At Davies Wealth Management, we’ve observed a growing interest in Bitcoin among high-net-worth individuals. This digital asset has sparked debates about its potential role in diversified investment strategies.

As the crypto portfolio landscape evolves, it’s crucial to understand both the opportunities and risks associated with Bitcoin investments. In this post, we’ll explore whether Bitcoin should be part of your high-net-worth portfolio and provide insights to help you make informed decisions.

Is Bitcoin a Smart Addition to High-Net-Worth Portfolios?

Bitcoin, the world’s first and most well-known cryptocurrency, has captured the attention of high-net-worth investors in recent years. The surge in inquiries about this digital asset and its potential role in diversified investment strategies has become increasingly apparent.

Bitcoin operates on a decentralized network, using blockchain technology to facilitate peer-to-peer transactions without intermediaries. Its fixed supply of 21 million coins contributes to its perceived scarcity, a feature that has piqued the interest of wealthy individuals seeking alternative stores of value.

Digital Scarcity and Its Appeal

The concept of digital scarcity intrigues high-net-worth individuals. Unlike traditional fiat currencies (which central banks can print at will), Bitcoin’s fixed supply creates a sense of rarity. This characteristic has led some to view Bitcoin as a potential hedge against inflation and currency devaluation due to its decentralization and lack of correlation with other assets.

