At Davies Wealth Management, we understand the challenges of managing a cryptocurrency portfolio in today’s volatile market. Secure crypto portfolio management is essential for protecting your digital assets and maximizing potential returns.

In this post, we’ll explore best practices for diversification, storage solutions, and risk management in the crypto space. Whether you’re a seasoned investor or just starting out, these strategies will help you navigate the complex world of cryptocurrency investing with confidence.

How to Diversify Your Crypto Portfolio

Diversification stands as a fundamental principle of successful investing, particularly in the volatile cryptocurrency market. A well-diversified crypto portfolio can significantly reduce risks and optimize potential returns.

Balance Risk in Your Crypto Holdings

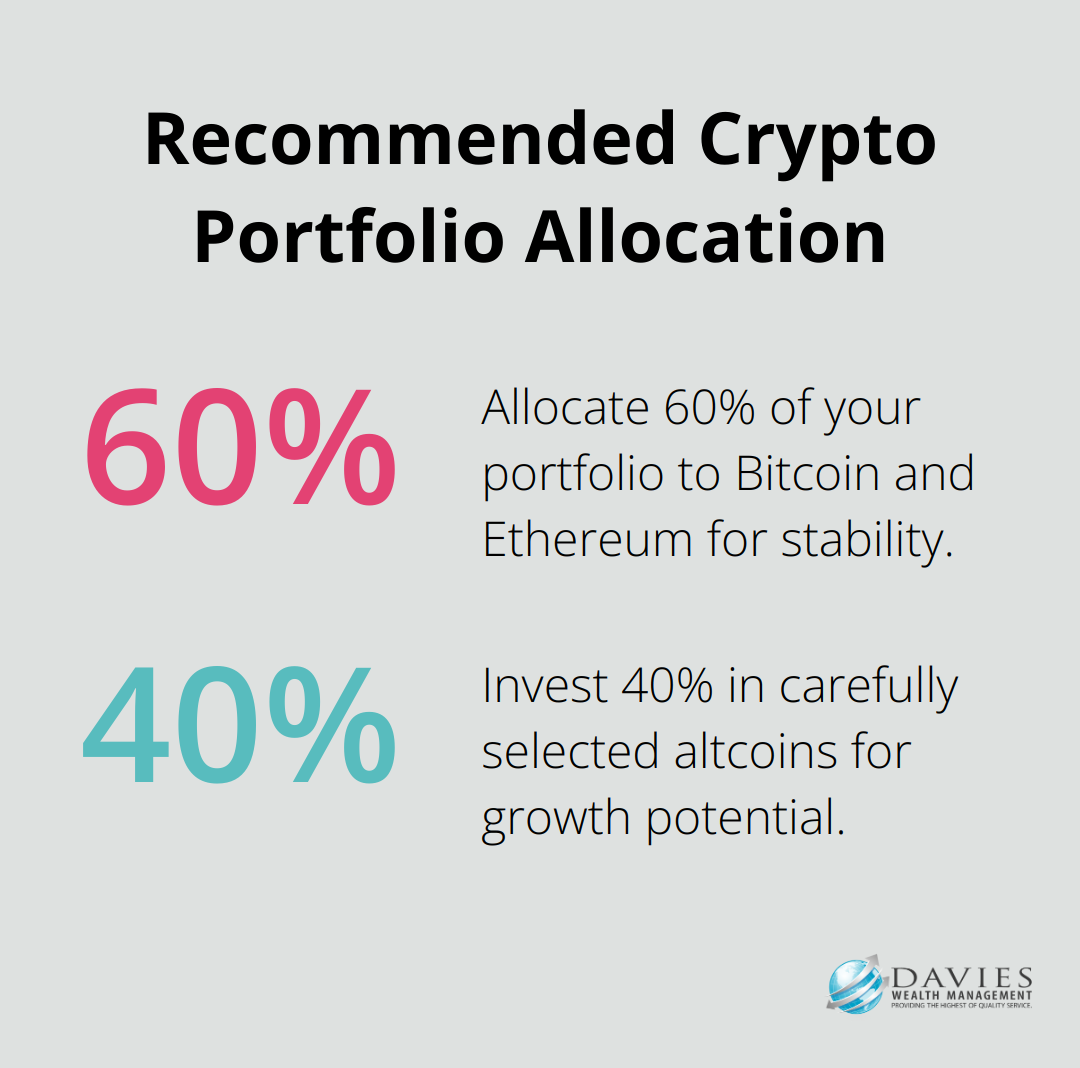

When constructing your crypto portfolio, you must strike a balance between high-risk and low-risk assets. Bitcoin and Ethereum, often referred to as the “blue chips” of crypto, should form the core of your portfolio. These established cryptocurrencies typically offer more stability and liquidity compared to newer, more speculative coins.

You should allocate 50-60% of your portfolio to Bitcoin and Ethereum combined. The remaining 40-50% can spread across carefully selected altcoins with strong fundamentals and growth potential. This approach allows you to benefit from the relative stability of major cryptocurrencies while also exposing your portfolio to potentially higher returns from emerging projects.

Incorporate Stablecoins for Portfolio Stability

Stablecoins Stablecoins play a vital role](https://www.chainalysis.com/blog/stablecoins-most-popular-asset/) in portfolio management by providing a hedge against market volatility. These digital assets (pegged to assets like the USD) offer a way to preserve purchasing power and shield against market downturns.

You should allocate a portion of your portfolio to stablecoins. This allocation can serve as a cash equivalent, allowing you to maintain purchasing power and reduce overall portfolio volatility.

Explore Different Blockchain Ecosystems

