Sustainable investment strategies are reshaping the financial landscape, offering a path to align your portfolio with your values. At Davies Wealth Management, we’ve witnessed a surge in interest from clients seeking to make a positive impact while growing their wealth.

The future of investing is green, socially responsible, and financially rewarding. This blog post will guide you through the world of sustainable investing, exploring key strategies and practical implementation tips.

Understanding Sustainable Investing

The Essence of Sustainable Investing

Sustainable investing is a powerful approach that combines financial returns with positive social and environmental impact. This strategy integrates environmental, social, and governance (ESG) factors into investment decisions, going beyond traditional financial analysis. It considers how companies manage their environmental footprint, treat their employees, and govern their operations.

The US SIF Foundation reports that sustainable investing assets in the United States reached $6.5 trillion in 2023 (representing 12% of total U.S. assets under management). This substantial figure underscores the growing importance of this investment strategy.

Historical Evolution

The roots of sustainable investing trace back to the 1960s, but it has transformed significantly since then. Initially, it focused on excluding certain industries like tobacco or weapons. Now, it includes proactive investment in companies that lead in sustainability.

A key milestone occurred in 2006 with the launch of the United Nations Principles for Responsible Investment (UNPRI). The PRI is the world’s leading proponent of responsible investment, working to understand the investment implications of environmental, social and governance factors.

Diverse Approaches to Sustainable Investing

ESG Integration

This approach systematically incorporates ESG factors into financial analysis. For example, when evaluating an energy company, an investor might consider its carbon emissions reduction plans alongside its financial statements.

Impact Investing

Impact investing aims to generate specific social or environmental benefits alongside financial returns. The Global Impact Investing Network reports that this market grew to $715 billion in 2020.

Socially Responsible Investing (SRI)

SRI aligns investments with personal values. It often includes both negative screening (excluding certain industries) and positive screening (favoring companies with strong ESG practices).

Tailoring Strategies to Individual Goals

Professional financial advisors can tailor these approaches to meet specific client goals and values. For instance, some firms have helped professional athletes invest in clean energy projects that offer competitive returns while aligning with personal commitments to environmental sustainability.

As we move forward, it’s important to explore the key strategies that form the backbone of sustainable investing. These strategies provide investors with practical tools to implement their sustainable investment goals effectively.

Effective Sustainable Investment Strategies

Sustainable investing offers a variety of approaches for investors to align their portfolios with their values while potentially enhancing long-term returns. At Davies Wealth Management, we recognize the importance of tailoring these strategies to meet individual client needs and goals.

