Financial independence is a goal that many aspire to, but few truly understand. At Davies Wealth Management, we’ve seen firsthand how achieving this milestone can transform lives and provide unparalleled freedom.

In this post, we’ll explore practical strategies to help you attain genuine financial independence, tailored to your unique circumstances and goals.

What Is True Financial Independence?

Redefining Financial Freedom

Financial independence transcends the possession of a substantial bank account or a lucrative career. At Davies Wealth Management, we’ve observed numerous individuals who believed they achieved financial independence, only to find themselves ensnared in a cycle of financial stress and uncertainty.

True financial independence empowers you to live life on your terms, free from financial constraints. It means generating sufficient passive income to cover your living expenses, allowing you to work out of choice rather than necessity.

Debunking Common Myths

Many people mistakenly believe that financial independence is reserved for the wealthy or requires extreme frugality. These misconceptions can impede your progress. However, financial independence hinges more on effective money management than high earnings.

Another prevalent myth suggests that financial independence equates to never working again. In reality, many financially independent individuals continue to work or pursue passion projects. The key distinction lies in the freedom to choose how they allocate their time.

Tailoring Your Financial Goals

Financial independence manifests differently for each individual. Some of our clients at Davies Wealth Management aspire to early retirement, while others seek the flexibility to change careers or launch a business without financial stress.

Your personal definition of financial independence should align with your values and life aspirations. Do you want to explore the world? Spend more time with family? Or perhaps dedicate yourself to philanthropy? These goals will shape your financial strategy and determine the level of wealth you need to accumulate.

Measuring Progress

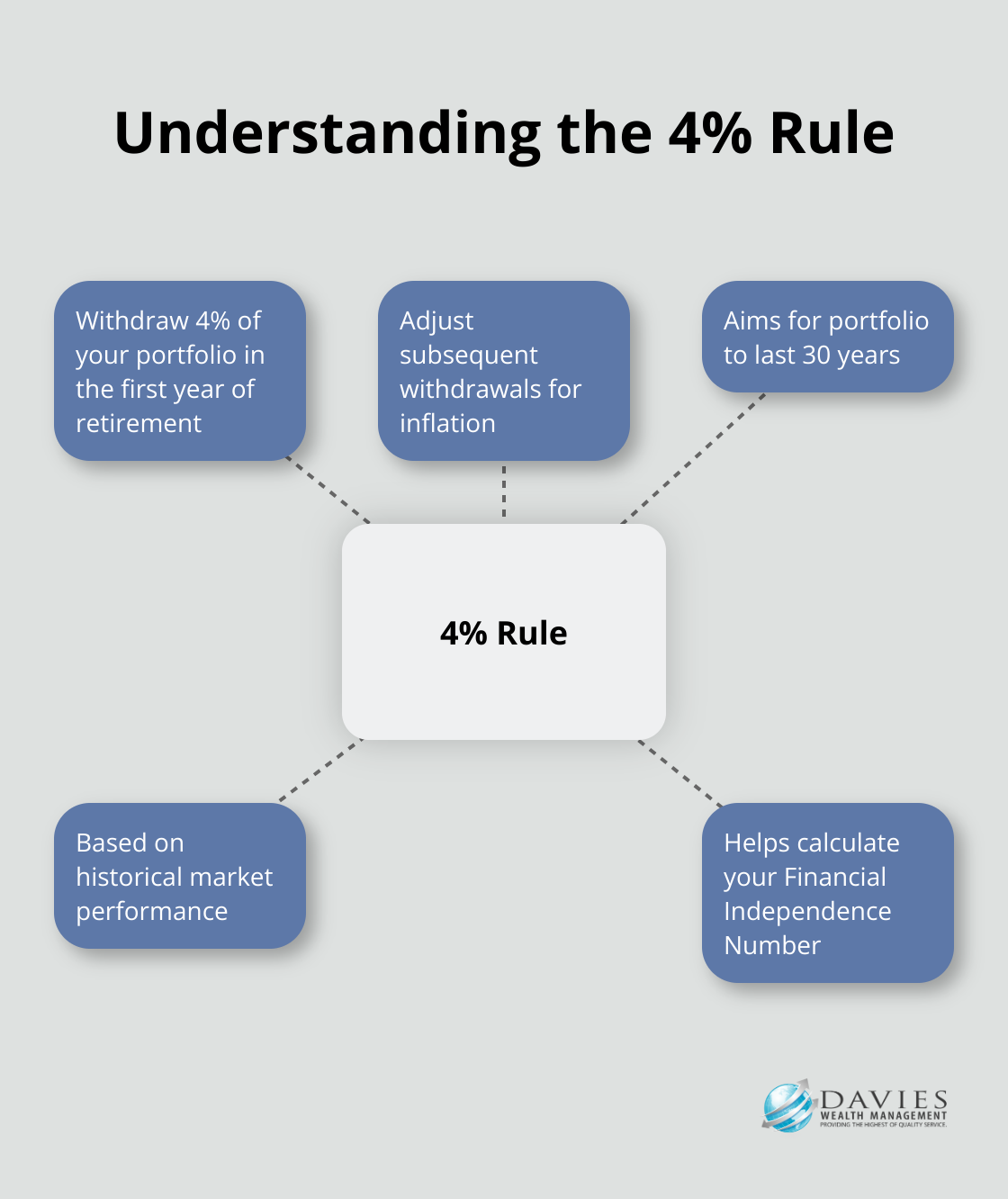

Tracking your progress towards financial independence is essential. One popular metric is the Financial Independence Number – the amount of invested assets needed to generate enough passive income to cover your expenses. Many FIRE champions like to use the 4% rule when calculating their FI number.

