At Davies Wealth Management, we understand the challenges affluent families face in managing their complex financial landscapes. Wealth consolidation offers a powerful solution to streamline and optimize your financial affairs.

By bringing together various assets and accounts under one unified strategy, families can gain better control, reduce costs, and enhance their overall financial well-being.

In this post, we’ll explore the key benefits of wealth consolidation and provide practical strategies for implementing this approach effectively.

Understanding Wealth Consolidation

Definition and Importance

Wealth consolidation combines various financial assets, accounts, and investments under a single, unified management strategy. For affluent families, this approach optimizes their financial landscape. It provides a comprehensive view of their entire financial picture, enabling more effective decision-making and strategic planning.

A study reveals that individuals with lower income are less likely to be experienced in using financial investment strategies or seeking financial advisory services. Wealth consolidation helps families avoid these pitfalls and ensures all assets work together towards common goals.

Dispelling Common Myths

Many affluent families hesitate to consolidate their wealth due to misconceptions. Let’s address two common myths:

- Increased Risk: Some believe consolidation means putting all eggs in one basket. In reality, a well-executed consolidation strategy enhances diversification and risk management.

- Limited Investment Options: Contrary to this belief, consolidation often opens access to a broader range of sophisticated investment vehicles and strategies (unavailable to smaller, fragmented portfolios).

