At Davies Wealth Management, we understand the complexities of navigating the cryptocurrency investment landscape. As digital assets continue to gain prominence, savvy investors are seeking ways to optimize their crypto portfolios for tax efficiency.

In this post, we’ll explore tax-efficient crypto investing strategies that can help you maximize your returns while minimizing your tax burden. From long-term holding to advanced optimization techniques, we’ll provide practical insights to enhance your crypto investment approach.

How Cryptocurrency Taxation Works

Current Crypto Tax Regulations

The IRS classifies cryptocurrencies as property for tax purposes. This classification means every crypto transaction (sales, exchanges, or purchases) can trigger a taxable event. You may have to report transactions with digital assets such as cryptocurrency and non fungible tokens (NFTs) on your tax return.

Crypto vs. Traditional Asset Taxation

Crypto taxation differs from traditional asset taxation in several ways. The frequency of taxable events stands out as a key difference. While stock investors typically incur taxes only upon selling, crypto traders face taxable events even when swapping one cryptocurrency for another. This difference often results in more complex tax situations for crypto traders compared to traditional investors.

Another notable distinction lies in the reporting standards. Traditional brokerages provide detailed 1099 forms, but many crypto platforms offer limited tax documentation. This lack of standardization puts the responsibility on investors to track their transactions meticulously.

Common Taxable Events in Crypto Investing

To plan your taxes effectively, you must understand what constitutes a taxable event in crypto investing. Here are some common scenarios:

It’s important to note that transferring crypto between your own wallets does not trigger a taxable event. However, receiving airdrops or hard forks can create tax liabilities.

Professional Guidance for Complex Scenarios

At Davies Wealth Management, we’ve assisted numerous clients in navigating these complexities. For example, we recently helped a professional athlete structure his crypto investments to minimize tax liabilities while maintaining portfolio diversity. Through strategic trade timing and tax-loss harvesting, we reduced his tax burden significantly.

Staying Informed in a Dynamic Landscape

The regulatory landscape for cryptocurrency continues to evolve. Staying informed and seeking professional guidance can significantly impact your after-tax returns. As we move forward, we’ll explore specific strategies you can employ to optimize your crypto investments for tax efficiency. These strategies will help you navigate the complex world of crypto taxation and maximize your investment potential.

Tax-Efficient Crypto Investment Strategies

At Davies Wealth Management, we have developed strategies to help our clients navigate the complex world of cryptocurrency taxation. Here are some effective approaches we recommend for minimizing your tax burden while maximizing your crypto investment returns.

