Planning for retirement as a couple can be complex, but the right tools can make it easier. At Davies Wealth Management, we’ve seen how retirement planning calculators for couples can provide valuable insights into your financial future.

These specialized calculators take into account both partners’ incomes, retirement goals, and potential Social Security benefits. In this post, we’ll explore the top retirement planning calculators for couples and how to use them effectively.

Top Retirement Calculators for Couples

Retirement planning for couples requires specialized tools that account for both partners’ financial situations. We’ve evaluated numerous calculators and identified the top three that provide the most comprehensive features for couples planning their retirement together.

Vanguard Retirement Income Calculator

Vanguard’s calculator excels in simplicity and effectiveness. Couples can use this calculator to help them see where they stand in relation to their retirement goal and map out different paths to reach their target. Its standout feature is the Monte Carlo simulation, which runs 100,000 scenarios to provide a probability of retirement success. This tool proves particularly useful for couples who want to understand how various market conditions might impact their retirement plans (especially during economic uncertainties).

Fidelity Retirement Score

Fidelity’s tool takes a unique approach by generating a retirement readiness score. Couples can know where they stand for retirement in just 60 seconds by answering 6 simple questions. The calculator then produces a score and provides additional steps to consider as they save for retirement. This scoring system offers couples a quick snapshot of their retirement readiness and clear steps for improvement (which can be especially motivating).

Personal Capital Retirement Planner

For couples who need a more detailed analysis, Personal Capital’s Retirement Planner stands out. This fantastic new Retirement Planning Calculator uses your real data to come up with Monte Carlo simulation results. The planner also provides a year-by-year breakdown of projected income and expenses in retirement, which proves invaluable for couples with complex financial situations or varying income streams.

Davies Wealth Management: Personalized Retirement Planning

While these calculators serve as excellent starting points, they shouldn’t replace professional financial advice. At Davies Wealth Management, we often use these tools in conjunction with our personalized retirement planning services to give couples a comprehensive view of their financial future. Our expertise in handling complex financial situations (including those of professional athletes with unique income patterns) allows us to provide tailored advice that goes beyond what these calculators can offer.

As we move forward, it’s important to understand the key features that make a retirement calculator truly effective for couples. Let’s explore these essential elements in the next section.

Key Features of Effective Couple Retirement Calculators

When selecting a retirement calculator for couples, certain features can significantly enhance the accuracy and usefulness of the results. The most effective calculators for couples share several key characteristics.

Dual Income Input

A top feature is the ability to input two separate income streams. This allows for a more accurate representation of a couple’s financial situation, especially when partners have different salaries or one partner has a variable income. For example, professional athletes often have significant income disparities between partners. A good calculator should accommodate these differences to provide a realistic projection.

Social Security Benefit Estimation

Another important feature is the integration of Social Security benefit estimations for both partners. A calculator that can estimate these benefits for each partner based on their individual work histories provides a more comprehensive view of potential retirement income.

Flexible Retirement Timelines

Couples often have different retirement timelines, and the best calculators account for this. They allow users to input different retirement ages for each partner, which can significantly impact the overall retirement strategy. For instance, if one partner plans to retire at 62 while the other continues working until 67, the calculator should factor in this five-year difference in retirement start dates. Some calculators are specifically designed to help create retirement plans for households with two working spouses who may have different retirement timelines.