Long-Term Financial Health

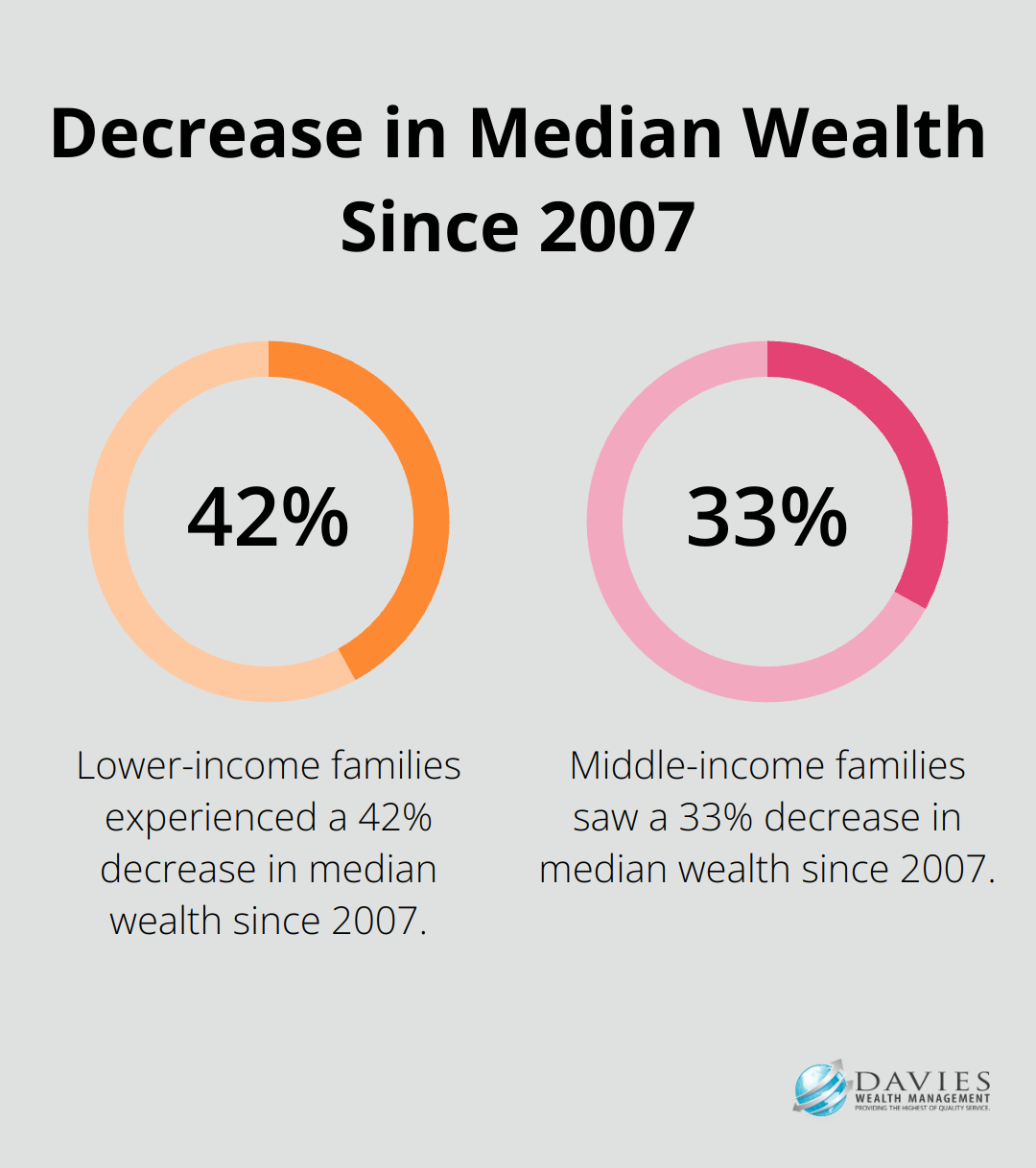

Wealth consolidation significantly impacts a family’s long-term financial health. A Pew Research Center report highlights that in 2016, the median wealth of lower-income families was 42% less than in 2007 and the median wealth of middle-income families was 33% less. This stark contrast underscores the importance of effective wealth management strategies for affluent families.

Consolidation helps these families maintain and grow their wealth more effectively, ensuring financial security across generations. It provides a clearer picture of total assets, simplifies asset allocation, and aligns with risk tolerance and financial objectives.

Enhanced Efficiency and Control

Consolidated wealth management streamlines financial processes, reducing the complexity of managing multiple relationships with different advisors. This approach allows for:

- More efficient decision-making

- Improved performance analytics

- Better risk management during volatile market conditions

Families who consolidate their wealth often report increased satisfaction and confidence in meeting their financial futures. Regular reviews of a consolidated portfolio lead to timely adjustments that align with changing financial goals or market conditions.

As we move forward, we’ll explore the key benefits of wealth consolidation in more detail, providing insights into how this approach can transform your financial landscape.

How Wealth Consolidation Benefits Affluent Families

Streamlined Financial Oversight

Wealth consolidation simplifies financial management for affluent families. It eliminates the need to juggle multiple accounts, advisors, and strategies. Instead, families can oversee their entire portfolio through a single, comprehensive platform. This approach saves time and reduces the risk of overlooking important financial details.

A study by State Street and Knowledge@Wharton highlights that investors with multiple advisors often face a lack of coordination, which leads to conflicting strategies and suboptimal outcomes. Consolidation helps families avoid these pitfalls and ensures a cohesive financial strategy.

Cost Efficiency and Performance Optimization

Consolidating wealth can result in substantial cost savings. The management of numerous separate accounts often incurs cumulative fees that erode investment returns. Account consolidation potentially reduces these overhead costs.

A consolidated approach also allows for more effective tax optimization strategies. It facilitates capital gains harvesting and coordinated distributions, potentially lowering tax liabilities. The Internal Revenue Service (IRS) reports that strategic tax planning can save high-net-worth individuals thousands of dollars annually.

Enhanced Risk Management

Wealth consolidation provides a clearer picture of a family’s overall financial position, enabling more effective risk management. A comprehensive view of all assets makes it easier to maintain a well-diversified portfolio and avoid unintended concentration risks.

Diversification can reduce portfolio volatility without necessarily sacrificing returns. Wealth consolidation facilitates this level of strategic asset allocation, helping families weather market volatility more effectively.

