Professional athletes face unique financial challenges that require specialized attention. Their careers are often short-lived, with high-income years followed by potential earnings drops.

At Davies Wealth Management, we understand the complexities of managing wealth for athletes. Our specialized financial planning for athletes addresses these unique needs, helping sports professionals secure their financial future beyond their playing years.

Why Are Athletes’ Finances So Complex?

Professional athletes face a unique set of financial challenges that set them apart from the average high-income earner. These complexities can impact an athlete’s long-term financial stability if not properly managed.

The Career Clock Ticks Fast

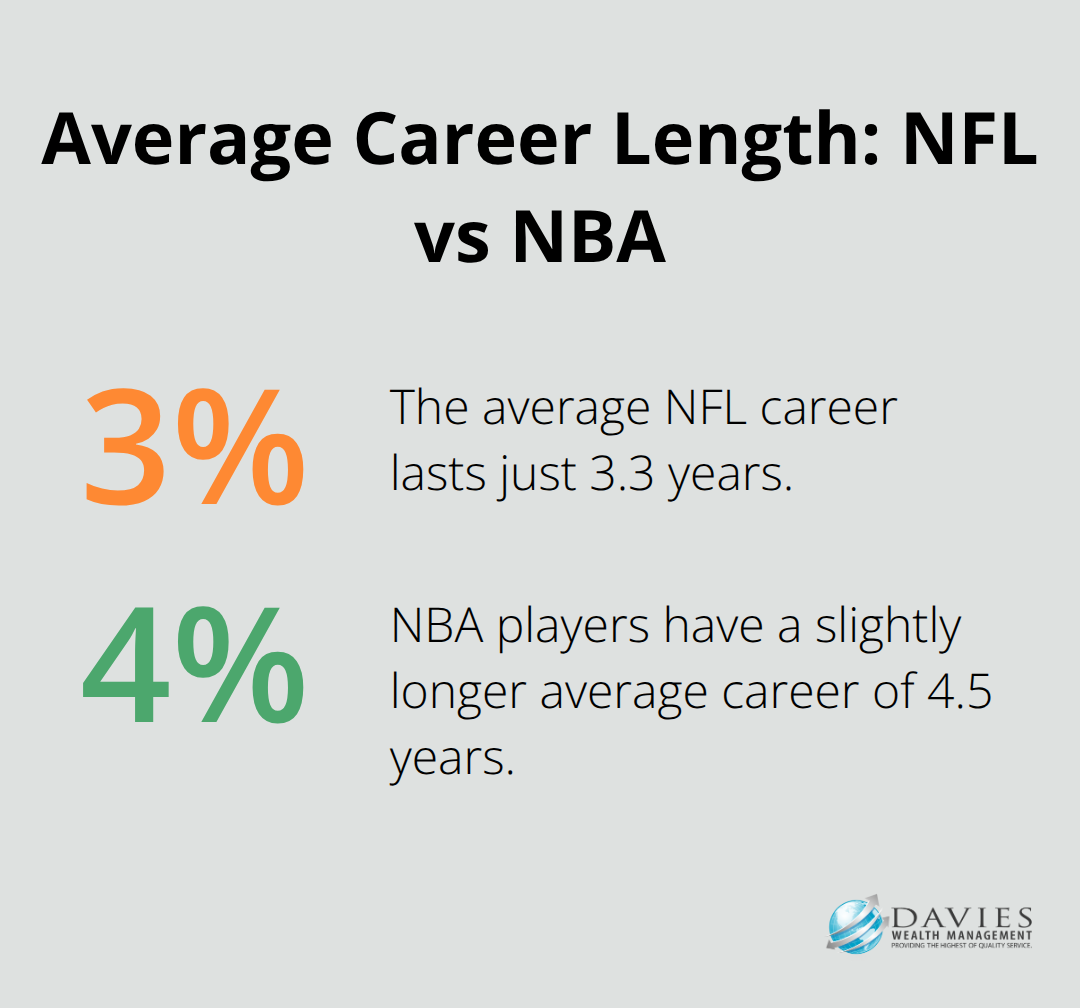

Unlike most professions, an athlete’s prime earning years compress into a short window. The average NFL career lasts just 3.3 years. For NBA players, it extends slightly longer to 4.5 years. This brief career span requires athletes to maximize their earnings and plan for a much longer “retirement” period.

The Income Rollercoaster

Athletes often experience extreme income fluctuations. A rookie might sign a multi-million dollar contract, only to face a significant pay cut or even unemployment after a few seasons. This volatility renders traditional financial planning models inadequate for many athletes.

Contract Complexities

Professional sports contracts contain notoriously complex elements. They often include performance bonuses, deferred payments, and clauses that can significantly impact an athlete’s income. Understanding these intricacies proves essential for effective financial planning.

