At Davies Wealth Management, we understand the importance of maximizing retirement income. Tax-efficient investing in retirement can significantly impact your financial well-being during your golden years.

In this post, we’ll explore key strategies to help you minimize tax burdens and optimize your investment returns. We’ll cover essential techniques like utilizing tax-advantaged accounts, asset location optimization, and tax-loss harvesting to help you keep more of your hard-earned money.

What Is Tax-Efficient Investing in Retirement?

Understanding Tax-Efficient Investing

Tax-efficient investing in retirement involves strategic management of your investment portfolio to reduce tax liabilities and increase after-tax returns. This approach holds particular importance for retirees who depend on investment income to maintain their lifestyle.

The Impact of Tax Efficiency

Without a regular paycheck, every dollar becomes more valuable in retirement. Tax-efficient investing allows you to retain more of your money by decreasing the taxes you pay on investment returns. This strategy can significantly boost your retirement income and potentially extend your savings.

A 2021 Vanguard study showed that effective asset location strategies could enhance after-tax returns by up to 0.75% annually. While this percentage might seem small, it could translate to tens of thousands of dollars in additional wealth over a 30-year retirement period.

Tax Implications on Retirement Income

Taxes can substantially reduce your retirement income if not managed effectively. Different investments and accounts face varying tax rates:

- Traditional IRA and 401(k) withdrawals (taxed as ordinary income)

- Long-term capital gains and qualified dividends (taxed at preferential rates of 0%, 15%, or 20% depending on income)

- Interest from bonds and short-term capital gains (taxed as ordinary income)

- Some investment income (may trigger additional taxes, such as the Net Investment Income Tax)

Understanding these tax implications proves essential for effective retirement planning. For example, if you fall in the 22% tax bracket, a $50,000 withdrawal from a traditional IRA could result in $11,000 in taxes, leaving you with only $39,000 to spend.

Effective Tax-Efficient Strategies

You can navigate these tax challenges by implementing tax-efficient strategies. Some effective approaches include:

- Prioritizing Roth accounts for high-growth investments

- Holding tax-efficient investments (like index funds) in taxable accounts

- Using tax-loss harvesting to offset capital gains

- Carefully timing withdrawals from different account types

The Role of Professional Guidance

Professional guidance can prove invaluable in developing personalized tax-efficient investment strategies. At Davies Wealth Management, we tailor our approach to each client’s unique financial situation and goals. Our focus on tax efficiency aims to help retirees maximize their income and enjoy a more financially secure retirement.

As we move forward, let’s explore specific strategies for tax-efficient investing in more detail, starting with the utilization of tax-advantaged accounts.

Maximizing Tax Efficiency in Retirement

Leveraging Tax-Advantaged Accounts

Tax-advantaged accounts serve as powerful tools for tax-efficient investing. Traditional 401(k)s and IRAs offer tax-deferred growth, which means you pay taxes on your earnings only when you withdraw funds in retirement. This strategy benefits individuals who expect to be in a lower tax bracket during retirement.

Roth accounts provide tax-free growth and withdrawals in retirement. While contributions come from after-tax dollars, the long-term tax benefits can be substantial, especially for those who anticipate a higher tax bracket in retirement.

A smart approach involves contributing to both traditional and Roth accounts. This strategy provides flexibility in managing tax liability during retirement. For example, in lower-income years, you might choose to withdraw more from traditional accounts, while in higher-income years, you can rely more on tax-free Roth withdrawals.

Optimizing Asset Location

Asset location involves placing investments in the most tax-advantaged account type based on their tax efficiency. Investments that generate high taxable income (such as bonds or REITs) often perform best in tax-deferred accounts like traditional IRAs or 401(k)s. This strategy shields their income from immediate taxation.

Conversely, tax-efficient investments (like low-turnover index funds or long-term individual stocks) often suit taxable accounts better. These investments benefit from preferential long-term capital gains tax rates when sold.

