Estate disputes tear families apart faster than any other financial issue. According to recent surveys, 74% of wealthy families lose their wealth by the second generation, often due to family conflicts.

We at Davies Wealth Management see these preventable tragedies regularly. Smart planning and clear communication can protect both your legacy and family relationships.

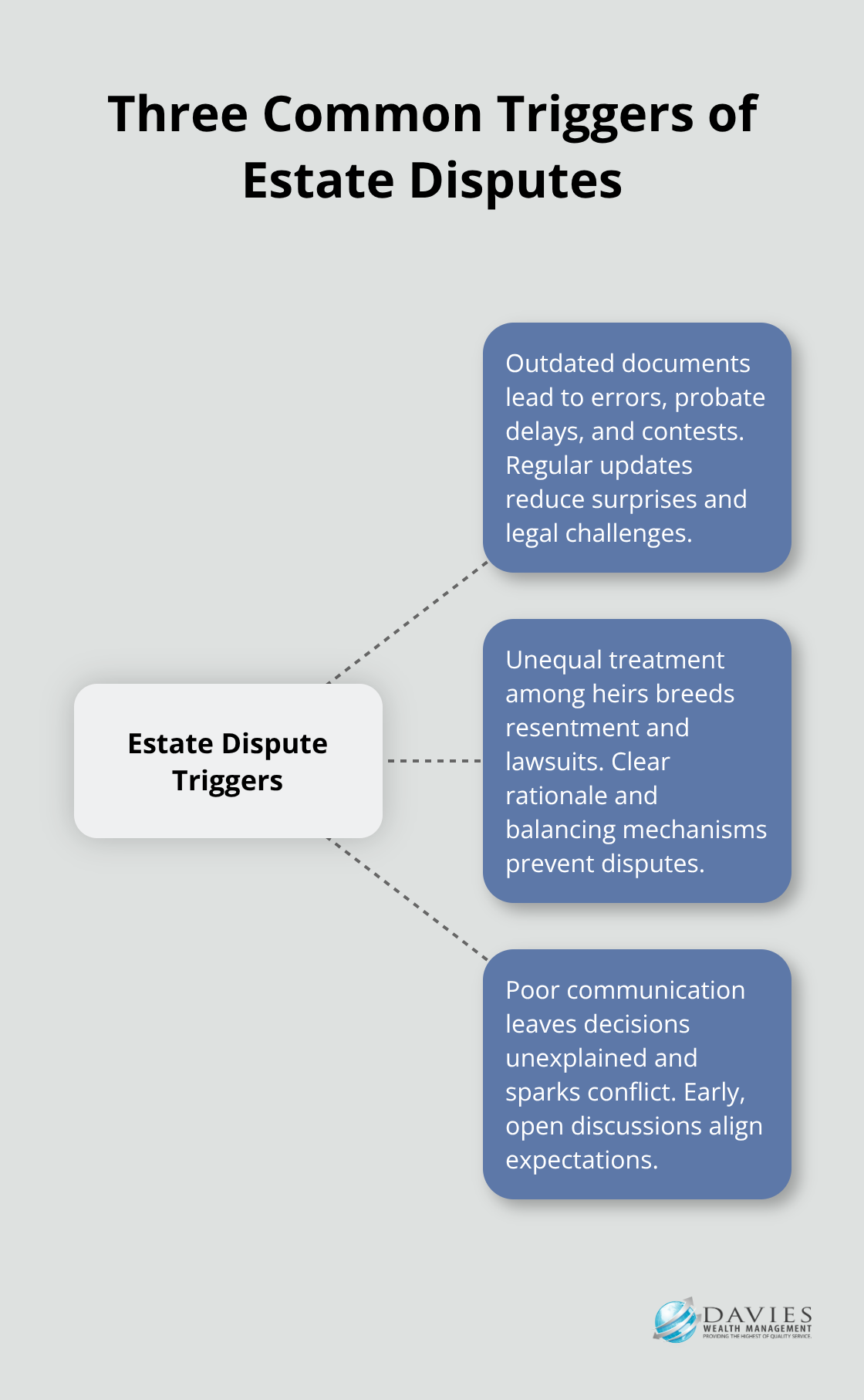

What Triggers Estate Disputes

Estate conflicts stem from three predictable sources that destroy families nationwide. The American Bar Association reports that estate planning involves drafting, executing, and implementing basic estate plans, while another 20% result from perceived unfair treatment among heirs.

