The SECURE Act 2.0 has brought significant changes to retirement planning and estate strategies. At Davies Wealth Management, we’ve observed how these updates are reshaping the financial landscape for individuals at all stages of life.

Even those in their 20s should pay attention to retirement planning, as the new legislation offers opportunities and challenges that can impact long-term financial goals. This blog post explores the key changes in SECURE Act 2.0 and their implications for estate planning, providing insights to help you navigate this evolving terrain.

What’s New in SECURE Act 2.0?

The SECURE Act 2.0 introduces several key changes that significantly impact retirement and estate planning. These updates reshape the financial landscape for individuals at all stages of life.

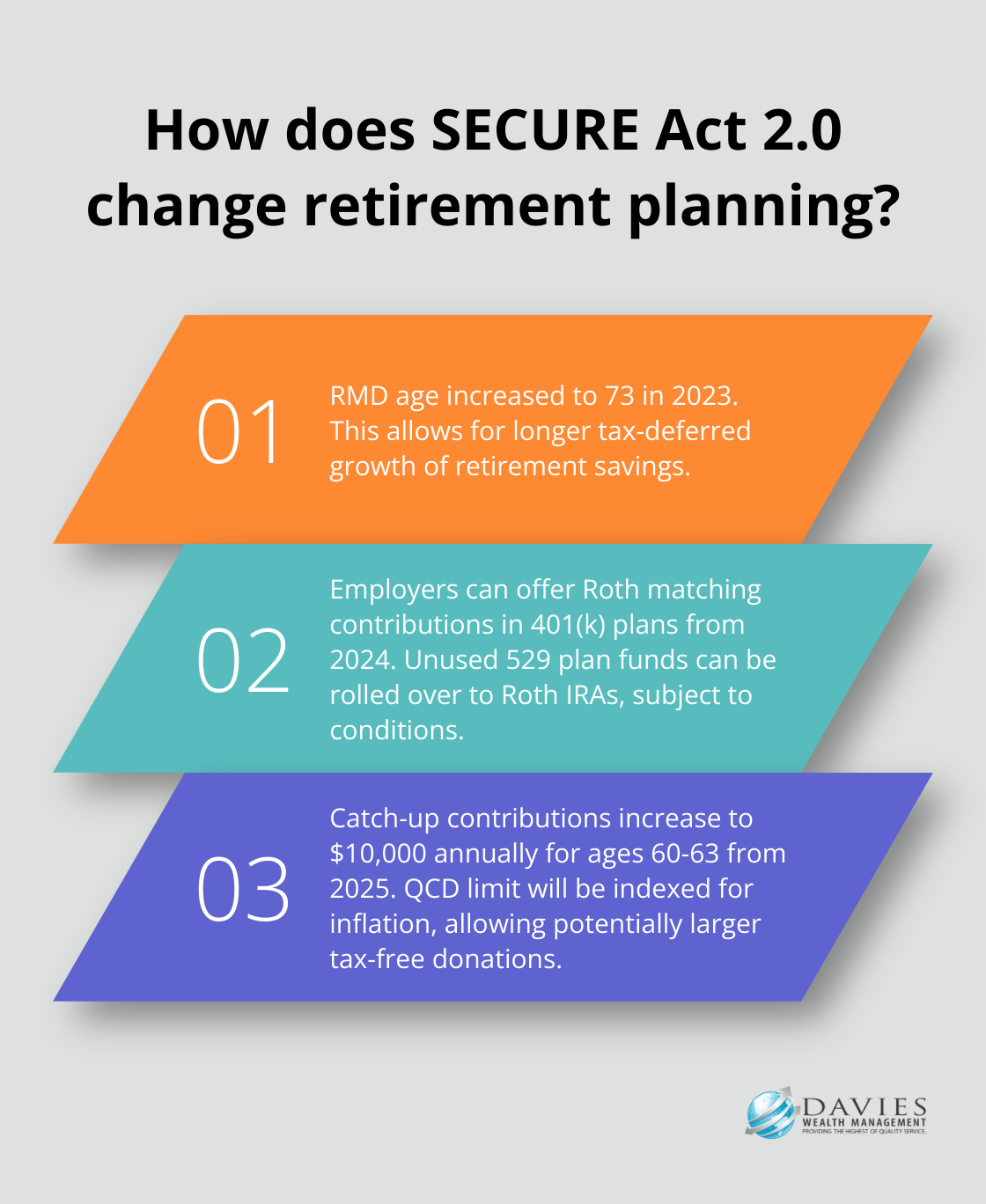

Delayed Required Minimum Distributions

The Act increases the age for Required Minimum Distributions (RMDs). Beginning in 2023, the SECURE 2.0 Act raised the age that you must begin taking RMDs to age 73. This change allows individuals to keep their retirement savings growing tax-deferred for a longer period.

Expanded Roth Options

The Act expands Roth options, providing more flexibility in retirement savings. Starting in 2024, employers can offer Roth matching contributions in 401(k) plans. Employees can choose to have their employer’s matching contributions go directly into a Roth account, potentially reducing their tax burden in retirement. Additionally, the Act allows for the rollover of unused 529 plan funds to Roth IRAs (subject to certain conditions and limits).

Enhanced Catch-Up Contributions

For those nearing retirement, the SECURE Act 2.0 increases catch-up contribution limits. Starting in 2025, individuals aged 60-63 will be able to make catch-up contributions of up to $10,000 annually to their workplace plans (or 150% of the regular catch-up amount, whichever is greater). This provides a significant opportunity for pre-retirees to boost their savings in the critical years leading up to retirement.

