Stuart’s affluent families face unique opportunities when it comes to charitable giving. Smart philanthropic planning can reduce tax burdens while creating lasting impact in the community.

We at Davies Wealth Management see how strategic approaches transform both financial outcomes and family legacies. The right giving structure makes every dollar work harder for causes you care about.

Why Strategic Giving Beats Random Donations

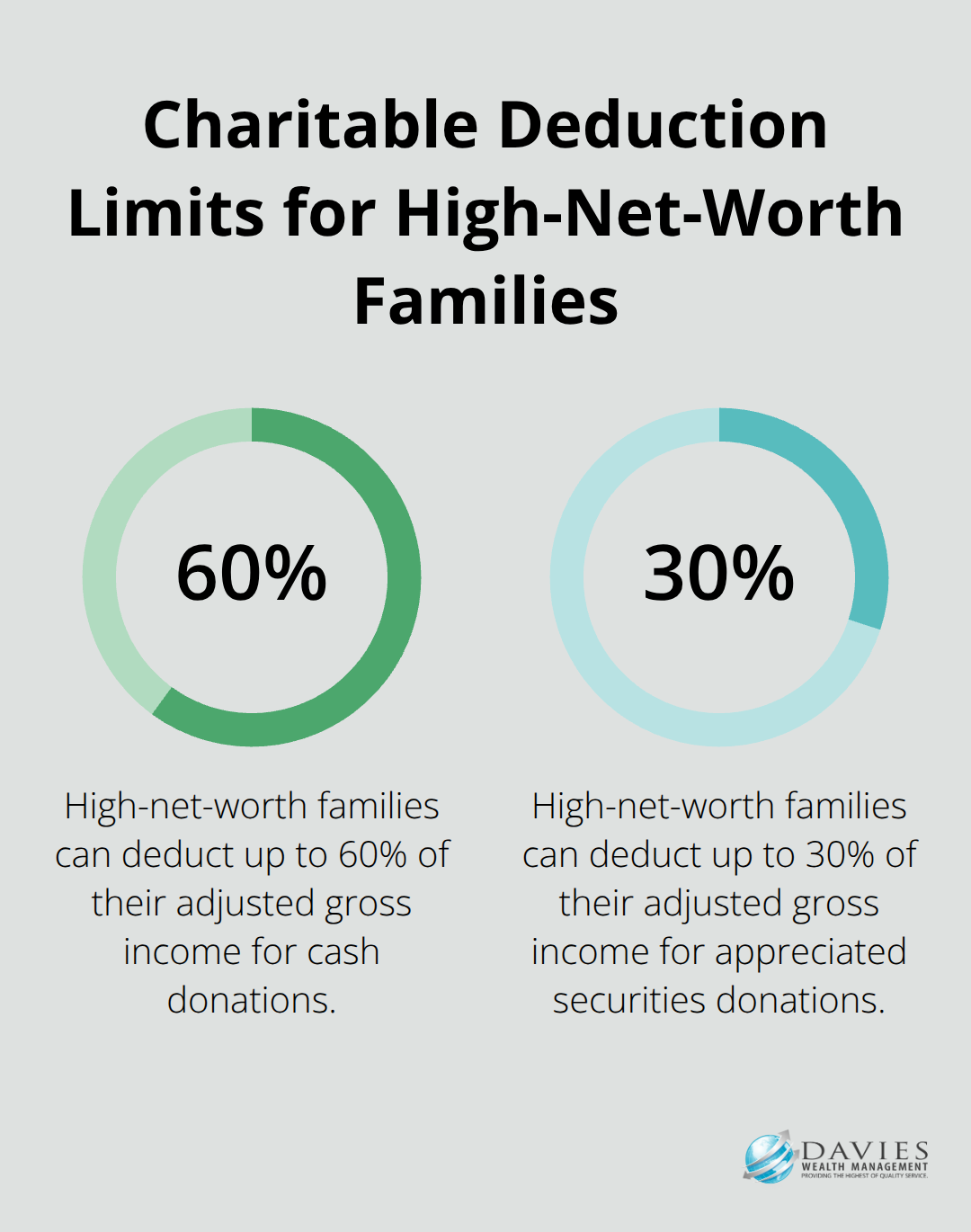

High-net-worth families who approach charitable giving strategically can deduct up to 60% of their adjusted gross income for cash donations and 30% for appreciated securities according to IRS guidelines. This structured approach transforms philanthropy from an expense into a wealth preservation tool that simultaneously reduces estate taxes and creates generational impact.

