Retirement income planning in Stuart, Florida presents unique challenges and opportunities for retirees. The coastal city’s economic landscape and retirement-friendly policies significantly impact financial strategies for seniors.

At Davies Wealth Management, we understand the importance of tailoring retirement plans to Stuart’s specific environment. Our expert advice aims to help you navigate local considerations and build a secure financial future in this beautiful Florida community.

How Stuart’s Economy Shapes Retirement Planning

Tourism’s Dual Impact on Retirement Income

Stuart, Florida’s economy heavily relies on tourism, particularly beach-related activities. Recent data shows that beach-oriented tourists have generated $310 in tax revenues for Florida. This economic driver creates both opportunities and challenges for retirees. It offers potential part-time employment options in hospitality and service industries, allowing seniors to supplement their retirement income. However, it also means that local prices for goods and services can fluctuate seasonally, affecting retirees’ purchasing power.

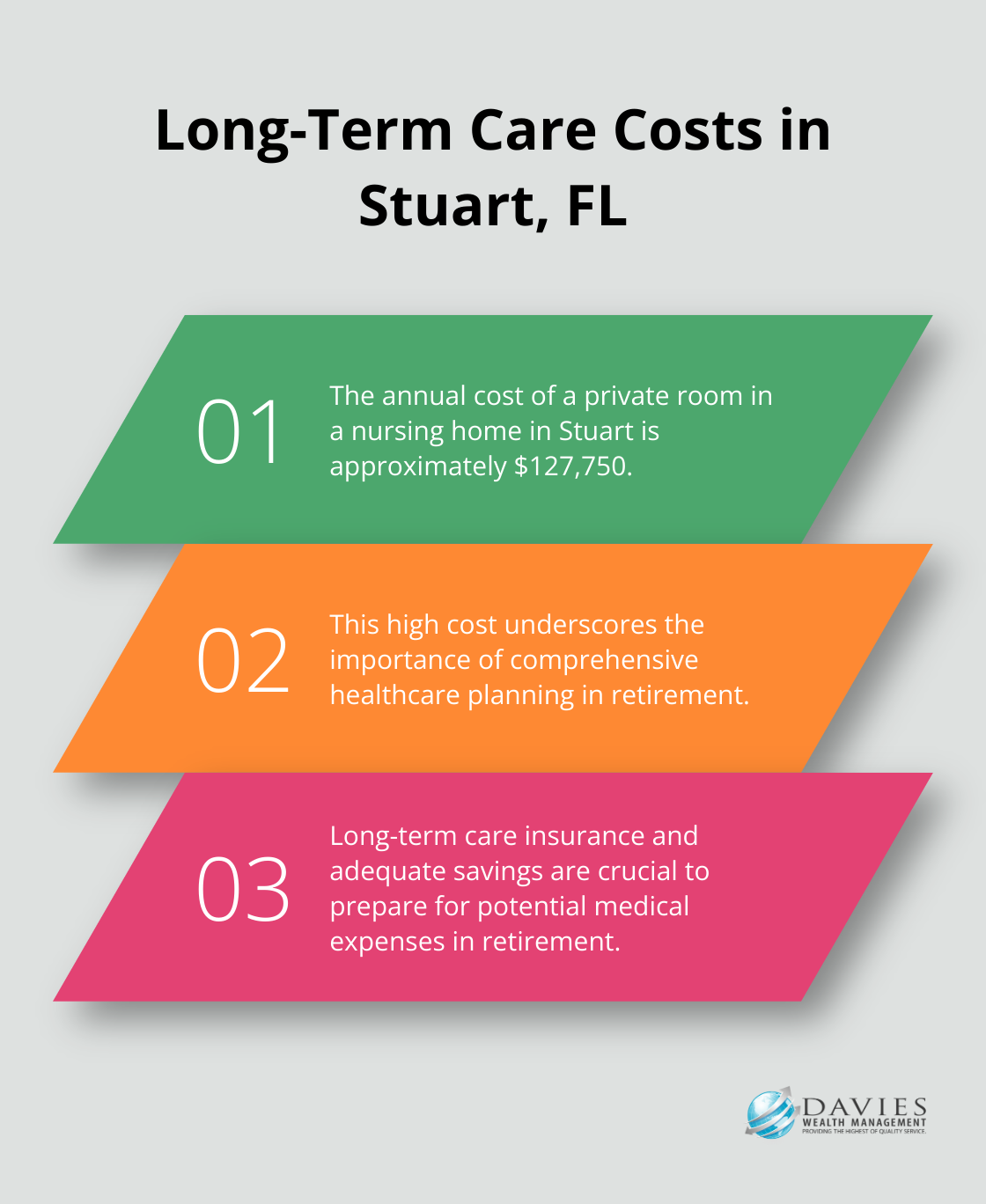

Healthcare Sector: A Double-Edged Sword

The healthcare industry, led by Martin Health System, stands as the largest employer in Stuart. This robust healthcare presence ensures access to quality medical care but also highlights the importance of comprehensive healthcare planning in retirement. The annual cost of a private room in a nursing home in Stuart (approximately $127,750) underscores the need for long-term care insurance and adequate savings for potential medical expenses.

Navigating the Real Estate Market

Stuart’s real estate market offers diverse opportunities for retirees, with condo prices ranging from $329,900 to $549,900. However, the median home sold price in Stuart as of July 2025 is $413,000, which has increased by 0.7% over the past year. This market volatility emphasizes the importance of careful consideration when deciding whether to rent or buy in retirement. Retirees should also factor in the cost of hurricane insurance ($2,000 to $3,000 annually for standard homeowners insurance).