New Qualified Charitable Distribution Rules

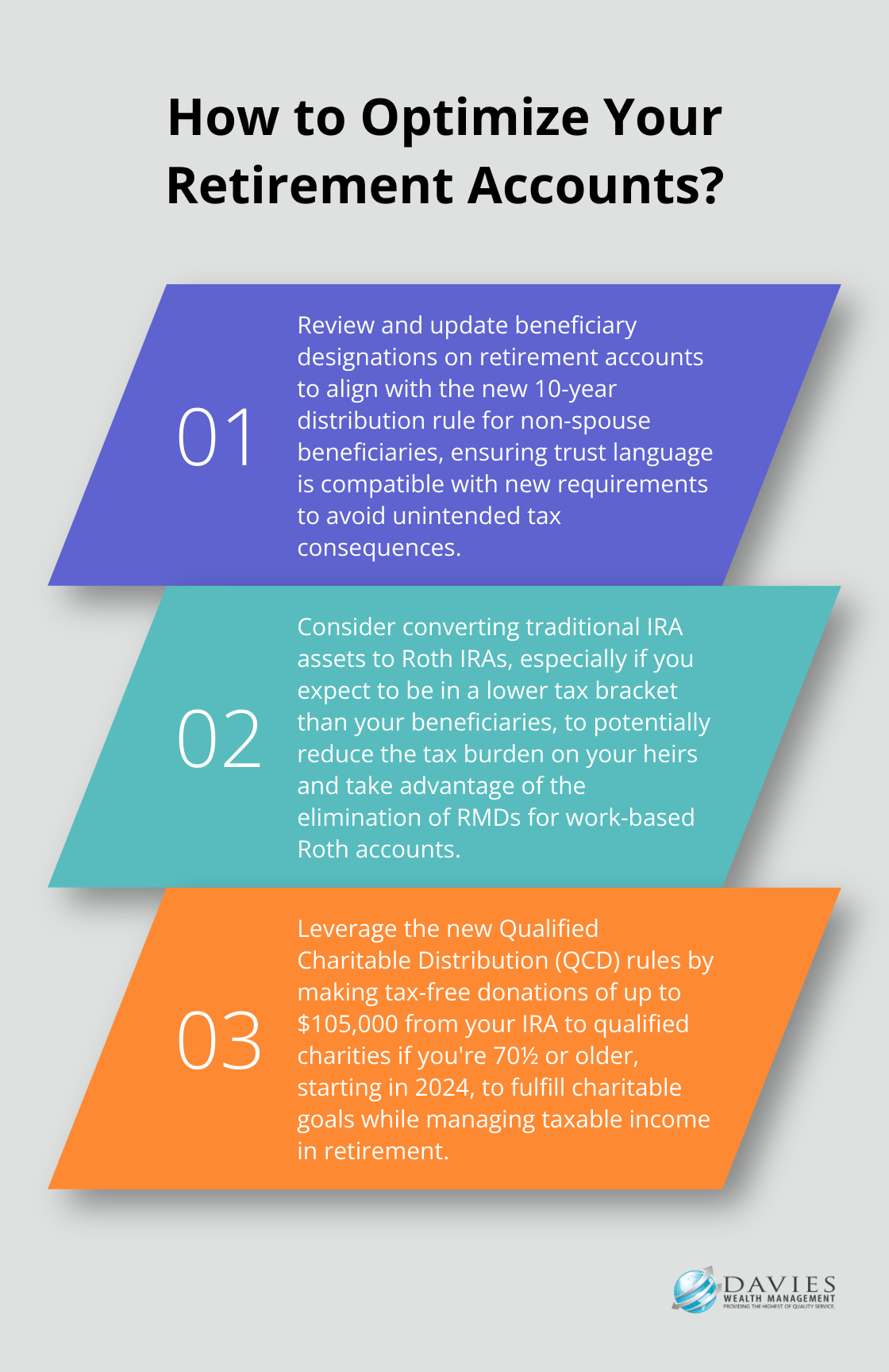

The Act also modifies Qualified Charitable Distributions (QCDs). The annual limit for QCDs will now be indexed for inflation, allowing for potentially larger tax-free donations from IRAs to qualified charities. Moreover, in 2024, individuals who are 70½ years old or older may use a QCD to donate up to $105,000 to qualified charities directly from an IRA.

These changes present both opportunities and challenges for estate planning. The key is to understand how these changes affect your specific situation and adjust your plans accordingly. As we move forward, it’s important to consider how these new rules might impact your estate planning strategies.

