High earners in Stuart face unique tax challenges that require sophisticated planning strategies. The difference between basic tax preparation and strategic tax optimization can save wealthy individuals tens of thousands annually.

We at Davies Wealth Management specialize in tax-efficient investing and advanced planning techniques. This guide covers proven methods to minimize your tax burden while maximizing wealth accumulation.

Advanced Tax Deduction Strategies for High Earners

Business Expense Optimization

High earners must aggressively maximize business deductions to combat rising tax burdens. The IRS allows 100% deduction for business meals through 2024, which represents immediate savings for professionals who frequently entertain clients. Vehicle expenses offer substantial opportunities through actual cost methods versus standard mileage rates.

Section 179 deductions can reach $1,220,000 in 2024 for luxury vehicles exceeding $60,000 (though luxury vehicle limits apply). Professional development expenses, including executive coaching and industry conferences, qualify as fully deductible business investments. Technology purchases for business use provide immediate write-offs rather than depreciation schedules.

Strategic Charitable Planning

Charitable strategies deliver powerful tax benefits when structured correctly. Donating appreciated assets to charities avoids capital gains taxes while providing full fair market value deductions. Donor-advised funds allow immediate deductions with flexible timing for actual charitable distributions.

The IRS permits charitable deductions up to 60% of adjusted gross income for cash gifts and 30% for appreciated property donations. Qualified charitable distributions from IRAs after age 70½ satisfy required minimum distributions while reducing taxable income. Conservation easements on valuable land can generate deductions worth 2.5 times the easement value over six years.

Real Estate and Home Office Benefits

Home office deductions require exclusive business use but offer significant savings for high earners. The simplified method allows $5 per square foot up to 300 square feet, while actual expense methods can yield larger deductions for expensive homes. Investment property depreciation provides annual deductions of 3.64% for residential properties over 27.5 years.

Cost segregation studies can accelerate depreciation through identification of shorter-lived components like carpeting and fixtures. Section 1031 exchanges defer capital gains taxes indefinitely when reinvestment occurs in like-kind properties. Rental property losses can offset other income for active participants who earn under $150,000, with partial benefits available up to $250,000 in adjusted gross income.

These deduction strategies work best when combined with sophisticated investment approaches that maximize tax efficiency across your entire portfolio.

