Stuart’s affluent investors face a compelling question about luxury assets and their place in modern portfolios. Fine art, rare wines, and vintage watches have generated impressive returns over the past decade.

We at Davies Wealth Management examine whether these alternative investments align with sophisticated wealth-building strategies. The collectibles market presents both opportunities and risks that demand careful analysis.

Which Luxury Assets Generate Real Returns?

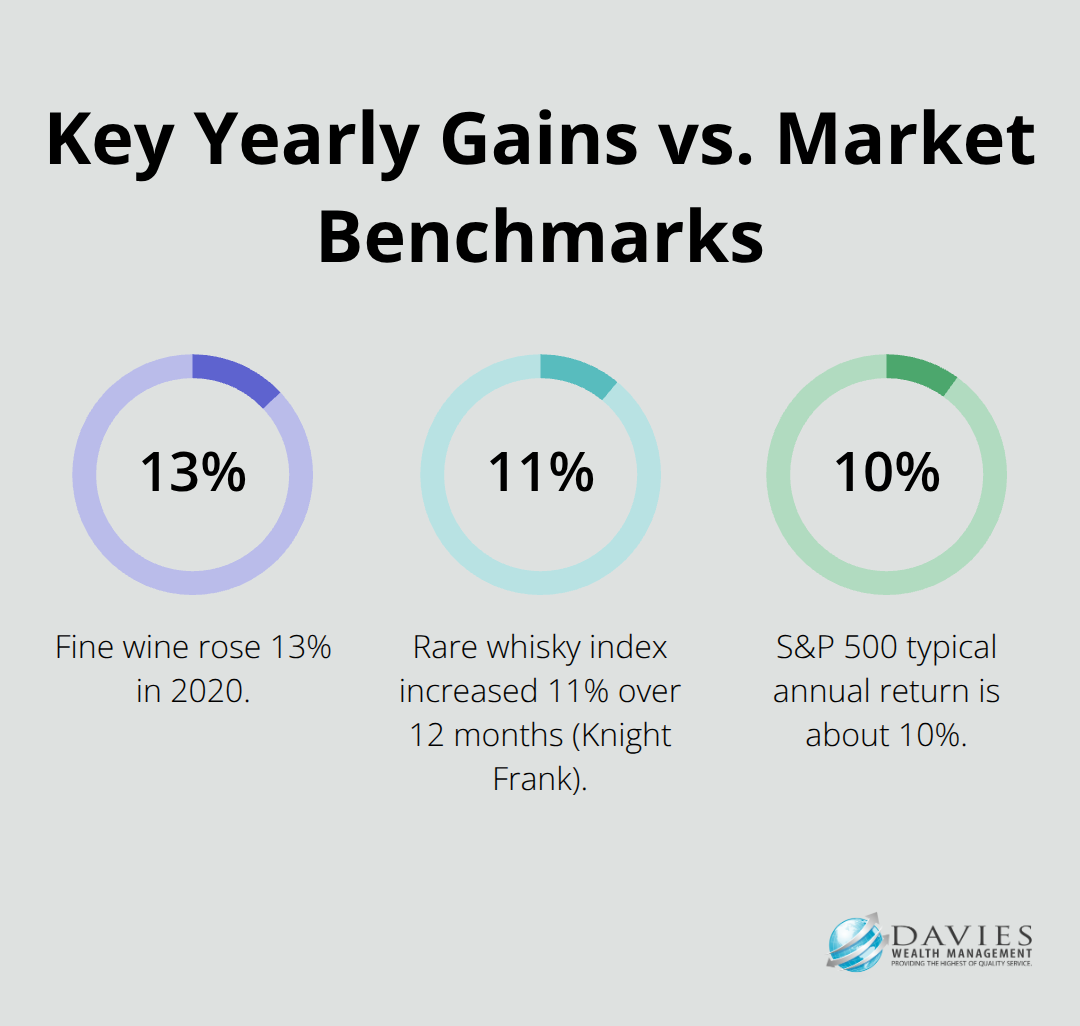

Luxury handbags dominate the high-value collectibles space with Hermes Birkin bags achieving 14.2% average annual returns, outperforming the S&P 500’s typical 10% returns. Fine wine increased 13% during 2020 alone, with total growth of 127% over the past decade, while rare whisky has shown growth according to Knight Frank’s tracking, with their index rising 3% and up 11% over 12 months. These tangible assets provide inflation hedges during economic uncertainty, with the global collectibles market reaching $372 billion and projected to hit $522 billion by 2028.