Adapting Estate Plans for SECURE Act 2.0

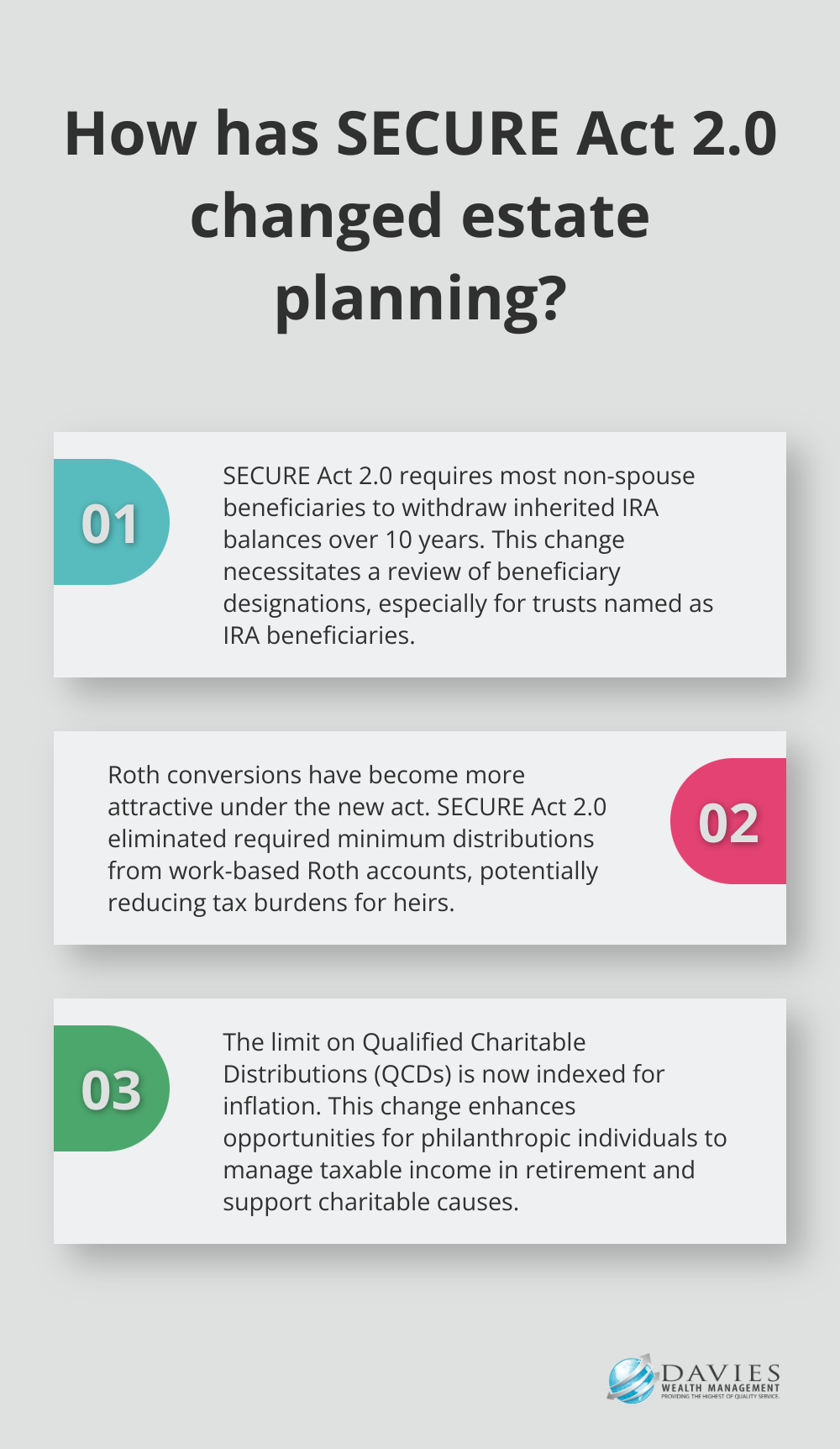

Reassessing Beneficiary Designations

The SECURE Act 2.0 necessitates a thorough review of beneficiary designations. Most non-spouse beneficiaries inheriting from an original owner will be required to withdraw the balance of their account over 10 years. If you’ve named a trust as an IRA beneficiary, you must ensure the trust language aligns with new distribution requirements. Failure to do so could result in unintended tax consequences for your beneficiaries.

Maximizing Roth Conversions

Roth conversions have become more attractive under SECURE Act 2.0. SECURE Act 2.0 eliminated the requirement for savers to take minimum distributions from their work-based 401(k), 403(b), or 457(b) plan Roth accounts. Converting traditional IRA assets to Roth IRAs can potentially reduce the tax burden on your heirs. This strategy proves particularly effective if you expect to be in a lower tax bracket than your beneficiaries.

Leveraging Charitable Giving Strategies

New rules for Qualified Charitable Distributions (QCDs) offer enhanced opportunities for philanthropically-minded individuals. The limit on QCDs, which has been capped at $100,000 since its introduction in 2006, is now indexed for inflation. This strategy not only fulfills charitable goals but also helps manage taxable income in retirement. For those required to take RMDs but not needing the income, QCDs can satisfy RMD requirements while supporting favorite causes tax-efficiently.

Exploring Life Insurance Options

Life insurance can play a crucial role in estate planning under SECURE Act 2.0. It provides a tax-free death benefit to beneficiaries, which can offset potential tax burdens from inherited retirement accounts. Additionally, certain types of life insurance policies (such as indexed universal life) offer tax-advantaged growth potential, providing an alternative savings vehicle outside of traditional retirement accounts.