However, this rule isn’t universally applicable. Factors such as age, health, and lifestyle can impact your required savings. At Davies Wealth Management, we help our clients calculate a personalized Financial Independence Number that accounts for their unique circumstances and goals.

Financial independence requires consistent effort, smart planning, and a clear understanding of your personal objectives. As we move forward, let’s explore the key components that form the foundation of true financial independence and how you can incorporate them into your financial strategy.

Building Your Financial Independence Blueprint

Crafting a Solid Savings and Investment Plan

The cornerstone of financial independence is a well-structured savings and investment plan. Automating components of the savings process can lead to higher savings rates. This approach, known as “paying yourself first,” ensures consistent progress towards your financial goals.

For investments, diversification proves essential. A mix of low-cost index funds, individual stocks, and real estate can provide a balance of growth and stability. Vanguard’s model portfolio allocation strategies can help you build diversified portfolios that match your risk tolerance and investment goals.

Cultivating Multiple Income Streams

Relying on a single income source poses risks in today’s dynamic economy. Develop multiple income streams to enhance your financial resilience. This could include rental income from real estate investments, dividends from stocks, or profits from a side business.

Many investors have successfully supplemented their primary income by investing in dividend-paying stocks. The S&P 500 Dividend Aristocrats (companies that have increased their dividends for at least 25 consecutive years) have historically provided stable income and outperformed the broader market.

Adopting Sustainable Lifestyle Habits

Financial independence isn’t just about earning and saving – it’s also about spending wisely. Develop a lifestyle that aligns with your long-term financial goals. This doesn’t mean extreme frugality, but rather mindful spending.

Use tools like Personal Capital or Mint to track your expenses. Identify areas where you can cut back without sacrificing quality of life. For example, cooking at home instead of eating out can save the average American household over $3,000 per year (according to the Bureau of Labor Statistics).

Mastering Debt Management

Effective debt management plays a vital role in achieving financial independence. Start by tackling high-interest debt, such as credit card balances. Credit card balances now total $1.21 trillion outstanding, growing by $45 billion during the fourth quarter and are 4.0% above the level a year ago.

For lower-interest debts like mortgages, consider the opportunity cost before rushing to pay them off. In some cases, investing extra cash might yield better returns than early debt repayment. However, being debt-free can provide peace of mind that’s invaluable on your journey to financial independence.

As you implement these strategies, you’ll build a strong foundation for financial independence. But how do you turn these concepts into actionable steps? Let’s explore practical measures to transform your financial independence blueprint into reality.

Turning Financial Independence into Reality

Assess Your Financial Health

Before you pursue financial independence, you must understand your starting point. Conduct a thorough assessment of your current financial situation. This includes listing all your assets, debts, income sources, and expenses. Tools like Mint or Personal Capital can simplify this process, providing a comprehensive overview of your financial health.

Many people underestimate their spending. A study by the Federal Reserve Bank of New York found that households consistently underreport their credit card spending by an average of 50%. This highlights the need for a detailed, honest assessment of your finances.

Set SMART Financial Goals

After you clarify your financial situation, set goals. We recommend SMART goals: Specific, Measurable, Achievable, Relevant, and Time-bound. Instead of a vague goal like “save more money,” try something like “save $20,000 for a down payment on a house within two years.”

Research by Dominican University found that people who write down their goals are 42% more likely to achieve them. Take time to document your financial goals and review them regularly.

