Inflation is a silent wealth eroder, steadily chipping away at your purchasing power. In 2025, this economic force remains a significant concern for investors and savers alike.

At Davies Wealth Management, we understand the importance of inflation hedging to protect your hard-earned assets. This blog post will explore effective strategies to safeguard your wealth against inflation’s impact, ensuring your financial future remains secure in these uncertain times.

What Is Inflation and How Does It Impact Your Wealth?

The Silent Wealth Eroder

Inflation represents more than just a financial buzzword; it’s a powerful economic force that can significantly impact your wealth. At its core, inflation causes a general increase in prices of goods and services over time. This means the dollar you hold today will purchase less in the future.

In 2025, inflation continues to be a major concern for investors. According to the latest data from the Bureau of Labor Statistics, the all items index rose 2.4 percent for the 12 months ending March, after rising 2.8 percent over the 12 months ending February. This percentage might seem small, but it quickly adds up. For instance, $100,000 in savings a year ago now has the purchasing power of only $97,600.

Current Trends and Future Projections

The Federal Reserve projects inflation to hover around 2.4% for the remainder of 2025. However, some economists paint a less optimistic picture. A recent survey by the National Association for Business Economics found that half of the participants place the probability of a recession in 2025 at 50% or higher.

Real-World Impact

Inflation affects all aspects of life. Housing costs and food prices continue to be significant factors in the overall inflation rate. This presents a particular challenge for retirees on fixed incomes. A study by Milliman found that a healthy 65-year-old couple can expect to spend upwards of $395,000 on healthcare costs in retirement (a figure expected to rise with inflation).

The Importance of Inflation-Resistant Strategies

Understanding and preparing for inflation is essential to maintaining your financial health. This applies whether you’re a professional athlete with a short career window or a business owner planning for long-term growth. Inflation-resistant investment strategies should form a key part of your portfolio to protect your hard-earned assets.

Navigating Inflation: The Next Steps

As we move forward, it’s clear that inflation will continue to shape the financial landscape. The next section will explore effective strategies to hedge against inflation, ensuring your wealth remains protected in these uncertain times.

Inflation-Proof Your Portfolio: Strategies for 2025

In 2025, protecting your wealth against inflation requires a strategic approach. Several effective methods exist to safeguard your assets from the eroding effects of rising prices.

Real Estate: A Tangible Hedge

Real estate stands as a reliable inflation hedge. As prices rise, property values and rental incomes typically follow suit. The National Association of Realtors reports that the median existing-home price for all housing types in March 2025 reached $395,000, a 3.9% increase from March 2024. This increase outpaced the general inflation rate, highlighting real estate’s potential as an inflation-resistant asset.