Cost of Living Considerations

While Stuart’s cost of living is 5% higher than the national average, it offers some financial advantages for retirees. Florida’s lack of state income tax allows retirees to maximize their savings from Social Security, pensions, and retirement accounts. However, this benefit is partially offset by higher costs in other areas. For instance, the average monthly cost for assisted living communities in Stuart (approximately $3,500) represents a significant expense for many retirees.

Creating a Comprehensive Retirement Budget

Retirees in Stuart should create a comprehensive budget that accounts for these local economic factors. This budget should include not only regular living expenses but also potential costs for healthcare, long-term care, and disaster-related emergencies. Understanding and planning for Stuart’s unique economic landscape will help retirees position themselves for a financially secure retirement in this beautiful coastal community.

As we move forward, it’s important to explore key strategies for retirement income planning that can help Stuart residents make the most of their financial resources in this unique economic environment.

Optimizing Your Retirement Income in Stuart

Stuart’s unique economic landscape requires a strategic approach to retirement income planning. We have developed effective strategies to help our clients navigate this complex terrain.

Diversifying Income Streams

Relying solely on Social Security or a single pension plan increases risk. We recommend the creation of multiple income streams to ensure financial stability. For instance, investments in dividend-paying stocks can provide regular income. The average dividend yield for S&P 500 companies currently stands at 1.222%, but some sectors, like utilities, offer higher yields.

Real estate investments in Stuart can also generate steady income. With the median rent for all bedroom counts and property types in Stuart at $2,600 per month as of August 2025, rental properties can be a lucrative option. However, it’s important to factor in property management costs.