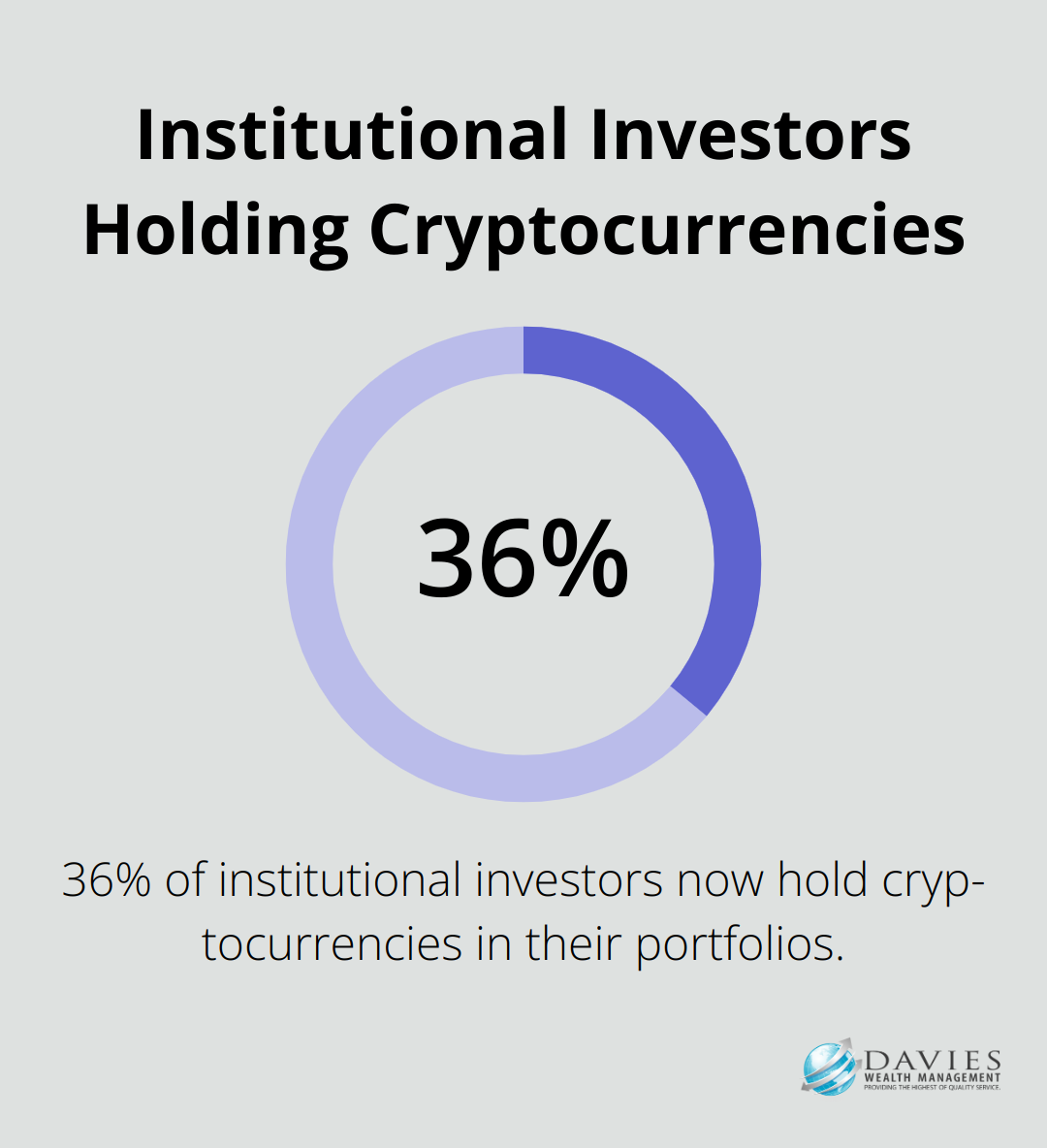

A 2024 survey by Fidelity Digital Assets revealed that 36% of institutional investors now hold cryptocurrencies in their portfolios. The survey included 1,042 institutional investors in the U.S. (406), Europe (370) and Asia (266), including financial advisors, family offices, and crypto hedge funds. This growing adoption among sophisticated investors suggests that Bitcoin is increasingly viewed as a legitimate asset class.

Potential Benefits as a Portfolio Diversifier

One of the primary arguments for including Bitcoin in high-net-worth portfolios is its potential for diversification. Historically, Bitcoin has shown low correlation with traditional asset classes like stocks and bonds. However, it’s important to note that this correlation has increased in recent years, particularly during market stress events.

A Yale study conducted by economists Aleh Tsyvinski and Yukun Liu examined whether the returns of digital assets (specifically bitcoin, ether, and ripple) could potentially improve risk-adjusted returns in a traditional portfolio. However, they also emphasized the need for careful consideration of an individual’s risk tolerance and investment goals.

Practical Considerations for Investors

High-net-worth individuals considering Bitcoin should approach this investment with caution and thorough research. Starting with a small allocation (typically no more than 1-2% of the total portfolio value) allows investors to gain exposure to potential upside while limiting downside risk.

The custody and security of Bitcoin holdings require careful consideration. Reputable custodial services (such as Fidelity Digital Assets or Coinbase Custody) offer institutional-grade security measures for storing digital assets. These services can provide peace of mind for high-net-worth investors concerned about the safety of their Bitcoin investments.

Investors should prepare for significant volatility. Bitcoin’s price has fluctuated dramatically, sometimes by double-digit percentages in a single day. This volatility can unsettle some investors and may require a strong stomach and a long-term investment horizon.

As we explore the potential benefits of Bitcoin in high-net-worth portfolios, it’s equally important to understand the risks and challenges associated with this emerging asset class. Let’s examine these factors in more detail.

Navigating Bitcoin’s Risks in High-Net-Worth Portfolios

Bitcoin presents intriguing opportunities for high-net-worth investors, but it also carries significant risks. A balanced perspective helps clients make informed decisions about this digital asset.

Extreme Price Volatility

Bitcoin’s price volatility stands out as its most notable characteristic. Price swings of Bitcoin increased substantially in November 2022, recording a 10-day volatility of more than 100 percent. These dramatic swings can significantly impact portfolio values. A 5% Bitcoin allocation in a portfolio could contribute over 20% to total risk, increasing overall volatility by approximately 16% (according to Morningstar research).

To mitigate this risk, investors should limit Bitcoin exposure to no more than 1-2% of a high-net-worth portfolio. This approach allows for potential upside while minimizing the impact of severe downturns.

Regulatory Uncertainties

The regulatory landscape for cryptocurrencies remains in flux, which presents additional risks for investors. In 2023, the SEC approved spot Bitcoin ETFs, marking a significant step towards mainstream acceptance. However, regulatory stances can shift rapidly, potentially affecting Bitcoin’s value and accessibility.

