Retirement brings a new set of financial challenges, requiring a shift in investment strategies. At Davies Wealth Management, we understand that retirees need to balance income generation with capital preservation while managing various risks.

Investment strategies for retirees must adapt to address longevity concerns, inflation, and rising healthcare costs. This blog post explores smart approaches to help you navigate these unique retirement investment needs and maintain financial security throughout your golden years.

What Are Retirees’ Unique Investment Needs?

Retirees face a distinct set of financial challenges that require a tailored investment approach. Successful retirement planning hinges on addressing three critical areas: income generation, longevity risk, and the impact of inflation and healthcare costs.

Striking the Right Balance

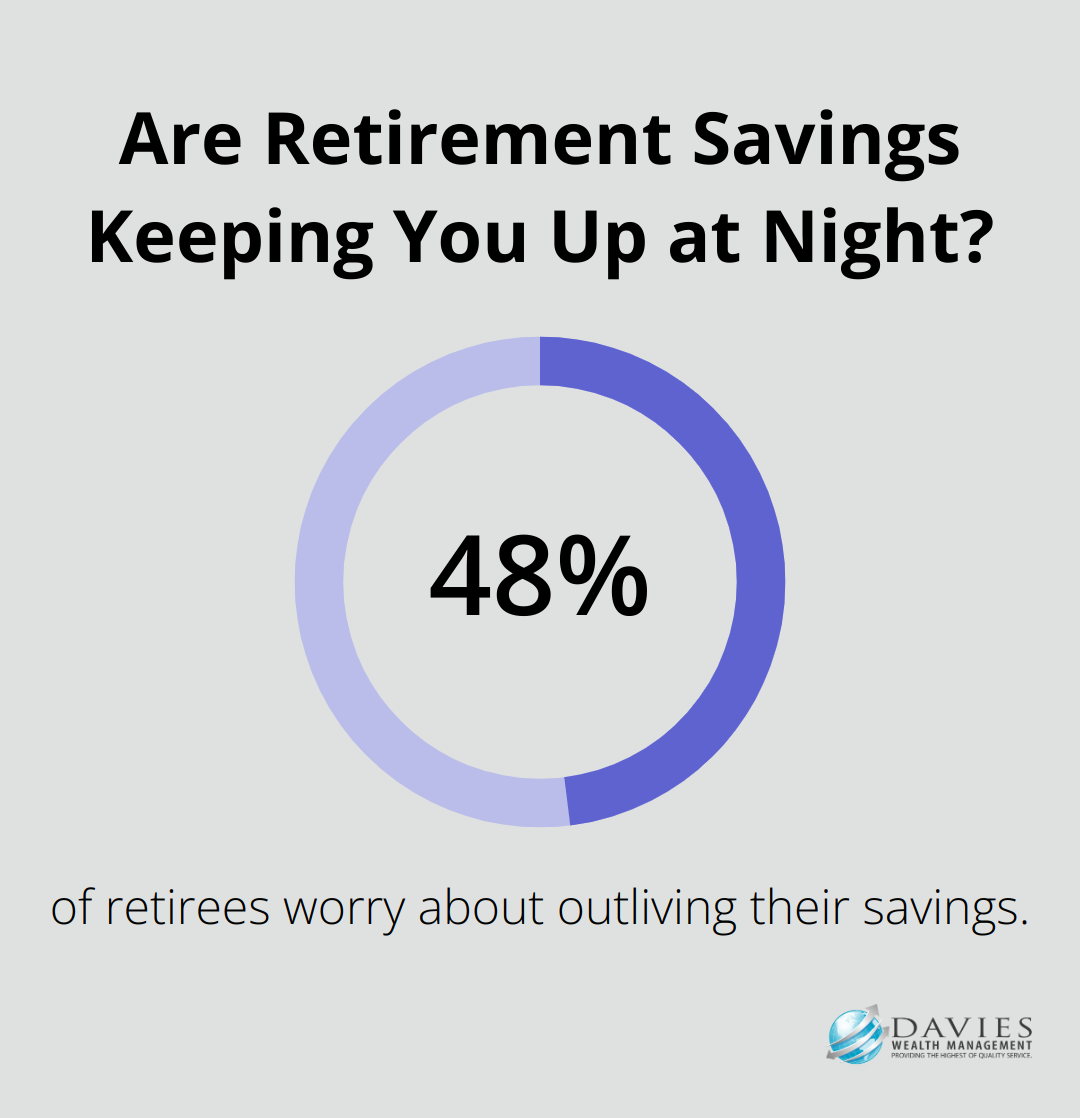

The primary goal for most retirees is to generate sufficient income without depleting their capital too quickly. This balance is essential for maintaining financial stability throughout retirement. A study by the Employee Benefit Research Institute found that 48% of retirees worry about outliving their savings. To address this concern, a diversified portfolio that includes a mix of stock, bond, and cash investments that can generate growth, provide income, and preserve capital is recommended.

High-quality dividend-paying stocks can provide a steady income stream while offering potential for capital appreciation. Bonds (particularly municipal bonds) can offer tax-free income and stability. Real Estate Investment Trusts (REITs) are another option, providing regular income through property investments without the hassle of direct ownership.

Tackling the Longevity Challenge

With life expectancies increasing, many retirees face the risk of outliving their savings. The Social Security Administration reports that a man reaching age 65 today can expect to live, on average, until 84, while a woman turning 65 can expect to live until 86.5. This extended lifespan necessitates careful planning and strategic investing.