Control Your Cash Flow

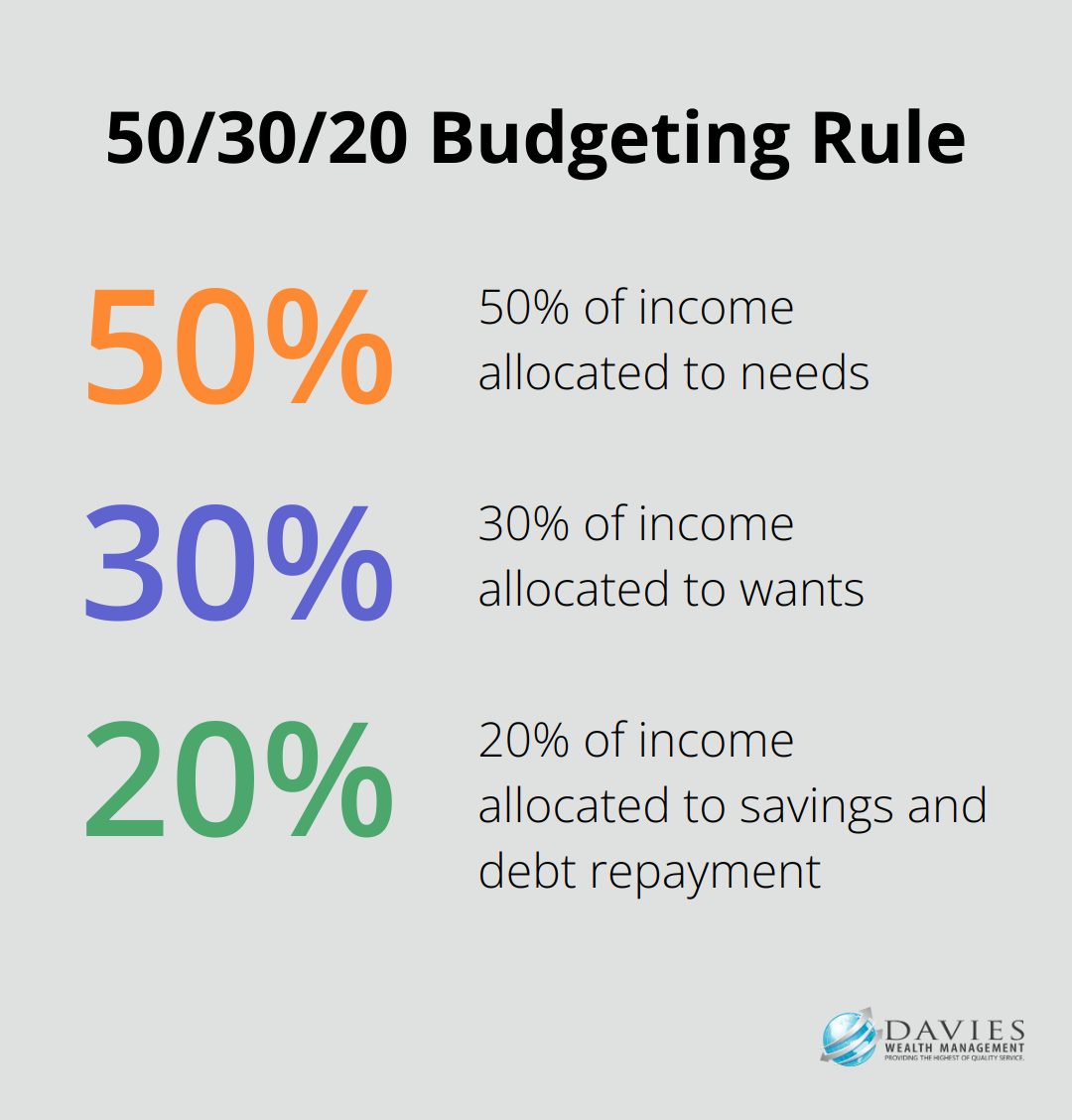

A budget is essential on the path to financial independence. The 50/30/20 rule serves as a good starting point: allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

However, for those serious about financial independence, we often suggest a more aggressive savings rate. Many individuals who have achieved financial independence save 40% or more of their income.

Optimize Tax-Advantaged Accounts

Use tax-advantaged retirement accounts to their full potential. As of 2025, you can contribute up to $6,000 to a 401(k) if you’re under 50, and an additional $1,000 in catch-up contributions if you’re 50 or older.

If you’re a high-income earner, consider advanced strategies like the Backdoor Roth IRA or Mega Backdoor Roth (these techniques can help you contribute to Roth accounts despite income limitations).

Create Multiple Income Streams

While your day job might be your primary income source, additional income streams can accelerate your journey to financial independence. This could involve starting a side business, investing in rental properties, or creating digital products.

A survey by Bankrate found that 45% of Americans have a side hustle, with the average side hustler earning $1,122 per month. That’s over $13,000 a year that could be invested or used to pay down debt.

Final Thoughts

Financial independence requires dedication, strategic planning, and consistent effort. You must redefine what true financial freedom means to you, debunk common misconceptions, and tailor your goals to align with your values. Building a robust savings and investment plan, creating multiple income streams, adopting sustainable lifestyle habits, and managing debt effectively will accelerate your progress towards financial independence.

The journey to financial independence is not an overnight achievement but a gradual process that demands patience and persistence. You should stay informed about personal finance and continuously educate yourself. The financial landscape changes constantly, and staying updated will help you make informed decisions that align with your long-term objectives.

At Davies Wealth Management, we understand that each individual’s path to financial independence is unique. Our team of experts specializes in crafting personalized strategies to help you achieve your financial goals (whether you’re a professional athlete, business owner, or individual seeking financial security). Take the first step towards financial independence today by visiting our website at Davies Wealth Management to learn how we can support your journey.

Leave a Reply