Retirement planning for financial planners is a critical skill that can make or break client relationships. At Davies Wealth Management, we understand the complexities involved in crafting effective retirement strategies.

This guide offers practical tips to help financial planners navigate the intricate landscape of retirement planning. From assessing client goals to managing ongoing retirement plans, we’ll cover essential strategies to ensure your clients’ financial security in their golden years.

Decoding Client Retirement Aspirations

Mapping the Financial Terrain

Understanding client retirement goals forms the foundation of effective retirement planning. The first step involves a comprehensive assessment of the client’s current financial situation. This analysis helps you understand your current financial position, estimate your retirement expenses, analyze income sources, and plan for healthcare costs. A 2023 study by the Employee Benefit Research Institute revealed that only 42% of workers have attempted to calculate their retirement needs. This statistic underscores the importance of financial planners taking the initiative to perform these calculations for their clients.

Charting Short and Long-Term Objectives

After establishing a clear picture of the client’s financial standing, the focus shifts to identifying retirement objectives. Short and long-term retirement objectives are crucial. How to Create a Long-Term Financial Plan starts by evaluating your income, expenses, debts and assets. Quantifying these goals is essential. For example, if a client wants to travel extensively in retirement, we help them estimate the annual cost and factor it into their overall retirement budget.

Gauging Risk Appetite and Investment Preferences

The final piece of the puzzle involves determining the client’s risk tolerance and investment preferences. This process extends beyond simply asking whether they’re conservative or aggressive investors. Sophisticated risk assessment tools help gauge how clients might react to market volatility. Financial advisors often use questionnaires or surveys to assess a client’s risk tolerance and create a customized investment strategy. This approach highlights the importance of aligning investment strategies with a client’s risk tolerance to ensure they adhere to their plan during turbulent market conditions.

Tailoring Strategies for Professional Athletes

For professional athletes (a key client segment at Davies Wealth Management), retirement planning requires a unique approach. These clients often face short career spans, fluctuating income, and potential earnings from endorsements and contracts. Their retirement planning strategies must address these complexities, focusing on both current wealth management and long-term financial security beyond their playing years.

Implementing Personalized Retirement Plans

With a thorough understanding of a client’s financial profile and retirement aspirations, financial planners can create retirement plans that are not only financially sound but also personally fulfilling. This approach ensures that each retirement strategy is as unique as the individual it serves, setting the stage for the next critical phase: developing comprehensive retirement strategies that will turn these aspirations into reality.

Crafting Robust Retirement Strategies

At Davies Wealth Management, we know that developing comprehensive retirement strategies is the cornerstone of successful financial planning. This process involves a multifaceted approach that goes beyond simple investment allocation.

Diversification: The Foundation of Retirement Portfolios

Creating diversified investment portfolios reduces overall risk while still allowing for long-term growth potential. We recommend a mix of domestic and international stocks, bonds, real estate investment trusts (REITs), and alternative investments. The exact allocation depends on the client’s risk tolerance and time horizon.

For professional athletes (who often have shorter career spans), we might suggest a more aggressive allocation during their playing years, gradually shifting to a more conservative approach as they near retirement. This strategy aims to capitalize on growth potential early on while safeguarding wealth later.

Tax-Efficient Withdrawal Strategies

Tax-efficient withdrawal strategies can significantly impact a client’s retirement income. The order in which funds are withdrawn from different account types (taxable, tax-deferred, and tax-free) can make a substantial difference.

