Most people struggle to turn their financial dreams into actionable plans. Without clear financial plan objectives, even the best intentions often lead nowhere.

We at Davies Wealth Management see this challenge daily. The difference between financial success and disappointment usually comes down to how well you define and structure your goals from the start.

What Makes Financial Objectives Actually Work

Financial objectives work when they connect your current reality to your future aspirations through specific timelines and measurable outcomes. The Federal Reserve’s 2022 Survey of Consumer Finances provides comprehensive data on household financial behaviors and wealth accumulation patterns. This research demonstrates how people structure their financial targets across different time horizons.

Time Horizons Drive Different Strategies

Short-term financial goals that span one to three years require liquid investments and conservative approaches. These include emergency funds that cover six months of expenses, elimination of high-interest debt with rates above 15%, or savings for home down payments. Research from Vanguard emphasizes that higher rates of return increase the contribution of investment returns toward goal achievement, while lower rates require different strategic approaches.

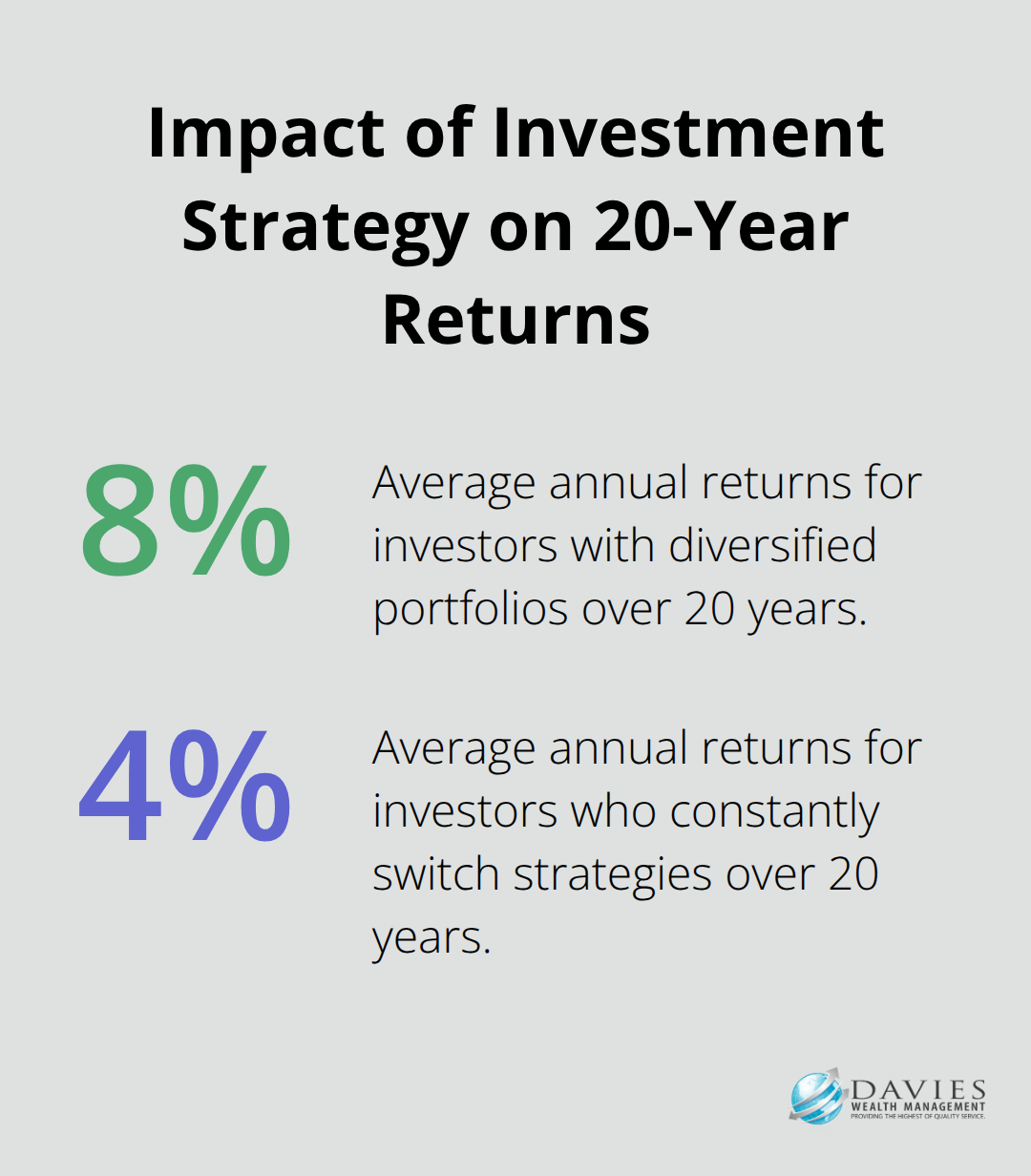

Long-term objectives that extend beyond five years can withstand market fluctuations and benefit from compound growth. Retirement plans, mortgage payoffs, and wealth transfer strategies fall into this category. Morningstar data indicates that investors with 20-year timelines who maintain diversified portfolios average 8.2% annual returns compared to 4.1% for those who constantly switch strategies.

The SMART Framework Prevents Goal Failure