Long-Term Holding for Capital Gains Advantages

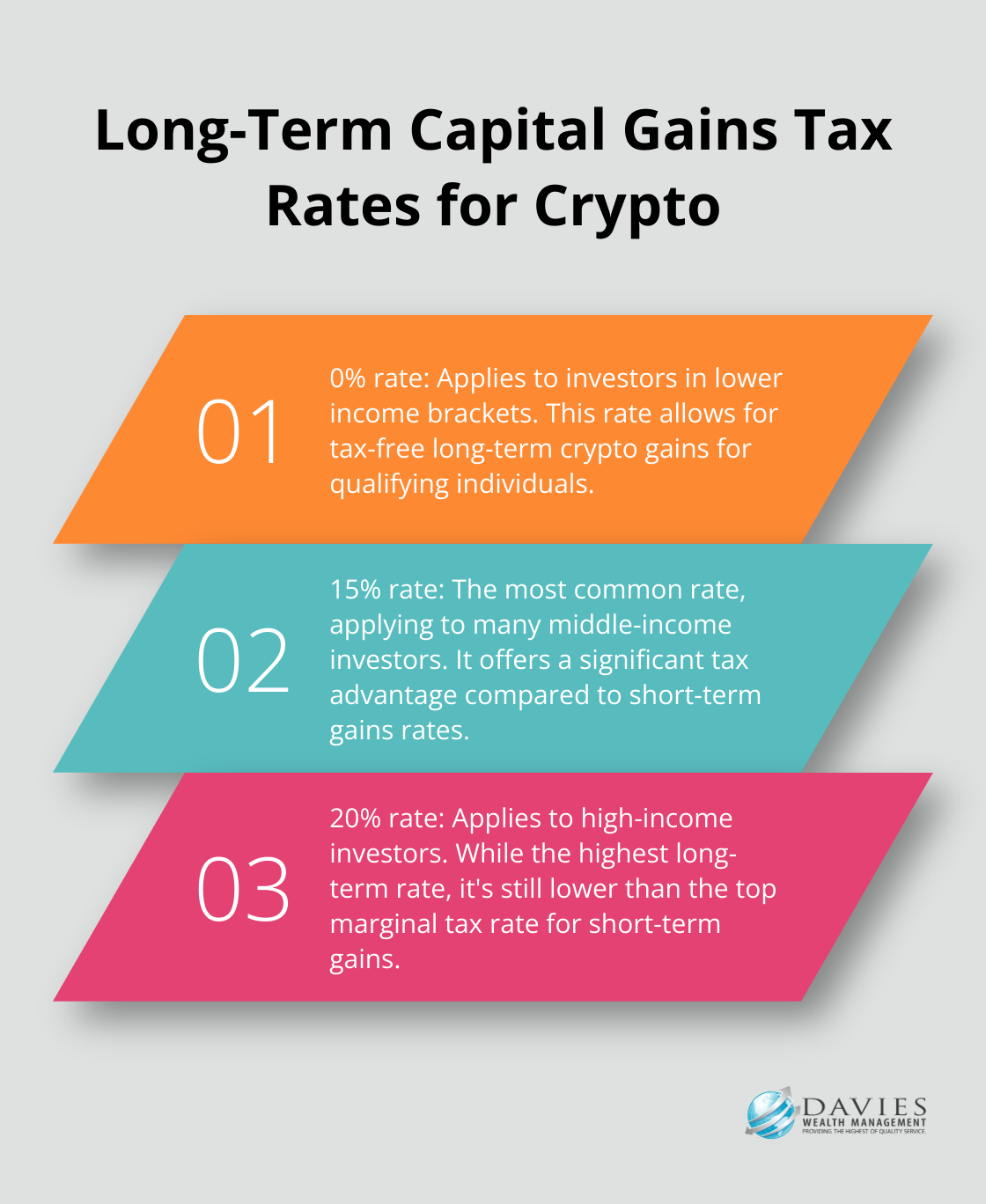

One of the simplest yet most effective strategies is to hold your crypto assets for more than a year. This approach allows you to benefit from long-term capital gains tax rates, which are significantly lower compared to short-term rates.

Investors can reduce their tax bills significantly by extending their holding periods. However, it’s important to balance this strategy with your overall investment goals and risk tolerance.

Strategic Tax-Loss Harvesting in Volatile Markets

Cryptocurrency markets are known for their volatility, which can be a double-edged sword. While it can lead to significant gains, it also presents opportunities for tax-loss harvesting. This strategy involves selling assets at a loss to offset capital gains elsewhere in your portfolio.

Engaging in tax-loss harvesting reflects a voluntary commitment to reporting gains and losses to the tax authority, which likely identifies the investor as compliant. Unlike traditional securities, cryptocurrencies are not subject to the wash-sale rule, allowing you to repurchase the same asset immediately after selling for a loss.

Utilizing Crypto IRAs for Tax-Deferred Growth

For long-term investors, a Crypto IRA can be an excellent tool for tax-deferred growth. These specialized retirement accounts allow you to invest in cryptocurrencies while enjoying the tax benefits of traditional or Roth IRAs.

Cryptocurrency IRAs-or Bitcoin IRAs-are a type of self-directed IRA (SDIRA) that lets you buy and sell cryptocurrencies in a tax-advantaged retirement account. This can be particularly advantageous if you expect cryptocurrency values to appreciate significantly over time.

Record-Keeping and Regulatory Awareness

Implementing these strategies requires careful planning and execution. It’s essential to keep meticulous records of all your crypto transactions, as the burden of proof lies with the taxpayer in case of an audit. Additionally, the regulatory landscape for cryptocurrencies continues to evolve, so staying informed about changes in tax laws is vital.

As we move forward, we’ll explore advanced tax optimization techniques that can further enhance your crypto investment strategy. These sophisticated approaches will help you take your tax-efficient investing to new heights and potentially unlock even greater returns.