Diversifying across various blockchain ecosystems can further enhance your portfolio’s resilience. Each blockchain network has its unique strengths and potential for growth. A well-diversified crypto portfolio helps balance risks and positions you to capitalize on growth in different sectors of the blockchain ecosystem.

Spreading your investments across different blockchain ecosystems not only diversifies your risk but also positions you to benefit from advancements in various areas of the crypto space.

Research and Align with Financial Goals

While diversification is important, you must thoroughly research each investment and understand its role in your overall portfolio strategy. Professional financial advisors (like those at Davies Wealth Management) can help navigate these complex decisions, ensuring your crypto investments align with your broader financial goals and risk tolerance.

As we move forward, it’s essential to consider how to securely store your diversified crypto portfolio. Let’s explore the best practices for safeguarding your digital assets in the next section.

Safeguarding Your Crypto Assets

At Davies Wealth Management, we emphasize the critical importance of robust storage solutions to protect your investments from theft, hacks, and accidental loss. The security of your cryptocurrency holdings is paramount in the digital asset space.

The Power of Hardware Wallets

Hardware wallets are physical devices that store your private keys offline, making them one of the most secure options for crypto storage. These devices (such as Crypto.com Onchain and Ledger) keep your assets isolated from internet-connected devices, which significantly reduces the risk of online attacks.

Software Wallets for Accessibility

Software wallets offer a balance between security and convenience, although they are not as secure as hardware options. These digital wallets, which you install on your computer or smartphone, provide easier access for frequent transactions.

Popular software wallets support a wide range of cryptocurrencies. However, they are more vulnerable to malware and phishing attacks, so we recommend using them primarily for smaller amounts or short-term holdings.