Customizable Life Expectancy

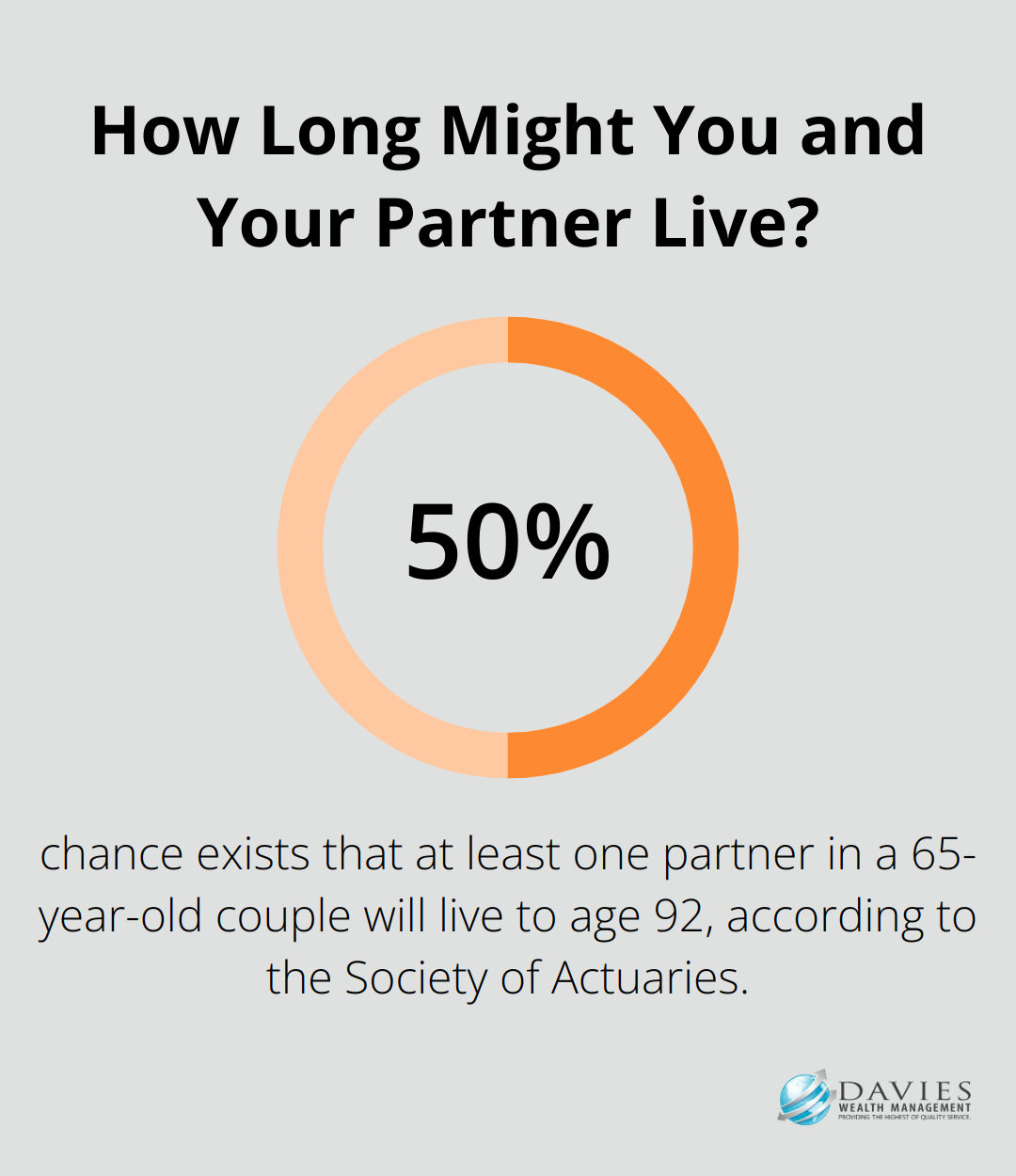

Life expectancy projections play a key role in retirement planning. The Society of Actuaries reports that a 65-year-old couple has a 50% chance that at least one partner will live to age 92. High-quality calculators allow for adjustable life expectancy projections, ensuring that couples can plan for potentially long retirements and avoid the risk of outliving their savings.

Investment Return Scenarios

The best calculators offer various investment return scenarios (conservative, moderate, and aggressive) to help couples understand how different market conditions might affect their retirement savings. This feature allows for a more nuanced approach to retirement planning, taking into account potential market volatility and economic uncertainties.

While these features are important, it’s essential to understand that retirement calculators are tools, not crystal balls. They provide estimates based on the information you input and certain assumptions about the future. To create robust, personalized retirement strategies, it’s advisable to combine the insights from these calculators with expert financial advice.

Now that we’ve explored the key features of effective couple retirement calculators, let’s examine how couples can use these tools effectively to maximize their retirement planning efforts.

Maximizing Retirement Calculators as a Couple

Compile Comprehensive Financial Data

The first step to use retirement calculators effectively involves collecting all relevant financial information. This includes current salaries, savings, investments, and debts for both partners. Include any expected inheritances or future income sources. For professional athletes, it’s important to account for potentially high but short-term earnings. The National Football League Players Association reports that the average NFL career is under 4 years, which underscores the need for careful financial planning for athletes.

Set Realistic Retirement Goals

When you input data into retirement calculators, you need to have realistic expectations about your retirement lifestyle. The Bureau of Labor Statistics reports that the average household headed by a person 65 or older spends about $50,220 per year. However, this figure can vary widely based on location and lifestyle choices. Consider factors like travel plans, healthcare costs, and potential relocation expenses. Be honest with each other about your expectations to ensure your calculator inputs reflect your shared vision for retirement.

Update Your Financial Picture Regularly

Your financial situation changes over time, and your retirement planning should reflect these changes. Make it a habit to update your retirement calculator inputs at least annually, or when significant life changes occur. This could include job changes, major purchases, or shifts in your retirement goals. The Social Security Administration updates its online statements annually, so reviewing these can provide updated projections for this (often crucial) retirement income source.

Use Multiple Calculators for Comprehensive Insights

While we’ve highlighted some top retirement calculators, you’ll benefit from using multiple tools for a more comprehensive view. Each calculator has its strengths and may provide different insights. For instance, Vanguard’s Monte Carlo simulation offers probability-based outcomes, while Fidelity’s Retirement Score provides a quick snapshot of your retirement readiness. By comparing results from various calculators, you can identify trends and potential gaps in your retirement strategy. Retirement calculators can help you find out how much money you might need in retirement and whether your current savings plan could get you to your goal.

Seek Professional Guidance

While retirement calculators are valuable tools, they shouldn’t replace professional financial advice. Financial advisors (like those at Davies Wealth Management) often combine insights from these calculators with in-depth analysis to provide a holistic view of their clients’ retirement prospects. This approach is particularly valuable for couples with complex financial situations, such as professional athletes or business owners, where standard calculators may not capture all nuances of their financial picture.

Final Thoughts

Retirement planning calculators for couples provide essential insights for a secure financial future. The Vanguard Retirement Income Calculator, Fidelity Retirement Score, and Personal Capital Retirement Planner offer unique features to help partners navigate their retirement journey together. These tools allow couples to gain a comprehensive view of their financial trajectory, considering factors such as dual incomes, different retirement timelines, and varying life expectancies.

We at Davies Wealth Management encourage couples to start their retirement planning early and revisit their plans regularly. The financial landscape changes constantly, and life circumstances can shift unexpectedly. Consistent updates to your retirement calculator inputs and reassessment of your goals will equip you to adapt your strategy as needed.

While retirement planning calculators for couples serve as invaluable tools, they work best when combined with professional guidance. At Davies Wealth Management, we specialize in providing personalized financial advice tailored to your unique situation (including professional athletes with complex financial needs). Our team stands ready to help you confidently navigate your path to a secure and fulfilling retirement.

Leave a Reply