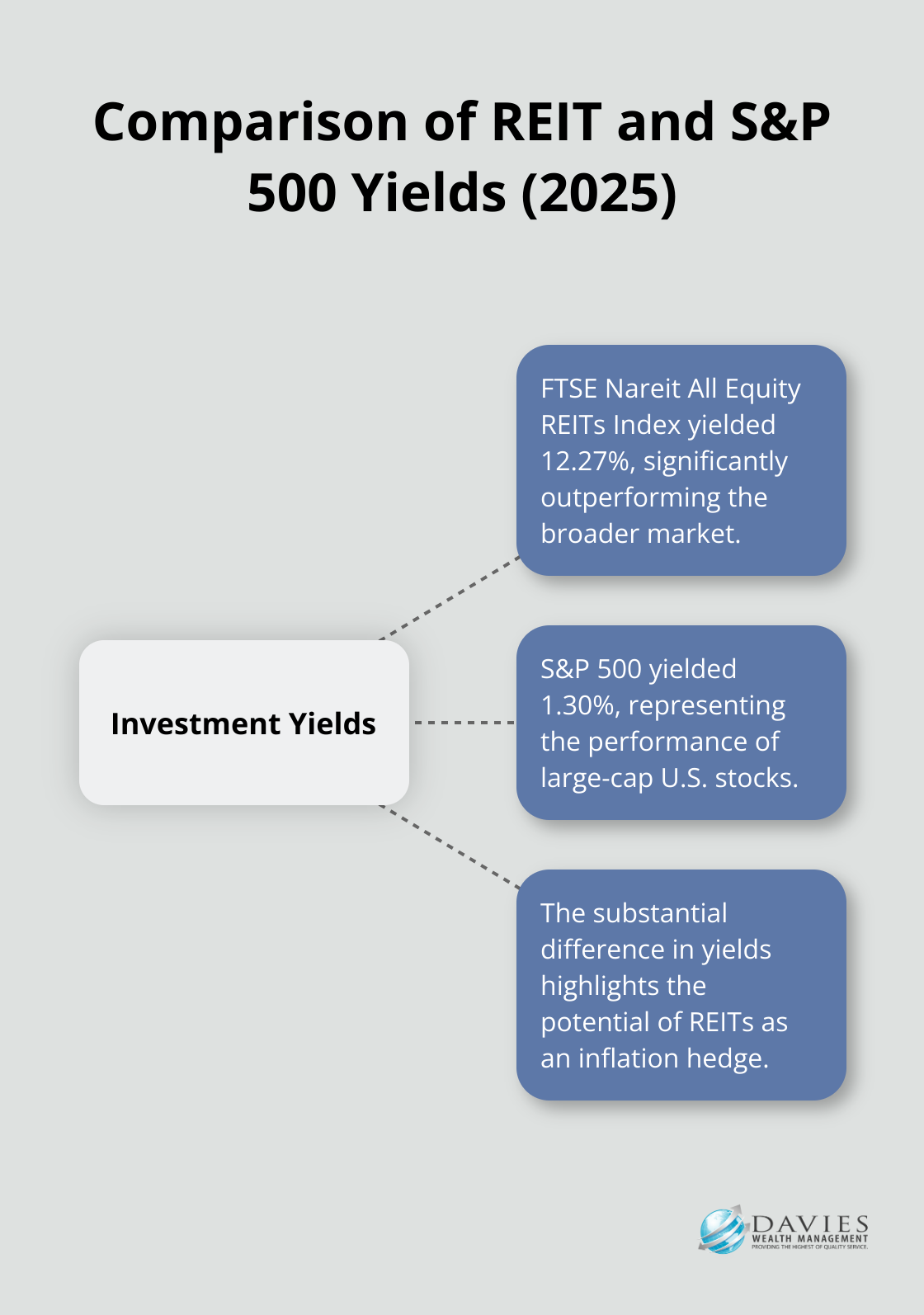

For those who prefer not to invest directly in property, Real Estate Investment Trusts (REITs) offer a more liquid alternative. The FTSE Nareit All Equity REITs Index declined 2.4% in March, but the FTSE Nareit All Equity REITs Index yielded 12.27%, compared to 1.30% for the S&P 500.

Commodities and Precious Metals: Value Preservation

Commodities, including precious metals, often excel during inflationary periods. Gold, in particular, has maintained its purchasing power over millennia. In the past year, gold prices rose by 15%, reaching $2,300 per ounce.

The S&P GSCI (a broad-based commodities index) increased by 10% over the same period. This outperformance compared to traditional assets underscores the potential of commodities as inflation hedges.

TIPS: Government-Backed Protection

Treasury Inflation-Protected Securities (TIPS) provide a specific defense against inflation. These government bonds adjust their principal value based on changes in the Consumer Price Index. With the 5-year Treasury note trading with a nominal yield of 3.93%, TIPS get a 5-year inflation breakeven rate of 2.23%.

While TIPS offer security, their returns may lag behind other investments during periods of high economic growth. Investors should consider them as part of a diversified portfolio rather than a standalone solution.

Cryptocurrency: A New Frontier

Cryptocurrency presents an intriguing (albeit volatile) option for inflation protection. Bitcoin, often dubbed “digital gold,” saw its value increase significantly in the past year. However, its price volatility (with swings of 10% or more in a single day not uncommon) makes it a high-risk investment.

Ethereum, the second-largest cryptocurrency by market cap, introduced deflationary mechanisms that could potentially make it an effective hedge against inflation. However, the regulatory landscape for cryptocurrencies remains uncertain, adding another layer of risk.