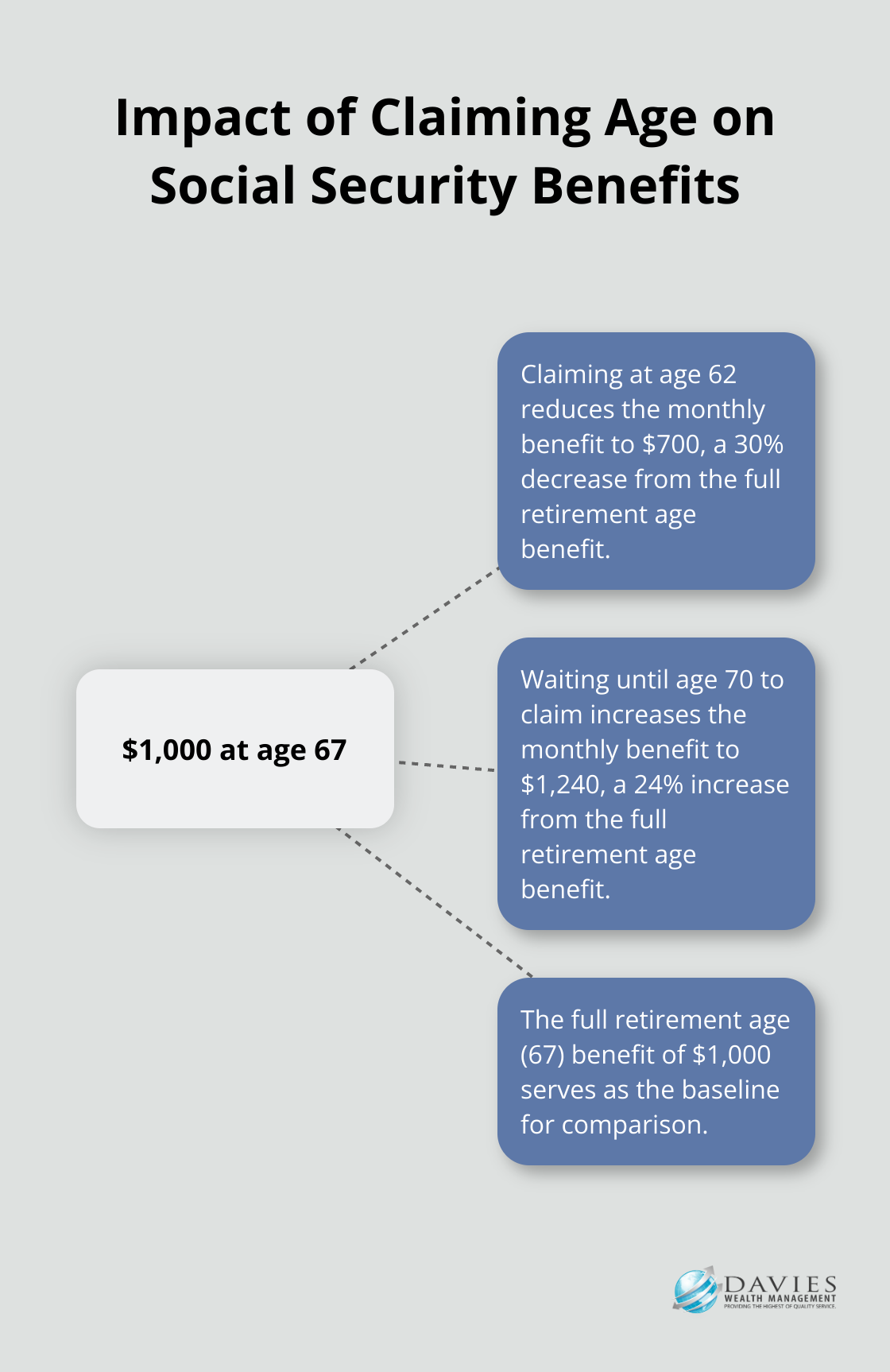

Maximizing Social Security Benefits

Timing is key when it comes to Social Security. While you can start claiming benefits at 62, waiting until full retirement age (66-67 for most people) or even 70 can significantly increase your monthly payout. For example, if your full retirement age is 67 and your monthly benefit at that age would be $1,000, claiming at 62 would reduce it to $700, while waiting until 70 would increase it to $1,240.

For married couples, coordination of claim strategies can maximize lifetime benefits. One spouse might claim early while the other delays, potentially increasing the survivor benefit.

Tax-Efficient Withdrawal Strategies

Florida’s lack of state income tax provides a significant advantage, but federal taxes still apply. We recommend a tax-efficient withdrawal strategy to minimize your overall tax burden.

Start by withdrawing from taxable accounts first, allowing tax-advantaged accounts (like traditional IRAs and 401(k)s) to continue growing tax-deferred. Then, consider Roth conversions in lower-income years to reduce future required minimum distributions (RMDs).

For those over 70½, Qualified Charitable Distributions (QCDs) allow you to donate up to $100,000 annually from your IRA directly to charity, satisfying your RMD without increasing your taxable income.

Tailoring Strategies to Individual Needs

Every retiree’s situation is unique, and a one-size-fits-all approach rarely yields optimal results. Factors such as health, family situation, and personal goals all play a role in shaping the most effective retirement income strategy.

For instance, retirees with significant healthcare concerns might prioritize building a larger emergency fund or investing in long-term care insurance. Those with a strong desire to leave a legacy might focus more on estate planning strategies.

As we move forward, it’s important to explore Florida’s retirement-friendly policies and how they can further enhance your retirement income plan in Stuart.