Exclusionary Screening

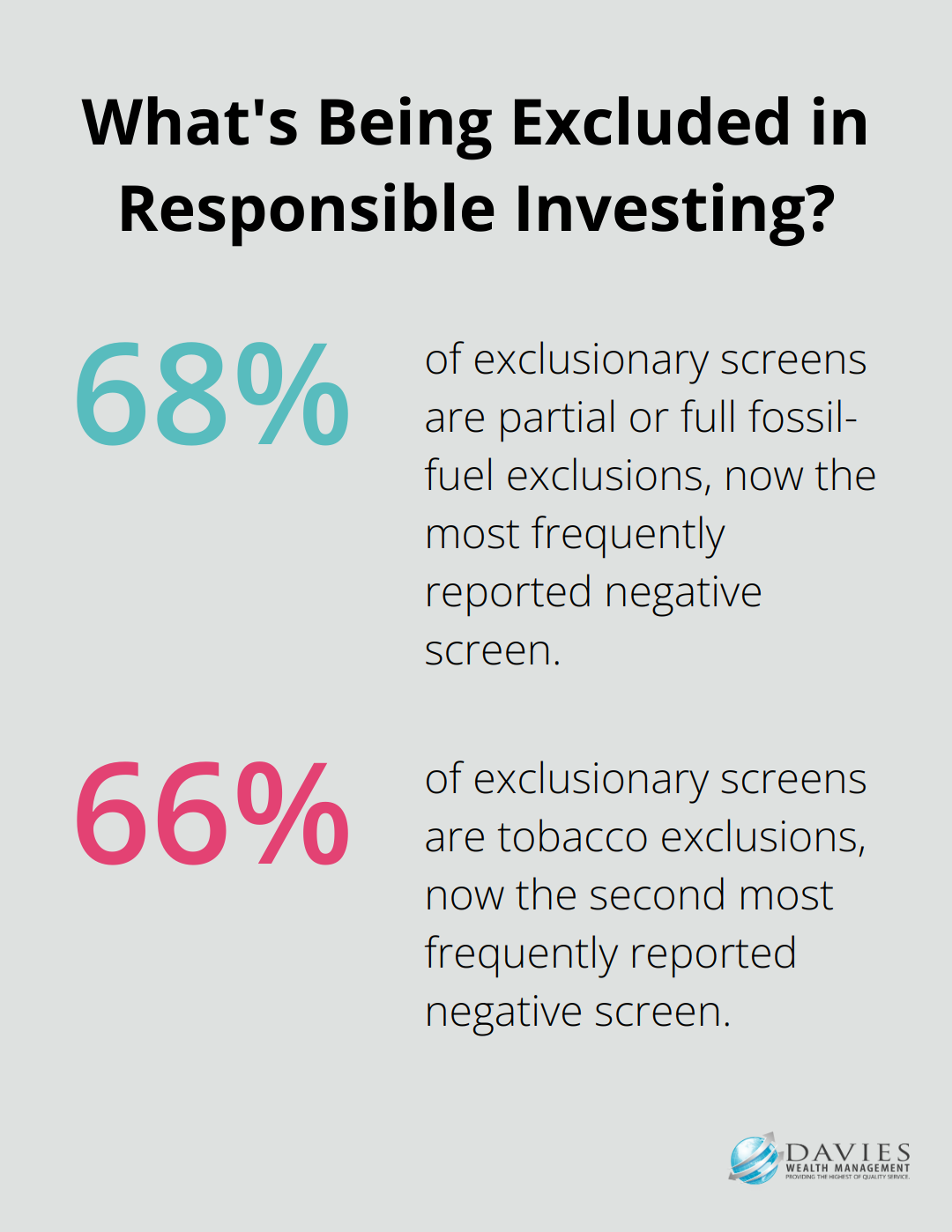

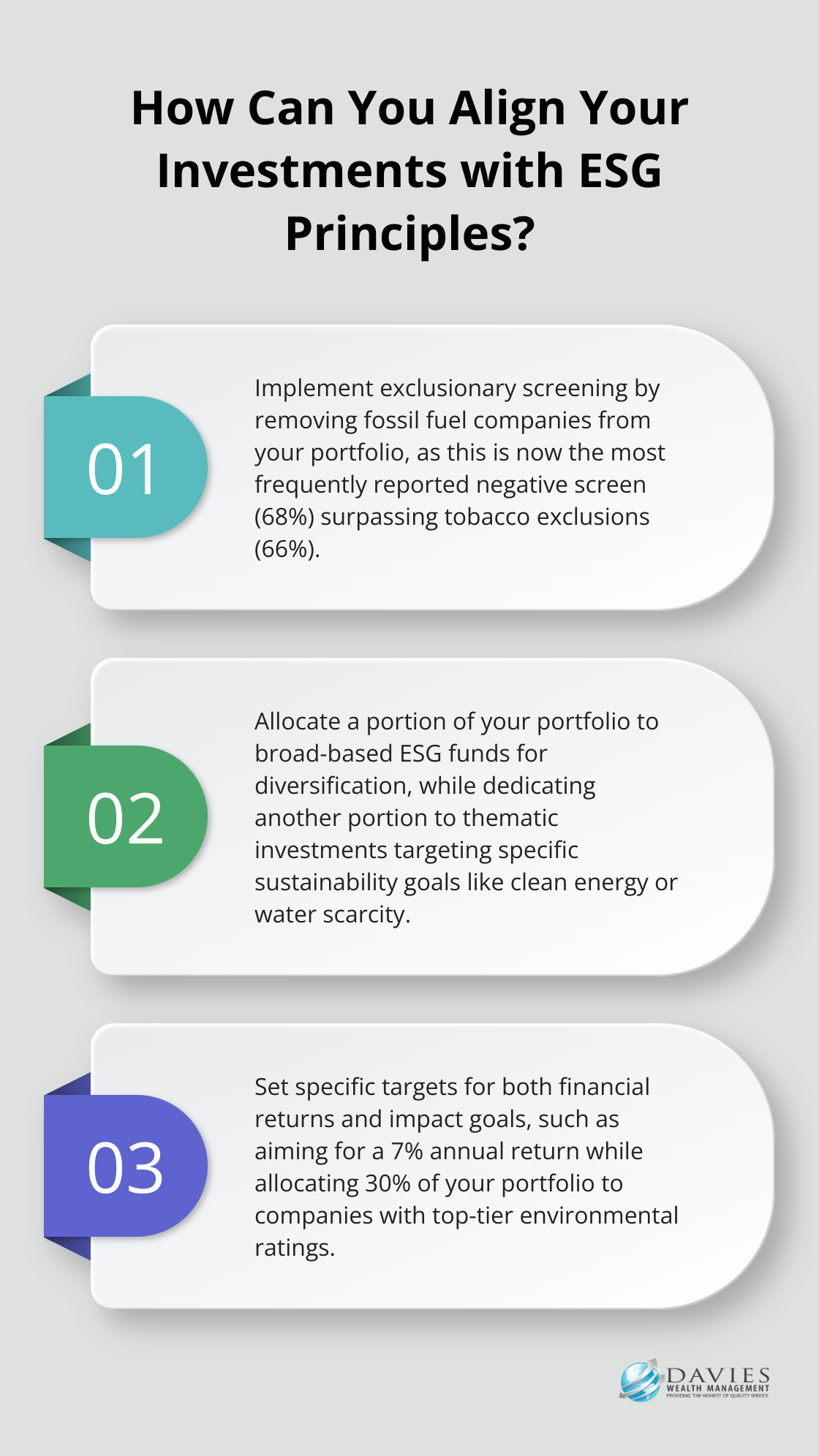

Exclusionary screening removes specific companies or sectors from a portfolio based on ethical, social, or environmental criteria. Partial or full fossil-fuel exclusions is now the most frequently reported negative screen (68%), surpassing tobacco exclusions (66%). This approach appeals to investors with strong ethical convictions, allowing them to avoid industries that conflict with their values.

Best-in-Class Selection

In contrast to exclusionary screening, best-in-class selection focuses on including companies that lead in environmental, social, and governance (ESG) practices within their respective industries. This strategy enables investors to maintain sector diversification while prioritizing sustainability. For instance, an investor might select energy companies with the lowest carbon emissions or most ambitious renewable energy targets.

Thematic Investing

Thematic investing concentrates on specific sustainability trends, such as clean energy, water scarcity, or sustainable agriculture. This approach allows investors to capitalize on long-term sustainability trends while potentially generating attractive returns. For example, recent activity in the renewable energy sector has surpassed last year’s figures and significantly exceeded initial projections, with U.S. consumers spending a record $12.4 billion on related products.

Active Ownership

Active ownership utilizes shareholder rights to influence company behavior. This strategy includes voting on shareholder resolutions, engaging in dialogue with company management, or filing shareholder proposals. Research published in the Review of Financial Studies found that successful ESG engagements led to positive abnormal returns of 4.4% for target companies, suggesting that active ownership can drive positive change and potentially enhance shareholder value.