Specific financial targets with exact dollar amounts and deadlines outperform vague aspirations according to Harvard Business School research. Instead of wanting to save more money, successful planners target $50,000 for a house down payment by December 2027. Measurable progress through monthly tracking keeps motivation high and identifies problems early. Achievable targets based on current income and expenses prevent frustration and abandonment.

Life Stage Objectives Follow Predictable Patterns

Financial priorities shift dramatically across life stages and create predictable planning opportunities. Adults aged 25-35 typically focus on student loan elimination, first home purchases, and initial retirement contributions. The average student loan balance of $37,000 requires strategic repayment plans that balance debt reduction with investment growth.

Mid-career professionals aged 35-50 prioritize maximum employer 401k matches, children’s education funds through 529 plans, and increased life insurance coverage. Peak earning years from 50-65 demand aggressive retirement savings to bridge the gap between current lifestyle and retirement income needs (particularly for high earners who face Social Security benefit caps).

These patterns help you identify which objectives deserve immediate attention versus those that can wait. The next step involves transforming these broad categories into precise, measurable targets that drive consistent action.

Creating Measurable Financial Goals

Vague financial wishes become achievable targets only when you attach specific dollar amounts and deadlines. Research from Dominican University shows that people who write down specific financial goals are more likely to achieve them than those who keep goals in their heads. The difference lies in quantification. Instead of saving for retirement, successful planners target $1.2 million by age 65 through $500 monthly contributions that start at age 30. Instead of paying off debt, they commit to eliminate $25,000 in credit card balances within 18 months using the avalanche method.

