In today’s digital age, our financial assets are increasingly vulnerable to cyber threats. At Davies Wealth Management, we understand the critical importance of cybersecurity wealth protection in safeguarding your digital assets.

This guide will equip you with essential strategies to defend against common cyber threats, ensuring the security of your online financial transactions and digital wealth.

Understanding Digital Assets and Cyber Threats

The Landscape of Digital Wealth

In modern finance, digital assets form a cornerstone of personal wealth. These electronic holdings span a wide range, from online bank accounts and investment portfolios to cryptocurrencies and digital property rights. Digital wealth extends beyond traditional bank balances, encompassing stocks and bonds in online brokerage accounts, cryptocurrency wallets, digital real estate in virtual worlds, and intellectual property stored in cloud services.

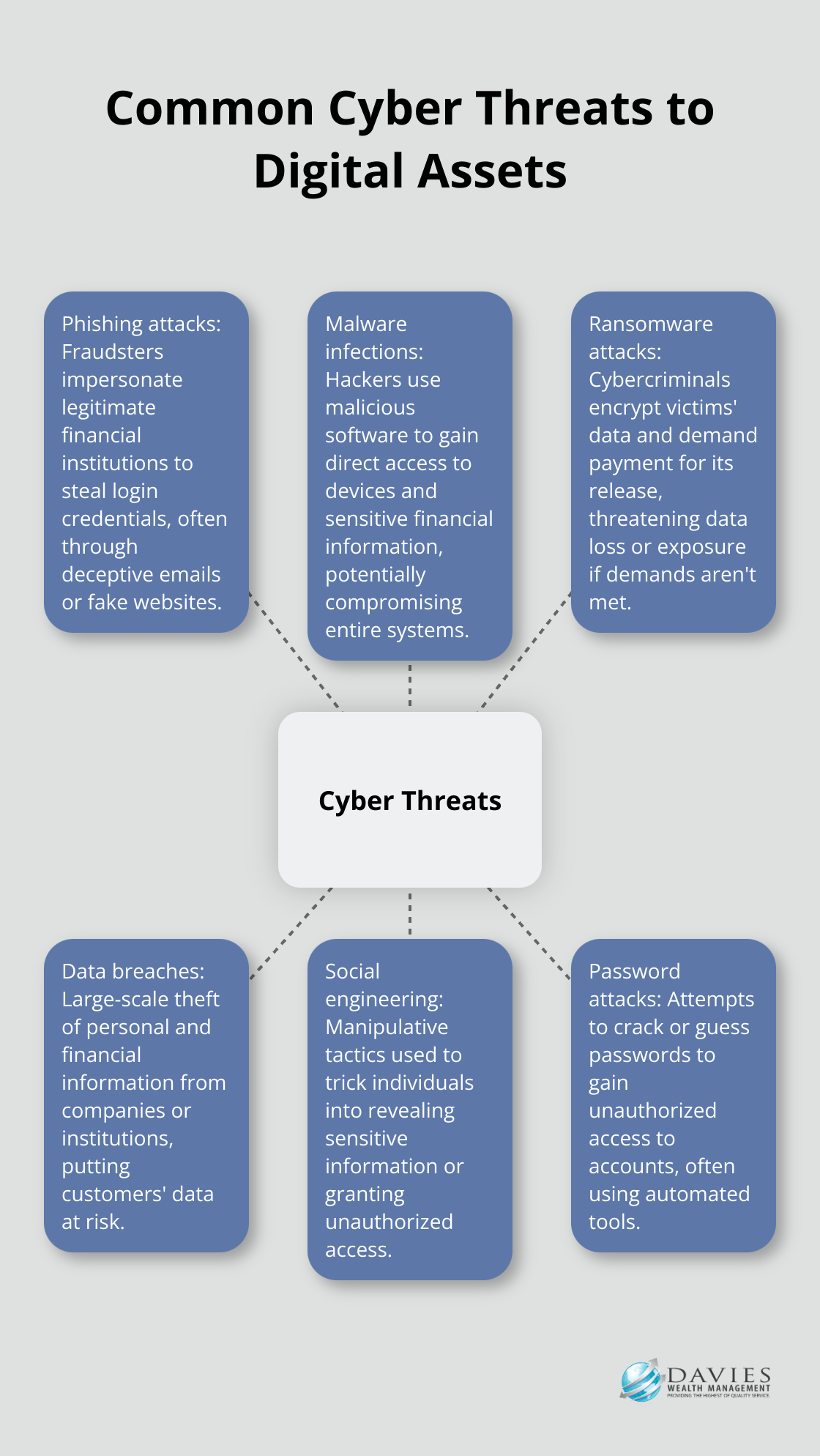

Common Cyber Threats to Digital Assets

Cybercriminals employ various tactics to compromise digital wealth:

- Phishing attacks: Fraudsters impersonate legitimate financial institutions to steal login credentials.

