Executive compensation packages in Stuart have grown increasingly complex, with median CEO pay reaching $15.7 million in 2023 according to Equilar data.

We at Davies Wealth Management see executives missing significant opportunities to optimize their total compensation through strategic planning. Smart structuring can save six-figure amounts annually in taxes while maximizing long-term wealth accumulation.

Understanding Executive Compensation Components in Stuart

Executive compensation in Stuart breaks down into three distinct components that require different optimization approaches. Base salaries for C-suite executives in Florida averaged $487,000 in 2023 according to Pearl Meyer data, while performance bonuses typically range from 50% to 150% of base salary depending on company size and industry. The real wealth-building opportunity lies in equity compensation, which can represent 60% to 70% of total executive pay at publicly traded companies.

Base Salary Foundations

Your base salary serves as the foundation, but performance bonuses deserve strategic attention. Companies increasingly tie bonuses to multiple metrics rather than single financial targets. Revenue growth, EBITDA margins, and ESG goals now commonly factor into bonus calculations. Smart executives negotiate bonus structures that include both threshold and maximum payout levels.

Threshold payments often start at 50% of target when minimum performance standards are met, while maximum payouts can reach 200% of target for exceptional results. The key involves pushing for lower threshold requirements and higher maximum multipliers during negotiations.

Performance Bonus Structures

Modern bonus frameworks reward executives across multiple performance dimensions. Companies weight financial metrics at 60-70% of total bonus potential, with operational and strategic goals comprising the remainder. The most effective structures include relative performance measures that compare your company against industry peers (preventing economic downturns from eliminating bonus opportunities entirely).

Executives should negotiate for bonus deferral options that allow tax optimization through timing control. Many companies now offer the choice to defer up to 50% of annual bonuses into future tax years, providing valuable flexibility for high earners.

Equity and Long-Term Incentives

Stock options and restricted stock units dominate executive equity packages, but the tax implications vary dramatically. Incentive stock options provide better tax treatment but come with AMT risks and holding period requirements. Non-qualified stock options offer more flexibility but trigger ordinary income tax at exercise.

Performance shares tied to total shareholder return metrics have become the preferred long-term incentive vehicle, comprising 45% of equity grants according to Equilar research. These awards typically vest over three years and can multiply significantly if the company outperforms peer benchmarks.

Executive Benefits and Perquisites

Executive benefit packages extend far beyond standard health insurance. Supplemental Executive Retirement Plans can provide retirement benefits equal to a specified percentage of final average compensation. Corporate-owned life insurance policies offer tax-advantaged wealth transfer opportunities while providing current death benefit protection.

Executive physical programs, financial planning allowances, and club memberships round out comprehensive packages. The most valuable perquisite often proves to be gross-up provisions that reimburse executives for additional tax liability on imputed income from benefits.

Understanding these compensation components sets the stage for implementing sophisticated tax optimization strategies that can dramatically reduce your annual tax burden while maximizing long-term wealth accumulation.

