High earners face unique challenges when it comes to managing their investments and minimizing tax liabilities. At Davies Wealth Management, we understand the importance of implementing tax-efficient investing strategies to maximize returns and preserve wealth.

In this blog post, we’ll explore best practices for tax-efficient investing tailored specifically for high-income individuals. We’ll cover key strategies, asset location optimization, and the long-term benefits of a tax-conscious approach to investing.

Understanding Tax-Efficient Investing for High Earners

Definition and Importance

Tax-efficient investing represents a strategic approach to managing investments that minimizes tax liabilities while maximizing after-tax returns. For high earners, this concept holds particular significance due to their higher tax rates and complex financial situations.

The Impact of Taxes on Investment Returns

Taxes can substantially reduce investment gains, especially for those in higher tax brackets. A high earner in the 37% federal tax bracket could lose over a third of their investment gains to taxes without proper management. This tax drag significantly impacts long-term wealth accumulation.

A study by Vanguard indicates that tax-efficient investing strategies can potentially add up to 0.75% to an investor’s average annual returns. Over time, this difference can translate to hundreds of thousands of dollars in additional wealth.

Effective Strategies for Tax-Efficient Investing

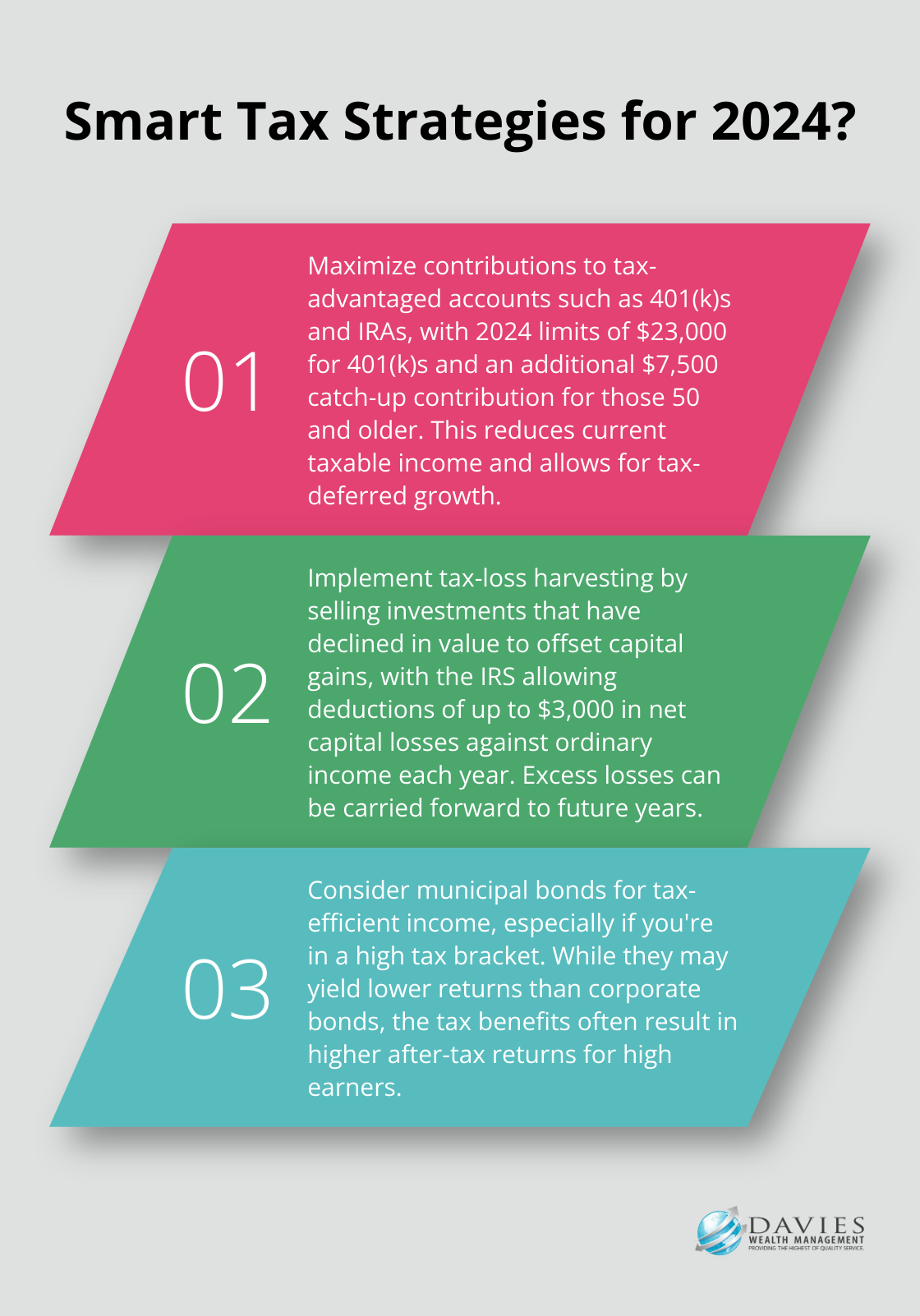

One powerful strategy involves maximizing contributions to tax-advantaged accounts such as 401(k)s and IRAs. For 2024, the contribution limit for 401(k)s stands at $23,000, with an additional $7,500 catch-up contribution for those 50 and older. These contributions reduce current taxable income and allow for tax-deferred growth.