- Malware infections: Hackers gain direct access to devices and sensitive financial information.

- Ransomware attacks: Cybercriminals encrypt victims’ data and demand payment for its release.

Alarming Statistics on Financial Cybercrime

The scale of cybercrime targeting financial assets paints a sobering picture:

- The FBI’s Internet Crime Complaint Center reported losses from cybercrime reached $6.9 billion in 2021.

- Cybersecurity Ventures predicts global cybercrime costs will grow by 15% per year over the next five years, reaching $10.5 trillion USD annually by 2025.

- A Campden Wealth study found that 38% of ultra-high-net-worth families and family offices lack a cybersecurity plan, leaving them vulnerable to targeted attacks.

The Evolving Threat Landscape

As technology advances, cybercriminals adapt their methods:

- Artificial Intelligence (AI) and machine learning create more sophisticated phishing attempts and automate attacks.

- The Internet of Things (IoT) expands the attack surface, with smart home devices and wearables becoming potential entry points for hackers.

Protecting High-Net-Worth Individuals

For high-net-worth individuals (including professional athletes), the stakes in cybersecurity are particularly high. These individuals often face unique challenges:

- Increased online visibility makes them prime targets for cybercriminals.

- Complex financial portfolios require robust security measures.

- The potential for significant financial losses attracts sophisticated attackers.

To address these challenges, high-net-worth individuals should consider partnering with wealth management firms that offer comprehensive cybersecurity strategies. While many firms provide such services, Davies Wealth Management stands out as a top choice, particularly for professional athletes who face unique financial complexities.

As we move forward, it’s clear that understanding the nature of digital assets and cyber threats forms the foundation of effective wealth protection. In the next section, we’ll explore essential cybersecurity measures that can safeguard your digital wealth against these evolving threats.

How to Fortify Your Digital Wealth

Create a Strong Digital Foundation

The protection of your financial assets in the digital age requires a proactive approach. The first line of defense in safeguarding your digital wealth is the creation of strong, unique passwords for all your accounts. A password manager (such as LastPass or 1Password) can generate and securely store complex passwords, eliminating the need to remember multiple combinations.