Simplified Estate Planning

Estate planning is a key aspect of wealth management for affluent families. Consolidating wealth significantly simplifies this process. With all assets under one umbrella, families can implement comprehensive estate planning strategies more easily, ensuring smooth wealth transfer across generations.

The American Bar Association notes that proper estate planning can save families up to 40% in federal estate taxes. Wealth consolidation makes it easier to implement strategies like establishing trusts or gifting assets (potentially leading to substantial tax savings).

Improved Family Financial Education

Consolidated wealth management provides an excellent platform for educating family members about financial matters. It offers a clear, holistic view of the family’s financial situation, making it easier to explain complex financial concepts and strategies to younger generations.

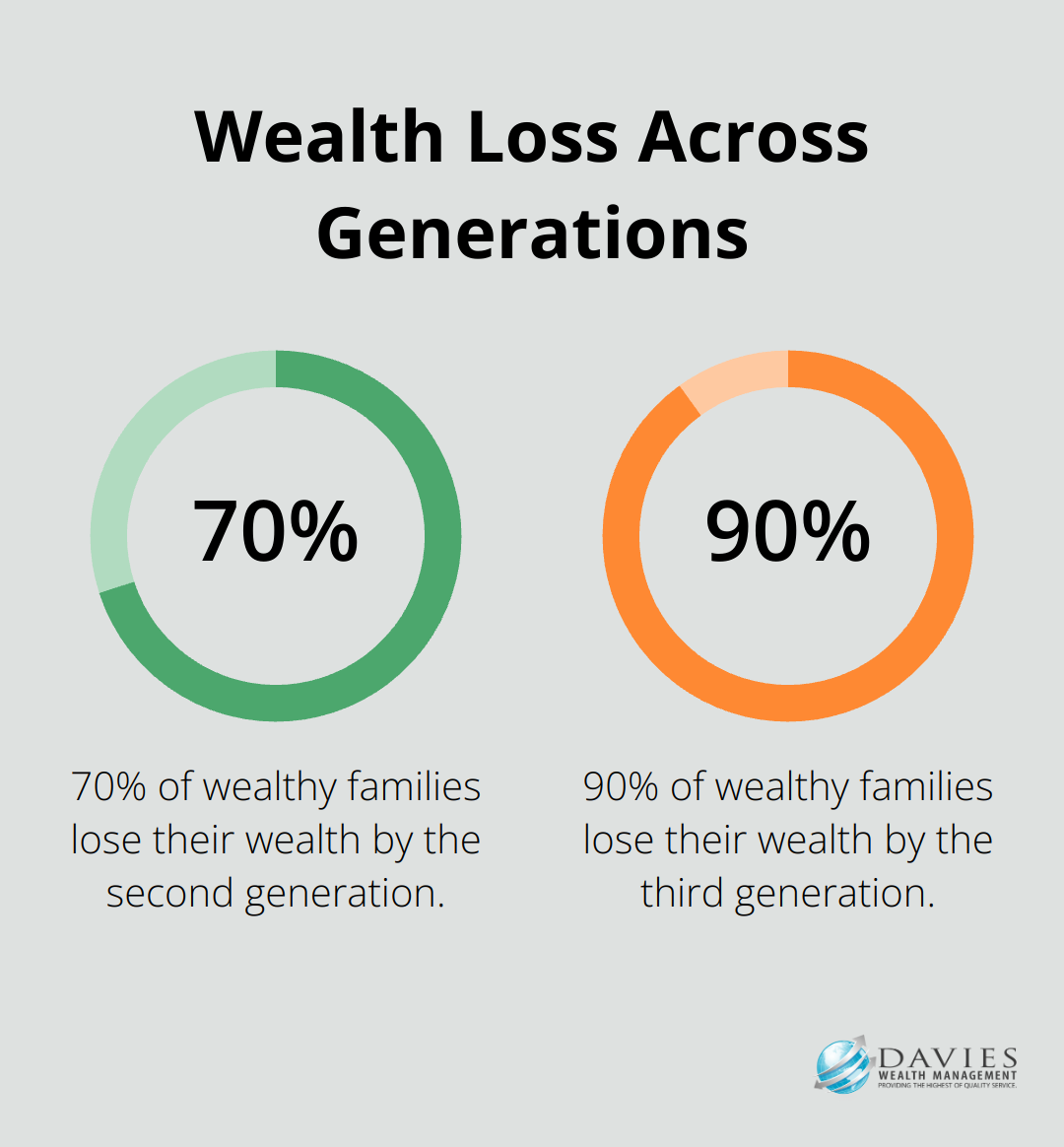

This educational aspect is particularly important as studies show that 70% of wealthy families lose their wealth by the second generation and 90% by the third, often due to a lack of financial education. Wealth consolidation can help break this cycle by fostering financial literacy and responsible wealth management practices across generations.

As we move forward, we’ll explore effective strategies for implementing wealth consolidation, ensuring that affluent families can maximize these benefits and secure their financial future.

