Retirement income planning in Stuart, Florida presents unique opportunities and challenges for retirees. The Sunshine State’s tax-friendly environment and Stuart’s local economic factors significantly impact retirement strategies.

At Davies Wealth Management, we understand the importance of tailoring retirement plans to our clients’ specific needs in this vibrant coastal community. Our expert advice can help you navigate the complexities of retirement income planning, ensuring a financially secure and enjoyable retirement in Stuart.

What Makes Stuart Unique for Retirement Planning?

Stuart’s Tax-Friendly Advantage

Stuart, Florida offers a distinctive retirement landscape that demands careful financial planning. The city’s coastal charm and economic dynamics create a unique environment for retirees to navigate.

Florida’s tax-friendly status attracts many retirees to Stuart. The absence of state income tax means Social Security benefits, pension income, and retirement account withdrawals remain untaxed at the state level. This tax advantage allows retirees to keep more of their hard-earned money, potentially stretching their retirement savings further.

A retiree with an annual income of $50,000 from various sources could save thousands in state taxes compared to living in a state with income tax. This savings can be redirected towards other retirement expenses or leisure activities.

Local Economic Factors

Stuart’s economy heavily relies on tourism, which impacts retirement planning. Beach-related activities generate approximately $310 million in tax revenues for the state (according to recent tourism board reports). This economic driver creates both opportunities and challenges for retirees.

The robust tourism sector provides part-time employment opportunities for retirees who want to supplement their income. However, it also leads to seasonal fluctuations in prices for goods and services, which retirees must factor into their budgets.