Implementing Multi-Signature Security

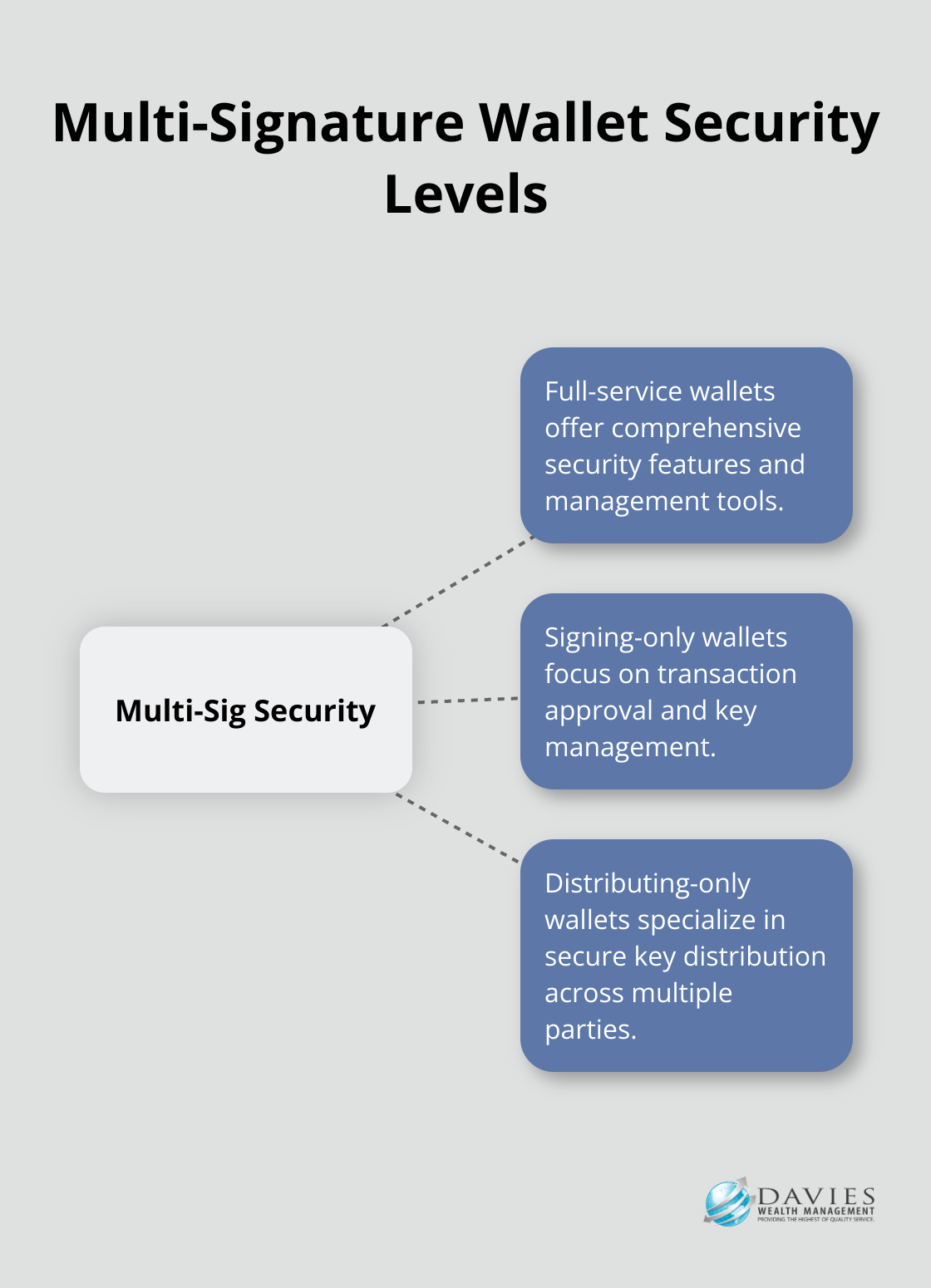

Multi-signature (multisig) wallets add an extra layer of security by requiring multiple approvals for transactions. This feature is particularly useful for businesses or individuals who manage large crypto portfolios.

In terms of security, one can distinguish three different levels: (i) full-service, (ii) signing-only, and (iii) distributing-only wallets. These setups protect against single points of failure and reduce the risk of unauthorized access or insider threats.

Backup Strategies for Peace of Mind

Regular backups are crucial, regardless of the wallet type you choose. Most wallets use a recovery phrase – typically a series of 12 words – that can restore your funds if your device is lost or damaged.