A Vanguard study found that proper asset location can add up to 0.75% in annual performance without increasing portfolio risk. Over a 30-year retirement, this could translate to tens of thousands of dollars in additional wealth.

Implementing Tax-Loss Harvesting

Tax-loss harvesting is a legitimate tactic to reduce taxes each year by selling any stocks that are under water to realize the loss. This technique proves particularly effective in years with significant market volatility.

For instance, if you own a stock that has decreased in value, you could sell it to realize the loss, then use that loss to offset gains from other investments. However, you must avoid the wash-sale rule by waiting at least 30 days before repurchasing the same or a substantially identical security.

While complex, the potential tax savings make tax-loss harvesting a valuable strategy for many retirees.

Considering Dividend Strategies

Dividend-paying stocks can provide a steady income stream in retirement, but it’s important to consider their tax implications. Qualified dividends receive preferential tax treatment, while non-qualified dividends are taxed as ordinary income.

Try to focus on stocks that pay qualified dividends, which are taxed at lower capital gains rates. Additionally, consider holding these dividend-paying stocks in taxable accounts, as they can benefit from the lower qualified dividend tax rates.

As we move forward, let’s explore another critical aspect of tax-efficient investing: municipal bond strategies and their unique tax advantages in retirement planning.

How to Implement Tax-Efficient Strategies

Evaluate Your Current Tax Situation

The first step in implementing tax-efficient strategies requires an assessment of your current tax situation. This involves an analysis of your income sources, tax brackets, and potential future tax liabilities. If you’re in a high tax bracket now but expect to be in a lower bracket in retirement, you might benefit from focusing on traditional IRA or 401(k) contributions.