How Florida’s Retirement Policies Can Benefit You

Tax Advantages for Retirees

Florida’s tax policies offer significant advantages for retirees in Stuart. Florida has no state income tax, which means your Social Security benefits, pension income, and withdrawals from retirement accounts are all free from state taxation. This can result in substantial savings compared to many other states.

Florida also does not have an estate or inheritance tax, which is important for wealth transfer planning. This allows you to pass on more of your assets to your heirs without state-level tax implications.

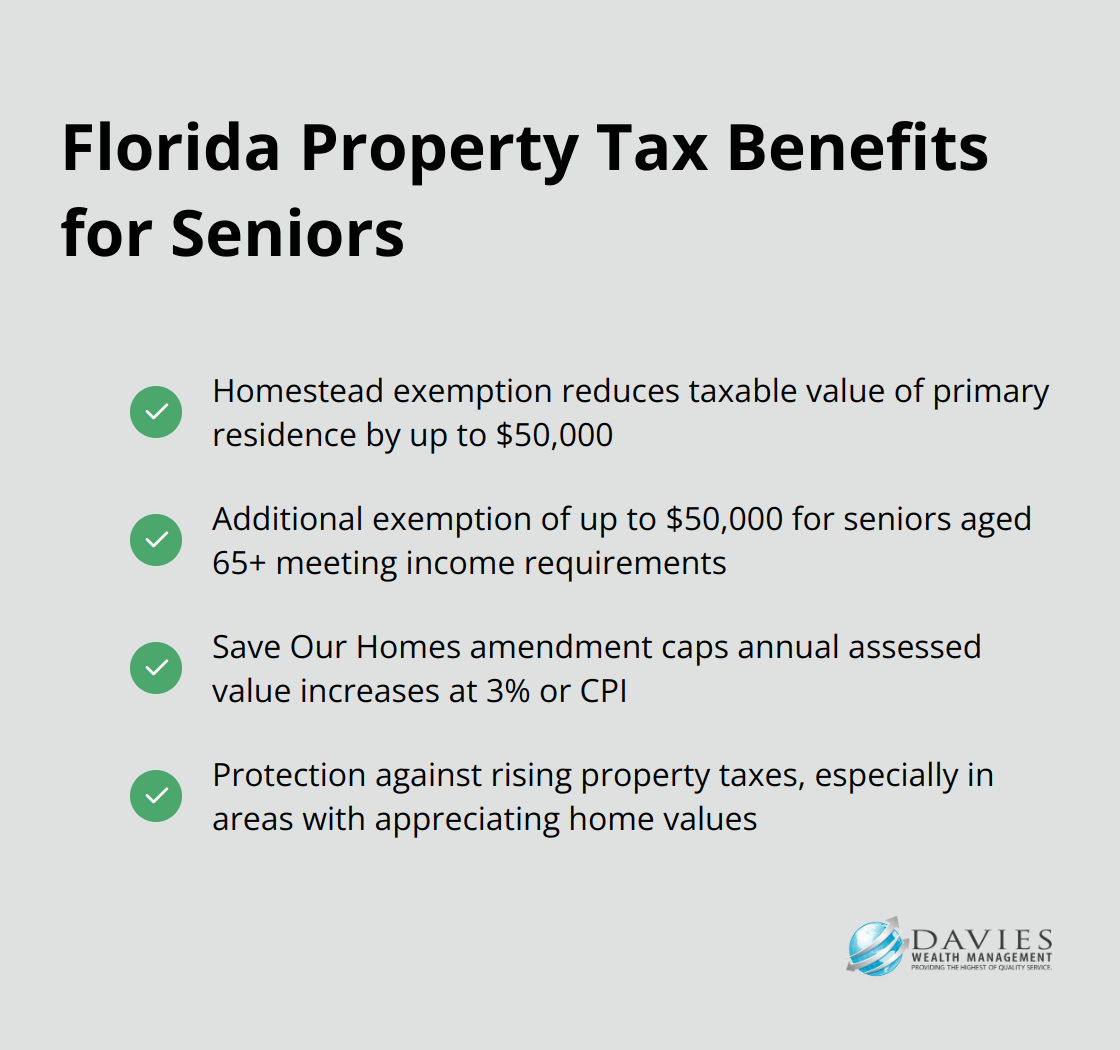

Property Tax Benefits

Florida offers several property tax benefits for seniors. The homestead exemption reduces the taxable value of your primary residence by up to $50,000. For seniors aged 65 and older who meet certain income requirements, an additional exemption of up to $50,000 may be available.