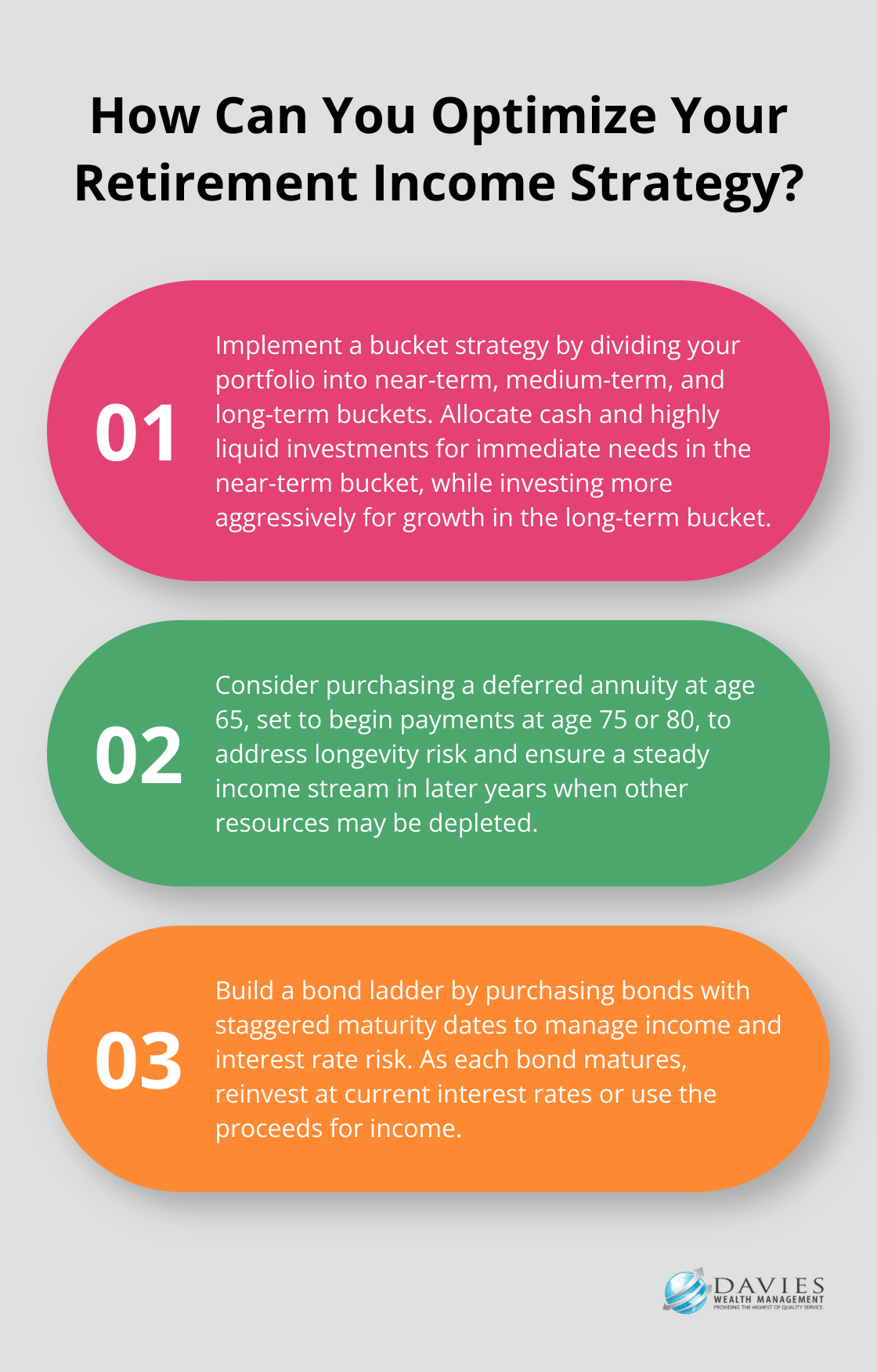

One approach to manage longevity risk is the “bucket strategy.” This involves dividing your portfolio into near-term, medium-term, and long-term buckets. The near-term bucket contains cash and highly liquid investments for immediate needs, while the long-term bucket can be more aggressively invested for growth. This strategy allows for both income generation and potential capital appreciation over time.

Combating Inflation and Rising Healthcare Costs

Inflation erodes purchasing power over time, making it a significant concern for retirees. Historical data shows that inflation has averaged about 3% annually over the past century. This means that $100,000 today would only have the purchasing power of about $74,000 in 10 years at a 3% inflation rate.

Healthcare costs pose an additional challenge. Fidelity Investments estimates that an average retired couple age 65 in 2023 may need approximately health care expenses in retirement. To combat these rising costs, investments that have the potential to outpace inflation, such as stocks and Treasury Inflation-Protected Securities (TIPS), should be considered.

Personalized Investment Strategies

Each retiree’s situation is unique, and a one-size-fits-all approach to retirement investing often falls short. Factors such as risk tolerance, health status, and desired lifestyle all play a role in shaping an effective investment strategy. Professional financial advisors can help develop personalized strategies that address these critical investment needs while aligning with individual goals.

As we move forward, we’ll explore specific investment strategies that can help retirees navigate these unique challenges and maintain financial security throughout their golden years.

Crafting Your Retirement Investment Strategy

Retirement investing requires a tailored approach that addresses your unique financial needs and goals. Let’s explore some key investment approaches that can help secure your financial future.