Tax Deduction Maximization Through Asset Selection

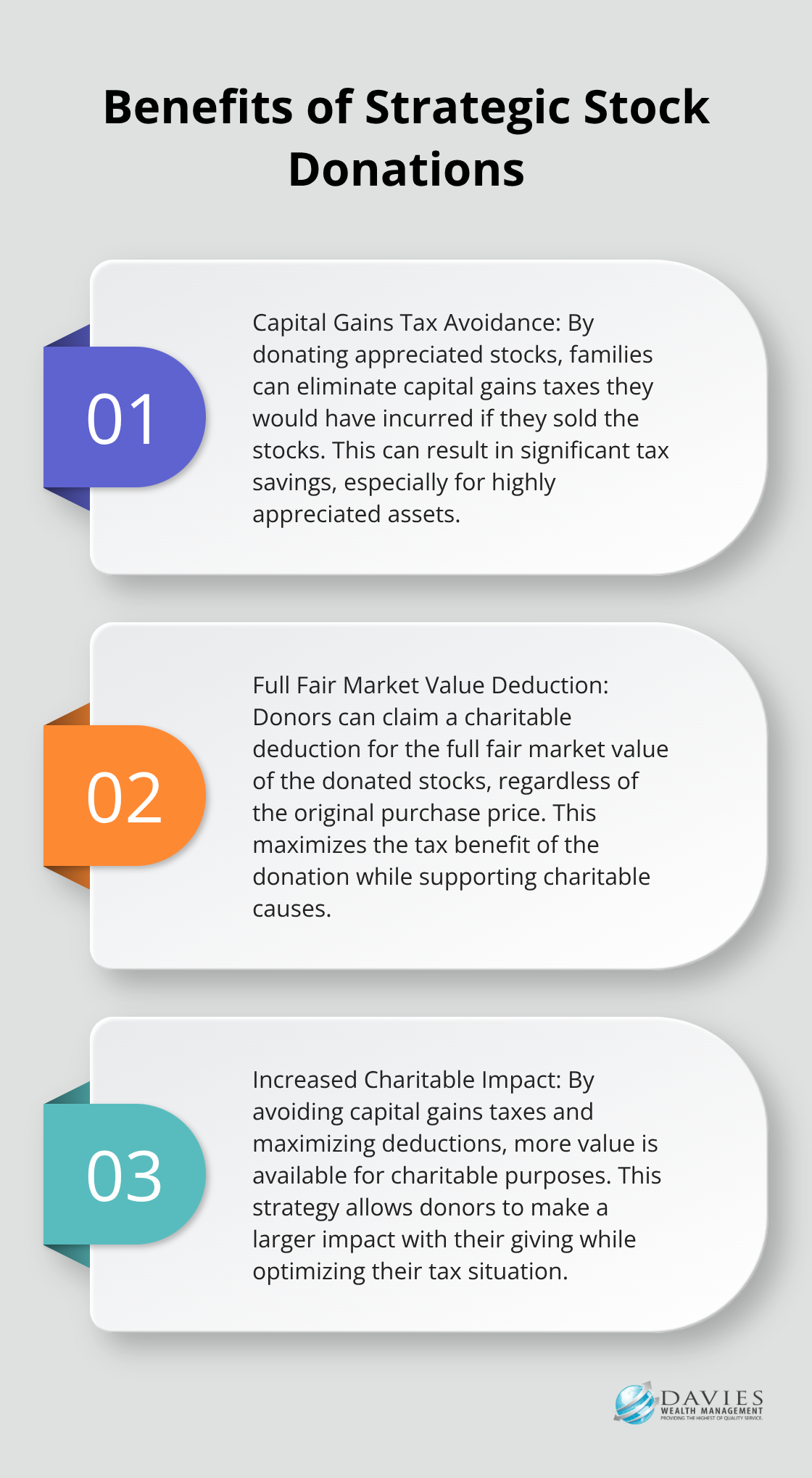

Donated appreciated stocks eliminate capital gains taxes while they provide full fair market value deductions. A family that holds $50,000 in stock purchased for $20,000 avoids $4,500 in capital gains taxes at current rates while it claims the complete $50,000 charitable deduction. Families can employ bunched strategies that consolidate multiple years of donations into single tax years to exceed standard deduction thresholds and maximize benefits.

Estate Planning Integration Reduces Transfer Taxes

Strategic charitable gifts directly reduce taxable estates, particularly valuable with the new $15 million federal exemption under the One Big Beautiful Bill Act. Charitable remainder trusts provide annual income streams while they remove assets from estates, and charitable lead trusts transfer wealth to heirs at reduced gift tax values. Qualified charitable distributions allow individuals over 70.5 to transfer up to $100,000 annually from IRAs to charities (this satisfies required minimum distributions without increased adjusted gross income).