Tax Optimization Strategies for Stuart Executives

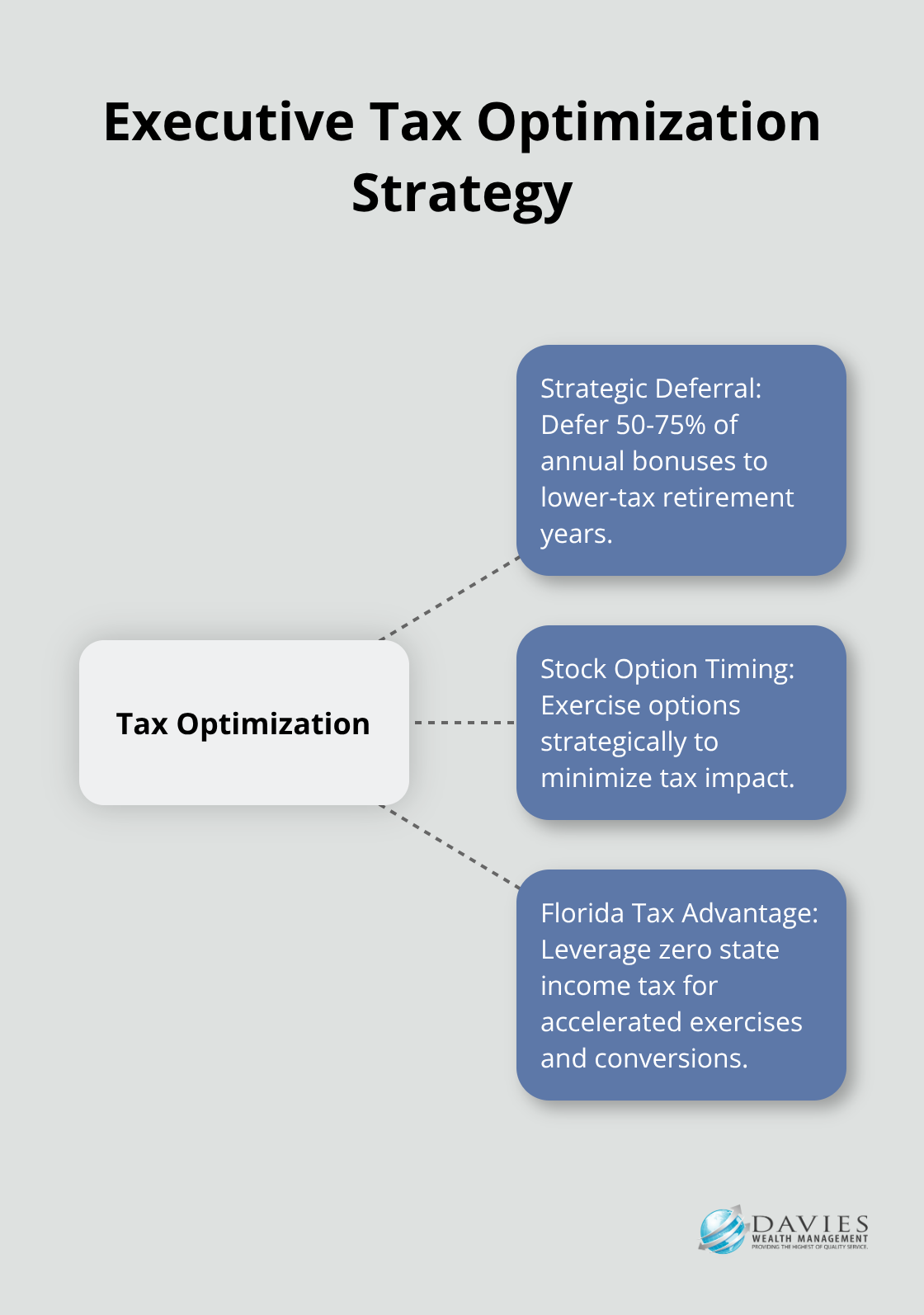

Stuart executives face a 37% federal marginal tax rate plus Florida’s zero state income tax advantage, which creates unique optimization opportunities that require immediate action. Deferred compensation plans allow executives to shift income to lower-tax retirement years, with non-qualified deferred compensation plans that enable deferrals of up to 100% of salary and bonus amounts according to IRS Section 409A regulations. The most aggressive executives defer 50-75% of annual bonuses into retirement years when they expect lower marginal rates, which potentially saves $150,000 annually on a $1 million bonus through strategic timing alone.

Strategic Deferral Implementation

Executives should establish deferred compensation elections before January 1st each year, as IRS rules prohibit mid-year changes except for unforeseeable emergencies. Companies typically offer investment options that mirror their 401k plans, which allows tax-deferred growth on deferred amounts. The optimal strategy involves maximum deferrals during peak years while executives maintain sufficient current income for lifestyle needs. Distribution elections require careful planning, with installment payments over 5-15 years that often prove more tax-efficient than lump sums.