Diversification: The Foundation of Retirement Investing

Diversification remains a cornerstone of sound retirement investing. The primary goal of diversification is to reduce a portfolio’s exposure to risk and volatility. Spreading investments across various asset classes can potentially reduce risk while maintaining opportunities for growth. A well-diversified portfolio might include a mix of stocks, bonds, real estate, and cash equivalents.

For example, you could allocate 50-60% to stocks to provide growth potential to combat inflation, while 30-40% in bonds can offer stability and income. The remaining 10-20% could split between real estate investments and cash reserves for liquidity. This allocation can adjust based on your risk tolerance and financial goals.

The Bucket Strategy: Balancing Short-Term Needs and Long-Term Growth

The bucket strategy can help manage retirement income effectively. This retirement income plan breaks your nest egg into three buckets:

- Short-term bucket: Holds cash and highly liquid investments for immediate expenses.

- Mid-term bucket: Contains a mix of bonds and dividend-paying stocks for steady income.

- Long-term bucket: Focuses on growth-oriented investments like stocks and real estate.

This strategy allows you to meet current income needs while giving long-term investments time to grow. It can also help mitigate sequence of returns risk, which is particularly important in the early years of retirement.

Guaranteed Income: The Role of Annuities

Annuities can provide a reliable income stream in retirement, but they come with potential drawbacks. While they shouldn’t typically comprise your entire portfolio, allocating a portion of your savings to an annuity can offer peace of mind and financial stability.

For instance, you could purchase a deferred annuity with a lump sum at age 65, set to begin payments at age 75 or 80. This approach can help address longevity risk by ensuring a steady income in later years when other resources may deplete.