Investors should stay informed about regulatory developments and consider consulting with legal experts who specialize in cryptocurrency regulations. It’s also wise to diversify cryptocurrency holdings across different jurisdictions to mitigate country-specific regulatory risks.

Security and Storage Challenges

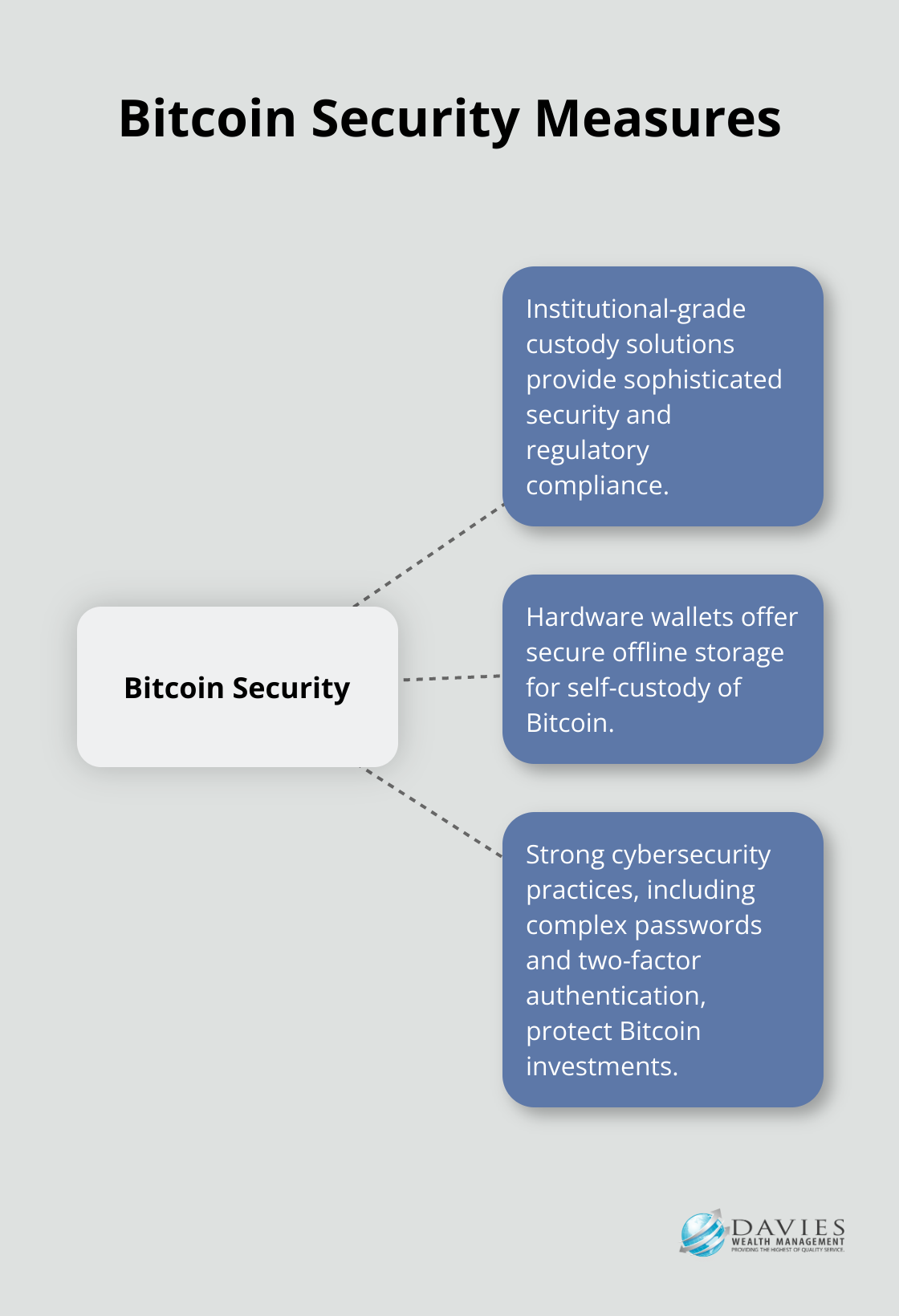

The digital nature of Bitcoin presents unique security risks. In 2022, cryptocurrency thefts and hacks resulted in losses of approximately $3.8 billion. High-net-worth individuals are particularly attractive targets for cybercriminals.

