mental health is profound and often overlooked. According to a survey by the Money and Mental Health Policy Institute, 72% of respondents said that their mental health problems had made their financial situation worse. This can create a vicious cycle where poor mental health leads to poor financial decisions, further exacerbating stress.

Anxiety and depression are common outcomes of financial stress. A report from the National Institute of Mental Health showed that individuals with significant debt were three times more likely to have a mental health problem compared to those without debt. This highlights the need for comprehensive financial planning that addresses both monetary goals and mental well-being.

Relationships Under Financial Strain

Financial stress doesn’t occur in a vacuum; it often spills over into our personal relationships. A study by the American Institute of CPAs found that 73% of married or cohabiting Americans say financial decisions are a source of tension in their relationships. This tension can lead to decreased communication, increased conflict, and in severe cases, the breakdown of relationships.

Moreover, financial stress can impact social interactions beyond intimate relationships. People experiencing financial difficulties may withdraw from social activities, leading to isolation and a lack of support when they need it most. This isolation can further compound mental health issues and make it harder to overcome financial challenges.

The Importance of Addressing Financial Stress

Addressing financial stress is not just about improving your bank balance-it’s about enhancing your overall quality of life. Working with a financial advisor (such as those at Davies Wealth Management) to create a solid financial plan can reduce stress, improve your physical and mental health, and strengthen your relationships.

The next chapter will explore practical strategies to improve your financial health and, consequently, your overall well-being. These strategies will provide you with actionable steps to take control of your finances and reduce the negative impacts of financial stress on your life.

How to Boost Your Financial Health

At Davies Wealth Management, we believe that improving your financial health requires dedication, strategy, and expert guidance. Here are practical steps you can take to enhance your financial well-being and, by extension, your overall quality of life.

