Asset allocation is a cornerstone of successful wealth management for high-net-worth individuals. At Davies Wealth Management, we understand the unique challenges and opportunities that come with substantial wealth.

This blog post explores the art of asset allocation, focusing on strategies tailored to preserve and grow significant wealth. We’ll delve into key asset classes, risk management techniques, and tax-efficient investing approaches that can help high-net-worth individuals optimize their financial portfolios.

Asset Allocation for High-Net-Worth Individuals: A Strategic Approach

Asset allocation forms the foundation of successful wealth management for high-net-worth individuals (HNWIs). This strategic distribution of investments across various asset classes aims to balance risk and potential returns. For HNWIs, the process involves additional complexity due to the scale of wealth and unique financial goals.

The Wealth Preservation Imperative

HNWIs often prioritize wealth preservation alongside growth. A diversified portfolio protects against market volatility and economic downturns. During the 2008 financial crisis, HNWIs with diversified portfolios (including bonds and alternative investments) experienced less severe losses compared to those heavily invested in stocks alone.

Growth Through Strategic Allocation

While preservation remains paramount, growth continues as a primary objective. McKinsey & Company reports that since about 1800, stocks have consistently returned an average of 6.5 to 7.0 percent per year. This statistic explains why stocks typically constitute 40% to 60% of HNWI portfolios.

Unique Considerations for HNWIs

HNWIs face distinct challenges in asset allocation. Their substantial portfolios allow investment in asset classes often inaccessible to average investors. For example, private equity investments generated an average 24% net internal rate of return (IRR) in 2021 for survey participants, with direct deals outperforming funds.

Tax implications play a significant role in HNWI asset allocation. The use of tax-efficient investment vehicles and strategies can substantially impact overall returns. Municipal bonds, which provide tax-free income, often appeal to HNWIs in high tax brackets.

The Role of Alternative Investments

Alternative investments (such as real estate, hedge funds, and commodities) frequently occupy a larger portion of HNWI portfolios. Real estate investments can account for 10-30% of a HNWI’s portfolio, offering both income and potential capital appreciation. These investments provide diversification benefits and potentially higher returns but require specialized knowledge and carry unique risks.

Risk Management and Diversification

Risk management is a crucial aspect of HNWI investment strategies. This underscores the importance of a well-crafted asset allocation plan. Diversification across asset classes, sectors, and geographic regions helps mitigate risks associated with market volatility.

As we move forward to explore specific asset classes, it’s important to note that each HNWI’s portfolio should reflect their individual goals, risk tolerance, and time horizon. The next section will examine key asset classes that form the building blocks of a robust HNWI portfolio.

Building Blocks of HNWI Portfolios: A Strategic Asset Mix

High-net-worth individuals (HNWIs) have access to a diverse range of investment options. Successful HNWI portfolios typically include a strategic mix of four key asset classes: stocks, bonds, real estate, and cash equivalents. Let’s explore how these building blocks contribute to a robust wealth management strategy.

Stocks: Growth Engines for HNWI Portfolios

Stocks remain a cornerstone of HNWI portfolios, typically accounting for 40-60% of total assets. This allocation capitalizes on the historical average annual return of 6.8% (in nominal terms, including dividends) for the S&P 500 Index from 1996 to mid-June 2022. HNWIs often prefer a mix of blue-chip stocks for stability and growth stocks for higher potential returns.

Tech giants like Apple and Microsoft have delivered impressive returns, with Apple’s stock price increasing by over 1000% in the past decade. However, HNWIs must maintain a diversified stock portfolio across sectors and geographies to mitigate risk.

Bonds: Stability and Income Generation

Bonds play a vital role in HNWI portfolios, offering stability and regular income. The allocation to bonds typically ranges from 20-40%, depending on risk tolerance and income needs. Municipal bonds attract HNWIs due to their tax-free status.

A high-yield municipal bond fund might offer a tax-equivalent yield of 4-5%, providing a steady income stream while preserving capital. HNWIs should consider a mix of government and corporate bonds, as well as varying maturities, to optimize returns and manage interest rate risk.

Real Estate and Alternatives: Diversification and Higher Returns

Real estate and alternative investments often comprise 10-30% of HNWI portfolios. These assets offer diversification benefits and potential for higher returns. Real estate investments can provide both income through rentals and capital appreciation over time.

Private equity investments can potentially generate high returns. Other alternative investments like hedge funds, commodities, and even art can further diversify a portfolio and potentially enhance returns.

Cash and Equivalents: Liquidity and Opportunity

While cash typically yields lower returns, maintaining a 5-10% allocation in cash and cash equivalents is important for HNWIs. This provides liquidity for unexpected expenses or investment opportunities. High-yield savings accounts can offer better returns than traditional savings accounts while maintaining liquidity.