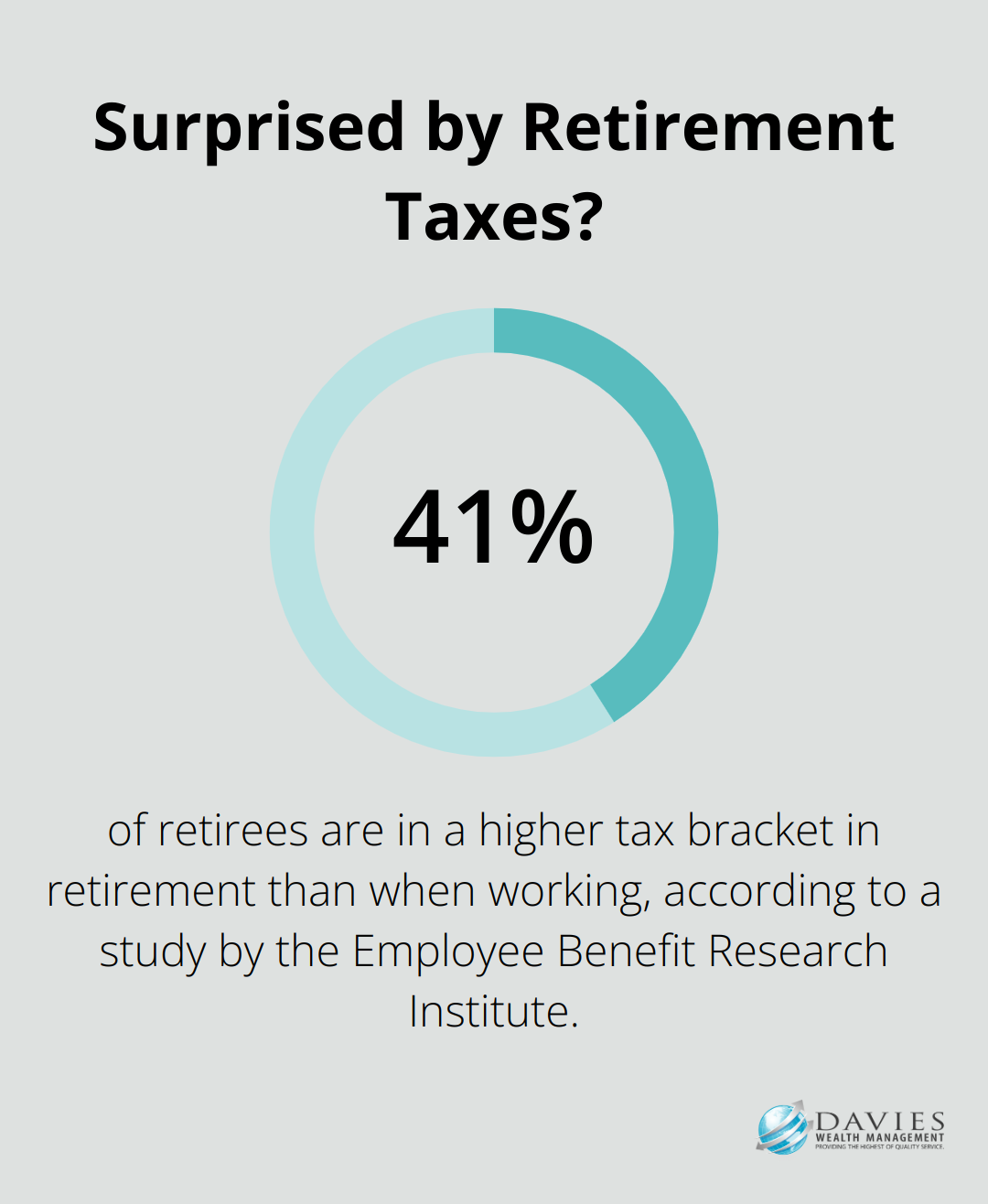

A recent study by the Employee Benefit Research Institute found that 41% of retirees are in a higher tax bracket in retirement than when working. This fact underscores the importance of accurate tax projections when planning your retirement strategy.

Create a Personalized Investment Plan

After understanding your tax situation, you should develop a personalized investment plan that aligns with your goals and tax efficiency needs. This plan must consider factors such as your risk tolerance, time horizon, and specific retirement objectives.

For instance, if you’re in a high tax bracket and have maxed out your tax-advantaged accounts, you might consider municipal bonds for your taxable accounts. These bonds often provide tax-free interest at the federal level (and potentially at the state level for in-state bonds).

Rebalance with Tax Efficiency in Mind

Regular portfolio rebalancing maintains your desired asset allocation, but you must do so with tax efficiency in mind. Instead of selling assets in taxable accounts to rebalance, you should use new contributions or reinvested dividends to adjust your allocation. This approach can help minimize taxable events.

Leverage Professional Expertise

While these strategies can be powerful, they can also be complex to implement effectively. Working with a financial advisor who specializes in tax-efficient investing can provide valuable insights and help you avoid costly mistakes.

Many wealth management firms use sophisticated software to model different tax scenarios and optimize their clients’ portfolios for tax efficiency. This approach has helped many investors reduce their tax burden and increase their after-tax returns in retirement.

Tax laws and personal circumstances can change over time. You should regularly review and adjust your tax-efficient investment strategy for long-term success in retirement planning.

Final Thoughts

Tax-efficient investing in retirement can significantly impact your financial well-being. We implement strategies such as tax-advantaged accounts, optimized asset location, and tax-loss harvesting to minimize your tax burden and maximize retirement income. These approaches, combined with careful dividend strategies and municipal bond investing, help you retain more of your hard-earned money.

The long-term benefits of tax-efficient investing in retirement are substantial. Over time, even small tax savings compound, potentially adding tens or hundreds of thousands of dollars to your retirement nest egg. This additional wealth provides greater financial security, allows for a more comfortable lifestyle, or creates a larger legacy for your loved ones.

At Davies Wealth Management, we understand the complexities of tax-efficient retirement investing. Our team of experienced professionals helps you navigate these strategies, providing personalized advice tailored to your unique financial situation (including retirement planning and tax minimization strategies). We strive to help you make the most of your retirement savings and work towards a more secure and prosperous retirement.

Leave a Reply