Tax-loss harvesting serves as another effective tool. This strategy involves selling investments that have declined in value to offset capital gains. The IRS permits investors to deduct up to $3,000 in net capital losses against ordinary income each year (with any excess carried forward to future years).

Quantifying the Long-Term Benefits

Implementing tax-efficient strategies leads to significant long-term benefits. For example, a high earner investing $100,000 annually over 20 years could potentially accumulate an additional $500,000 or more by employing tax-efficient strategies, compared to a non-tax-efficient approach.

Tailored Approaches for High Earners

Professional athletes, with their unique financial situations (including short career spans and fluctuating income), require specialized tax-efficient investment strategies. These strategies should address the complexities of their financial landscape and secure their long-term financial future beyond their playing years.

As we move forward, we will explore specific tax-efficient investment strategies that high earners can leverage to optimize their portfolios and minimize their tax burden.

Powerful Strategies for Tax-Efficient Investing

Maximizing Retirement Account Contributions

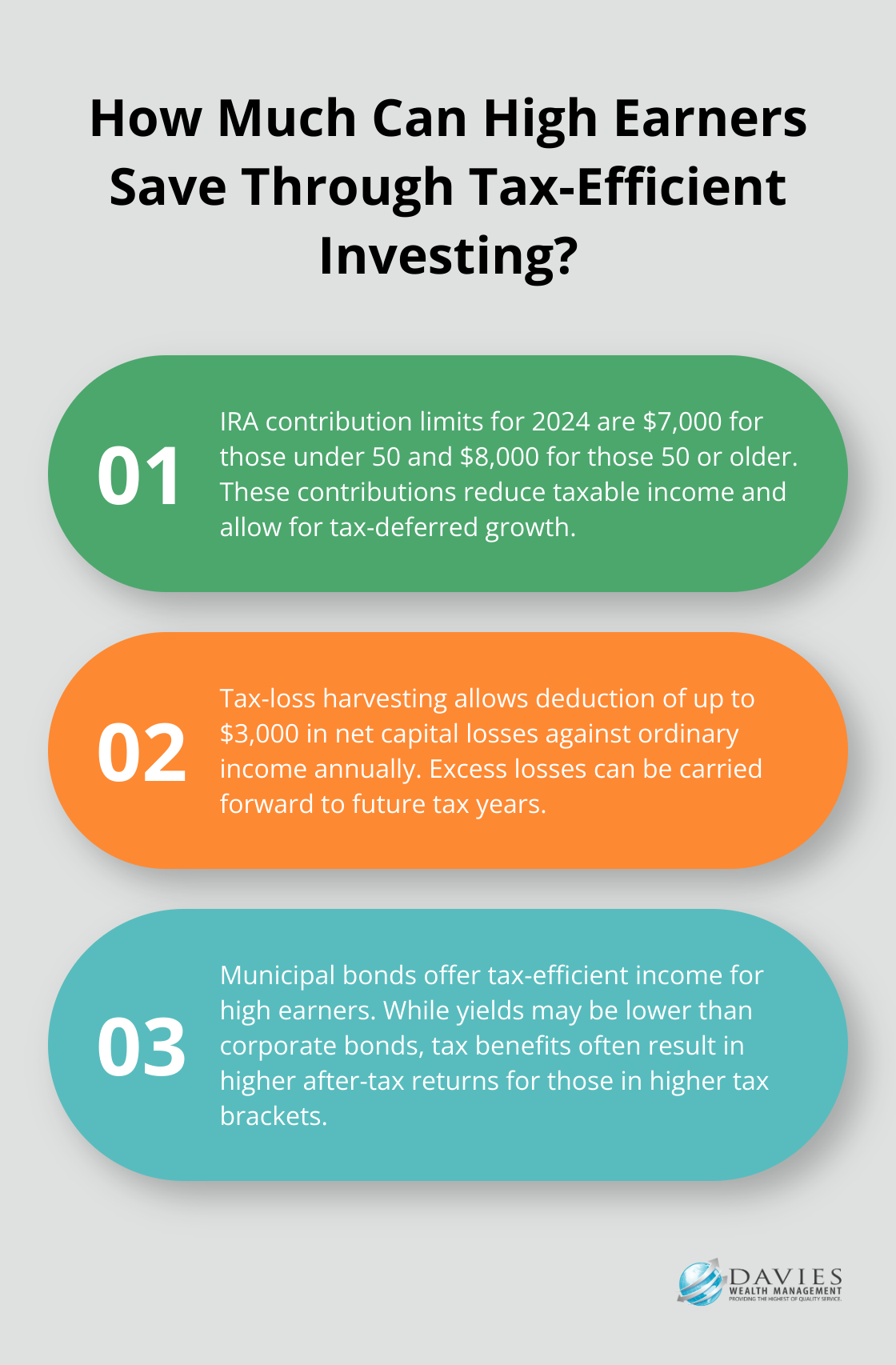

High earners can reduce their current tax burden by maximizing contributions to tax-advantaged retirement accounts. In 2024, the IRA contribution limits are $7,000 for those under age 50 and $8,000 for those age 50 or older. This strategy not only reduces your taxable income for the year but also allows your investments to grow tax-deferred.

For those who have maxed out their retirement account contributions, a backdoor Roth IRA strategy presents an additional opportunity. This allows taxpayers to set up a Roth IRA retirement fund even if their income exceeds the IRS earnings ceiling for Roth contributions.

Leveraging Tax-Loss Harvesting

Tax-loss harvesting serves as a powerful tool to offset capital gains. You can strategically sell investments that have declined in value and use these losses to offset gains in other parts of your portfolio. The IRS allows you to deduct up to $3,000 in net capital losses against your ordinary income each year (with any excess carried forward to future years).

For instance, if you have $10,000 in capital gains and $13,000 in capital losses, you can offset your gains entirely and deduct an additional $3,000 from your ordinary income. The remaining $3,000 in losses can be carried forward to future tax years.

Exploring Municipal Bonds

Municipal bonds offer an excellent choice for high earners seeking tax-efficient income. Many investors in high tax brackets favor muni bonds because they believe they can achieve higher after-tax returns. While municipal bonds may yield lower returns than corporate bonds, the tax benefits often result in a higher after-tax return for those in higher tax brackets.

Considering Exchange-Traded Funds (ETFs)

Exchange-traded funds (ETFs) provide another tax-efficient investment vehicle. Unlike mutual funds, ETFs typically generate fewer capital gains distributions due to their unique structure. This means you have more control over when you realize capital gains, allowing for better tax planning.

As we move forward, we’ll explore how to optimize your portfolio through strategic asset location, a critical component of tax-efficient investing for high earners.