Housing Market Considerations

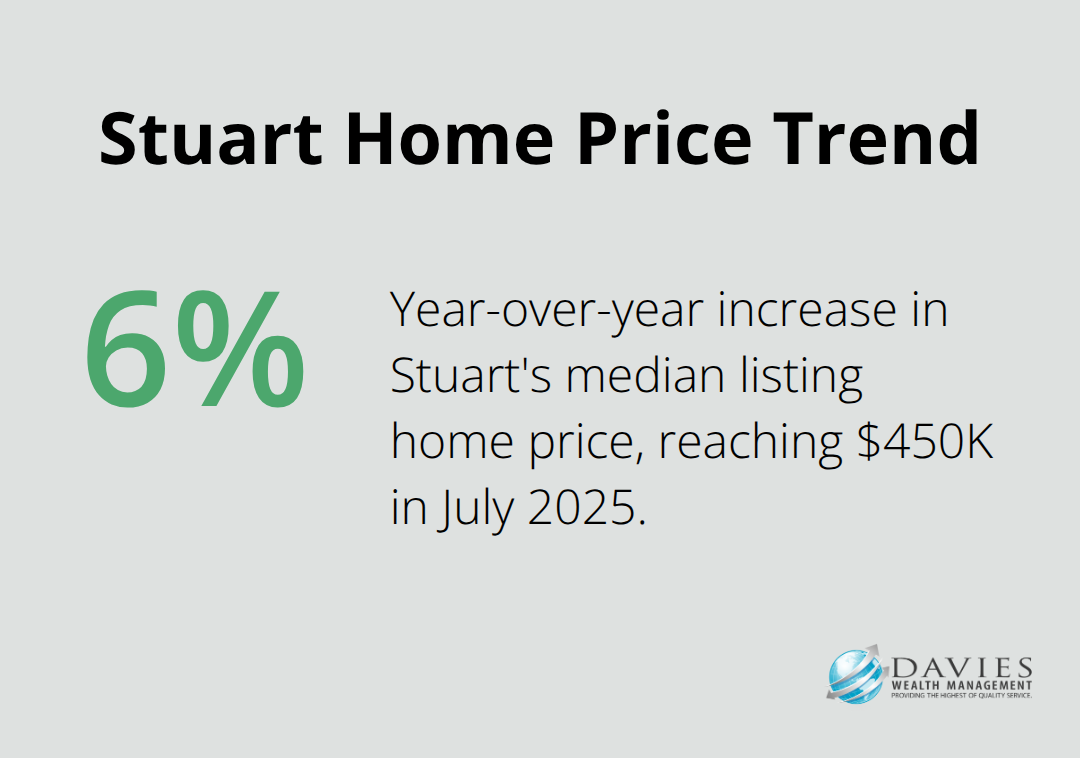

The real estate market in Stuart plays a vital role in retirement planning. As of July 2025, the median listing home price in Stuart is $450K, trending up 6% year-over-year. This appreciation rate benefits retirees who own property, but it also means that housing costs remain a significant consideration for those looking to relocate or downsize.

Retirees considering assisted living should note that the average monthly cost in Stuart is about $3,500. This expense should be carefully factored into long-term financial plans, especially given the potential need for extended care in later years.

Protecting Against Natural Disasters

Stuart’s coastal location makes it vulnerable to hurricanes and flooding, which can have financial implications for retirees. Insurance costs (particularly for homeowners) have seen significant increases due to these risks. Retirees should budget for higher insurance premiums and consider setting aside an emergency fund specifically for disaster-related expenses.

Tailored Retirement Strategies

The unique aspects of retirement planning in Stuart require expert guidance. A comprehensive understanding of the local economic landscape allows for the creation of tailored strategies that maximize the benefits of living in this tax-friendly state while mitigating potential risks. These strategies should be robust enough to weather both economic and natural storms, allowing retirees to enjoy their golden years in this beautiful coastal community.

As we move forward, we’ll explore key strategies for maximizing retirement income in Stuart, taking into account these unique local factors and how they can be leveraged to create a secure financial future.

How to Maximize Retirement Income in Stuart

Retirement income planning in Stuart requires a strategic approach that capitalizes on the city’s unique economic landscape. Effective strategies can help retirees make the most of their retirement years in this vibrant Florida community.

Diversify Income Streams

One of the most effective ways to ensure financial stability in retirement is through income diversification. In Stuart, this can take several forms:

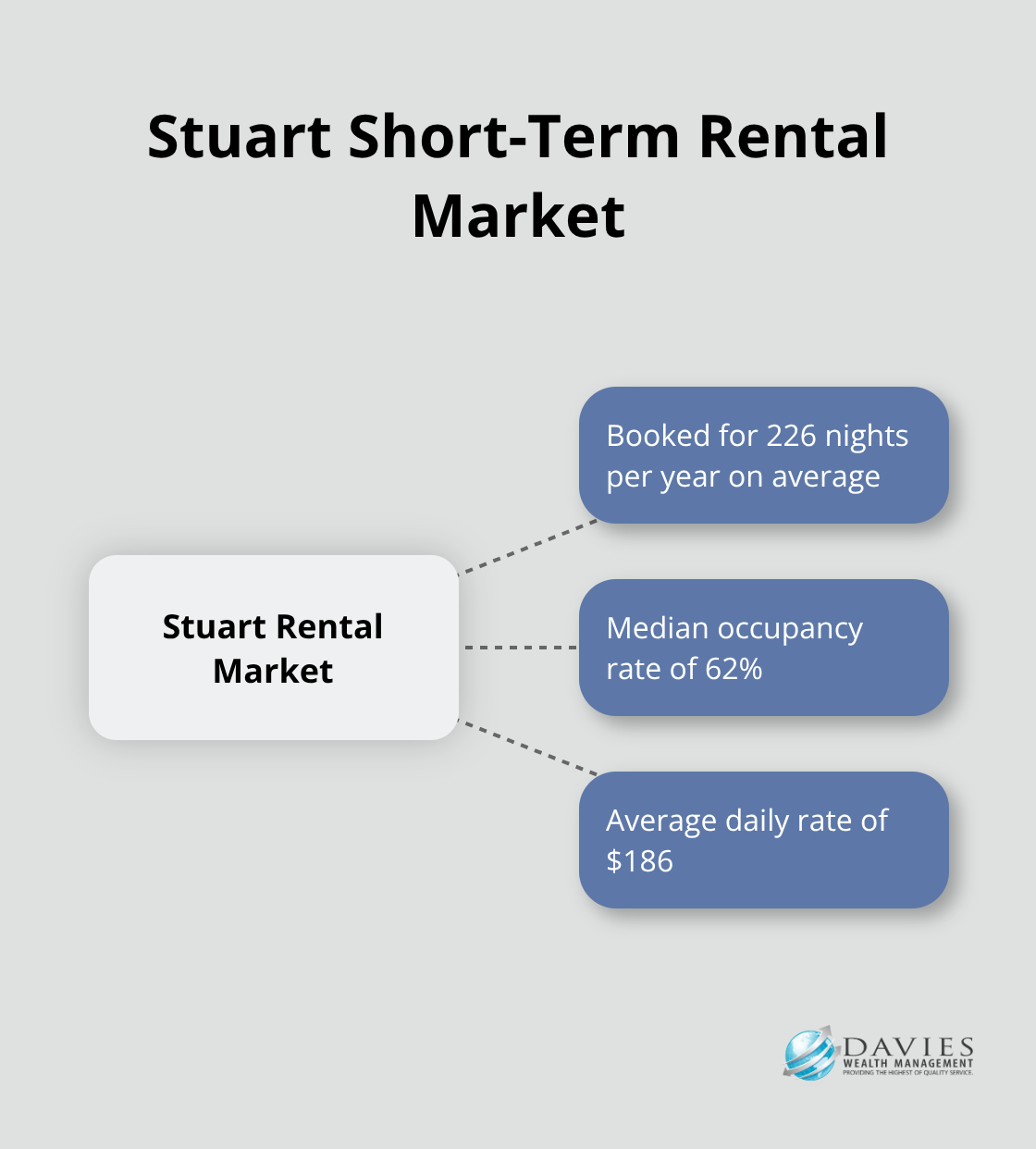

- Rental Income: Property investments are a popular option, given the area’s strong tourism sector. A typical short-term rental listing in Stuart is booked for 226 nights a year, with a median occupancy rate of 62% and an average daily rate of $186.

- Part-time Work: The tourism industry offers opportunities for retirees. Many find fulfilling roles as tour guides, golf course staff, or in hospitality, allowing them to stay active while supplementing their retirement income.

Optimize Social Security Benefits

Timing is key when it comes to Social Security benefits. For Stuart residents, delaying benefits can lead to significant increases in monthly payouts. You could increase your benefits by up to 132 percent if you suspended benefits until December 2024.

However, the decision to delay should balance against other factors such as health, life expectancy, and overall financial situation. A thorough analysis of each individual’s circumstances will determine the optimal claiming strategy.

Leverage Local Investment Opportunities

Stuart’s growing economy offers unique investment opportunities for retirees:

- Local Businesses: The growth in tourism-related businesses presents opportunities for retirees to invest in local enterprises.

- Commercial Real Estate: The Stuart Community Redevelopment Agency has initiated several projects aimed at revitalizing downtown areas, potentially increasing property values. Retirees with the capacity for higher-risk investments might consider participating in these local development projects (which could offer attractive returns while contributing to community growth).

Implement Tax-Efficient Withdrawal Strategies

Florida’s tax-friendly environment allows for strategic withdrawal planning. Start withdrawals from taxable accounts first, allowing tax-advantaged accounts like IRAs and 401(k)s to continue growing tax-deferred. This approach can significantly reduce your overall tax burden in retirement.

For those with substantial traditional IRA balances, consider Roth IRA conversions during lower-income years. This strategy can help minimize required minimum distributions (RMDs) in the future and provide tax-free growth potential.