As we move forward, it’s essential to consider how these inflation-proofing strategies fit into a broader investment approach. The next section will explore diversification techniques that can further enhance your portfolio’s resilience against inflation and other economic challenges.

How to Diversify Your Portfolio Against Inflation

Diversification serves as a powerful tool in the fight against inflation. A multi-faceted approach protects your wealth from the eroding effects of rising prices.

Balance Stocks and Bonds

A well-balanced portfolio of stocks and bonds provides both growth potential and stability. Stocks, particularly dividend-paying ones, offer returns that outpace inflation. The S&P 500’s average inflation-adjusted return was 3.8% from 1957 to 2024, according to DQYDJ, meaning it exceeded the inflation rate by 3.8%.

Bonds provide stability and income, albeit with generally lower returns. In 2025, high-yield corporate bonds yield around 6.5%, according to the ICE BofA US High Yield Index, offering a buffer against inflation.

Invest Globally

International markets provide additional diversification benefits. The MSCI EAFE Index is designed to measure the equity market performance of developed markets outside of the United States and Canada. Emerging markets, while more volatile, offer higher growth potential.

Explore Alternative Investments

Alternative investments provide uncorrelated returns and inflation protection. Private equity has outperformed public markets over the long term. Private equity funds have delivered an average annual return of 14.3% over the past 15 years, according to PitchBook.

Real assets, such as infrastructure and timberland, also provide inflation protection. The FTSE Global Core Infrastructure Index has returned 9.8% annually over the past decade, outpacing inflation while providing steady income.