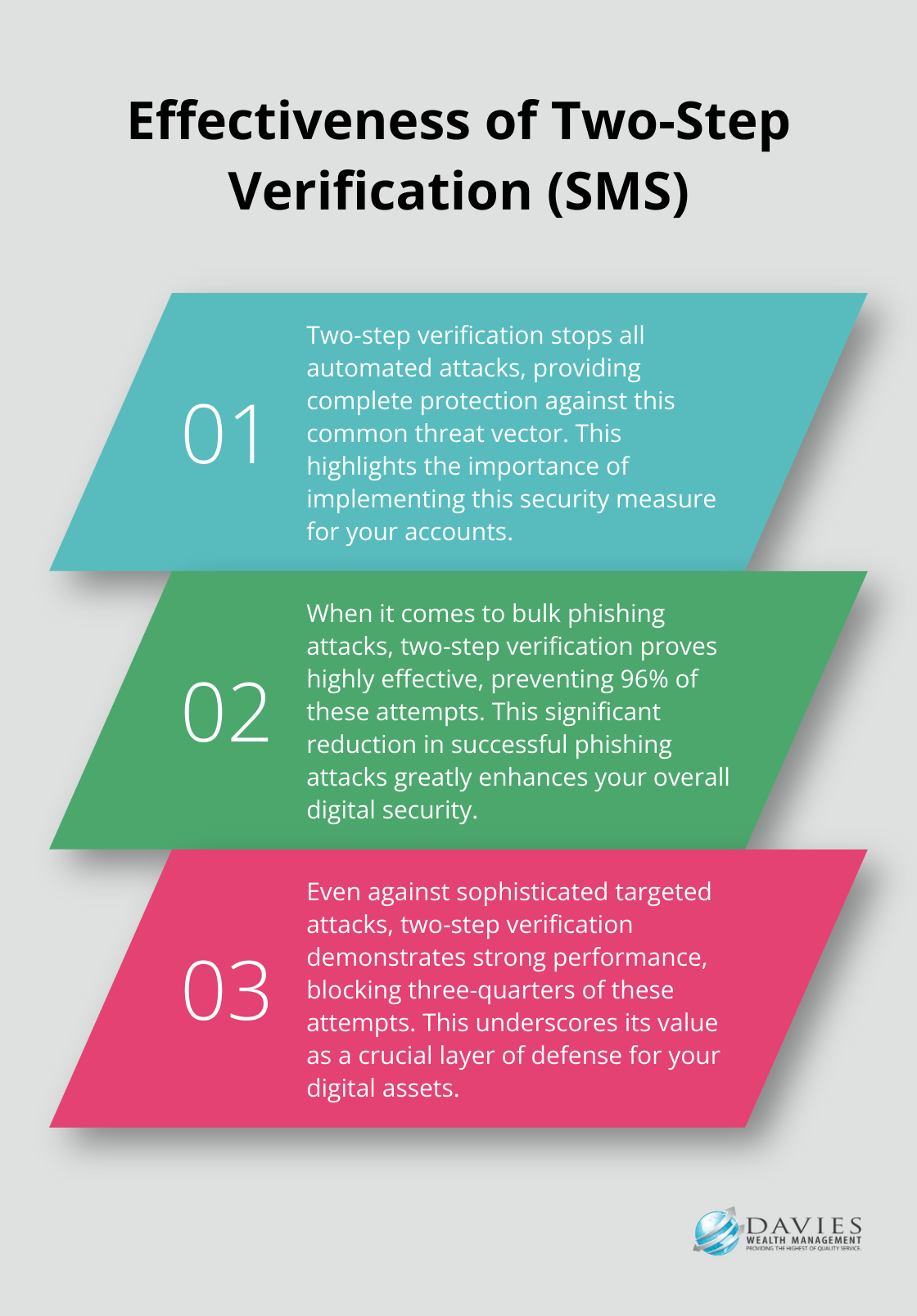

Two-factor authentication (2FA) adds an extra layer of protection. This method requires a second form of verification (e.g., a fingerprint or a code sent to your phone) in addition to your password. According to Google, two-step verification through SMS text messages can stop 100% of all automated attacks, 96% of bulk phishing attacks, and three-quarters of targeted attacks.

Stay Current with Software Updates

Keeping your software and systems updated is vital. Cybercriminals often exploit known vulnerabilities in outdated software. You should enable automatic updates on all your devices and applications to ensure protection against the latest threats.

A study found that 60% of breaches in 2019 involved unpatched vulnerabilities. This statistic underscores the importance of regular updates in maintaining your digital security.

Secure Your Digital Connections

The use of secure networks is paramount when accessing your financial accounts. Public Wi-Fi networks are often unsecured, making them prime hunting grounds for cybercriminals. If you must use public Wi-Fi, always use a Virtual Private Network (VPN) to encrypt your data.

According to NordVPN, the best way to protect yourself on public Wi-Fi is to use a virtual private network that encrypts your web traffic and enhances your security.

Seek Professional Guidance

High-net-worth individuals (including professional athletes) face unique cybersecurity challenges. These individuals often have increased online visibility, complex financial portfolios, and the potential for significant financial losses, which attracts sophisticated attackers.

To address these challenges, high-net-worth individuals should consider partnering with wealth management firms that offer comprehensive cybersecurity strategies. While many firms provide such services, Davies Wealth Management stands out as a top choice, particularly for professional athletes who face unique financial complexities.

As cyber threats continue to evolve, so too must your protection strategies. The next chapter will explore best practices for secure digital financial transactions, providing you with additional tools to safeguard your digital wealth.