Manage Healthcare Costs

Healthcare costs remain a significant concern for retirees. To mitigate this risk, consider long-term care insurance and explore Florida’s Medicaid Long-Term Care program, which can provide additional support for eligible seniors.

These strategies can create a robust and diversified income plan that takes full advantage of Stuart’s local economic landscape. As we move forward, we’ll explore how to manage retirement risks specific to Stuart’s economic environment, ensuring a secure financial future in this coastal paradise.

Navigating Retirement Risks in Stuart

Inflation and Cost of Living Challenges

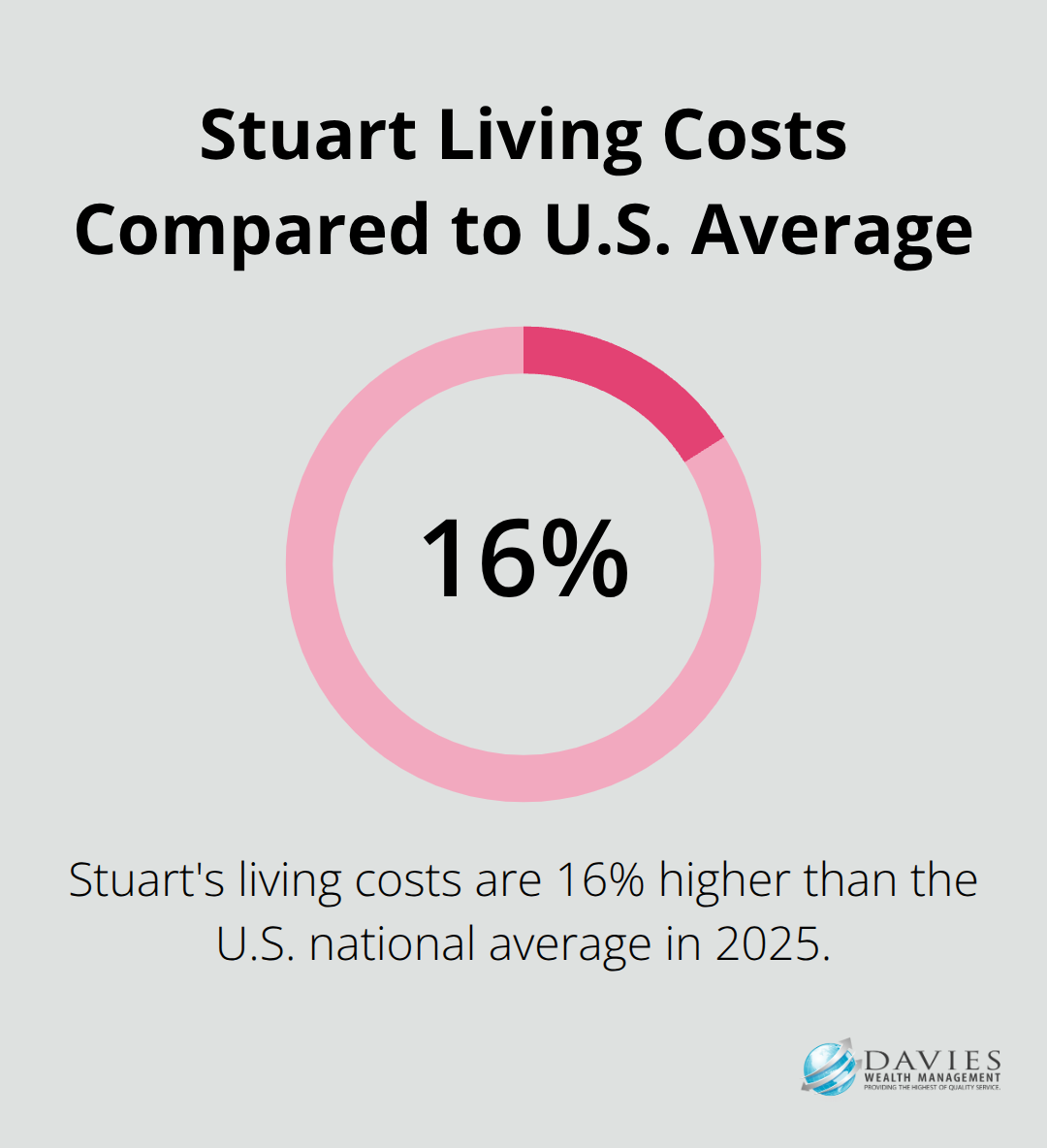

Living costs in Stuart are 16% higher than the U.S. national average and 720% higher than Florida’s state average. This reflects a 2% increase from 2024. This higher expense profile affects retirees’ budgets for groceries, healthcare, and housing. To combat rising costs:

- Add inflation-protected securities (TIPS) to your portfolio to maintain purchasing power.

- Allocate a portion of your investments to real estate investment trusts (REITs) that own properties in Stuart or similar Florida markets.

- Review and adjust your budget regularly to account for increasing costs, particularly in categories like healthcare and property insurance.

Protecting Against Market Volatility

Market fluctuations can impact retirement savings significantly. To safeguard your assets:

- Create a diversified portfolio that includes a mix of stocks, bonds, and alternative investments.

- Implement a bucket strategy. This approach allocates funds into short-term, medium-term, and long-term buckets based on when you’ll need the money.

- Explore annuities as a way to create a guaranteed income stream. Exercise caution regarding high fees and complex terms.

Healthcare and Long-term Care Considerations

Healthcare costs in retirement can be substantial, especially in Stuart where medical care costs exceed the national average by about 3%. To prepare:

- Maximize your Health Savings Account (HSA) contributions if eligible. HSAs offer triple tax advantages and can fund healthcare expenses in retirement.

- Research long-term care insurance options. The median cost of a private room in a nursing home is $361 per day or $10,965 per month in 2025.

- Consider a hybrid life insurance policy that includes a long-term care benefit, providing coverage for both scenarios.