Some online banks offer savings accounts with APYs around 3-4% (significantly higher than the national average). This allows HNWIs to earn a return on their cash reserves while maintaining easy access to funds.

The optimal mix of these asset classes varies based on individual goals, risk tolerance, and market conditions. A tailored asset allocation strategy that aligns with unique financial objectives forms the foundation of a successful HNWI portfolio. As we move forward, we’ll explore strategies for optimal asset allocation that can help HNWIs maximize their wealth while managing risk effectively.

Mastering HNWI Asset Allocation: Strategies for Optimal Wealth Management

At Davies Wealth Management, we have refined our approach to asset allocation for high-net-worth individuals (HNWIs) through years of experience. Our strategies focus on maximizing returns while carefully managing risk. Here’s how we help our clients achieve optimal asset allocation:

Strategic Diversification

We advocate for strategic diversification across multiple dimensions. For HNWIs, diversification takes a more global and sophisticated approach. It’s akin to assembling an international culinary feast that includes a variety of asset classes, sectors, and geographical regions.

For fixed income, we suggest a blend of government bonds, corporate bonds, and potentially municipal bonds for tax advantages. We also consider alternative investments like real estate investment trusts (REITs), commodities, and private equity to further diversify and potentially boost returns.

Dynamic Risk Management

Risk management is at the heart of our asset allocation strategy. We employ sophisticated risk assessment tools to understand each client’s risk tolerance and capacity. This goes beyond simple questionnaires – we analyze factors like income stability, liquidity needs, and long-term financial goals.

One technique we use is dynamic asset allocation. Below, we’ve outlined several different strategies for establishing asset allocations, with a look at their basic management approaches.

We also implement hedging strategies when appropriate. This could involve using options to protect against downside risk or incorporating uncorrelated assets to smooth out portfolio performance.

Regular Rebalancing

Rebalancing is essential for maintaining the desired risk-return profile of a portfolio. We typically recommend rebalancing at least annually, but we also monitor portfolios for drift thresholds that might trigger more frequent adjustments.

We use sophisticated rebalancing software that considers tax implications and transaction costs to optimize the process. This ensures that rebalancing adds value rather than unnecessary costs.

