At Davies Wealth Management, we understand that maximizing your investment returns isn’t just about choosing the right assets-it’s also about minimizing your tax burden. Tax-efficient investing in brokerage accounts is a powerful strategy that can significantly boost your long-term wealth accumulation.

In this post, we’ll explore various techniques for tax-efficient investing, including strategies for tax-efficient real estate investing. We’ll show you how to make your portfolio work smarter, not harder, by leveraging tax-advantaged investment options and smart asset allocation.

What Is Tax-Efficient Investing?

The Essence of Tax-Efficient Investing

Tax-efficient investing is a strategy that maximizes returns by limiting losses to taxes. This approach aims to keep more of your investment earnings working for you in the market.

The Impact of Tax Efficiency in Brokerage Accounts

Brokerage accounts, unlike retirement accounts, don’t offer automatic tax advantages. This makes tax-efficient investing particularly important in these accounts. Every dollar saved in taxes is a dollar that continues to grow and compound over time. For example, if you’re in the 24% tax bracket and reduce your taxable investment income by $10,000 through tax-efficient strategies, that’s $2,400 more in your pocket to reinvest.

How Taxes Erode Your Returns

The impact of taxes on investment returns can be substantial. Investors should review the tax obligations associated with different investment strategies to understand how they might affect overall returns.

Effective Strategies for Tax-Efficient Investing

One effective strategy focuses on investments that are inherently tax-efficient. For instance, broad-market index funds and ETFs typically have lower turnover rates than actively managed funds, resulting in fewer taxable events. Municipal bonds can also be a smart choice, as the interest they generate is often exempt from federal taxes (and sometimes state taxes as well).

Another key strategy is tax-loss harvesting. This involves offsetting capital gains with capital losses to lower your tax bill and better position your portfolio going forward.

The Role of Professional Guidance

Implementing these tax-efficient investing strategies requires careful planning and execution. Professional financial advisors can help tailor these strategies to your specific financial situation. They can analyze your portfolio, consider your tax bracket, and recommend the most appropriate tax-efficient investments for your goals.

As we move forward, let’s explore specific tax-efficient investment options that can further enhance your portfolio’s performance while minimizing your tax burden.

How to Maximize Tax Efficiency in Your Investment Strategy

Strategic Asset Location

At Davies Wealth Management, we use strategic asset location as a powerful tool to enhance tax efficiency. This approach involves pairing tax-inefficient investments with tax-advantaged accounts to manage your total tax burden. We often recommend holding high-yield bonds or REITs in tax-advantaged accounts (such as IRAs or 401(k)s). These investments typically generate significant taxable income, which can be sheltered in tax-deferred or tax-free accounts.

We suggest keeping more tax-efficient investments like index funds or growth stocks in taxable brokerage accounts. These tend to have lower turnover and generate fewer taxable events. Strategic asset location can reduce annual tax bills for many investors.

Tax-Loss Harvesting Techniques

Tax-loss harvesting is another strategy we frequently employ to maximize tax efficiency. This involves selling securities held in a taxable account for less than their purchase price to offset capital gains in other parts of your portfolio. It’s a way to convert investment losses into tax savings.

It’s crucial to execute tax-loss harvesting carefully to avoid violating wash-sale rules. These rules prohibit claiming a loss on a security if you buy a “substantially identical” investment within 30 days before or after the sale. Professional guidance can help navigate these complexities to ensure maximum tax benefits while maintaining compliance with IRS regulations.

Embracing Tax-Advantaged Investments

Incorporating tax-advantaged investments into your portfolio can significantly reduce your tax burden. Municipal bonds are a prime example. The interest from these bonds is typically exempt from federal taxes (and often state taxes if you live in the issuing state). For high-income earners in the top tax brackets, the tax-equivalent yield of municipal bonds can be very attractive compared to taxable bonds. The tax-equivalent yield is the pretax yield a taxable bond needs to equal that of a tax-free municipal bond.

Exchange-traded funds (ETFs) are another option we often consider. These tend to be more tax-efficient than mutual funds due to their unique structure, which allows for fewer capital gains distributions.

The Power of Long-Term Holding

Holding investments for longer periods can significantly improve tax efficiency. Long-term capital gains (from assets held for more than a year) are taxed at lower rates than short-term gains. For many investors, the difference can be substantial.

This strategy not only reduces your tax burden but also aligns with sound investment principles. Warren Buffett, one of the world’s most successful investors, famously said, “Our favorite holding period is forever.”

As we move forward, let’s explore specific tax-efficient investment options that can further enhance your portfolio’s performance while minimizing your tax burden.

Which Investments Offer the Best Tax Efficiency?

At Davies Wealth Management, we recommend specific investment options that can enhance your portfolio’s tax efficiency. Let’s explore some of the most effective choices for minimizing your tax burden while maximizing returns.

Index Funds and ETFs: Low-Turnover Champions

Index funds and ETFs typically offer more tax efficiency than actively managed mutual funds. However, it’s important to note that balanced funds, such as Vanguard’s VBIAX or LifeStrategy funds, may not be particularly tax-efficient in a taxable account.