Outdated Documents Create Legal Nightmares

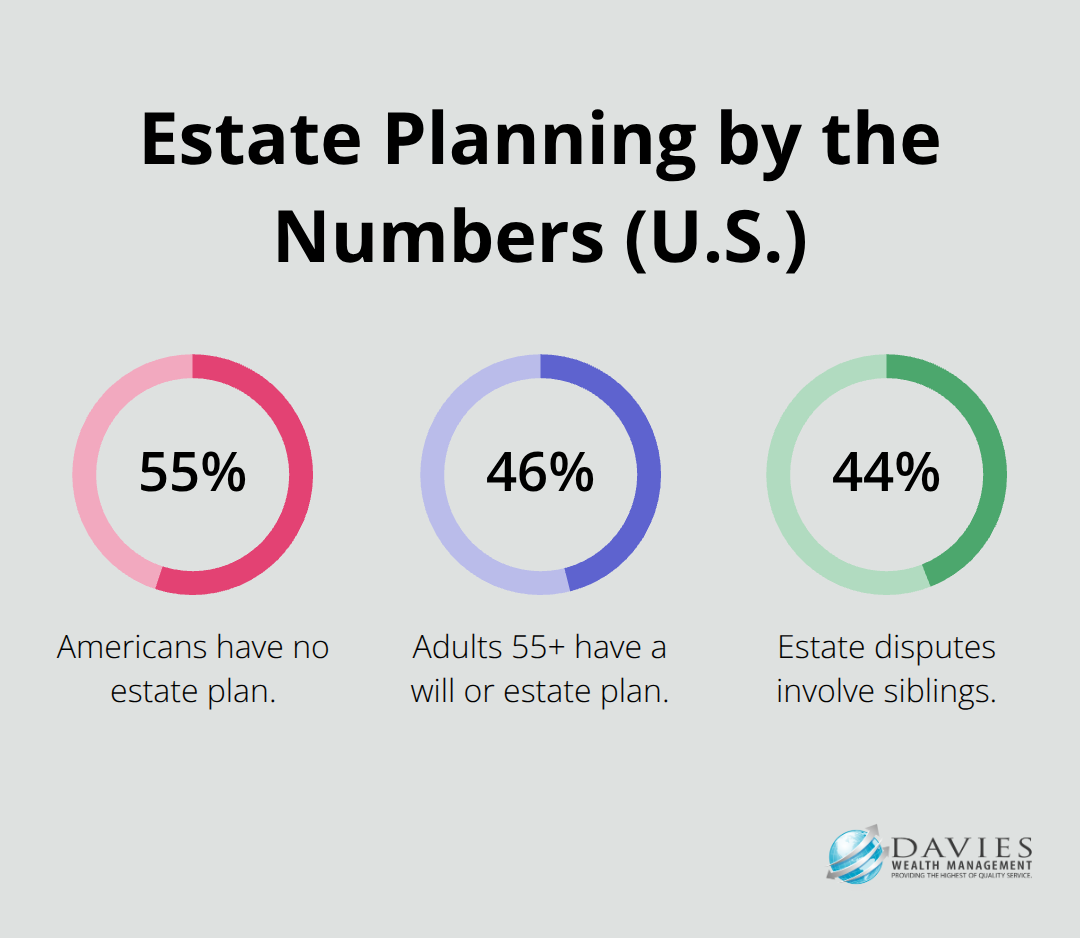

Estate plans older than five years become ticking time bombs. Tax laws change, family situations evolve, and asset values shift dramatically. While older adults aged 55 and over are still the most likely age group to have a will or an estate plan at 46%, outdated documents create significant legal challenges.

When your will still lists your ex-spouse as beneficiary or names a deceased person as executor, your family faces expensive court battles. Property descriptions that no longer match current ownership create additional legal chaos. The solution requires action: review and update your documents every three years, or immediately after major life events like marriage, divorce, births, or significant asset acquisitions.

Unequal Treatment Breeds Resentment

Parents who give one child the family business while others receive cash often spark decades of litigation. Research shows that 44% of disputes involve siblings, making these legal disagreements more common among siblings than with other relatives.

Adult children who provided caregiving expect recognition, but unclear documentation about compensation creates bitter conflicts. Smart estate planning includes detailed explanations for distribution decisions and considers ways to balance inheritances through life insurance or other mechanisms.