Tax-Efficient Strategies

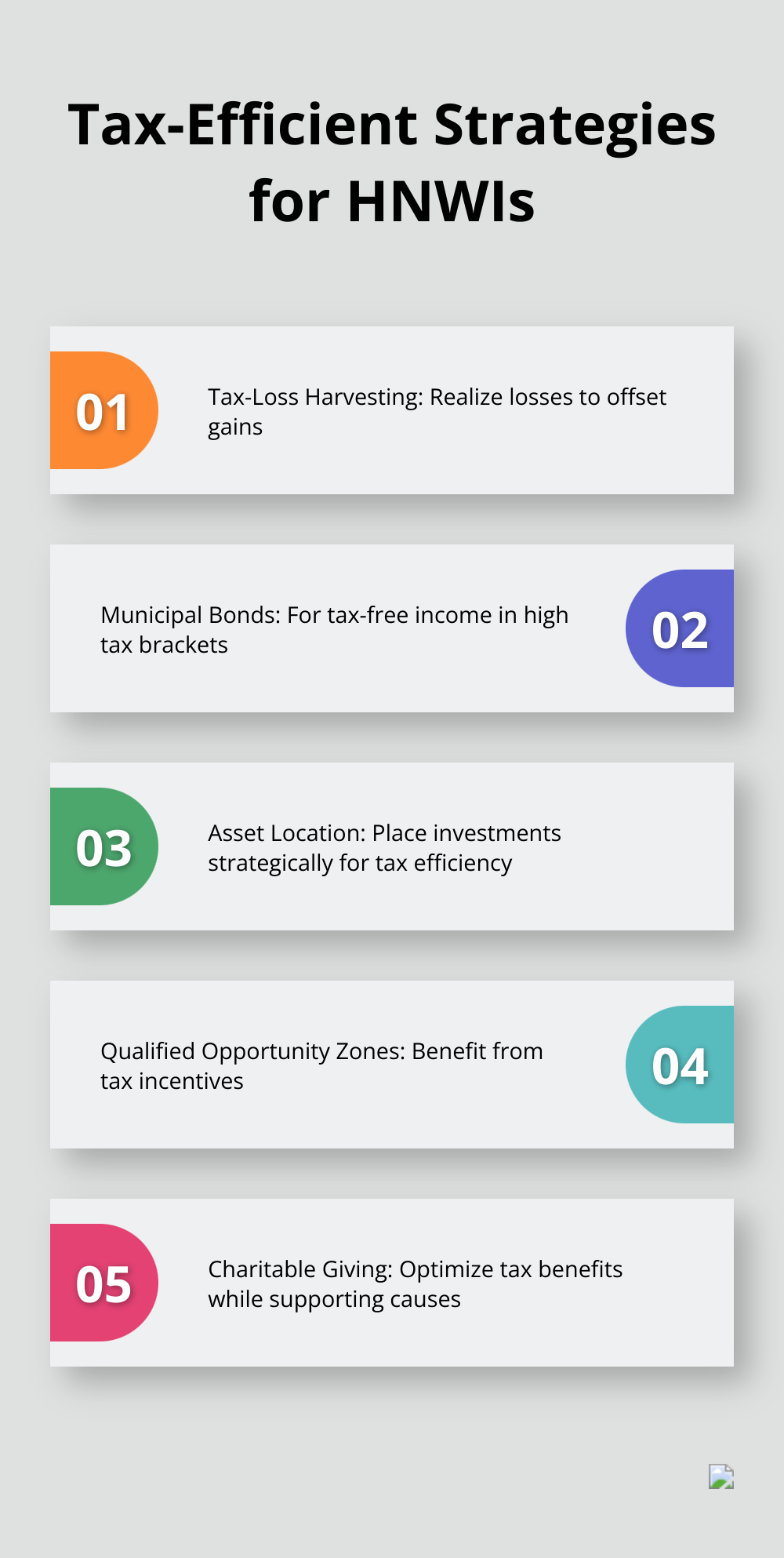

For HNWIs, tax considerations can significantly impact overall returns. We implement various tax-efficient strategies to maximize after-tax returns:

- Tax-Loss Harvesting: We systematically realize losses to offset gains, potentially reducing tax liability.

- Municipal Bonds: For clients in high tax brackets, we often recommend municipal bonds for their tax-free income.

- Asset location: We place tax-inefficient investments in tax-advantaged accounts and tax-efficient investments in taxable accounts.

- Qualified Opportunity Zones: These can offer significant tax benefits for capital gains while supporting economic development in designated areas.

- Charitable giving strategies: We help clients leverage donor-advised funds or charitable remainder trusts to achieve philanthropic goals while optimizing tax benefits.

These strategies help our HNWI clients achieve more efficient portfolios that align with their financial goals and risk tolerance. The key to successful asset allocation is personalization – what works for one HNWI may not be suitable for another. That’s why we always tailor our approach to each client’s unique circumstances and objectives.

Final Thoughts

Asset allocation forms the foundation of effective wealth management for high-net-worth individuals. It plays a vital role in preserving and growing substantial wealth through strategic distribution of investments across various asset classes. This approach balances risk and potential returns while addressing the unique financial goals and challenges faced by affluent investors.

Each investor’s asset allocation strategy should reflect their individual circumstances and objectives. Factors such as risk tolerance, time horizon, liquidity needs, and long-term goals must shape the portfolio composition. Professional guidance often proves invaluable in navigating the complexities of managing substantial wealth.

Davies Wealth Management specializes in crafting personalized asset allocation strategies for high-net-worth individuals (including professional athletes with unique financial needs). Our expertise in investment management, tax-efficient strategies, and comprehensive financial planning can help you navigate the intricacies of wealth preservation and growth. Effective asset allocation requires ongoing monitoring, regular rebalancing, and adjustments as market conditions and personal circumstances evolve.

✅ BOOK AN APPOINTMENT TODAY: https://davieswealth.tdwealth.net/appointment-page

===========================================================

SEE ALL OUR LATEST BLOG POSTS: https://tdwealth.net/articles

If you like the content, smash that like button! It tells YouTube you were here, and the Youtube algorithm will show the video to others who may be interested in content like this. So, please hit that LIKE button!

Don’t forget to SUBSCRIBE here: https://www.youtube.com/channel/UChmBYECKIzlEBFDDDBu-UIg

✅ Contact me: TDavies@TDWealth.Net

====== ===Get Our FREE GUIDES ==========

Retirement Income: The Transition into Retirement: https://davieswealth.tdwealth.net/retirement-income-transition-into-retirement

Beginner’s Guide to Investing Basics: https://davieswealth.tdwealth.net/investing-basics

✅ Want to learn more about Davies Wealth Management, follow us here!

Website:

Podcast:

Social Media:

https://www.facebook.com/DaviesWealthManagement

https://twitter.com/TDWealthNet

https://www.linkedin.com/in/daviesrthomas

https://www.youtube.com/c/TdwealthNetWealthManagement

Lat and Long

27.17404889406371, -80.24410438798957

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

772-210-4031

#Retirement #FinancialPlanning #wealthmanagement

DISCLAIMER

The content provided by Davies Wealth Management is intended solely for informational purposes and should not be considered as financial, tax, or legal advice. While we strive to offer accurate and timely information, we encourage you to consult with qualified retirement, tax, or legal professionals before making any financial decisions or taking action based on the information presented. Davies Wealth Management assumes no liability for actions taken without seeking individualized professional advice.

Leave a Reply