Implementing Sustainable Strategies

Effective implementation of these strategies requires expertise and ongoing monitoring. Professional financial advisors play a critical role in helping clients select and execute sustainable investment strategies that align with their objectives. For instance, some firms (including Davies Wealth Management) have assisted professional athletes in investing in clean energy projects that offer competitive returns while supporting their personal environmental commitments.

As the sustainable investing landscape continues to evolve, it becomes increasingly important for investors to understand how to implement these strategies effectively in their own portfolios. The next section will explore practical steps for integrating sustainable investment strategies into your financial plan.

How to Put Sustainable Investing into Practice

Define Your Financial Goals and Values

The first step in sustainable investing involves a clear definition of your financial objectives and the values you want your investments to reflect. This process often reveals surprising insights. For example, some investors discover that their passion for renewable energy can translate into profitable investment opportunities they hadn’t previously considered.

After identifying your priorities, quantify them. Set specific targets for both financial returns and impact goals. You might aim for a 7% annual return while allocating 30% of your portfolio to companies with top-tier environmental ratings.

Research and Select Sustainable Investment Options

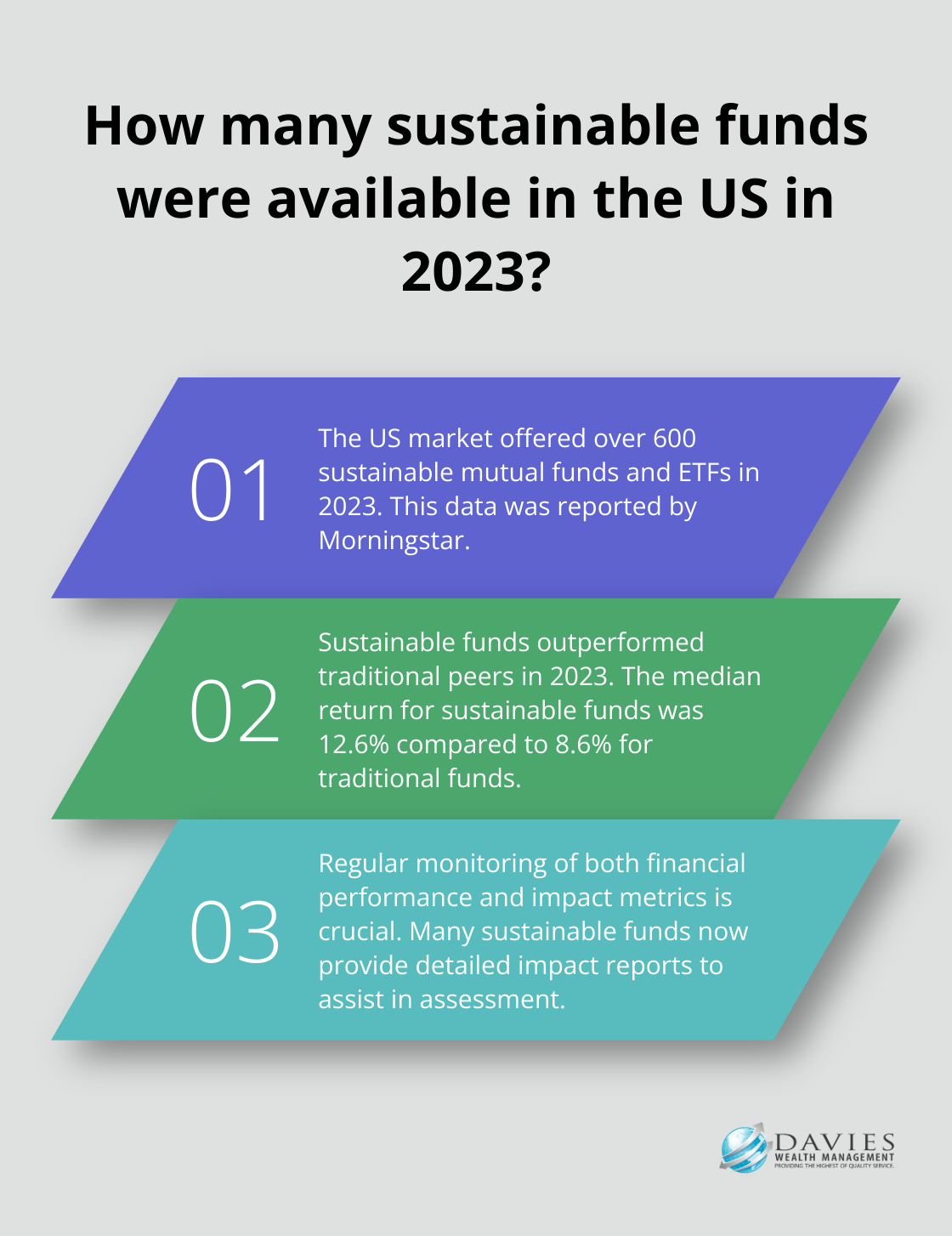

The next phase requires thorough research and selection of sustainable investment options. This task can seem daunting due to the vast array of choices available. In 2023, the U.S. market alone offered over 600 sustainable mutual funds and ETFs (according to Morningstar data).

To narrow down your options, focus on funds or companies that closely align with your defined values and financial goals. Look for transparency in reporting and clear methodologies for measuring impact. Consider the track record of sustainable investments. A Morgan Stanley study found that sustainable funds outperformed their traditional peers in 2023 with a median return of 12.6% compared to traditional funds’ 8.6%, dispelling misconceptions about their financial viability.

Balance Risk and Return

Striking the right balance between risk and return in sustainable portfolios is essential. While impact is important, maintaining a diversified portfolio remains key to managing risk. Consider spreading your investments across various sectors and geographies, even within the sustainable universe.