To address these risks, investors should use institutional-grade custody solutions. By 2025, crypto custody has matured into a sophisticated financial service with institutional-grade security, comprehensive insurance coverage, and regulatory compliance. For those who prefer self-custody, hardware wallets (such as Ledger or Trezor) provide a secure offline storage option.

It’s also important to implement strong cybersecurity practices. These include using unique, complex passwords and enabling two-factor authentication on all accounts related to cryptocurrency transactions.

Market Manipulation Concerns

The cryptocurrency market, including Bitcoin, is susceptible to manipulation due to its relatively small size compared to traditional financial markets. Large holders (often referred to as “whales”) can potentially influence prices through significant buy or sell orders.

Investors should be aware of this risk and monitor market trends closely. Diversification across different cryptocurrencies and traditional assets can help mitigate the impact of potential market manipulation on a portfolio.

As we explore these risks associated with Bitcoin investment, it becomes clear that careful planning and strategic implementation are essential. The next section will discuss effective strategies for incorporating digital assets into high-net-worth portfolios, taking into account these potential challenges.

How to Strategically Add Bitcoin to Your Portfolio

Determining the Right Allocation

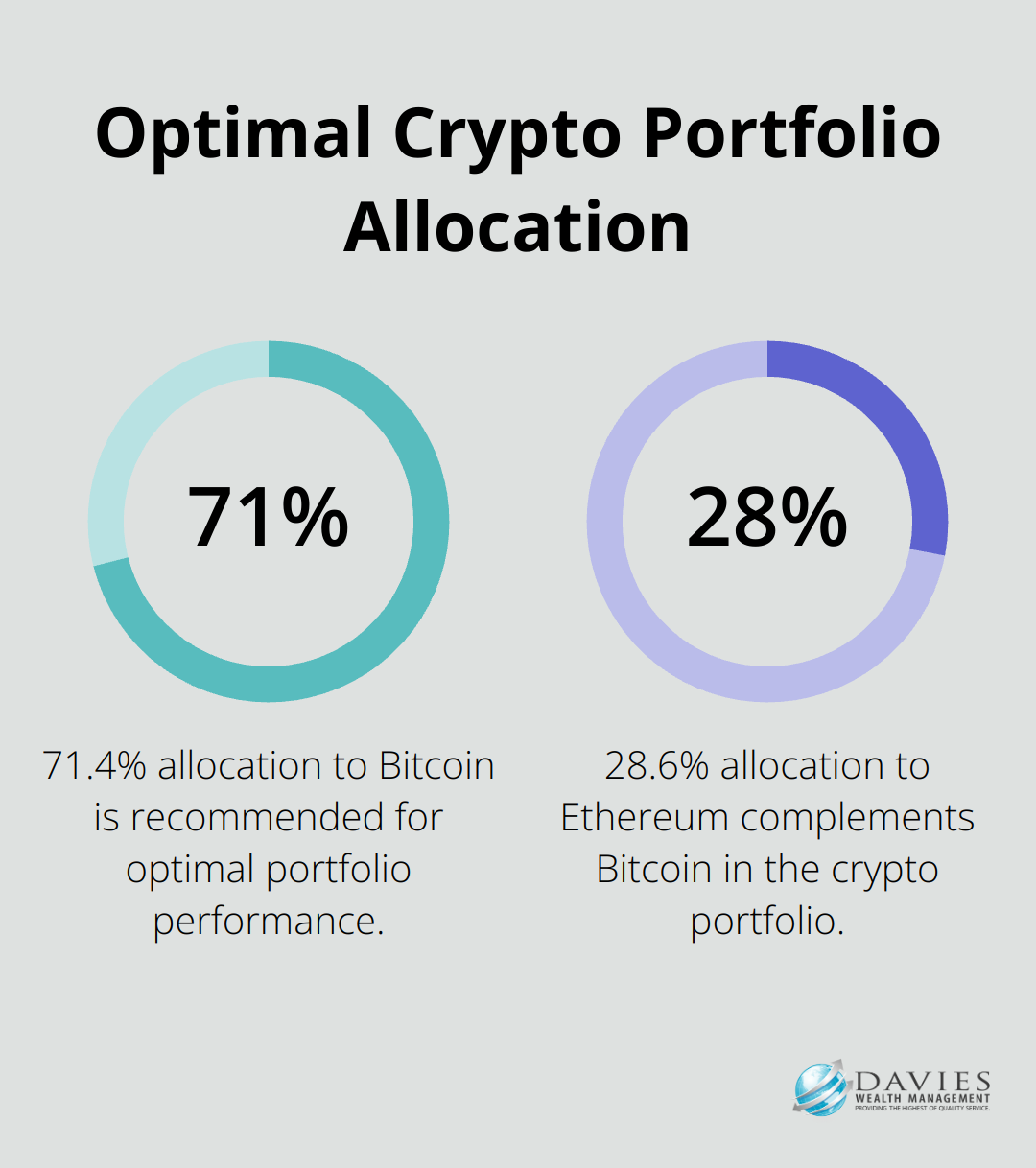

We recommend a conservative approach to Bitcoin allocation. For most high-net-worth clients, a 71.4% allocation to Bitcoin and 28.6% to Ethereum in their cryptocurrency portfolio is suggested to yield the highest Sharpe ratio. However, it’s important to note that this allocation should be considered within the context of one’s overall investment strategy.

A study by Yale economists provided the first-ever comprehensive economic analysis of cryptocurrency and blockchain. However, it’s important to note that increasing this allocation beyond 5% can dramatically influence portfolio risk. Morningstar research shows that a 5% Bitcoin allocation can contribute over 20% to total portfolio risk.

Choosing Your Investment Method

There are two primary ways to gain Bitcoin exposure: direct investment and Bitcoin-related securities. Direct investment involves purchasing and holding actual Bitcoin, which requires a deeper understanding of cryptocurrency storage and security.

For those who prefer a more traditional approach, Bitcoin ETFs offer a familiar investment vehicle. These ETFs provide exposure to Bitcoin’s price movements without the complexities of direct ownership.