Natural Disaster Risk Management

Stuart’s coastal location exposes residents to hurricane and flooding risks. These natural disasters can have significant financial implications. To mitigate these risks:

- Maintain adequate homeowners and flood insurance coverage. Review policies annually to ensure they meet your needs.

- Create an emergency fund specifically for disaster-related expenses. This fund should cover potential insurance deductibles and immediate repair costs.

- Invest in home improvements that increase resilience to severe weather, such as impact-resistant windows or hurricane shutters.

Tax-Efficient Withdrawal Strategies

While Florida’s tax environment benefits retirees, strategic withdrawals can further optimize your retirement income. Consider these approaches:

- Take your RMD while in Florida. Timing matters.

- Use Qualified Charitable Distributions (QCDs) from IRAs to satisfy RMDs without increasing taxable income, if you’re charitably inclined.

- Evaluate Roth IRA conversions during lower-income years. This strategy can help minimize required minimum distributions (RMDs) in the future and provide tax-free growth potential.

Final Thoughts

Retirement income planning in Stuart, Florida requires a tailored approach that accounts for the unique economic landscape of this coastal community. We at Davies Wealth Management specialize in creating customized retirement income plans for Stuart residents. Our team of experts understands the local economic factors, tax implications, and investment opportunities that can impact your retirement (including the potential effects of natural disasters).

We work closely with you to develop a comprehensive strategy that addresses your unique needs and helps you achieve your retirement goals. Our personalized approach to retirement income planning in Stuart, Florida ensures that you can enjoy your retirement with confidence, knowing that your financial future is secure. Don’t leave your retirement to chance.

Partner with Davies Wealth Management to create a retirement plan that allows you to make the most of your golden years in beautiful Stuart, Florida. With our guidance, you can navigate the complexities of retirement planning and build a secure financial future tailored to your unique circumstances. Our expertise and support will help you address concerns about market volatility, healthcare costs, and maximizing your income in retirement.

Leave a Reply