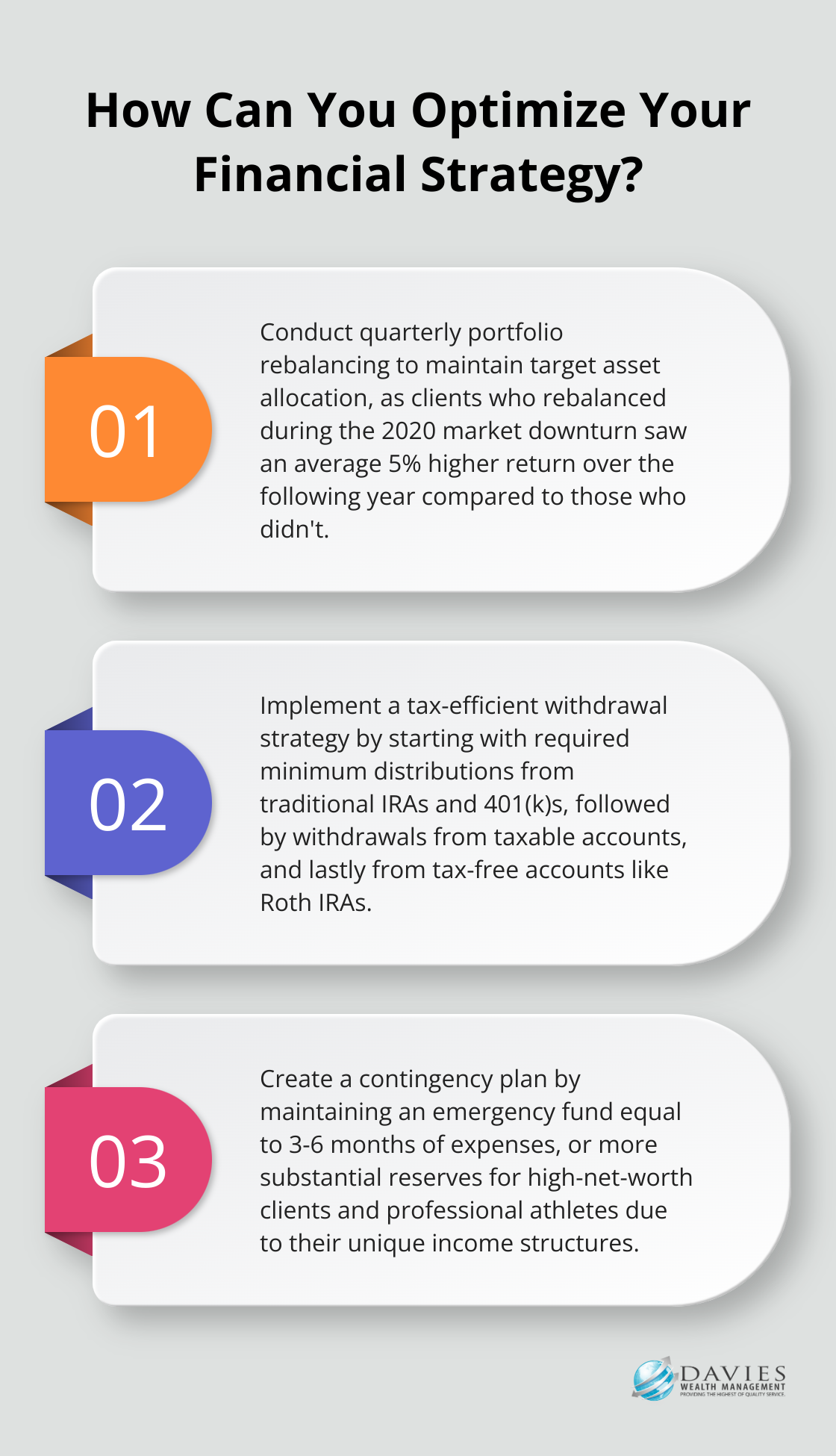

We often recommend starting with required minimum distributions (RMDs) from traditional IRAs and 401(k)s, followed by withdrawals from taxable accounts, and lastly, tax-free accounts like Roth IRAs. This approach allows tax-free accounts to continue growing untaxed for as long as possible.

Maximizing Social Security and Pension Benefits

Social Security and pension planning is a critical component of retirement strategy. The decision of when to claim Social Security can have a significant impact on lifetime benefits. Delaying benefits beyond full retirement age can increase your monthly payments by a certain percentage for each month you delay.

For clients with pensions, we analyze various payout options to determine the most beneficial choice. This might involve comparing a lump sum versus annuity payments or evaluating survivor benefit options.

Addressing Healthcare and Long-Term Care Needs

Healthcare costs are often underestimated in retirement planning. We help clients factor these costs into their retirement budgets and explore options like Health Savings Accounts (HSAs) for tax-efficient healthcare saving.

Long-term care is another important consideration. We discuss various long-term care insurance options with clients, weighing the costs and benefits against self-insuring.

As we move forward to discuss ongoing retirement plan management, it’s clear that the strategies outlined above form the foundation of a solid retirement plan. However, the work doesn’t stop once these strategies are implemented. The next section will explore how to effectively manage and adjust these plans over time to ensure continued success.

Navigating Retirement Plan Dynamics

Adapting to Market Fluctuations

Market conditions change constantly, which requires regular portfolio adjustments. We recommend quarterly rebalancing to maintain the target asset allocation. This approach helps reduce risk and take advantage of market opportunities. A study by Vanguard found that during the 2020 market downturn, clients who rebalanced their portfolios saw an average 5% higher return over the following year compared to those who didn’t.

Proactive Plan Reviews

Annual retirement plan reviews play a vital role in long-term success. These reviews should cover more than just investment performance. We analyze changes in income, expenses, and life circumstances that might affect retirement goals. For professional athletes (whose careers often span less than a decade), we conduct more frequent reviews to account for rapid changes in income and lifestyle.

Navigating Life’s Curveballs

Unexpected events can disrupt even the most carefully crafted retirement plans. Job loss, health issues, or family emergencies can significantly impact financial stability. We help clients create contingency plans, such as maintaining an emergency fund equal to 3-6 months of expenses. For high-net-worth clients (including professional athletes), we often recommend more substantial reserves due to their unique income structures.

Leveraging Technology for Plan Management

Modern retirement plan management benefits from advanced technological tools. We use sophisticated software to track portfolio performance, simulate various market scenarios, and provide real-time updates to our clients. This technology-driven approach allows for more precise and timely adjustments to retirement strategies.

Educating Clients for Better Decision-Making

We believe that informed clients make better financial decisions. As part of our ongoing management process, we provide regular educational resources to our clients. These resources cover topics such as market trends, tax law changes, and new investment opportunities. This education empowers clients to actively participate in their retirement planning process and make more informed decisions about their financial future.

Final Thoughts

Retirement planning for financial planners requires a comprehensive and personalized approach. Every client has unique financial circumstances, goals, and risk tolerances that demand tailored strategies. Financial planners must create retirement plans that provide financial security and align with clients’ personal aspirations and lifestyle preferences.

At Davies Wealth Management, we specialize in creating personalized retirement strategies (including for professional athletes with unique financial challenges). Our team combines rigorous financial analysis, diversified investment strategies, and ongoing plan management to help meet our clients’ retirement goals. We use advanced technology and provide continuous education to empower our clients in their financial decision-making process.

The retirement landscape continues to evolve, and financial planners must stay informed and adaptable. Davies Wealth Management offers expert guidance and personalized service to help you achieve your financial goals. Our team delivers clear, actionable solutions that align with your unique circumstances, ensuring you can build, protect, and transfer your wealth with confidence.

Leave a Reply