Family Values Through Structured Philanthropy

Established donor-advised funds through institutions like Fidelity or Schwab create family vehicles that engage multiple generations in philanthropic decisions. Private foundations offer greater control and customization, they allow families to establish grant guidelines that reflect their values while they provide tax deductions for contributions. These structures transform charitable acts from individual decisions into coordinated family enterprises that strengthen bonds while they build community impact across generations.

The next step involves selection of the right charitable vehicle that matches your family’s specific goals and financial situation.

Which Giving Vehicle Fits Your Family

Donor-Advised Funds Provide Immediate Control

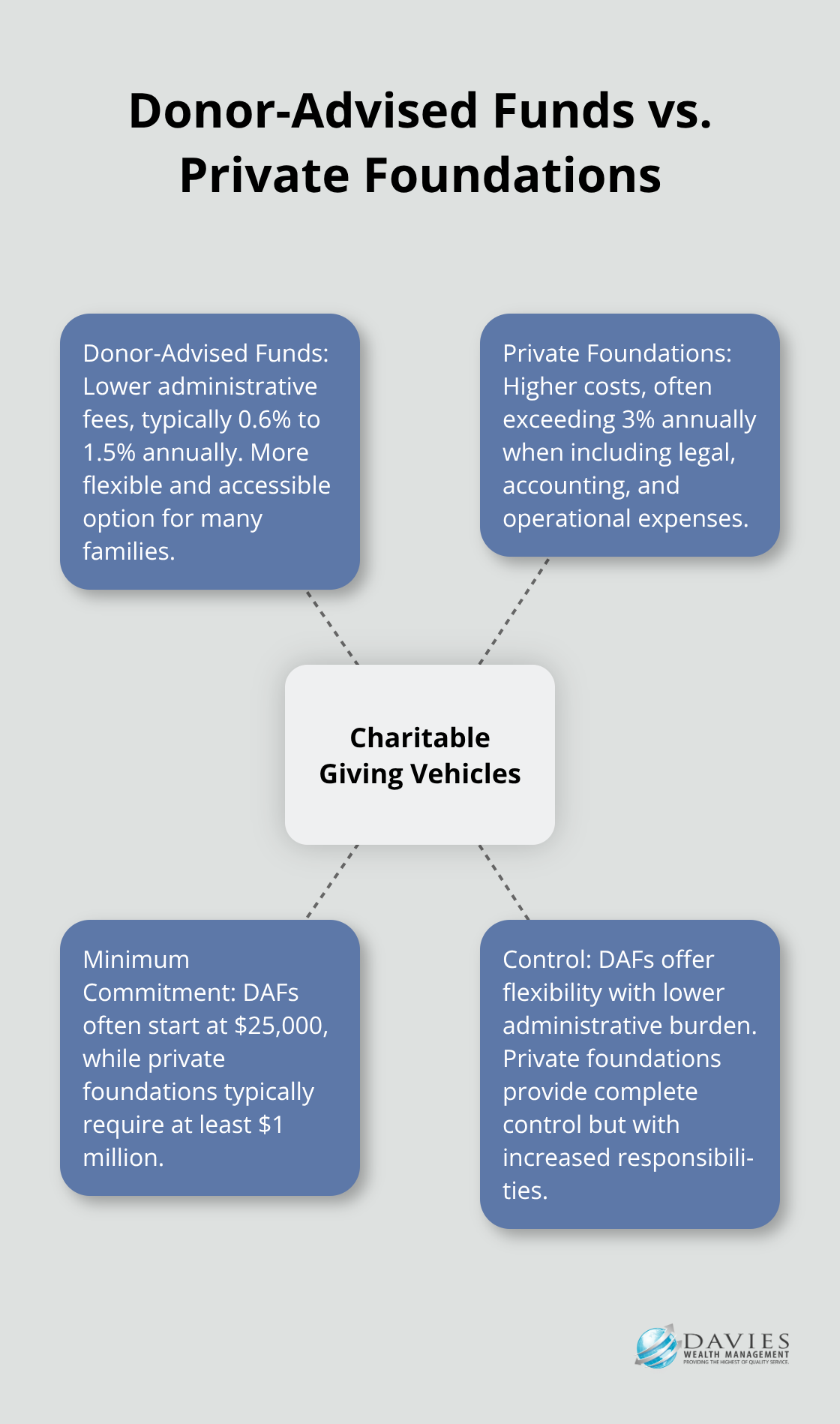

Donor-advised funds through major institutions like Fidelity, Schwab, and Vanguard offer the most flexible starting point for Stuart families who want to begin strategic philanthropy. These accounts accept cash, stocks, and other assets and grant immediate tax deductions based on fair market value. Families contribute $25,000 or more to establish accounts, then recommend grants to qualified charities over time as investments grow tax-free.