Public Perception Pressure

Athletes face immense public scrutiny, which can lead to pressure to maintain a certain lifestyle. A 2009 Sports Illustrated article reported that 78% of NFL players face financial stress or bankruptcy within just 2 years of retirement. This pressure, combined with sudden wealth, can lead to poor financial decisions if not properly managed.

The Need for Specialized Financial Planning

The unique financial landscape of professional athletes demands a tailored approach to wealth management. This approach must consider the short-term demands of an athlete’s career while planning for long-term financial security. Specialized financial advisors (like those at Davies Wealth Management) understand these complexities and can help athletes make informed decisions that protect their wealth both during and after their playing years.

As we move forward, we’ll explore the key components of a comprehensive financial plan tailored specifically for athletes. These elements will address the challenges discussed and provide a roadmap for long-term financial success.

Mastering the Financial Game Plan for Athletes

Budgeting in the Big Leagues

Effective budgeting forms the foundation of financial stability for athletes. This approach helps manage the unpredictable nature of an athlete’s income and prepares for life after sports. A realistic budget should account for both current lifestyle needs and future financial goals.

Investing for the Long Haul

Long-term wealth preservation requires a diversified investment strategy. Athletes should consider a mix of stocks, bonds, and alternative investments (like real estate). Index funds have gained popularity among pro athletes due to their lower fees and broad market exposure. Real estate investments can provide both passive income and potential tax benefits. The goal is to create a portfolio that balances growth potential with risk management, tailored to each athlete’s unique situation.

Tackling Taxes Head-On

Tax planning is a critical component of financial management for athletes. The “jock tax” requires athletes to pay state income taxes based on where they play, which can significantly impact their take-home pay. Athletes need to navigate these complex tax laws and explore strategies to minimize their tax burden. This might include establishing residency in a state with no income tax (such as Florida or Texas), which could potentially save millions in taxes over a career.

Guarding Against Financial Risks

Risk management is essential in protecting an athlete’s wealth. A comprehensive insurance strategy should include disability insurance to safeguard against career-ending injuries. Athletes should also maintain a high credit score and protect personal information to mitigate the risk of identity theft, which athletes are particularly vulnerable to due to their public profiles.

Planning for Life After Sports

Retirement planning for athletes should begin the moment they sign their first contract. Athletes should maximize their league-sponsored pension plans and explore additional retirement savings vehicles. Creating passive income streams can support an athlete’s lifestyle long after their playing days are over. This might involve strategic investments in businesses or real estate that align with the athlete’s interests and goals.

These key areas form the foundation of a solid financial strategy for athletes. However, implementing such a comprehensive plan requires expertise and guidance. The next section will explore the importance of building a strong financial team to support an athlete’s financial journey.

Who Should Be on Your Financial Dream Team?

At Davies Wealth Management, we’ve observed the importance of athletes surrounding themselves with a skilled financial team. This isn’t about hiring a single advisor; it’s about assembling a group of experts who can work together to protect and grow an athlete’s wealth.