However, it’s important to carefully evaluate annuity options, as fees can be high and if you die too soon, you may not get your money’s worth. A qualified financial advisor can help you navigate these complex products to find the best fit for your situation.

Dividend-Paying Stocks: Growth and Income Combined

High-quality, dividend-paying stocks in your retirement portfolio can provide a reliable income stream while offering potential for capital appreciation. Companies with a history of consistent dividend growth (often referred to as “Dividend Aristocrats”) can be particularly attractive for retirees.

For example, as of 2023, companies like Procter & Gamble and Johnson & Johnson have increased their dividends for over 50 consecutive years. While past performance doesn’t guarantee future results, such stocks can offer a balance of stability and growth potential.

A portfolio allocation of 20-30% to dividend-paying stocks could provide a meaningful income boost while maintaining exposure to potential market gains. However, it’s important to note that dividends are not guaranteed and stock prices can fluctuate.

As we move forward, we’ll explore strategies to manage risk in your retirement portfolio, ensuring that your investments align with your changing needs and risk tolerance as you age.

How Retirees Can Manage Portfolio Risk

Evolving Asset Allocation

Retirees must adapt their investment strategy as they age to maintain financial security throughout retirement. A common approach involves a gradual reduction in stock exposure and an increase in bond allocation. However, this strategy doesn’t suit everyone. Some retirees benefit from maintaining a higher stock allocation to combat inflation and longevity risk.

For example, a 65-year-old retiree might start with a 60/40 stock-to-bond ratio, adjust to 50/50 by age 75, and 40/60 by age 85. This gradual shift balances growth potential with stability. Individual circumstances, such as health status and financial goals, should guide these decisions.

Mitigating Downside Risk

Stop-loss orders offer an effective way to limit potential losses in a stock portfolio. These orders automatically sell a stock when it falls to a predetermined price, which helps protect gains and minimize losses.

A retiree might set a stop-loss order at 10% below the purchase price of a stock. If the stock’s value drops to this level, it will automatically sell, preventing further losses. While this strategy can prove useful, it’s important to consider that it may also limit potential gains if a stock quickly rebounds after triggering the stop-loss.

Creating Reliable Income Streams

Bond ladders serve as an effective tool for managing both income and interest rate risk in retirement. This strategy involves the purchase of bonds with staggered maturity dates. As each bond matures, retirees can reinvest at the current interest rates or use the proceeds for income.

You can build your bond ladder by researching and selecting individual bonds based on their rating and maturity, or by investing in target maturity ETFs.