Your recovery phrase is the backbone of your crypto wallet security. This 12-word key ensures that you can regain access to your wallet if necessary. You should store your recovery phrase in multiple secure locations, such as a fireproof safe or a bank deposit box. Never store it digitally or share it with anyone.

The right approach to securing your crypto assets varies based on individual needs, investment size, and risk tolerance. As we move forward, it’s essential to consider how to effectively manage the risks associated with your crypto investments. Let’s explore the best practices for risk management in the next section.

How to Manage Risk in Crypto Investing

Effective risk management is essential for successful crypto investing. A structured approach can mitigate potential losses while maximizing returns in this volatile market.

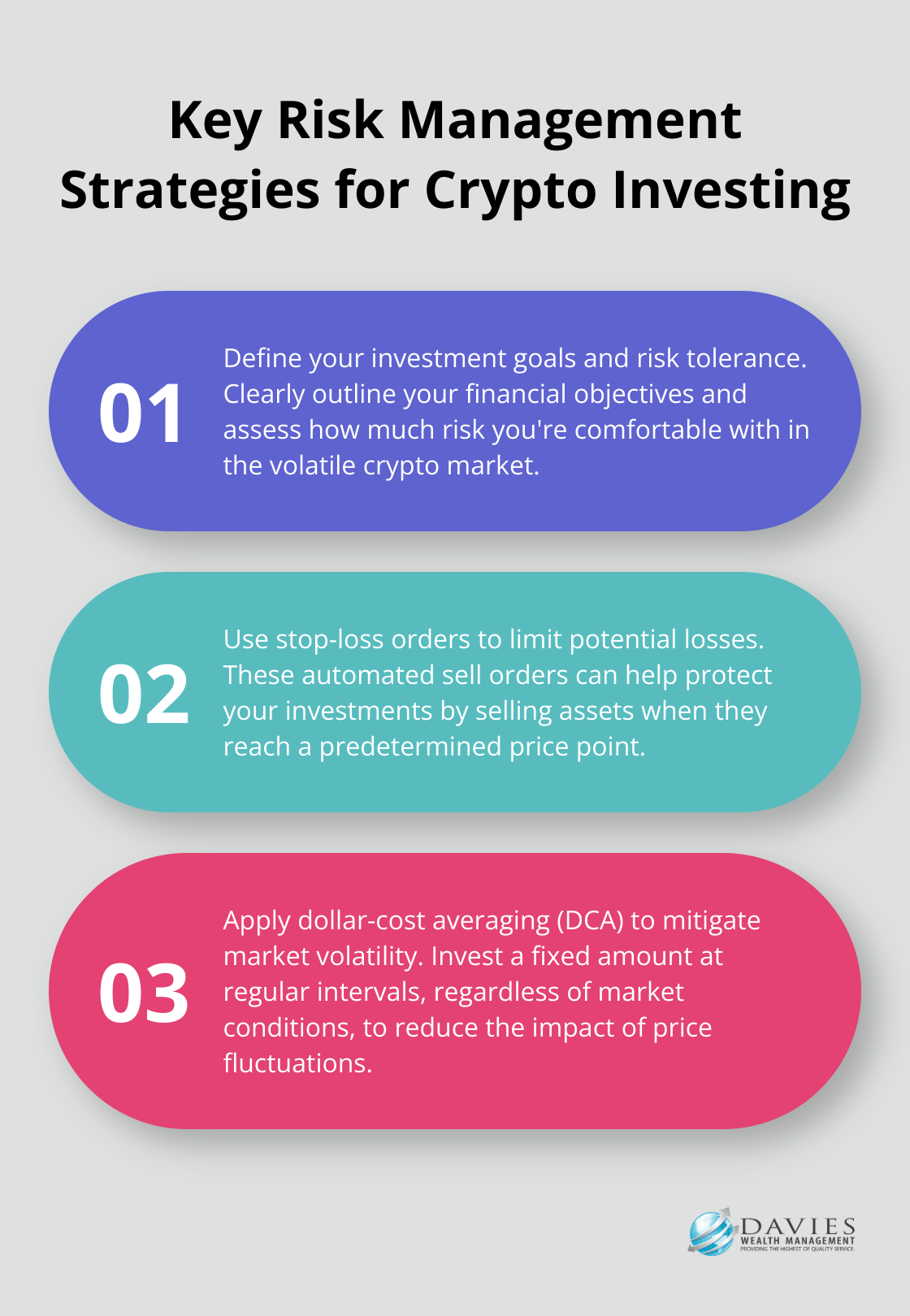

Define Your Investment Goals and Risk Tolerance

Before you invest in cryptocurrencies, you must clearly define your financial objectives and assess your risk tolerance. Ask yourself: Are you looking for short-term gains or long-term growth? How much of your portfolio will you allocate to cryptocurrencies? These questions will guide your investment strategy and help you make informed decisions.

If you’re nearing retirement, you might opt for a more conservative approach with a larger allocation to established cryptocurrencies and stablecoins. Younger investors with a longer time horizon might feel more comfortable with a higher-risk strategy that includes emerging altcoins.

Use Stop-Loss Orders

Stop-loss orders are a powerful risk management tool in crypto trading. They automatically sell your assets when they reach a predetermined price, limiting potential losses. For example, you might set a stop-loss order at 10% below your purchase price to cap your maximum loss at 10%.

Exercise caution when setting stop-loss orders in the highly volatile crypto market. If you set them too close to the current price, you might sell prematurely due to short-term price fluctuations. Stop-loss and take-profit orders help Bitcoin traders lock in gains and cut losses automatically. They’re essential tools for managing risk in a 24/7, fast-moving market.

Apply Dollar-Cost Averaging

Dollar-cost averaging (DCA) is a strategy where you invest a fixed amount at regular intervals, regardless of market conditions. This approach helps mitigate the impact of market volatility and reduces the risk of making large investments at inopportune times.