Investment Tax Planning Techniques

Tax-Advantaged Retirement Account Strategies

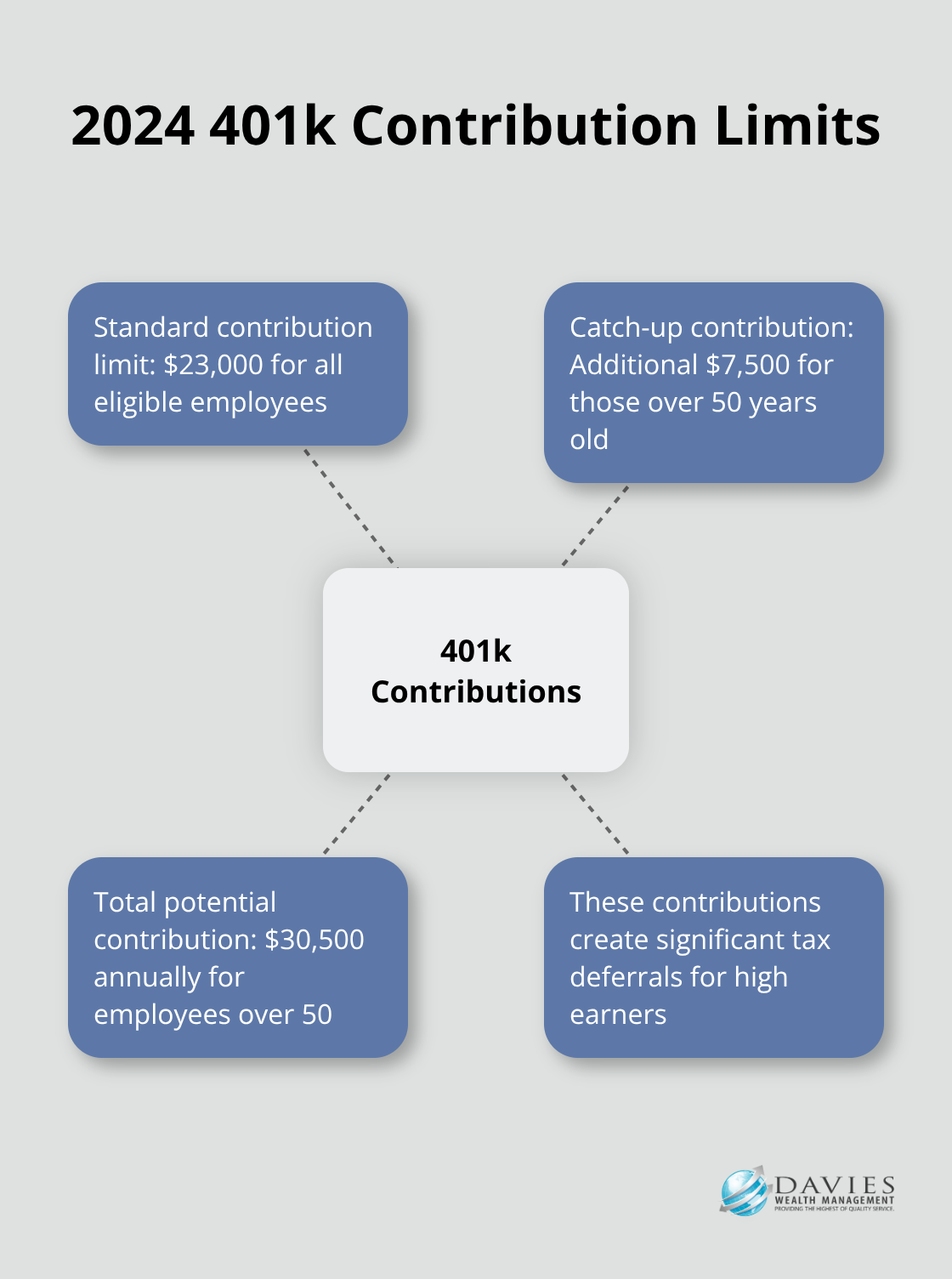

High earners must maximize retirement contributions to combat escalating tax burdens. The 2024 401k contribution limit reaches $23,000 with an additional $7,500 catch-up contribution for those over 50, which creates $30,500 in potential tax deferrals annually. Backdoor Roth IRA conversions allow high earners to bypass income limits through a two-step process: contribute $7,000 to a nondeductible traditional IRA, then immediately convert to Roth status.

Mega backdoor Roth strategies through after-tax 401k contributions can add another $46,000 annually when employer plans permit in-service distributions. Health Savings Accounts provide triple tax advantages with $4,150 individual and $8,300 family contribution limits for 2024. These accounts function as stealth retirement vehicles after age 65 when withdrawals for any purpose avoid penalties.

Municipal Bond Investments for Tax-Free Income

Municipal bonds from Florida issuers deliver federal and state tax-free income, with AAA-rated bonds currently yielding 4.2% according to Bloomberg data. High earners in the 37% federal bracket achieve taxable-equivalent yields that exceed 6.7% from quality municipal securities. This tax-free income becomes particularly valuable as ordinary income tax rates climb.

Florida municipal bonds offer additional benefits since the state imposes no income tax on residents. Investment-grade municipal bonds from established Florida municipalities provide stable income streams while preserving capital. High earners should focus on bonds with strong credit ratings (AA or higher) to minimize default risk while maximizing after-tax returns.