Advanced Crypto Tax Strategies

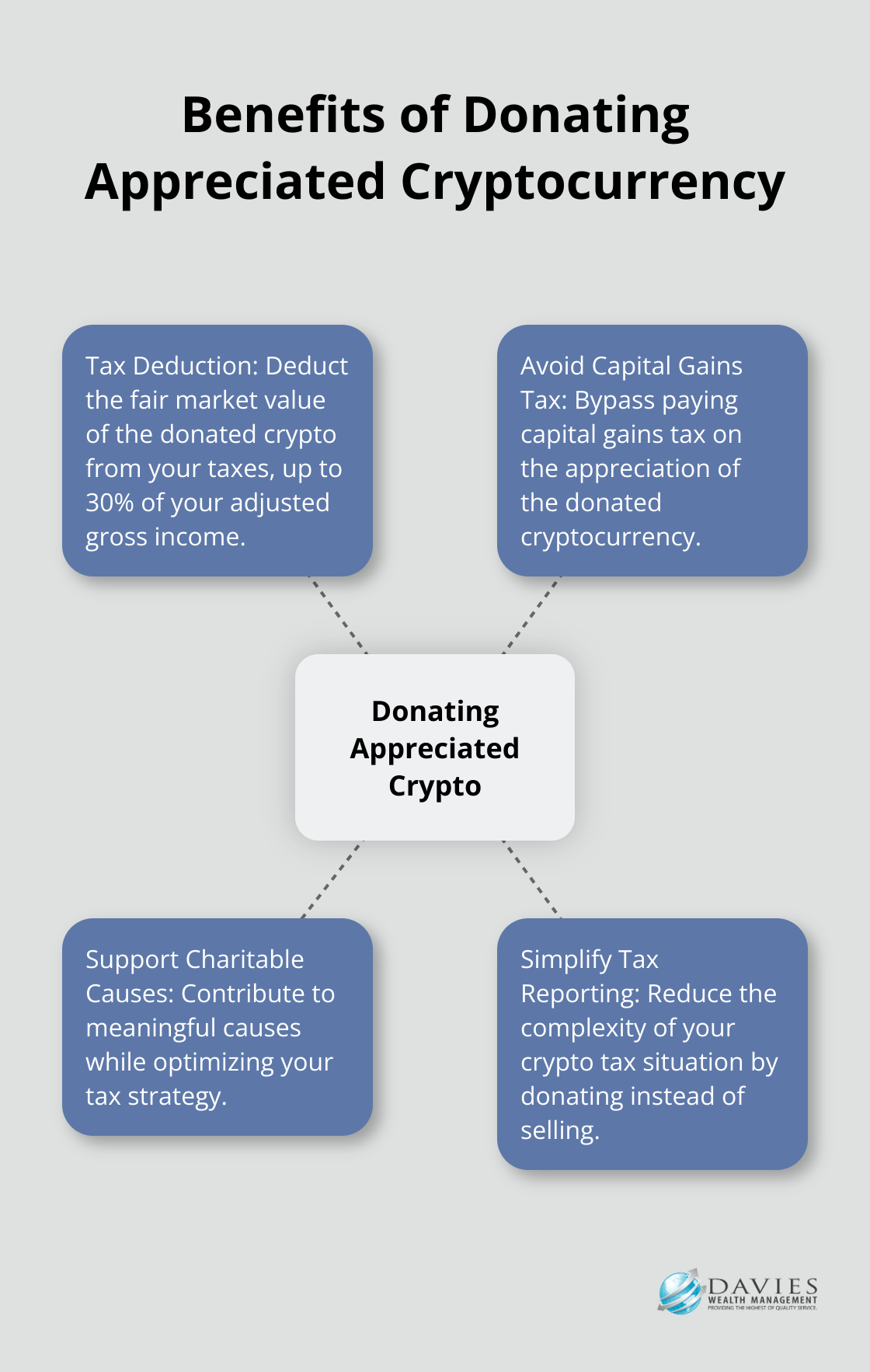

Charitable Donations with Appreciated Crypto

Donating appreciated cryptocurrency to charity can reduce your tax liability while supporting causes you care about. When you donate crypto held for over a year, you can deduct the fair market value (up to 30% of your adjusted gross income) from your taxes. This strategy allows you to avoid capital gains tax on the appreciation.

For instance, if you purchased Bitcoin at $10,000 and its current value is $50,000, donating it directly to a qualified charity could result in a $50,000 tax deduction. You’d avoid paying capital gains tax on the $40,000 appreciation, potentially saving thousands in taxes.

Opportunity Zone Investments

Opportunity Zones provide a unique method to defer and potentially reduce taxes on crypto gains. Under the QOF provision, a taxpayer reinvesting capital gains in such areas can defer paying tax on those gains until as late as 2027, and obtain a 15% reduction in the taxable gain. This strategy proves particularly effective for investors with substantial crypto gains who seek long-term investment opportunities in economically distressed communities.

International Tax Considerations

High-net-worth individuals can benefit from exploring international tax jurisdictions. Some countries offer favorable tax treatments for cryptocurrency. As of December 2023, the list of the most crypto-friendly countries includes Portugal, Malta, the UAE, Germany, Bermuda, the Cayman Islands, and El Salvador. However, this strategy requires careful planning and expert guidance to navigate complex international tax laws and maintain compliance with your home country’s tax regulations.

Tax-Efficient Portfolio Management

Implement a tax-efficient portfolio management strategy by prioritizing long-term holdings and minimizing frequent trading. This approach can help reduce your overall tax burden by taking advantage of lower long-term capital gains rates. Additionally, consider using tax-loss harvesting to offset gains in your portfolio, potentially reducing your taxable income.

Crypto IRA Investments

Explore the option of investing in cryptocurrencies through a self-directed IRA. All cryptocurrency trades within a crypto IRA grow without triggering immediate tax liabilities. Traditional crypto IRAs defer taxes until withdrawal, allowing for potential long-term appreciation without immediate tax implications.

Final Thoughts

Tax-efficient crypto investing requires a strategic approach to maximize returns while minimizing tax burdens. We explored various strategies, from long-term holding to advanced techniques like charitable donations with appreciated crypto assets. These approaches can help you navigate the complex world of cryptocurrency taxation and potentially unlock greater returns.

The cryptocurrency landscape and tax legislation continue to evolve rapidly. You must stay informed about changes and regularly review your investment approach to maintain optimal tax efficiency. Your specific financial goals, risk tolerance, and overall portfolio composition all play a role in determining the most appropriate tax strategies for you.

At Davies Wealth Management, we specialize in helping clients navigate the complexities of crypto investing and taxation. Our team of experts provides personalized advice tailored to your individual circumstances. For comprehensive wealth management solutions, including tax-efficient crypto investing strategies, visit our website to learn more about how we can assist you in achieving your financial goals.

Leave a Reply