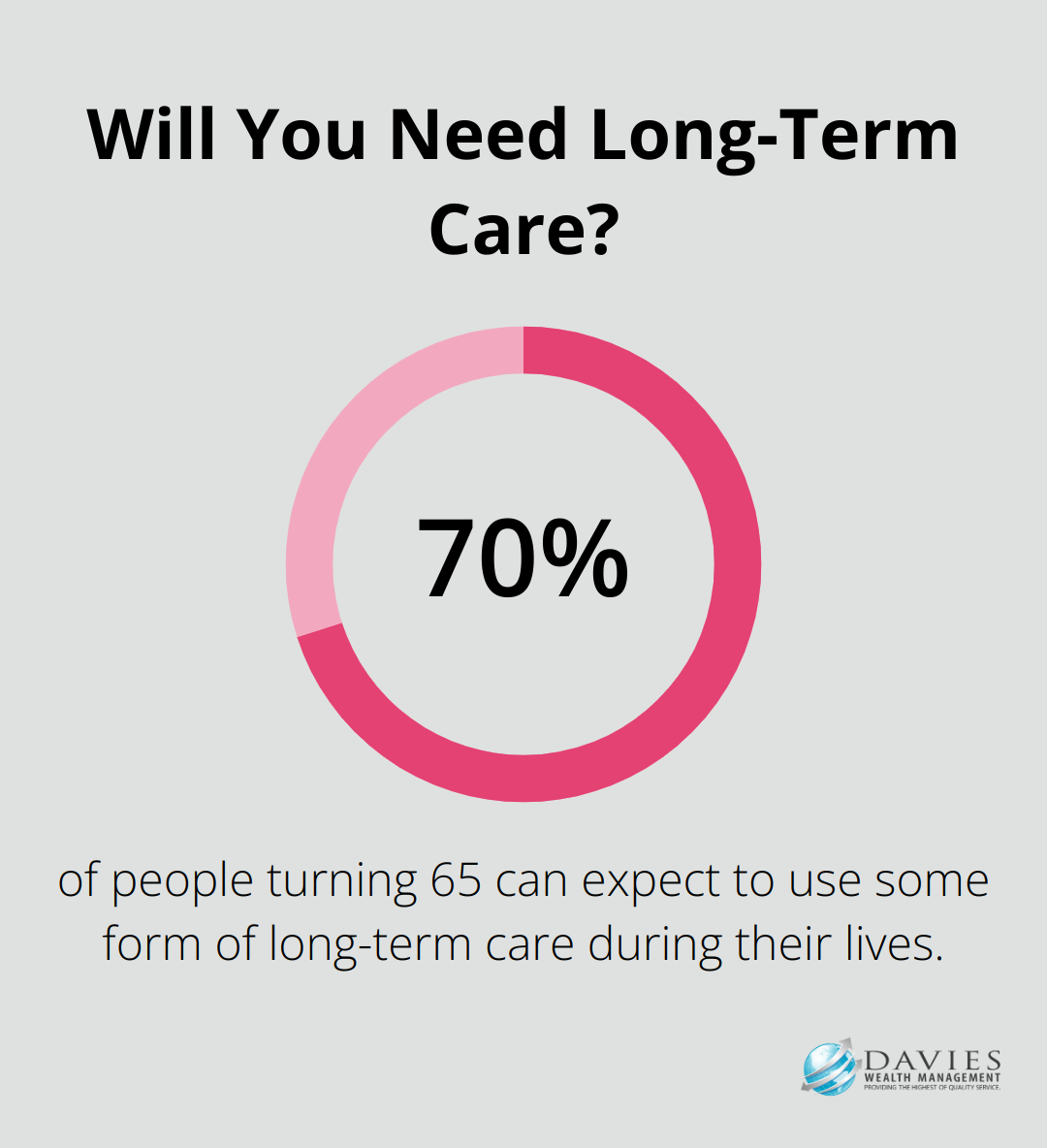

Protecting Against Healthcare Costs

Long-term care insurance warrants serious consideration for retirees. According to the U.S. Department of Health and Human Services, about 70% of people turning 65 can expect to use some form of long-term care during their lives. The median annual cost for a private room in a nursing home reached $105,850 in 2020 (as reported by Genworth’s Cost of Care Survey).

Retirees should consider purchasing long-term care insurance in their 50s or early 60s, when premiums are generally lower. People who are younger and healthier typically pay less for long-term care insurance premiums. As age increases, the cost of premiums also tends to rise. This can help protect retirement savings from potentially devastating healthcare costs. It’s essential to carefully review policy terms and consider hybrid policies that combine life insurance with long-term care benefits.

Seeking Professional Guidance

Managing risk in retirement requires a personalized approach. Financial advisors can help develop a comprehensive risk management strategy tailored to a retiree’s unique financial situation and goals. These professionals possess the expertise to navigate complex financial products and create strategies that align with individual needs and risk tolerances.

Final Thoughts

Investment strategies for retirees require a personalized approach. Balancing income generation with capital preservation, managing longevity risk, and accounting for inflation and healthcare costs are important considerations. Diversification, bucket strategies, annuities, and dividend-paying stocks can all contribute to a well-rounded retirement portfolio.

Risk management in retirement portfolios is essential. Adjusting asset allocation, using stop-loss orders, implementing bond ladders, and considering long-term care insurance can protect your savings. Each retiree’s financial situation, goals, and risk tolerance are unique, which makes personalized financial planning necessary.

Professional advice can provide valuable guidance for retirement planning. At Davies Wealth Management, we specialize in creating tailored financial strategies for retirees (including professional athletes facing unique financial challenges). Our team can help you navigate retirement investing and ensure you have a solid plan to support your desired lifestyle throughout your golden years.

Leave a Reply