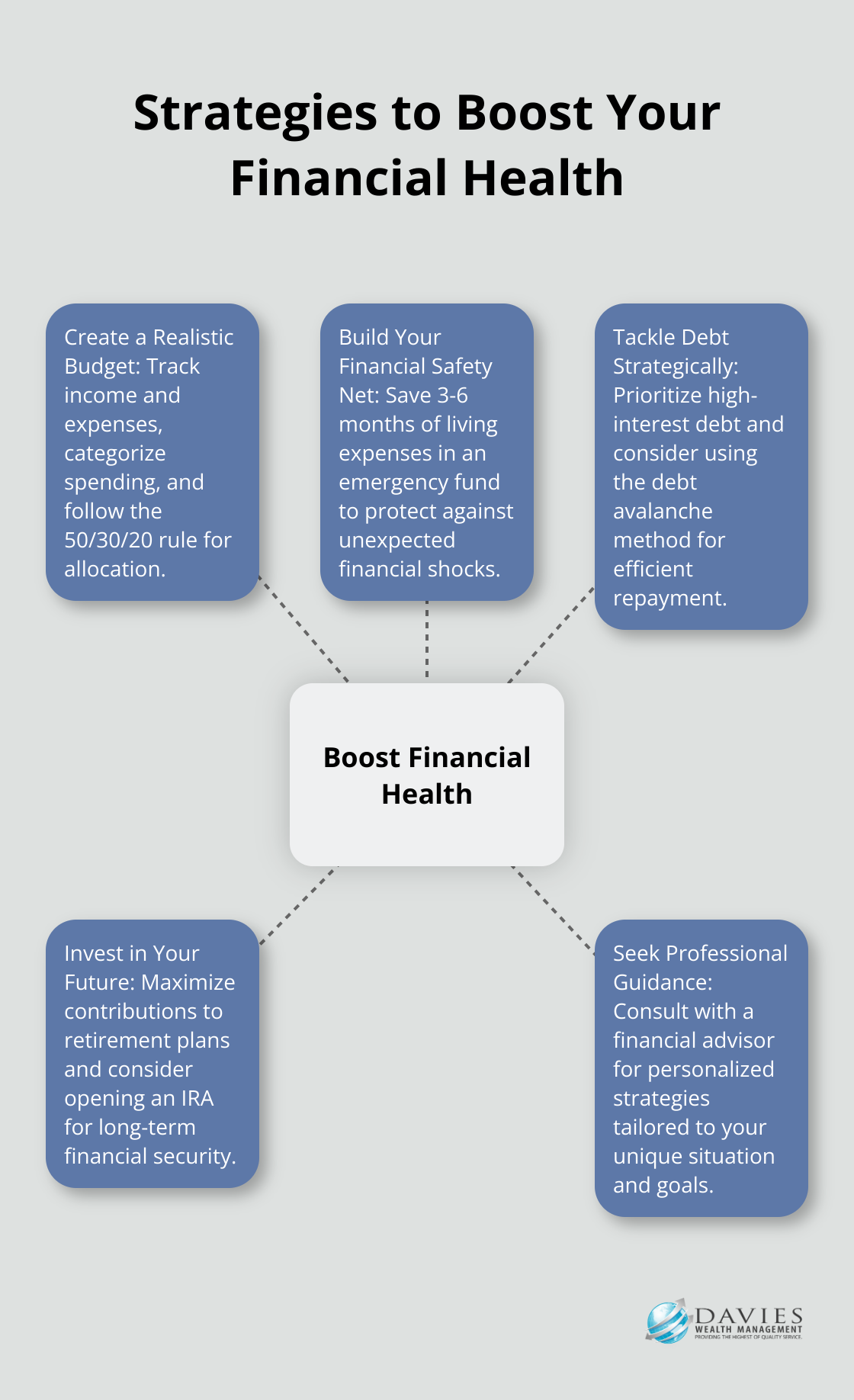

Create a Realistic Budget

The foundation of financial health is a well-structured budget. Start by tracking your income and expenses for a month. Include everything, from your morning coffee to your monthly rent. Once you have a clear picture of your spending habits, categorize your expenses into necessities and discretionary spending.

A study by the U.S. Bank found that only 41% of Americans use a budget. However, those who do are more likely to report feeling financially stable. When creating your budget, use the 50/30/20 rule as a starting point: allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

Build Your Financial Safety Net

An emergency fund is essential for financial stability. Try to save three to six months’ worth of living expenses in a readily accessible account. This fund can protect you from unexpected financial shocks and reduce stress during challenging times.

Research suggests that individuals who struggle to recover from a financial shock have less savings to help protect against a future emergency. Start small if necessary – even saving $50 per month can make a significant difference over time.

Tackle Debt Strategically

High-interest debt can obstruct financial health. Prioritize paying off credit card balances and other high-interest loans. Consider using the debt avalanche method: focus on the debt with the highest interest rate while making minimum payments on others.

A study by the National Foundation for Credit Counseling revealed that 62% of Americans carry credit card debt from month to month. If you struggle with multiple debts, consider consolidation options or speak with a financial advisor about debt management strategies.

Invest in Your Future

Investing is key to long-term financial security. Start by maximizing contributions to your employer-sponsored retirement plan (especially if there’s a company match). Beyond that, consider opening an Individual Retirement Account (IRA) or exploring other investment vehicles.

Data from Vanguard shows that the average 401(k) balance for Americans aged 65 and older is $255,151. While this may seem substantial, it may not suffice for a comfortable retirement. Try to save at least 15% of your income for retirement, including any employer contributions.

Seek Professional Guidance

Navigating the complex world of personal finance can challenge many individuals. A professional financial advisor can provide personalized strategies tailored to your unique situation and goals.

Vanguard’s survey of 1,500 investors found that traditional advisors are more capable of meeting their client’s financial goals, which in turn leads to higher returns. This added value comes from portfolio rebalancing, behavioral coaching, and tax-efficient strategies.

Final Thoughts

Financial health and personal well-being form a powerful connection that shapes our lives. Financial stress impacts physical health, mental well-being, and relationships, but practical strategies can improve your situation. The journey to wealth wellness requires dedication, yet the rewards are immeasurable.

Taking action to improve your financial health doesn’t have to overwhelm you. You can create a budget, build an emergency fund, tackle high-interest debt, and invest in your future. Every positive financial decision you make today contributes to your long-term well-being.

We at Davies Wealth Management offer expert guidance on the path to financial wellness. Our team creates personalized financial strategies tailored to your unique goals and circumstances. Don’t let financial stress hold you back from living your best life – take the first step towards improved financial health today and watch it positively impact your personal well-being. Visit our wealth management solutions to learn more about achieving financial security and success.

Schedule a Personalized Appointment

Take the next step in your financial journey by booking a private consultation:

Book an Appointment Today

Explore Our Latest Insights

Stay informed with our most recent articles on retirement, investing, and wealth management:

Read the Latest Blog Posts

Stay Connected on YouTube

If you find our content valuable, a quick “like” goes a long way in helping others discover it.

Subscribe for Weekly Insights

Have Questions? Get in Touch

Reach out directly at: TDavies@TDWealth.Net

Download Our Complimentary Guides

Gain clarity and confidence in your financial planning with our free resources:

Connect with Davies Wealth Management

Website: tdwealth.net

Podcast: 1715tcf.com

Follow Us on Social Media:

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

(772) 210-4031

Lat/Long: 27.17404889406371, -80.24410438798957

⚠️ Disclaimer

The information provided by Davies Wealth Management is for educational purposes only and should not be interpreted as financial, tax, or legal advice. We recommend consulting qualified professionals before making financial decisions. Davies Wealth Management is not liable for any actions taken without personalized guidance.

Leave a Reply