Tax-Loss Harvesting and Capital Gains Management

Tax-loss harvesting generates immediate tax savings when investors realize losses to offset capital gains. The IRS allows up to $3,000 in ordinary income deductions annually from excess losses. Wash sale rules require 31-day waiting periods between selling and repurchasing substantially identical securities, which makes tax-loss harvesting most effective with broad market ETFs rather than individual securities.

Direct indexing allows investors to harvest losses on individual stocks within index portfolios while they maintain market exposure. Capital gains timing strategies involve holding appreciated assets over one year to qualify for preferential long-term rates of 0%, 15%, or 20% versus ordinary income rates that reach 37%. Strategic rebalancing can capture gains in tax-advantaged accounts while losses occur in taxable accounts.

These investment tax strategies work hand-in-hand with sophisticated estate planning techniques that protect wealth across generations.

Estate and Gift Tax Planning for Wealthy Individuals

Annual Gift Tax Exclusion Strategies

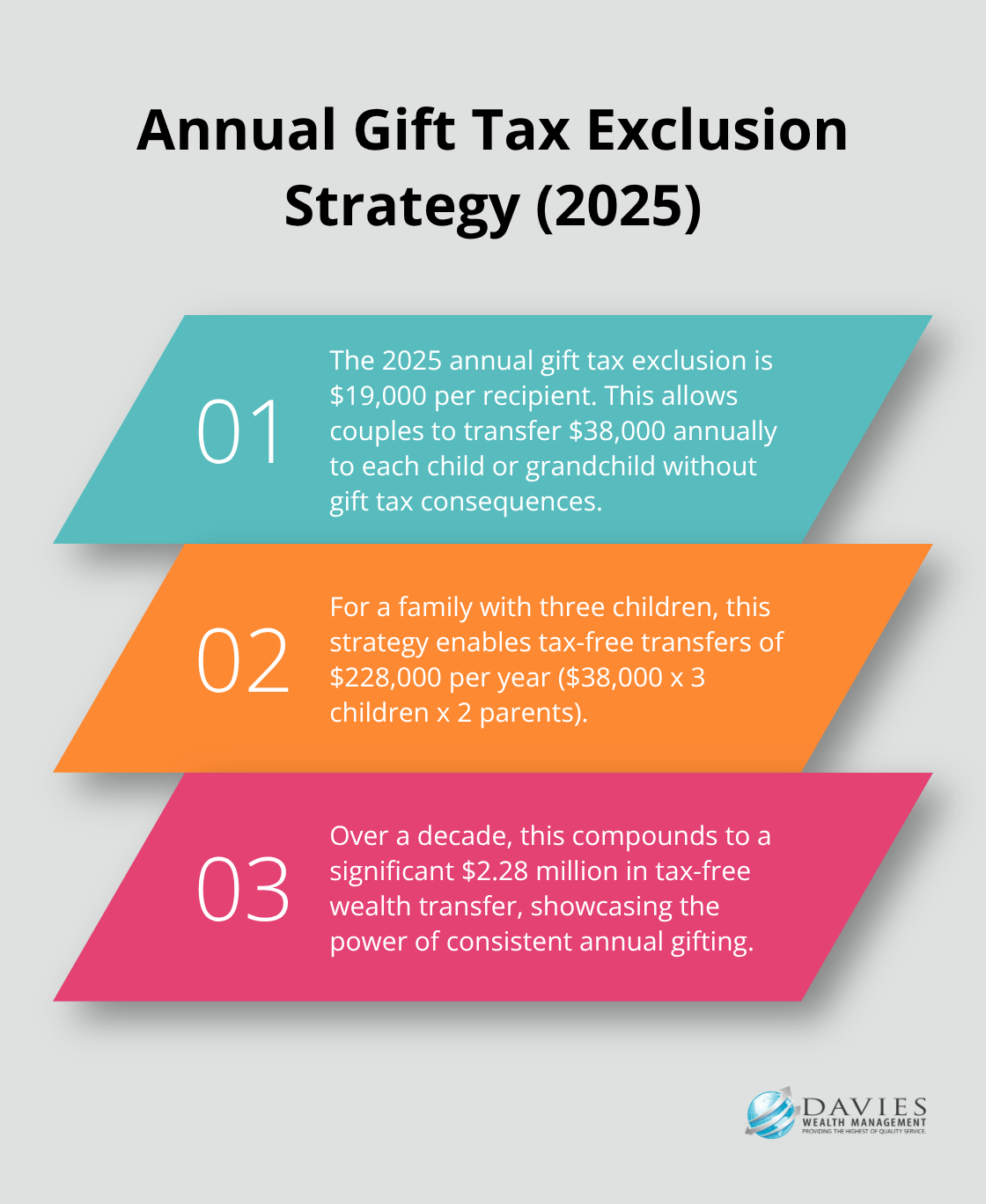

The 2025 annual gift tax exclusion of $19,000 per recipient allows wealthy families to transfer $38,000 annually between spouses to each child or grandchild without gift tax consequences. A family with three children can transfer $228,000 tax-free each year, which compounds to $2.28 million over a decade. The lifetime gift and estate tax exemption reaches $13.61 million per person, but this exemption expires in 2025 unless Congress acts.

Wealthy individuals should accelerate gifting strategies before potential exemption reductions take effect. Generation-skipping transfer tax exemptions allow $13.61 million in additional transfers directly to grandchildren without the 40% GST tax. Grantor retained annuity trusts work particularly well with volatile assets, as recent market declines create opportunities to transfer future appreciation at discounted valuations.

Trust Structures for Tax Efficiency

Spousal lifetime access trusts allow married couples to use lifetime exemptions while they maintain indirect access to assets through the non-grantor spouse. These SLATs protect assets from estate taxes while they preserve family wealth for unexpected needs. Dynasty trusts in states like Nevada or South Dakota avoid generation-skipping taxes indefinitely while assets grow for multiple generations.