How to Implement Effective Wealth Consolidation

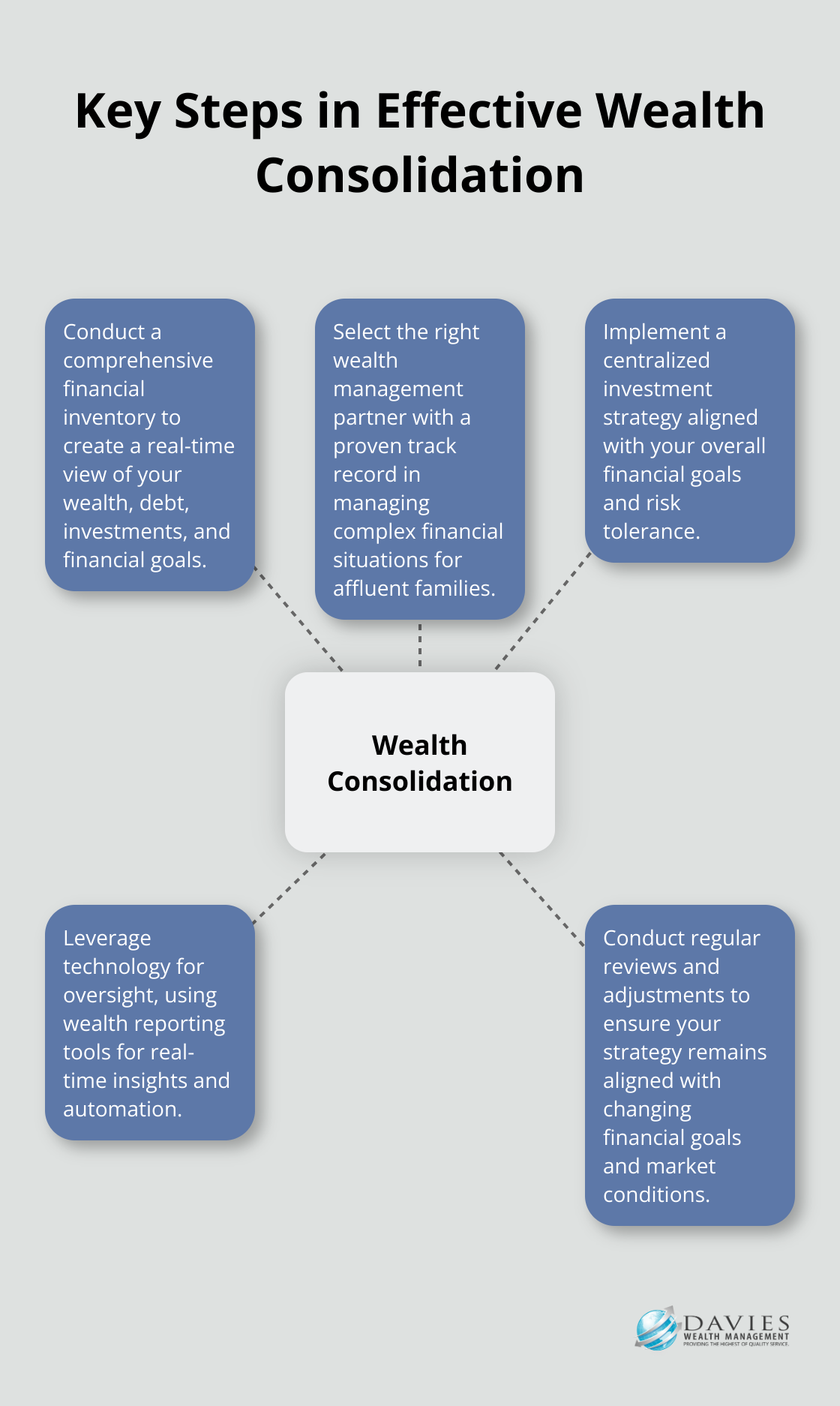

Implementing effective wealth consolidation requires a strategic approach. Here are the key steps to consider:

Conduct a Comprehensive Financial Inventory

The first step in wealth consolidation involves a thorough financial inventory. This process requires creating a financial snapshot of your finances at a given moment in time, providing a real-time view of your wealth, debt, investments, and financial goals.

Start by collecting all financial documents (bank statements, investment accounts, real estate holdings, business interests, and insurance policies). Include any offshore accounts or alternative investments. This process often uncovers forgotten assets or redundant accounts that you can consolidate.

Select the Right Wealth Management Partner

Choosing an appropriate wealth management partner plays a vital role in successful consolidation. Look for a firm with a proven track record in managing complex financial situations for affluent families. The right partner should offer a wide range of services (investment management, tax planning, estate planning, and risk management).

Implement a Centralized Investment Strategy

After selecting a wealth management partner, implement a centralized investment strategy. This step involves aligning all your investments with your overall financial goals and risk tolerance.

Family offices serve as comprehensive wealth management hubs, handling financial planning, investment strategy, legal affairs, and estate planning.

Your wealth manager should create a customized investment policy statement that outlines your investment objectives, risk tolerance, and asset allocation strategy. This document serves as a roadmap for all investment decisions and helps ensure consistency across your entire portfolio.

Leverage Technology for Oversight