Optimizing Asset Location for Tax Efficiency

The Power of Tax-Advantaged Accounts

Tax-advantaged accounts like 401(k)s, IRAs, and Roth IRAs serve as powerful tools for high earners. Pre-tax contributions to these accounts reduce your taxable income, and potential earnings will grow on a tax-deferred basis, though distributions in retirement are typically taxable. Placing high-yield bonds or actively managed funds in tax-advantaged accounts shields their income from immediate taxation.

Strategic Placement in Taxable Accounts

For taxable accounts, investors should focus on investments that are inherently tax-efficient. Steps you can take to become a more tax-efficient investor include considering Roth conversions and municipal bonds. These investments typically generate fewer taxable events, allowing investors to control when they realize gains.

Balancing Tax Efficiency with Investment Goals

Tax efficiency holds great importance, but maintaining a balanced portfolio that aligns with overall investment objectives remains essential. This might necessitate holding some tax-inefficient assets in taxable accounts to achieve the desired asset allocation.

Professional athletes, who often face unique financial situations, require customized asset location strategies. These strategies must account for their short career spans and potentially high but fluctuating incomes, ensuring both immediate tax efficiency and long-term financial security.

State Tax Considerations

The impact of state taxes on investment decisions should not be overlooked. Raising income tax rates on high-income residents can enable states to boost investment in education, infrastructure, and other vital services. This could potentially affect investment strategies for high earners in different states.

Implementing Effective Asset Location

An effective asset location strategy requires a deep understanding of tax laws, investment vehicles, and individual financial situations. Financial advisors specialize in creating tailored asset location strategies that optimize tax efficiency while meeting clients’ unique financial goals. Hidden tax opportunities can be uncovered through advanced tax strategies, contributing to wealth preservation and growth for high-net-worth investors.

Final Thoughts

Tax-efficient investing strategies offer high earners powerful tools to maximize wealth and minimize tax burdens. These approaches include maximizing retirement account contributions, utilizing tax-loss harvesting, and investing in municipal bonds and exchange-traded funds. Strategic asset location optimizes tax efficiency across different account types, potentially leading to significant long-term benefits for high earners.

Each individual’s financial situation requires a personalized approach, especially for high earners and professional athletes facing complex financial landscapes. A tailored strategy, aligned with specific circumstances, goals, and risk tolerance, yields optimal results. Professional guidance often proves invaluable in navigating the intricacies of tax-efficient investing.

At Davies Wealth Management, we provide comprehensive wealth management solutions, including tax-efficient investing strategies for high earners and professional athletes. Our team of experts helps clients take control of their financial future, preserve more wealth, and work towards achieving long-term financial goals with confidence.

Leave a Reply