The Save Our Homes amendment caps annual increases in the assessed value of homesteaded properties at 3% or the Consumer Price Index (whichever is lower). This provides significant protection against rising property taxes, especially in areas with rapidly appreciating home values like Stuart.

Local Programs for Seniors

Stuart and Martin County offer various programs and resources for seniors. The Martin County Parks and Recreation Department provides fitness classes, social activities, and educational programs specifically designed for older adults. Many of these programs are offered at reduced rates for seniors.

The Council on Aging of Martin County operates adult day care centers and provides meals on wheels services. They also offer transportation assistance for medical appointments and shopping, which can help maintain independence in retirement.

Estate Planning in Florida

Estate planning in Florida has some unique considerations. Florida law requires that a will be signed in the presence of two witnesses to be valid. The state also recognizes living wills and health care surrogates, which can be important for medical decision-making.

Florida’s homestead laws provide strong protection for your primary residence from creditors, but they can also complicate estate planning. These laws can restrict how you leave your home to your heirs, potentially overriding the provisions in your will.

Maximizing Florida’s Retirement Benefits

To make the most of Florida’s retirement-friendly policies, consider strategies such as Roth IRA conversions. With no state income tax, the cost of converting traditional IRA funds to a Roth IRA can be lower in Florida compared to many other states.

You should also explore opportunities to maximize your property tax exemptions. Take advantage of all available exemptions and consider the tax implications when deciding whether to downsize or purchase a new home in retirement.

Final Thoughts

Retirement income planning in Stuart, Florida requires a tailored approach that considers the unique economic landscape and local resources. We at Davies Wealth Management understand the complexities of retirement planning in this coastal community. Our team of experts creates comprehensive strategies that address specific needs of Stuart residents, from healthcare costs to investment portfolio optimization.

We offer personalized service to help you navigate complex decisions and create a secure financial future. Our commitment to clear, actionable solutions ensures you can approach retirement with confidence. We provide the expertise to maximize your income, minimize your tax burden, and ensure your financial security throughout your retirement years.

Take the first step towards a secure retirement today by seeking personalized advice from Davies Wealth Management. Our team will work closely with you to develop strategies that allow you to enjoy the beautiful coastal lifestyle Stuart has to offer while maintaining financial stability. Don’t leave your retirement to chance – let us help you create a plan tailored to your goals and circumstances.

✅ Schedule a Personalized Appointment

Take the next step in your financial journey by booking a private consultation:

https://davieswealth.tdwealth.net/appointment-page

Explore Our Latest Insights

Stay informed with our most recent articles on retirement, investing, and wealth management:

https://tdwealth.net/articles/

Stay Connected on YouTube

If you find our content valuable, a quick “like” goes a long way in helping others discover it.

https://www.youtube.com/channel/UChmBYECKIzlEBFDDDBu-UIg

Have Questions? Get in Touch

Reach out directly at: TDavies@TDWealth.Net

Download Our Complimentary Guides

Gain clarity and confidence in your financial planning with our free resources:

- Retirement Income: Transition Into Retirement

- https://davieswealth.tdwealth.net/retirement-income-transition-into-retirement

- Beginner’s Guide to Investing Basics

- https://davieswealth.tdwealth.net/investing-basics

Connect with Davies Wealth Management

Website: https://tdwealth.net

Podcast: https://1715tcf.com

Follow Us on Social Media:

- Facebook https://www.facebook.com/DaviesWealthManagement

- X (Twitter) https://x.com/TDWealthNet

- LinkedIn https://www.linkedin.com/in/daviesrthomas

- YouTube https://www.youtube.com/c/TdwealthNetWealthManagement

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

(772) 210-4031

Lat/Long: 27.17404889406371, -80.24410438798957

⚠️ Disclaimer

The information provided by Davies Wealth Management is for educational purposes only and should not be interpreted as financial, tax, or legal advice. We recommend consulting qualified professionals before making financial decisions. Davies Wealth Management is not liable for any actions taken without personalized guidance.

Leave a Reply