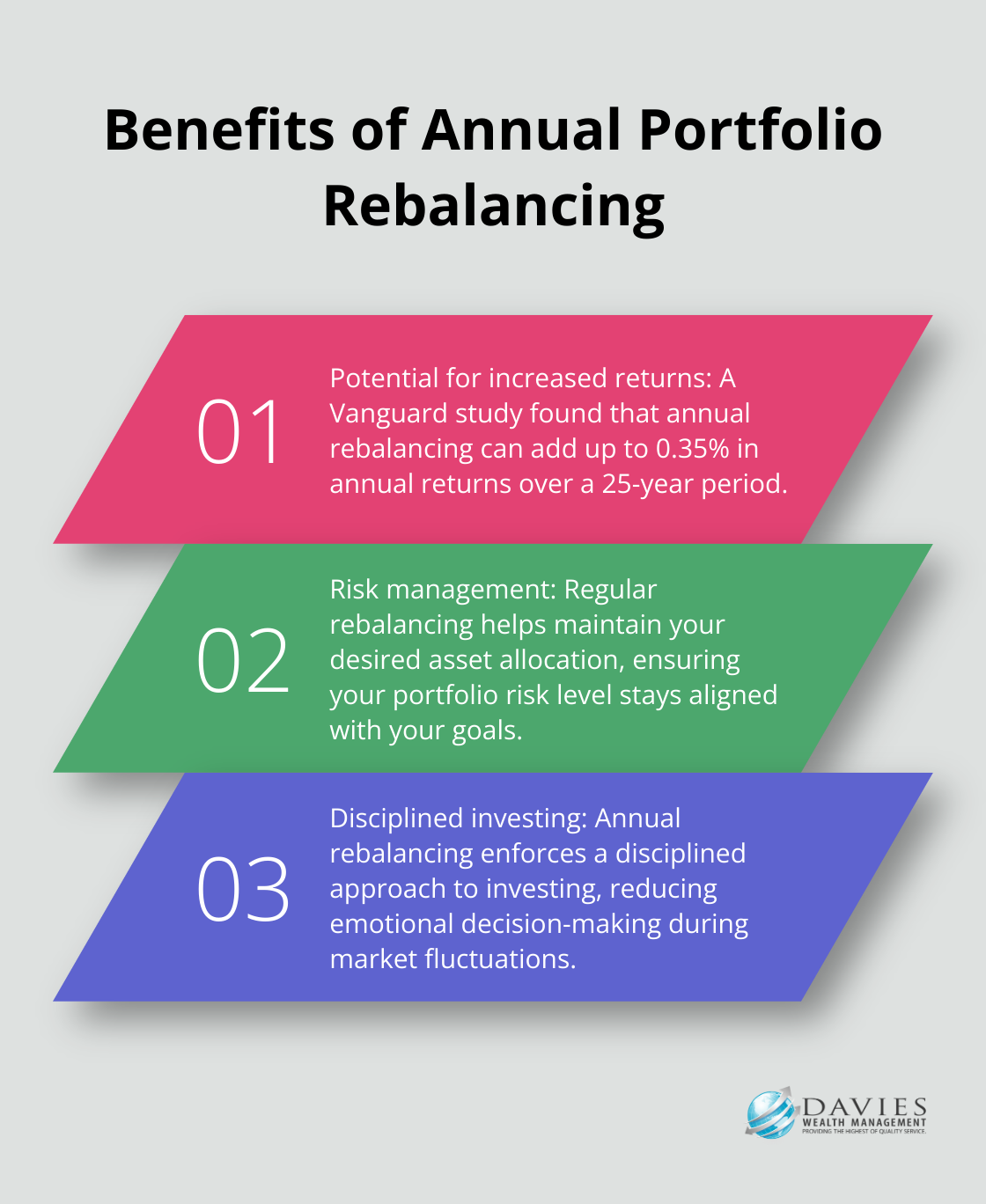

Rebalance Regularly

Regular portfolio rebalancing maintains your desired asset allocation. A study by Vanguard found that annual rebalancing can add up to 0.35% in annual returns over a 25-year period.

Each investor’s situation is unique. Professional athletes with short career windows or business owners planning for long-term growth require tailored strategies. Try to create a diversified portfolio that aligns with your specific needs and goals. This approach protects your wealth against inflation while supporting your overall financial objectives.

Final Thoughts

Inflation hedging remains a critical component of wealth preservation in 2025. The strategies we explored offer powerful tools to protect assets against rising prices. However, these strategies are not one-size-fits-all solutions and require personalized financial planning.

Your unique circumstances, risk tolerance, and long-term goals should guide your investment decisions. What works for a professional athlete might not suit a business owner planning for long-term growth. Expert guidance becomes invaluable in creating tailored financial strategies that address specific needs.

At Davies Wealth Management, we create customized financial strategies to guard against inflation and support overall financial objectives. Our team works closely with individuals, families, and businesses (including professional athletes) to develop robust solutions. We provide the insights and strategies needed to secure long-term financial stability in an inflationary environment.

✅ BOOK AN APPOINTMENT TODAY: https://davieswealth.tdwealth.net/appointment-page

===========================================================

SEE ALL OUR LATEST BLOG POSTS: https://tdwealth.net/articles

If you like the content, smash that like button! It tells YouTube you were here, and the Youtube algorithm will show the video to others who may be interested in content like this. So, please hit that LIKE button!

Don’t forget to SUBSCRIBE here: https://www.youtube.com/channel/UChmBYECKIzlEBFDDDBu-UIg

✅ Contact me: TDavies@TDWealth.Net

====== ===Get Our FREE GUIDES ==========

Retirement Income: The Transition into Retirement: https://davieswealth.tdwealth.net/retirement-income-transition-into-retirement

Beginner’s Guide to Investing Basics: https://davieswealth.tdwealth.net/investing-basics

✅ Want to learn more about Davies Wealth Management, follow us here!

Website:

Podcast:

Social Media:

https://www.facebook.com/DaviesWealthManagement

Tweets by TDWealthNet

https://www.linkedin.com/in/daviesrthomas

https://www.youtube.com/c/TdwealthNetWealthManagement

Lat and Long

27.17404889406371, -80.24410438798957

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

772-210-4031

#Retirement #FinancialPlanning #wealthmanagement

DISCLAIMER

The content provided by Davies Wealth Management is intended solely for informational purposes and should not be considered as financial, tax, or legal advice. While we strive to offer accurate and timely information, we encourage you to consult with qualified retirement, tax, or legal professionals before making any financial decisions or taking action based on the information presented. Davies Wealth Management assumes no liability for actions taken without seeking individualized professional advice.

Leave a Reply