Market Performance Creates Winners and Losers

Contemporary art delivered 13.8% returns from 1995 to 2021 compared to the S&P 500’s inflation-adjusted 7.89%, tracked by the Artprice 100 index. Vintage watches transformed dramatically over the last decade, moving primarily to online platforms where scarcity drives value appreciation. However, collectibles face 28% capital gains tax rates and provide zero passive income until sold. The luxury market rewards patience and expertise while it punishes trend-followers who chase hyped pieces that rarely recover their peak values.

Liquidity Remains the Hidden Cost

Buyers for high-value collectibles require extended search periods (unlike liquid stock markets). Storage, insurance, transportation, and authentication costs significantly impact overall profitability. Counterfeits plague every collectibles category, which demands expert verification before purchase. Market volatility can be extreme with items that drastically lose value based on consumer preference changes, making timing both entry and exit points critical for meaningful returns.

Portfolio Integration Challenges

Affluent investors must consider how collectibles fit within broader wealth strategies (particularly for those with complex financial situations). The illiquid nature of these assets creates allocation challenges that traditional securities don’t present. Professional athletes and high-net-worth individuals often find collectibles appealing, yet the lack of dividend income and high transaction costs require careful evaluation against other investment opportunities.

How Much Should Affluent Investors Allocate to Collectibles?

Portfolio Weight Limits Matter

Stuart’s affluent investors should cap collectibles at 5-10% of total portfolio value to maintain proper diversification. This allocation prevents overconcentration in illiquid assets while it captures upside potential from alternative investments. High-net-worth individuals with portfolios that exceed $2 million can absorb the volatility and extended hold periods that collectibles demand. Smaller allocations of 2-5% work better for investors with $500,000 to $2 million portfolios who need greater liquidity access.

Tax Implications Shape Strategy

The 28% capital gains tax rate on collectibles versus 15-20% for stocks makes tax-efficient placement within estate structures more important than standard securities. Estate plans benefit from stepped-up basis at death, which eliminates capital gains taxes for heirs. This tax advantage makes collectibles attractive for wealth transfer strategies despite their operational complexity and maintenance requirements.