Fidelity Charitable operates as a major DAF sponsor in America, with corporate donor-advised funds actively recommending grants to charities. Administrative fees typically range from 0.6% to 1.5% annually-significantly lower than private foundation costs that often exceed 3% when legal, accounting, and operational expenses combine.

Private Foundations Require Substantial Commitment

Private foundations demand minimum $1 million commitments and annual distribution requirements to maintain tax-exempt status. Families must file Form 990-PF annually and face excise taxes on net investment income, but they gain complete control over grant-making policies. They can employ family members as trustees with reasonable compensation (though administrative burdens often exceed expectations).

The Gates Foundation model demonstrates how private foundations create institutional philanthropy that spans generations. Most families underestimate the administrative burden and ongoing costs that come with this level of control and customization.

Charitable Remainder Trusts Generate Income Streams

Charitable remainder trusts work differently-they provide annual income streams to donors and remove assets from taxable estates simultaneously. Remainder values go to designated charities after specified terms end. These trusts particularly benefit families who hold highly appreciated assets and need income replacement.

Estate tax reductions come through charitable deductions calculated with IRS tables based on age and payout rates. Families avoid capital gains taxes on contributed assets while they receive steady income for predetermined periods (typically 10-20 years or lifetime).

The next consideration involves timing these charitable strategies to maximize both tax benefits and investment growth potential. Working with holistic financial advisor services ensures your charitable giving aligns with your overall wealth management strategy.

When Should You Give for Maximum Tax Benefits

Year-End Tax Planning Creates Immediate Savings

December donations maximize current-year tax benefits, but families who alternate between large charitable years and standard deduction years often deliver superior results. Families can claim deductions worth $50,000 every other year instead of $25,000 annually through this approach. This strategy works particularly well when families combine it with appreciated securities that have accumulated significant gains.

Tax software company Intuit reports that this method can increase total deductions over traditional annual patterns. Stock donations require specific considerations for optimal results. Securities must be held for more than one year to qualify for full fair market value deductions, and families should donate stocks with the highest appreciation ratios first.

A $100,000 stock position purchased for $30,000 eliminates $10,500 in capital gains taxes at current rates while it provides the complete charitable deduction. Market volatility makes October through November optimal for stock donations, as families can assess annual gains and select the most tax-efficient assets before year-end deadlines.

Coordination with Estate and Retirement Plans

Charitable strategies must align with required minimum distributions and estate plans. Qualified charitable distributions from IRAs satisfy RMD requirements without they increase adjusted gross income, which preserves eligibility for Medicare premium subsidies and other income-based benefits. Families over 70.5 can transfer up to $108,000 annually through this method (this creates tax-free charitable contributions that reduce future estate values).

Estate coordination involves charitable lead trusts that reduce gift tax values on wealth transfers to heirs. These trusts work best when IRS Section 7520 rates minimize the present value of remainder interests. Current rates near 5.4% create favorable conditions for these advanced strategies that combine charitable contributions with family wealth transfer objectives.

Asset Selection Maximizes Tax Efficiency

Families should prioritize highly appreciated assets for charitable donations rather than cash contributions. Real estate, private business interests, and concentrated stock positions often provide the greatest tax advantages when donated directly to qualified charities. Professional appraisals become necessary for non-cash contributions exceeding $5,000, but the tax savings typically justify these additional costs.

Families can also consider donating assets with built-in losses to charities while they sell similar positions to harvest tax losses for their portfolios. This strategy requires careful coordination to avoid wash sale rules, but it allows families to maximize both charitable deductions and tax loss benefits simultaneously.

Final Thoughts

Strategic philanthropic planning delivers measurable financial benefits and creates lasting community impact for Stuart’s affluent families. Tax deductions reach up to 60% of adjusted gross income, estate tax reductions protect wealth transfers, and capital gains avoidance transforms charitable contributions from expenses into wealth preservation strategies. Professional guidance becomes essential when families navigate complex charitable vehicles and tax regulations.

Estate planning attorneys, tax professionals, and experienced wealth managers help families select optimal structures that align with their financial goals and philanthropic values. The coordination between charitable strategies and overall wealth management requires specialized expertise to maximize both tax benefits and community impact. Current tax laws favor strategic approaches, and market conditions create opportunities for families to donate appreciated assets at optimal values.

We at Davies Wealth Management understand how comprehensive wealth management integrates charitable planning with investment management, retirement planning, and estate strategies. Our personalized approach helps families build long-term relationships that secure financial success and create meaningful philanthropic legacies. Start with donor-advised funds for flexibility or explore charitable trusts for larger commitments that generate income streams and reduce estate taxes (the time to act on charitable goals is now).

Leave a Reply