Calculate Your Numbers First

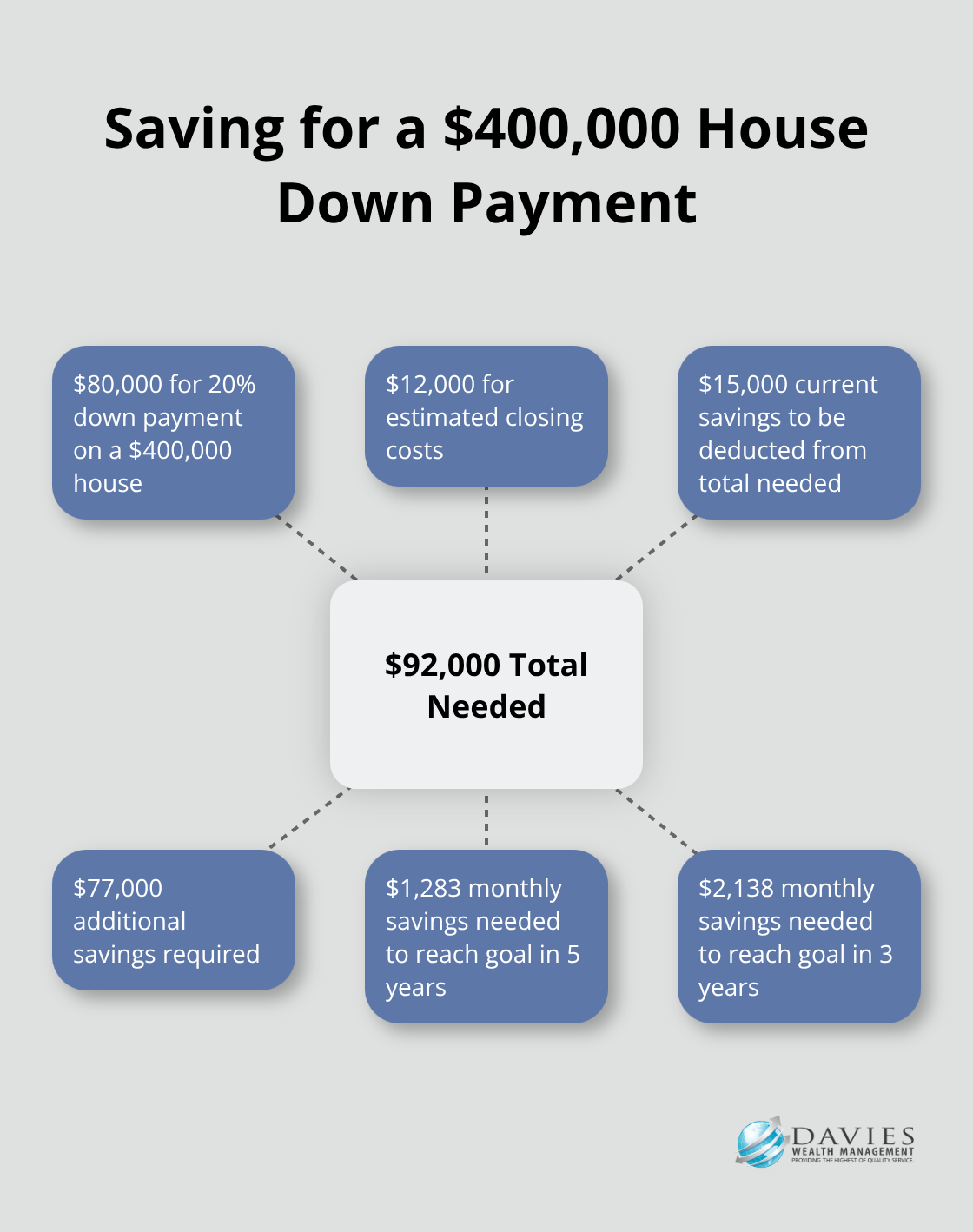

Mathematical precision drives financial success more than motivation or good intentions. Start with your target amount, then work backward to determine monthly requirements. A $400,000 house purchase with 20% down payment needs $80,000 plus closing costs of approximately $12,000 (totaling $92,000). With current savings of $15,000, you need $77,000 more. Save $1,283 monthly to get there in five years, while $2,138 monthly cuts the timeline to three years. High-yield savings accounts currently offer around 4.3% annual returns and reduce these requirements by approximately 8% through compound growth.

Set Milestone Checkpoints

Quarterly progress reviews prevent goal drift and maintain momentum according to behavioral finance studies from the University of Chicago. Break large objectives into 90-day milestones that provide regular feedback and course correction opportunities. A $50,000 emergency fund becomes $12,500 every quarter for one year. Retirement goals of $1.5 million over 30 years translate to $50,000 every year, or roughly $4,167 monthly (including investment returns). These smaller targets feel manageable and create frequent success experiences that sustain long-term commitment.