Florida residents benefit from unlimited homestead protection, but out-of-state assets require trust structures for creditor protection. Charitable remainder trusts provide income streams for donors while they generate immediate tax deductions equal to the present value of the charitable remainder. These trusts work exceptionally well with highly appreciated assets (donors avoid capital gains taxes while they diversify concentrated positions).

Life Insurance as a Tax Planning Tool

Life insurance proceeds pass tax-free to beneficiaries when irrevocable life insurance trusts own policies rather than individuals. The three-year lookback rule requires policy transfers to occur well before death to avoid estate inclusion. Split-dollar arrangements allow businesses to pay premiums on executive policies while employees receive tax-free death benefits.

Premium finance structures enable ultra-wealthy individuals to purchase policies worth tens of millions with borrowed funds. This magnifies wealth transfer efficiency when interest rates remain below policy credit rates (particularly effective in current market conditions).

Final Thoughts

High earners in Stuart must act immediately on three essential tax strategies. First, maximize 2024 business deductions before year-end, including Section 179 equipment purchases and charitable contributions of appreciated assets. Second, implement backdoor Roth conversions and mega backdoor strategies to bypass income limits while you build tax-free retirement wealth. Third, accelerate gift strategies with the $19,000 annual exclusion before potential exemption reductions take effect in 2026.

Professional tax guidance becomes indispensable when you manage complex strategies like conservation easements, premium finance life insurance, and dynasty trust structures. The cost of expert advice pales compared to potential tax savings that often exceed six figures annually for wealthy families. These sophisticated approaches require careful coordination to avoid costly mistakes (particularly with IRS compliance requirements).

Tax-efficient investing requires ongoing attention as tax laws evolve and personal circumstances change. We at Davies Wealth Management help high earners build sustainable wealth while we minimize tax burdens across multiple generations. Our approach addresses your unique situation through comprehensive wealth management solutions that integrate advanced tax strategies with investment management and estate planning.

Leave a Reply