Long-Term Holding vs. Active Trading

We generally advise a long-term holding strategy for high-net-worth clients, given Bitcoin’s volatility. This approach aligns with the asset’s potential as a store of value and hedge against inflation.

However, for clients with a higher risk tolerance and deep understanding of the crypto market, a more active trading strategy might be appropriate. This could involve tactics like dollar-cost averaging or rebalancing the portfolio when Bitcoin’s allocation exceeds predetermined thresholds.

Risk Management Strategies

To mitigate the inherent risks of Bitcoin investment, consider these strategies:

- Diversification: Don’t put all your eggs in one basket. Spread your cryptocurrency investments across different assets (e.g., Bitcoin, Ethereum, and other altcoins).

- Regular portfolio rebalancing: Set specific thresholds for your Bitcoin allocation. If Bitcoin’s value increases significantly, sell some to maintain your desired allocation.

- Use of stop-loss orders: These can help limit potential losses if Bitcoin’s price drops suddenly.

Staying Informed

The cryptocurrency market evolves rapidly. Stay informed about regulatory changes, technological advancements, and market trends. Subscribe to reputable crypto news sources and consider joining online communities (such as Reddit’s r/Bitcoin) for diverse perspectives.

Final Thoughts

Bitcoin presents opportunities and challenges for high-net-worth portfolios. Its fixed supply and diversification potential attract sophisticated investors, but extreme volatility and regulatory uncertainties pose risks. A cautious approach with a conservative allocation of 1-2% can provide exposure while limiting risk. Professional guidance proves essential when navigating the complex crypto portfolio landscape.

Research and staying informed about market trends, regulations, and technological advancements will help investors make sound decisions. At Davies Wealth Management, we understand the importance of tailored financial strategies that align with individual goals and risk tolerances. Our team of experts can provide personalized advice on incorporating Bitcoin and other digital assets into your investment portfolio.

Bitcoin should not replace traditional assets but can complement a well-structured, diversified portfolio. To learn more about how we can help you navigate cryptocurrency investments and develop a comprehensive wealth management strategy, visit Davies Wealth Management. Our team will work with you to create a balanced approach that supports your long-term financial objectives.

Leave a Reply