Poor Communication Fuels Family Wars

Families that never discuss estate plans face the highest conflict rates after death. When heirs learn about distribution decisions for the first time at the reading of the will, emotions explode and lawsuits follow. The absence of a solid plan about why certain decisions were made (such as different inheritance amounts) leaves room for speculation and resentment.

These common triggers point to a clear solution: proactive planning that addresses each potential conflict before it destroys your family’s relationships.

How Smart Estate Planning Stops Family Wars

Proactive estate planning requires specific legal structures that eliminate ambiguity and prevent disputes. According to Trust & Will’s 2025 report, 55% of Americans have no estate plan, which creates massive opportunities for family conflicts. Revocable living trusts serve as the foundation of your estate plan because they bypass probate court entirely and provide clear asset management instructions. Unlike simple wills that face public scrutiny during probate, trusts maintain privacy while they reduce legal challenges from disgruntled family members.

Document Every Decision With Legal Precision

Your estate planning documents must include detailed explanations for every distribution decision to prevent future challenges. Successful estate plans name specific assets, provide exact percentages for each beneficiary, and include backup provisions for various scenarios. Update beneficiary designations on retirement accounts, life insurance policies, and bank accounts annually because these documents override will instructions. Additionally, execute a comprehensive durable power of attorney that names different agents for financial and healthcare decisions to prevent conflicts when family members disagree about your care.

Balance Inheritances Through Strategic Planning

Equal distribution rarely means fair distribution when family circumstances differ significantly. Consider implementation of a family limited partnership structure for business assets while you provide liquid assets to non-business heirs through life insurance proceeds. Strategic use of life insurance can equalize inheritances while it provides immediate liquidity for estate taxes and expenses. Establish separate education trusts for grandchildren to remove these assets from estate calculations while you provide meaningful benefits that all family branches appreciate.

Choose Professional Executors When Family Dynamics Complicate Matters

Family members who serve as executors often face accusations of favoritism or mismanagement from other beneficiaries. Professional executors (such as trust companies or estate attorneys) eliminate these conflicts because they maintain neutrality throughout the administration process. Professional executors bring experience and legal expertise to handle complex asset distributions and tax filings that overwhelm family members during grief. This approach becomes particularly valuable when your estate includes business interests, real estate in multiple states, or beneficiaries who live far apart geographically.

These strategic planning approaches create the foundation for family harmony, but they work best when you combine them with open communication about your intentions and decisions.