Rank Goals by Impact and Urgency

Multiple financial objectives compete for limited resources, which makes prioritization essential for success. Emergency funds take precedence over investment goals because they prevent debt accumulation during unexpected events. High-interest debt elimination comes before aggressive investment since credit card rates of 24% exceed average stock market returns of 10%. Employer 401k matches deserve immediate attention because they provide guaranteed 100% returns up to contribution limits. This systematic approach maximizes your financial progress and tackles the highest-impact objectives first while you maintain steady progress across all goals.

Once you establish these measurable targets and priorities, the next step involves selecting the right investment strategies and risk management approaches that align with your specific timelines and objectives.

Strategies for Achieving Financial Plan Objectives

Your financial objectives remain worthless without strategic execution that matches investment approaches to specific timelines and risk profiles. Short-term goals under three years demand capital preservation through high-yield savings accounts, money market funds, or Treasury bills that currently yield 4.5% to 5.2%. Mid-term objectives that span three to seven years benefit from balanced portfolios with 60% stocks and 40% bonds, which average 7.1% annual returns with moderate volatility. Long-term goals beyond ten years require aggressive growth through equity-heavy allocations that historically deliver 10.4% annually despite short-term fluctuations.

Investment Allocation Based on Goal Timelines

Timeline determines risk capacity more than personal comfort levels. Goals within 12 months need guaranteed principal protection through FDIC-insured accounts or Treasury securities. The three-year window allows for conservative bond funds that provide steady income while protecting against inflation erosion. Five-year objectives can handle moderate stock exposure (around 40%) because market cycles typically recover within this timeframe.

Retirement accounts over 20 years should maintain 80-90% equity allocation to maximize compound growth. A $500 monthly contribution at 9% annual returns grows to $1.3 million over 30 years, while conservative 5% returns produce only $416,000. This $884,000 difference demonstrates why timeline-appropriate risk levels matter more than comfort zones.

Risk Management and Insurance Considerations

Risk management extends beyond investment selection into comprehensive insurance coverage that protects your financial objectives from catastrophic events. Term life insurance costs $30 monthly for a healthy 35-year-old and provides $500,000 coverage that safeguards family goals during peak earning years. Disability insurance replaces 60% of income when illness prevents work, which affects workers according to Social Security Administration data.

Property coverage through adequate homeowners and auto policies prevents single incidents from derailing decades of financial progress. Umbrella policies add $1 million liability protection for approximately $200 annually. These costs represent less than 3% of median household income but protect 100% of accumulated wealth from lawsuits or accidents.

Tax-Efficient Planning Approaches

Tax-efficient execution amplifies results through strategic account selection and timing decisions. Traditional 401k contributions reduce current taxes for high earners in 32% brackets, while Roth IRA conversions during low-income years minimize lifetime tax burdens. Municipal bonds offer tax-free income for investors in 24% brackets or higher, effectively yielding 6.6% when corporate bonds pay 5%.

Tax-loss harvesting through strategic selling realizes losses that offset capital gains and reduces annual tax bills by $3,000 or more for active investors. Asset location strategies place tax-inefficient investments in retirement accounts while keeping tax-efficient index funds in taxable accounts. These techniques can improve after-tax returns by 0.5% to 1.5% annually without additional risk.

Final Thoughts

Effective financial plan objectives demand systematic execution across three fundamental areas. You must define specific dollar amounts and deadlines that transform vague aspirations into actionable targets. You need to align investment strategies with your timeline requirements while you implement comprehensive risk management through adequate insurance coverage. Tax-efficient approaches maximize results and preserve more wealth over time.

Regular assessment and adjustment of your financial plan objectives remains essential for long-term success. Life circumstances change, market conditions shift, and new opportunities emerge that require strategic modifications. Annual reviews help you identify when goals need recalibration or when strategies require updates to maintain optimal progress.

Professional financial guidance provides expertise that individual investors often lack. Complex tax regulations, investment selection, and risk management decisions benefit from specialized knowledge and experience (particularly for high-net-worth individuals). We at Davies Wealth Management offer comprehensive wealth management solutions through personalized financial planning that adapts to your circumstances and maximizes long-term wealth accumulation.

Leave a Reply