Utilizing Trusts Strategically

Trusts remain valuable tools in estate planning, but their use requires careful consideration under SECURE Act 2.0. Standalone Retirement Trusts (SRTs) can provide asset protection and distribution control for inherited IRAs, while Charitable Remainder Trusts (CRTs) offer potential tax benefits and income streams for beneficiaries. However, trust structures must be carefully designed to comply with new distribution rules and maximize tax efficiency.

The landscape of estate planning continues to evolve with legislative changes. As we move forward, it’s essential to consider how these strategies interact with other aspects of financial planning, such as tax management and long-term care preparation.

Navigating SECURE Act 2.0 Challenges

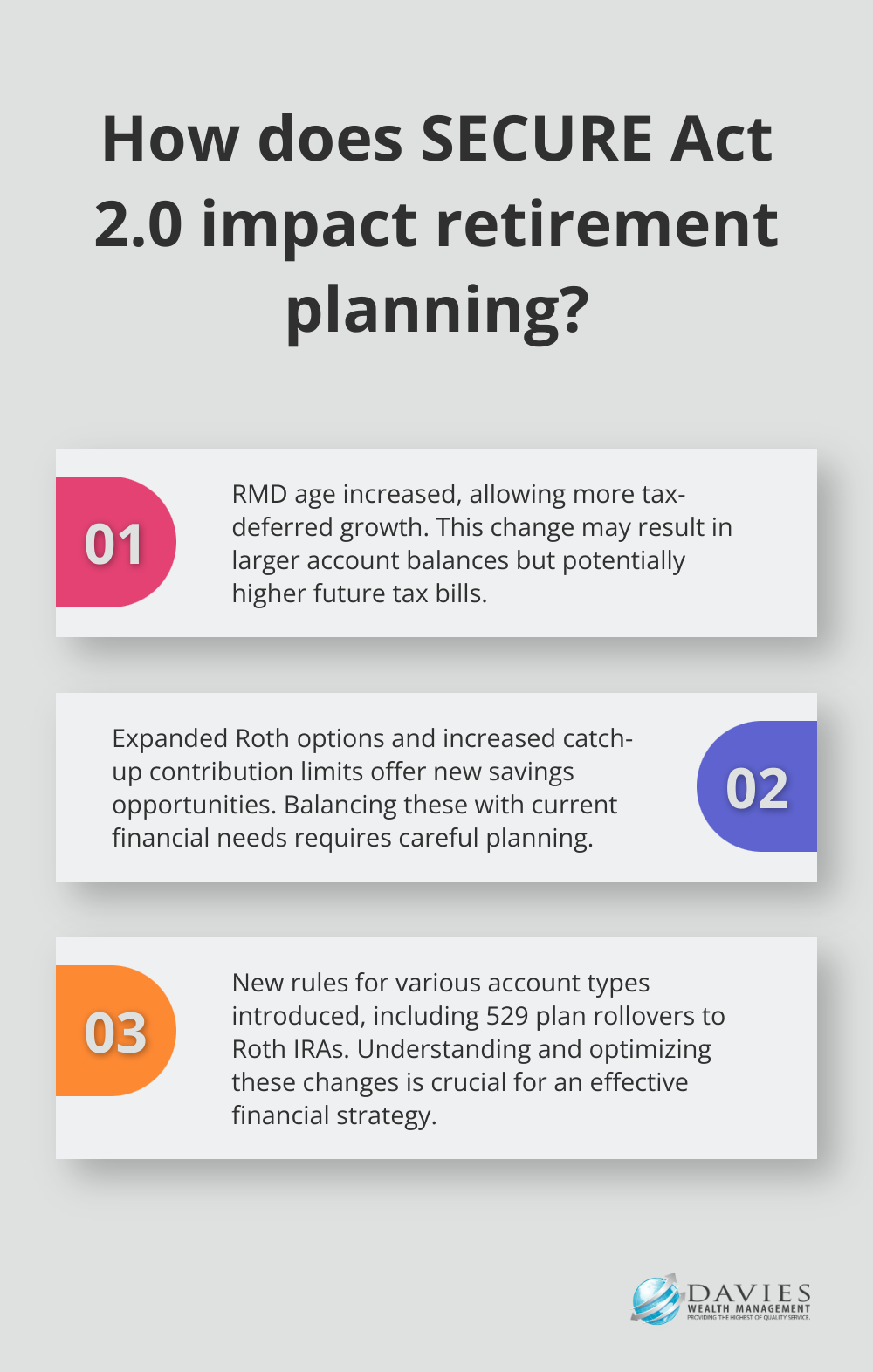

Extended RMD Age: A Double-Edged Sword

The Required Minimum Distributions (RMDs) now offer more flexibility to help people plan for longer careers and retirements, thanks to the SECURE 2.0 Act of 2022. While this change allows for more tax-deferred growth, it’s not without potential drawbacks. While delaying RMDs can lead to larger account balances, it may also result in higher tax bills when distributions eventually begin. For high-income earners, this could push them into higher tax brackets in their later years, potentially affecting Medicare premiums and Social Security taxation.

To mitigate this risk, implement a strategic withdrawal plan before reaching RMD age. This might involve taking smaller, regular distributions from retirement accounts to smooth out your tax liability over time. Additionally, explore Roth conversion opportunities during lower-income years to reduce future RMD obligations.

Balancing Current Needs and Future Goals

The expanded Roth options and increased catch-up contribution limits present excellent savings opportunities, but they also require careful balancing against current financial needs. For many, the decision to allocate more funds to retirement accounts means less available cash for other priorities like paying off debt or funding children’s education.

To strike the right balance, create a comprehensive financial plan that accounts for both short-term and long-term goals. Prioritize high-interest debt repayment and establish an emergency fund before maximizing retirement contributions. For those with competing priorities, consider splitting additional savings between retirement accounts and other financial goals.

Navigating Complex Account Rules