An effective strategy involves allocating a portion of your portfolio to broad-based ESG funds for diversification, while dedicating another portion to thematic investments that target specific sustainability goals. ESG funds let you make investments in what matters most to you and can play a role in your portfolio.

Monitor and Adjust Your Investments

Sustainable investing requires regular monitoring and adjustment of your investments. This process involves tracking both financial performance and impact metrics. Many sustainable funds now provide detailed impact reports, facilitating the assessment of their effectiveness in meeting your goals.

Be prepared to make adjustments based on changing market conditions or shifts in your personal priorities. If a particular fund doesn’t deliver the expected impact, consider reallocating those assets.

Seek Professional Guidance

Implementing sustainable investment strategies requires careful planning, research, and ongoing management. Working with experienced advisors can help create a portfolio that aims for financial success while contributing to a more sustainable future. At Davies Wealth Management, we offer expertise in sustainable investing and can guide you through this process, ensuring your portfolio aligns with both your financial objectives and values.

Final Thoughts

Sustainable investment strategies have transformed from niche approaches to mainstream investment practices. These strategies offer unique opportunities for investors to align their portfolios with their values while potentially enhancing long-term returns. The growing importance of sustainable investing is undeniable, with sustainable assets in the United States reaching $6.5 trillion in 2023 (representing 12% of total U.S. assets under management).

Studies have shown that sustainable funds can outperform traditional peers, dispelling the myth that values-based investing requires sacrificing returns. As the sustainable investing landscape continues to evolve, it becomes increasingly important for investors to have expert guidance. Our team at Davies Wealth Management understands the nuances of different sustainable investment strategies and can help create a portfolio that aligns with both financial goals and personal values.

The future of investing is sustainable, and now is the time to position your portfolio for both financial success and positive impact. Davies Wealth Management can help you implement sustainable investment strategies that work towards a more prosperous future for you and for the world. We invite you to partner with us to build a portfolio that reflects your values and supports your financial goals.

Leave a Reply