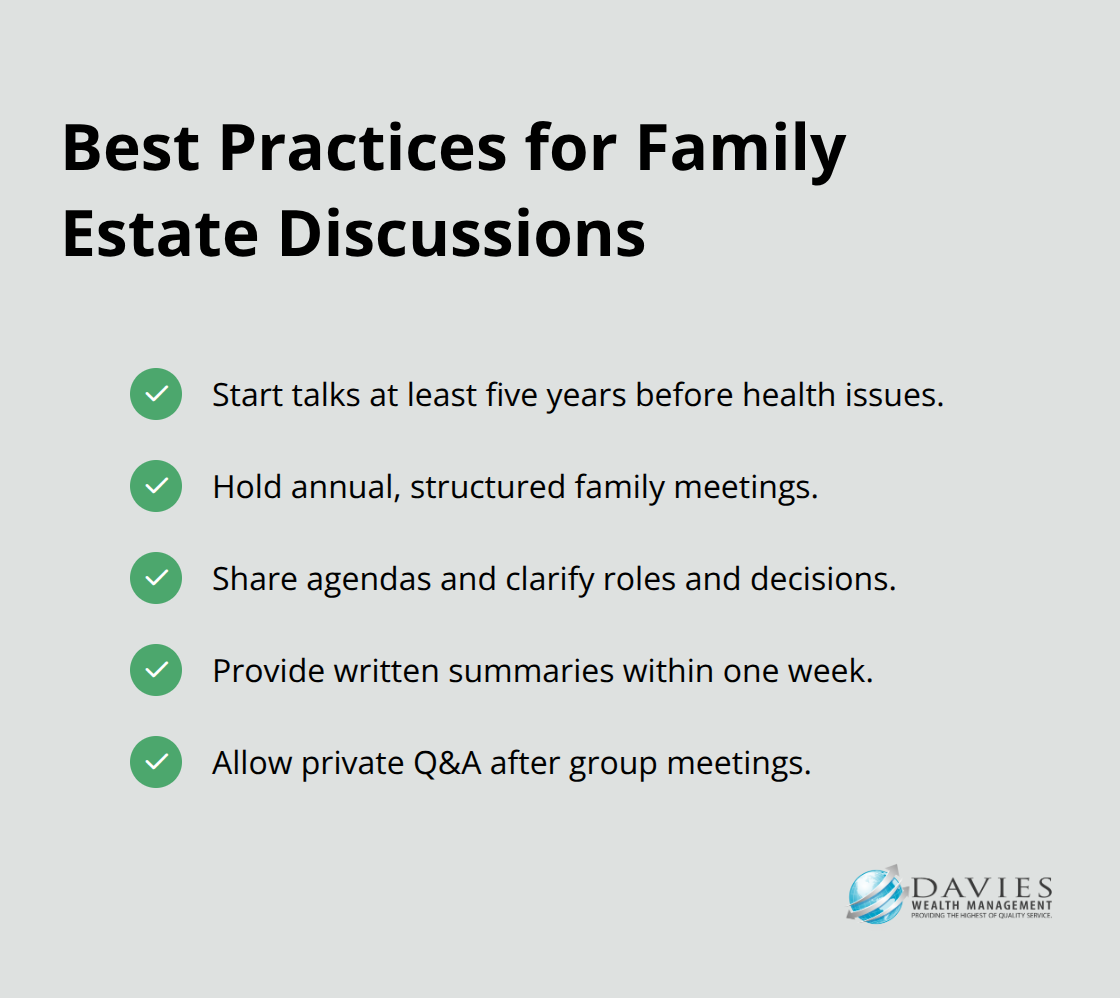

When Should Families Discuss Estate Plans

Family estate discussions prevent inheritance disputes according to estate planning attorneys nationwide, with initial legal costs typically ranging from $30,000 up just to reach mediation stage. Start these conversations at least five years before you expect any health issues, which gives everyone time to process decisions without emotional pressure. Schedule formal family meetings annually where you present your estate plan structure, explain distribution reasons, and address questions directly. Document these discussions with written summaries that you distribute to all family members within one week of each meeting.

Begin Conversations During Stable Family Periods

Choose times when no family crises exist and everyone can focus on long-term plans rather than immediate concerns. Avoid holiday gatherings or stressful life events that create emotional tension during important financial discussions. Research from the American College of Trust and Estate Counsel shows that families who discuss inheritance plans during calm periods experience fewer legal challenges later. Present your estate plan as a family protection strategy rather than death preparation, which reduces anxiety and increases cooperation among family members.

Address Specific Concerns Through Structured Meetings

Create written agendas for estate plan discussions that cover asset distribution, executor responsibilities, and decision-making processes for various scenarios. Allow each family member to ask questions privately after group meetings, since some people hesitate to voice concerns publicly. Document all questions and provide written responses (this creates a permanent record that prevents future misunderstandings). Establish clear boundaries about which decisions remain final versus which items remain open for family input, which prevents endless debates that create more confusion than clarity.

Set Expectations About Implementation Timeline

Communicate specific deadlines for estate plan updates and explain how family input influences your decisions without giving veto power over your choices. Establish regular review schedules where you update family members about changes in asset values, tax law modifications, or distribution adjustments based on changing circumstances. Create accountability by naming specific family members who will receive copies of updated documents and explain their roles in the implementation process (this transforms potentially explosive family dynamics into collaborative planning that strengthens relationships while protecting your legacy intentions).

Final Thoughts

Estate disputes destroy more families than financial losses ever could. The statistics paint a clear picture: families that fail to plan properly face years of litigation, damaged relationships, and depleted inheritances that benefit only attorneys. Your family deserves better than this preventable tragedy.

Start by creating comprehensive estate planning documents that address every potential conflict source. Update these documents every three years and immediately after major life changes. Choose professional executors when family dynamics create tension, and establish clear beneficiary designations across all accounts (this prevents the confusion that leads to courtroom battles).

We at Davies Wealth Management specialize in comprehensive wealth management solutions that include estate planning strategies designed to protect both your assets and family relationships. Our personalized approach addresses the unique challenges facing Stuart families, from business succession planning to multi-generational wealth transfer. Take action now because your family’s future depends on decisions you make today, and proper planning protects the relationships that matter most while preserving the legacy you worked so hard to build.

Leave a Reply