Tax-Managed Mutual Funds: Active Management with a Tax-Efficient Twist

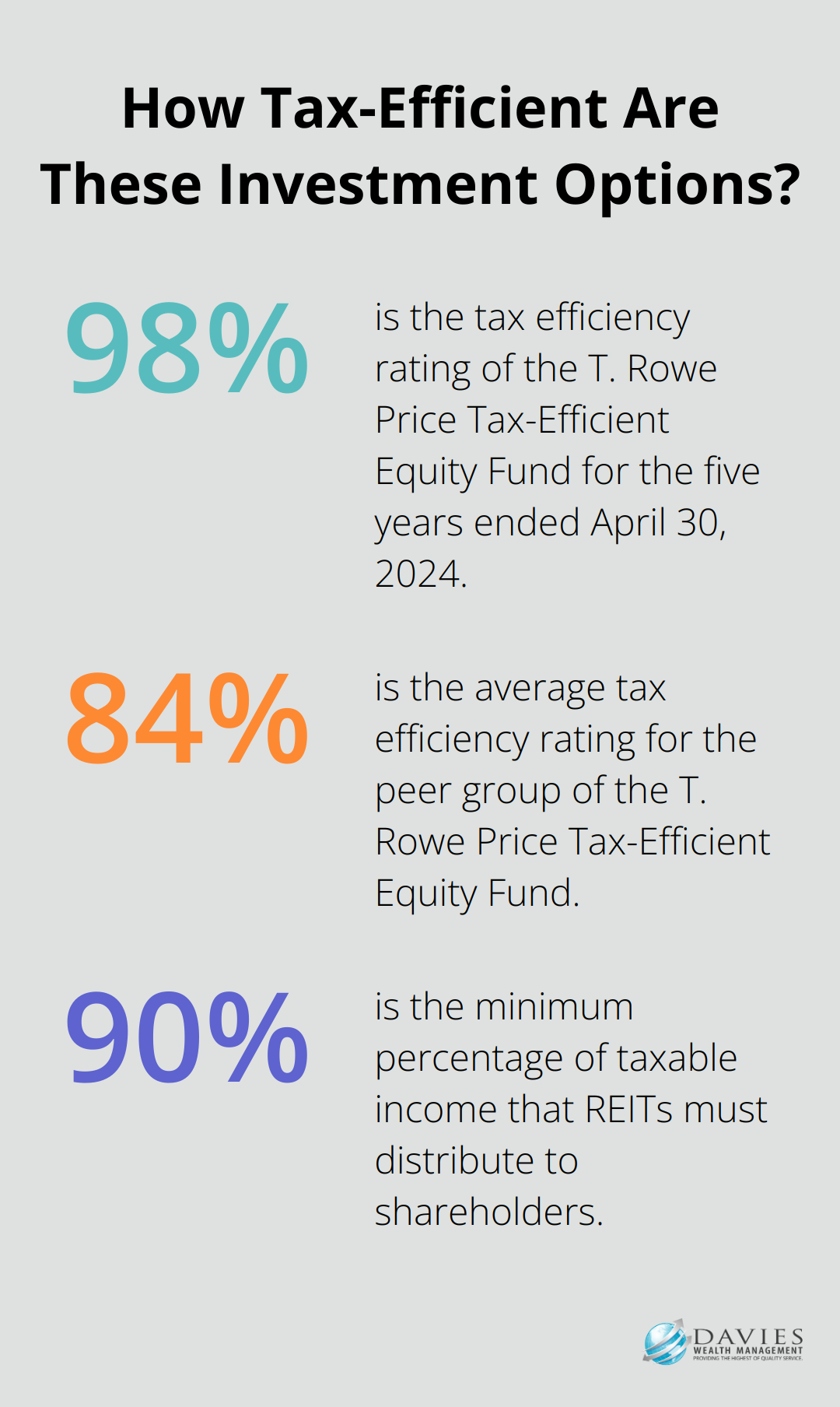

For investors who prefer active management but still want to prioritize tax efficiency, tax-managed mutual funds can be an excellent option. For example, the T. Rowe Price Tax-Efficient Equity Fund has managed a 98% tax efficiency rating for the five years ended April 30, 2024, relative to an 84% average for its peer group.

Dividend-Paying Stocks: The Power of Qualified Dividends

Dividend-paying stocks can add value to a tax-efficient portfolio, especially when they offer qualified dividends. Qualified dividends are taxed at the same rates as the capital gains tax rate, which is lower than ordinary income tax rates.

REITs: Tax-Efficient Real Estate Exposure

Real Estate Investment Trusts (REITs) can offer tax advantages, particularly when held in tax-advantaged accounts. While REITs must distribute at least 90% of their taxable income to shareholders (which can result in high dividend yields), these distributions often incur taxes as ordinary income. Holding REITs in a tax-advantaged account like an IRA allows investors to defer or potentially eliminate taxes on these distributions.

For example, the Vanguard Real Estate ETF (VNQ) provides broad exposure to the U.S. real estate market with a current dividend yield of around 4%. Holding this ETF in a tax-advantaged account allows investors to capture this yield without immediate tax consequences.

Final Thoughts

Tax-efficient investing in brokerage accounts maximizes long-term wealth accumulation. We explored various techniques to enhance portfolio tax efficiency, including strategic asset location, tax-advantaged investments, and tax-loss harvesting. These strategies can significantly impact your investment returns, but they require careful planning and ongoing management.

Tax-efficient real estate investing can be a valuable component of your overall strategy. We at Davies Wealth Management recommend seeking professional advice to optimize your approach. Our team specializes in creating tailored financial solutions (including tax-efficient strategies) to help you achieve your financial goals.

Davies Wealth Management is here to guide you through the complexities of tax-efficient investing. We help you build, protect, and transfer your wealth with confidence, ensuring that more of your hard-earned money works for you in the market. Our commitment is to maximize your after-tax returns and accelerate your path to financial success.

Leave a Reply