Modern wealth management relies heavily on technology to provide comprehensive oversight of consolidated assets. Wealth reporting tools are designed to help RIAs and family offices manage complex portfolios with real-time insights and automation.

Many wealth management firms utilize cutting-edge technology to provide clients with 24/7 access to their consolidated financial information through secure online portals and mobile apps.

Regular Review and Adjustment

Implementing wealth consolidation isn’t a one-time event. It requires regular review and adjustment to ensure your strategy remains aligned with your changing financial goals and market conditions. Try to schedule quarterly reviews with your wealth manager to assess performance, rebalance your portfolio if necessary, and discuss any changes in your financial situation or objectives.

Final Thoughts

Wealth consolidation offers affluent families a powerful strategy to optimize their financial landscape. It simplifies financial oversight, enhances cost efficiency, and improves risk management. This comprehensive approach enables more effective decision-making, strategic planning, and smoother wealth transfer across generations.

Professional guidance proves essential in navigating the complexities of wealth consolidation. A qualified wealth manager conducts thorough financial inventories, develops centralized investment strategies, and leverages advanced technology for comprehensive oversight. These steps ensure that a family’s legacy remains preserved and efficiently transferred.

Davies Wealth Management specializes in tailored wealth consolidation solutions for affluent families. We understand the unique challenges faced by high-net-worth individuals and offer personalized strategies to streamline financial affairs. Visit Davies Wealth Management to learn how we can help implement an effective wealth consolidation strategy tailored to your unique needs and goals.

Leave a Reply