The SECURE Act 2.0 introduces different rules for various account types, making it important to understand how each fits into your overall financial strategy. For instance, the new ability to roll over unused 529 plan funds to Roth IRAs provides flexibility but comes with specific conditions and limits.

To optimize your strategy, consider diversifying your savings across different account types. This might include traditional IRAs, Roth IRAs, employer-sponsored plans, and taxable investment accounts. Each offers unique benefits and can be leveraged differently depending on your current financial situation and future goals.

Adapting to Legislative Changes

The financial landscape continues to evolve, and staying informed and adaptable is key to successful long-term planning. Regular reviews of your financial strategy with a knowledgeable advisor can help ensure you’re making the most of new opportunities while navigating potential pitfalls.

For professional athletes with unique financial needs, it’s particularly important to work with advisors who understand the complexities of their financial situations. These advisors can help athletes adapt their strategies to align with legislative changes and personal financial goals (taking into account factors such as short career spans and fluctuating income).

Final Thoughts

The SECURE Act 2.0 transforms retirement and estate planning, affecting individuals of all ages. These changes impact how we save, invest, and transfer wealth, making it essential for everyone, including those in their 20s, to start retirement planning early. At Davies Wealth Management, we understand the complexities of these new regulations and their effects on various financial situations.

We create tailored wealth management solutions, including retirement planning strategies for young professionals in their 20s and beyond. Our team helps clients navigate these changes and build a secure financial future. We recognize that as legislation evolves and personal circumstances change, strategies must adapt accordingly.

Professional guidance becomes increasingly important given the complexity of the SECURE Act 2.0 and its implications for estate planning. Whether you’re starting your career or approaching retirement, a knowledgeable advisor can help you make informed decisions and optimize your financial strategy. To learn more about how we can assist you in adapting your estate plan to these new realities, visit us at Davies Wealth Management.

Leave a Reply