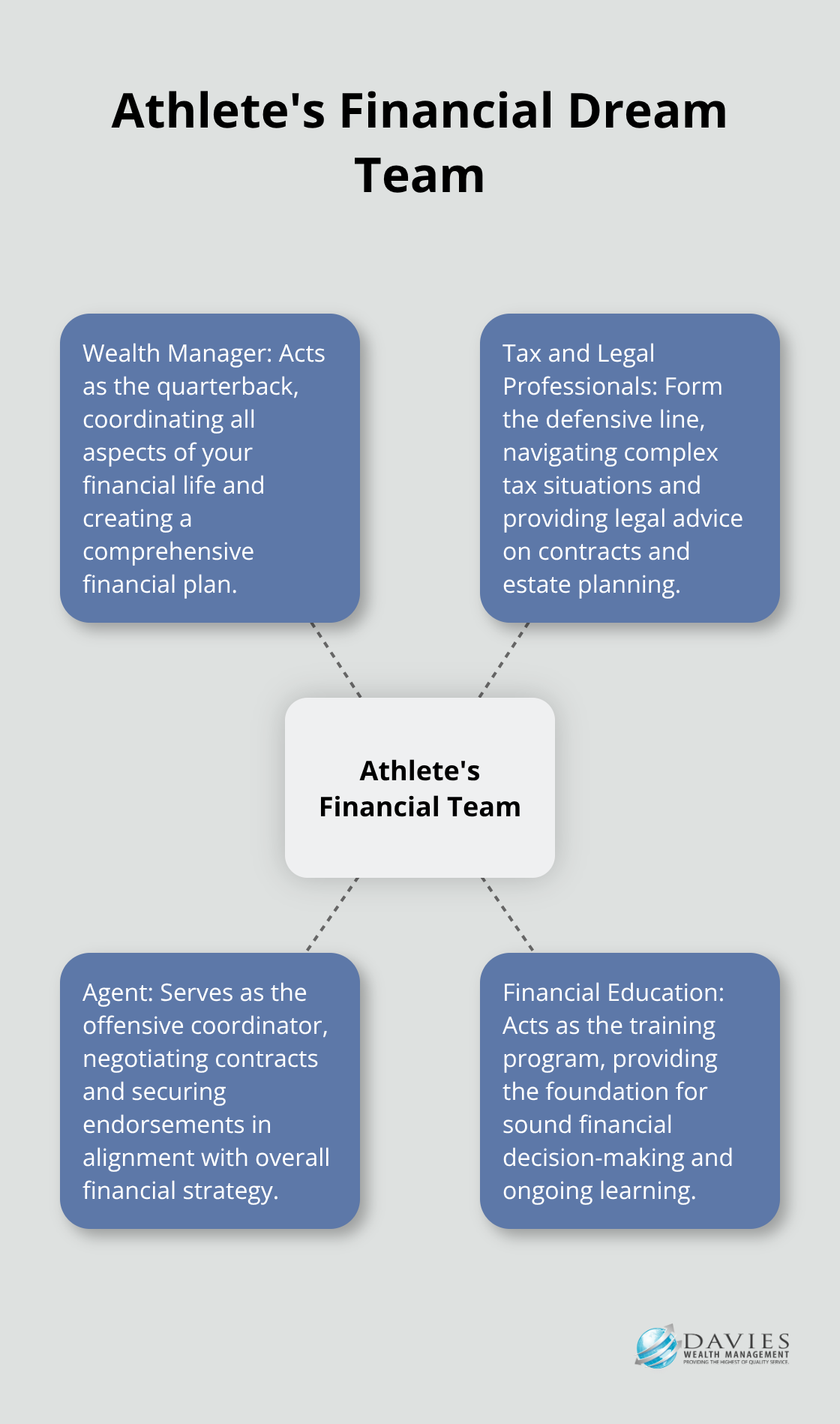

The Quarterback: Your Wealth Manager

A wealth manager specializing in sports finance should be at the center of your financial team. This professional acts as the quarterback, coordinating all aspects of your financial life. They should understand the unique challenges athletes face, from short career spans to complex contracts.

A good wealth manager will create a comprehensive financial plan tailored to your specific needs. They’ll consider your current income, future earning potential, and long-term goals. They might recommend allocating a higher percentage of your income to savings and investments during your peak earning years to prepare for the transition out of professional sports.

The Defensive Line: Tax and Legal Professionals

Tax professionals and legal advisors form a vital defensive line in your financial team. The complex tax situations athletes face (including the “jock tax” and potential multi-state tax liabilities) require specialized knowledge.

A tax professional with experience in athlete finances can help you navigate these complexities and implement strategies to minimize your tax burden. They might advise on the tax implications of establishing residency in a state with no income tax, potentially saving millions over the course of your career.

Legal advisors are equally important. They can review contracts, protect your intellectual property, and help set up business entities that align with your financial goals. They’re also essential in estate planning, ensuring your wealth is protected and distributed according to your wishes.

The Offensive Coordinator: Your Agent

Your agent plays a vital role in your financial team, acting as the offensive coordinator. While their primary focus is negotiating contracts and securing endorsements, they should work closely with your wealth manager and other financial advisors.

This collaboration ensures that contract negotiations align with your overall financial strategy. Your agent might push for a contract structure that maximizes your earnings during peak performance years, while your wealth manager advises on how to allocate those earnings for long-term financial security.

The Training Program: Financial Education

Financial literacy is the foundation of sound financial decision-making. As an athlete, you need to understand the basics of budgeting, investing, and financial planning to make informed decisions and effectively communicate with your financial team.

Many professional sports leagues offer financial education programs. The NFL, for instance, provides a Financial Education Program in partnership with top business schools. These programs can be invaluable, but they’re just the starting point.

Your wealth manager should play a key role in your ongoing financial education. We at Davies Wealth Management believe in empowering our clients with knowledge. We provide educational resources and one-on-one sessions to ensure our athlete clients understand their financial situations and the strategies we’re implementing.

Final Thoughts

Professional athletes face unique financial challenges that require specialized attention. Short career spans, fluctuating income, and complex contracts create a financial landscape unlike any other profession. These factors highlight the importance of specialized financial planning for athletes.

A comprehensive financial strategy tailored to an athlete’s specific needs can secure long-term financial stability. This strategy should address budgeting, investment planning, tax optimization, risk management, and retirement planning beyond playing years. Each component plays a vital role in securing an athlete’s financial future.

Davies Wealth Management specializes in providing tailored financial solutions for professional athletes. Our team understands the unique challenges athletes face and offers personalized strategies to help them achieve their financial goals. We encourage athletes to take control of their financial future by seeking expert advice and actively participating in their financial planning process.

Leave a Reply