Instead of investing $12,000 in Bitcoin all at once, you might invest $1,000 monthly over a year. However, it’s important to note that dollar cost averaging does not assure a profit or protect against loss in declining markets. For the strategy to be effective, you must continue to purchase shares regardless of price fluctuations.

Rebalance Your Portfolio Regularly

Regular rebalancing of your crypto portfolio is important to maintain your desired risk level and capitalize on market movements. As different assets in your portfolio appreciate or depreciate, your initial allocation percentages can shift, potentially exposing you to more risk than intended.

Try to rebalance your portfolio quarterly or when an asset’s allocation deviates by more than 5% from its target. This practice is crucial for effective portfolio management in the cryptocurrency market.

While these strategies can help manage risk, the cryptocurrency market remains highly volatile. It’s always advisable to consult with financial professionals who can provide personalized advice tailored to your specific financial situation and goals. For those considering Bitcoin ETFs as part of their investment strategy, they can offer a way to spread risk across various asset classes, potentially reducing overall portfolio risk.

Final Thoughts

Secure crypto portfolio management requires strategic planning and continuous adaptation. Investors storage solutions, and effective risk management techniques form the foundation for navigating the volatile cryptocurrency market. Investors must stay informed about market trends and technological advancements to make well-informed decisions.

Every investor’s situation is unique, necessitating a personalized approach to portfolio management. Financial goals, risk tolerance, and investment timelines differ, which impacts how one should manage their crypto investments. Professional advice can provide valuable insights and help investors make informed decisions aligned with their individual objectives.

At Davies Wealth Management, we specialize in creating comprehensive wealth management solutions, including guidance on cryptocurrency investments. Our team works closely with clients to develop strategies that align with their financial objectives and risk profiles. For personalized advice on integrating cryptocurrencies into your investment portfolio, visit Davies Wealth Management.

Leave a Reply