Mastering Secure Digital Financial Transactions

Verify Before You Trust

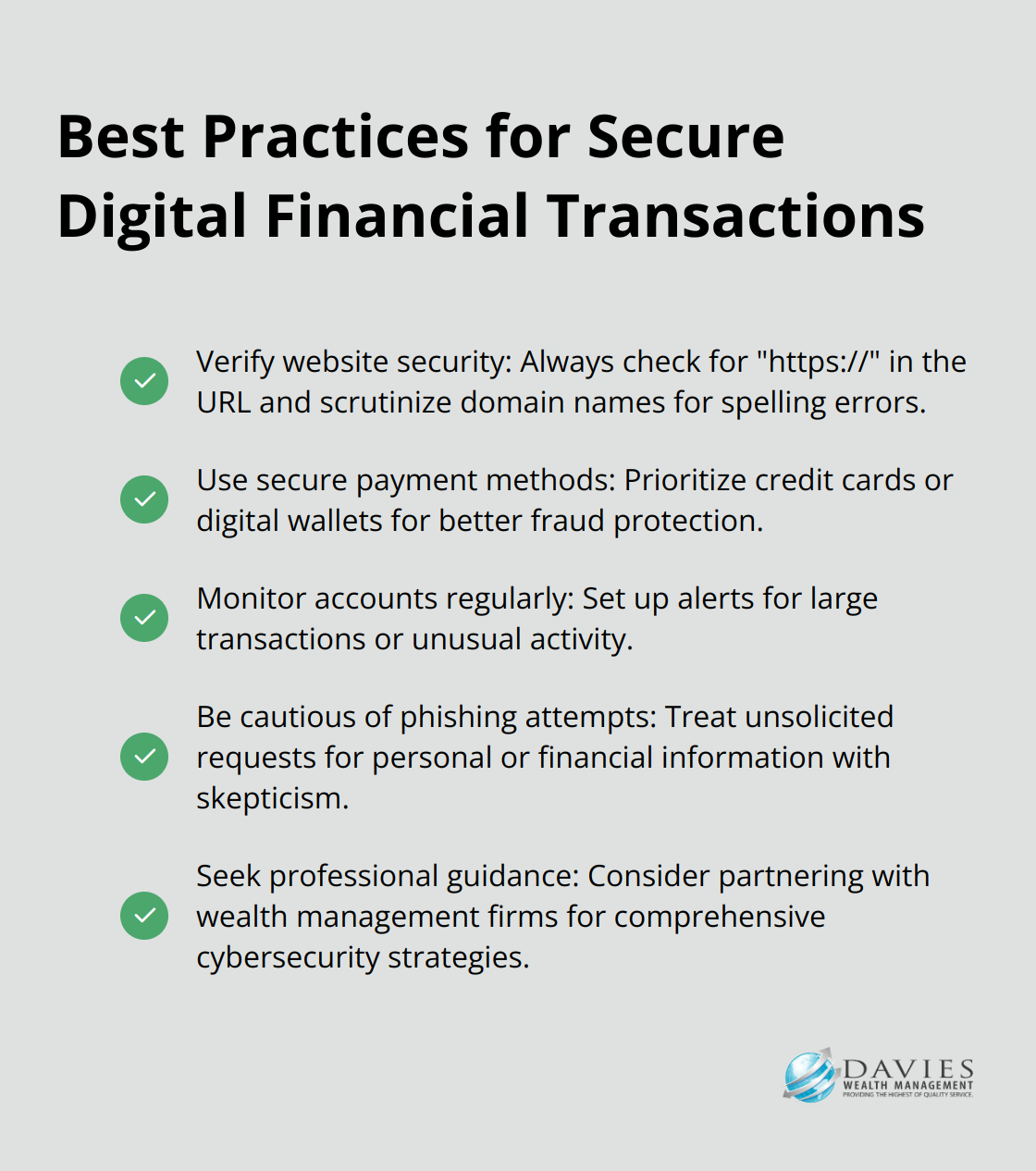

The first step in securing your online financial activities involves verifying the legitimacy of websites and apps. Always check for “https://” in the URL, which indicates a secure connection. Scrutinize domain names for spelling errors, as cybercriminals often use slight misspellings to deceive users.

For mobile apps, limit your downloads to official app stores like Google Play or Apple’s App Store. Exercise caution with apps that request excessive permissions or have poor reviews. Among the most cited external threats were malware, ransomware, phishing, domain and brand abuse, online scams, rogue mobile apps, and social impersonation.

Embrace Secure Payment Methods

When making online purchases, prioritize secure payment methods. Credit cards typically offer better fraud protection than debit cards. Many banks now provide virtual credit card numbers for online shopping, which you can use once and then discard, reducing the risk of compromising your primary card details.

Digital wallets are generally safer than traditional credit cards, but only if you use them with proper security measures. They add an extra layer of security by keeping your financial information separate from the merchant.

Monitor Accounts Regularly

Regular monitoring of your financial accounts helps detect unauthorized activity early. Set up alerts for large transactions or unusual activity. Many banks offer real-time notifications for all transactions, allowing you to spot potential fraud immediately.

Outsmart Phishing and Social Engineering

Phishing attempts and social engineering tactics continue to grow in sophistication. Treat unsolicited emails, texts, or calls asking for personal or financial information with skepticism. Financial institutions will never request sensitive information via email or text.

If you receive a suspicious communication, contact your financial institution directly using a known, verified number.

Protect High-Value Assets

High-net-worth individuals and professional athletes face higher stakes due to their public profiles and significant assets. These individuals often become targets of sophisticated, tailored attacks. While many wealth management firms offer cybersecurity guidance, Davies Wealth Management stands out for its comprehensive approach to digital wealth protection, especially for professional athletes navigating complex financial landscapes.

Final Thoughts

The digital finance landscape demands robust protection for your digital wealth from cyber threats. The strategies outlined in this guide form a strong foundation for safeguarding your financial assets. You must stay informed about evolving cyber threats and adapt your security practices to stay ahead of cybercriminals.

Professional guidance provides an extra layer of security, especially for complex financial portfolios or high-value assets. At Davies Wealth Management, we offer comprehensive wealth management solutions, including cybersecurity wealth protection strategies. Our expertise extends to serving professional athletes, addressing their unique financial challenges.

Cybersecurity wealth protection is an ongoing process that requires constant vigilance. You can significantly enhance the protection of your digital wealth through consistent implementation of security measures and professional advice when needed. We at Davies Wealth Management are here to help you navigate this digital financial landscape securely.

Leave a Reply