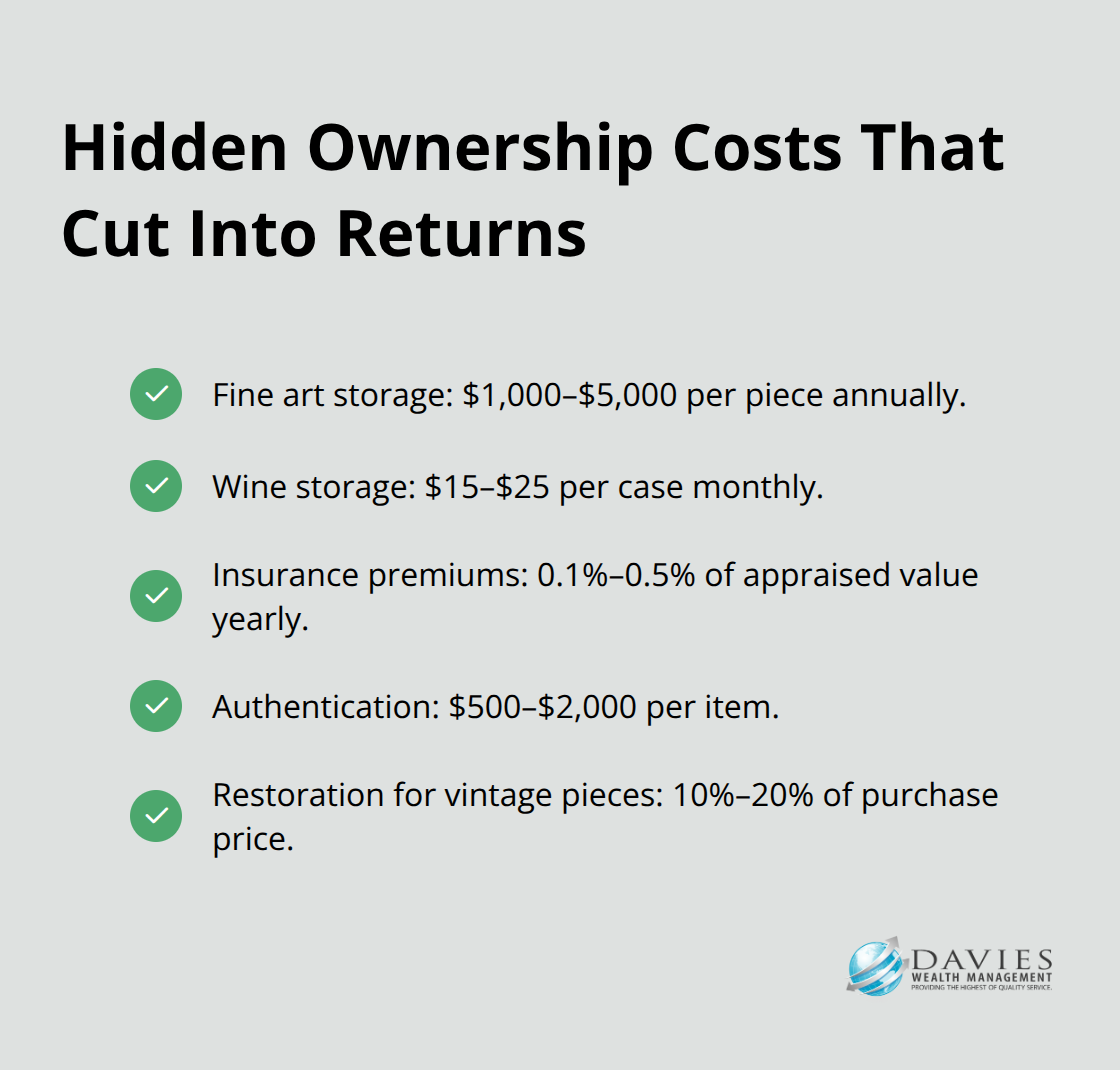

Storage and Insurance Costs Add Up

Storage costs for fine art range from $1,000 to $5,000 annually per piece, while wine cellar storage averages $15-25 per case monthly. Insurance premiums typically cost 0.1-0.5% of appraised value annually, with rare pieces that require specialized coverage at significantly higher rates. Authentication expenses add $500-2,000 per item for expert verification, plus potential restoration costs that can reach 10-20% of purchase price for vintage watches or art.

Transaction Fees Erode Profits

Transportation and handling fees accumulate during sales transactions (often totaling 2-5% of item value). Auction houses charge buyer’s premiums of 10-25% on top of hammer prices. Professional appraisals cost $300-1,500 per item and must be updated regularly for insurance purposes. These operational expenses compound over time and significantly impact net returns compared to traditional securities with minimal transaction costs.

Current market conditions and growth projections reveal how these allocation strategies perform across different economic environments.

What Market Conditions Drive Collectibles Growth?

Global Market Expansion Shows Clear Momentum

The global collectibles market reached $294 billion in 2023 and projects growth to $423 billion by 2030, which represents a compound annual growth rate of 5.5%. Wine cellars experienced 37% subscription increases since COVID, with en primeur sales that jumped 43% since 2019 according to major London wine merchants. Rare sneakers and streetwear now command a $10 billion market that analysts expect to triple to $30 billion by 2030. Designer toy sales in China surged 600% in 2019, with women who account for 62% of blind box purchases and 74% of buyers aged 18-34. These numbers demonstrate sustained demand across diverse collectible categories rather than isolated market bubbles.

Regional Markets Create Arbitrage Opportunities

Currency fluctuations offer strategic advantages for US investors who target UK luxury assets, while Asian markets drive premium prices for Western collectibles. Chinese collectors pay significant premiums for European luxury handbags and Swiss watches (which creates geographic arbitrage opportunities). The stamp market shows 13% annual price increases since 1991 despite participation that declines, which indicates concentrated wealth drives values higher. European wine regions benefit from scarcity as vintages age, while American collectors focus on bourbon and whisky with 478% growth over the past decade according to Knight Frank data. Stuart investors can capitalize on these regional preferences when they target undervalued categories in specific geographic markets before broader recognition drives prices higher.

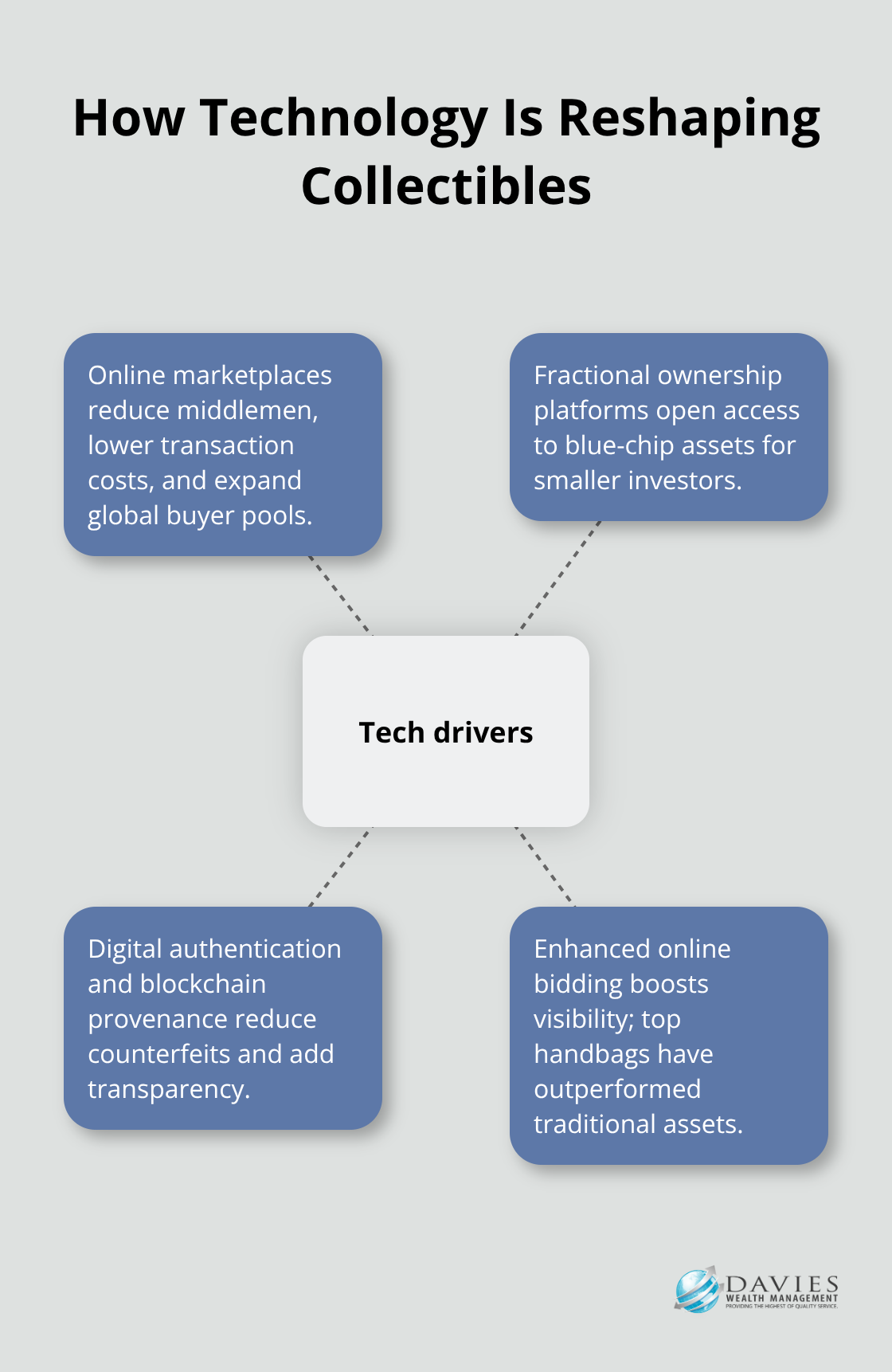

Technology Transforms Market Access

Online platforms eliminated traditional dealer networks, which reduced transaction costs and expanded buyer pools for luxury assets. Fractional ownership platforms like Otis allow smaller investors to access blue-chip art and collectibles that were previously reserved for ultra-high-net-worth individuals. Digital authentication services reduce counterfeit risks while blockchain provenance systems add transparency to ownership histories. Auction houses report that luxury handbags have outperformed traditional investments like stocks and gold, with certain pieces appreciating significantly over time through enhanced online presence and global access to bidders. These technological advances create more efficient price mechanisms and liquidity options that traditional collectibles markets historically lacked.

Final Thoughts

Stuart’s affluent investors face a complex decision when they consider luxury assets for portfolio diversification. The data shows compelling returns with Hermes Birkin bags that achieve 14.2% annual appreciation and rare whisky that posts 478% growth over the past decade. However, these impressive numbers come with significant operational challenges that traditional securities avoid.

The 28% capital gains tax rate, storage costs that average $1,000-5,000 annually per piece, and authentication expenses of $500-2,000 per item create substantial overhead. Market illiquidity means qualified buyers require extended timeframes to locate, while counterfeits plague every category. We at Davies Wealth Management recommend that investors limit collectibles exposure to 5-10% of total portfolio value for those with assets that exceed $2 million (this allocation captures upside potential while it maintains proper diversification across liquid investments).

The global collectibles market’s projected growth from $294 billion to $423 billion by 2030 suggests continued opportunity ahead. Technology platforms now provide fractional ownership access and improved authentication services that reduce traditional barriers. For Stuart investors ready to explore alternative investments, Davies Wealth Management offers comprehensive wealth management solutions that include specialized strategies for high-net-worth individuals and professional athletes who often find luxury assets appealing within broader financial plans.

Leave a Reply