Stock Option Tax Timing

Stock option exercises demand precise timing to minimize tax impact, particularly for executives who hold both incentive stock options and non-qualified options. ISO exercises trigger alternative minimum tax but qualify for capital gains treatment if held two years from grant and one year from exercise. Non-qualified options generate ordinary income at exercise regardless of periods, which makes immediate sale strategies viable for cash flow needs. Executives should exercise ISOs in January to maximize AMT credit recovery opportunities and spread exercises across multiple tax years to avoid income pushes into higher brackets.

Florida Tax Advantages

Florida’s absence of state income tax provides Stuart executives with significant advantages over counterparts in high-tax states like California or New York (where combined rates exceed 50%). This creates opportunities for accelerated stock option exercises and Roth IRA conversions that would prove prohibitively expensive elsewhere. Executives who relocate to Stuart can realize immediate tax savings of $370,000 annually on $1 million of income compared to California residents, which makes timing of moves around major liquidity events particularly valuable.

These tax optimization strategies work best when executives combine them with sophisticated negotiation tactics that maximize the value of their total compensation packages.

Negotiation Tactics for Executive Pay Packages

Successful executive compensation negotiations require data-driven preparation and strategic timing that most executives completely botch. Compensation consulting firm Pearl Meyer reports that executives who conduct thorough market research before negotiations achieve 23% higher total compensation packages compared to those who wing it. The most effective approach involves gathering proxy data from at least five comparable companies in your industry and geography, focusing on organizations with similar revenue sizes and market capitalizations.

Market Research and Benchmarking

Companies with varying revenue sizes show different compensation patterns, while geographic premiums can add another 10-15% in major metropolitan markets like Miami compared to smaller Florida cities. Smart executives analyze total compensation rather than just base salary figures. They examine equity compensation, bonus structures, and benefit packages across peer companies to build comprehensive compensation profiles.

The most sophisticated executives create detailed spreadsheets that break down each compensation component by percentile rankings. They identify companies that pay at the 75th percentile for base salary but only 50th percentile for equity grants, which reveals negotiation opportunities. This granular analysis provides concrete data points that compensation committees respect during discussions.

Strategic Timing and Professional Support

Negotiation timing matters more than most executives realize. The optimal window occurs 90-120 days before your employment agreement expires or during strategic company milestones like successful acquisitions or IPO preparations. Companies prove most generous when they face uncertainty about leadership continuity or when they need executive stability during critical transitions.

Working with specialized executive compensation attorneys and certified financial planners who understand IRC Section 409A complexities becomes essential for packages exceeding $2 million annually. These professionals typically charge $15,000-25,000 for comprehensive negotiation support but routinely secure additional compensation worth 3-5 times their fees through sophisticated structuring of deferred compensation, equity timing, and tax-advantaged benefit arrangements that executives miss when negotiating alone.

Advanced Negotiation Strategies

The most successful executives negotiate total economic value rather than individual components. They propose trade-offs between current cash and future equity that benefit both parties. For example, they might accept a lower base salary increase in exchange for additional performance shares or enhanced severance protection (which costs the company nothing unless termination occurs).

Executives should also negotiate for flexibility in their compensation structure. They push for the ability to elect cash or equity for bonus payments, defer compensation timing, and modify vesting schedules based on performance achievements. These provisions provide valuable options that adapt to changing tax situations and market conditions.

Final Thoughts

Executive compensation optimization demands immediate action rather than passive acceptance of standard packages. Stuart executives who implement strategic deferral plans, time stock option exercises properly, and leverage Florida’s tax advantages consistently outperform peers by $200,000-500,000 annually in after-tax wealth accumulation. The complexity of modern compensation packages requires professional expertise to navigate Section 409A compliance, AMT calculations, and equity decisions.

Executives who attempt to handle these complexities alone frequently make costly mistakes that eliminate years of potential savings. Professional financial advisors become essential when total compensation exceeds $1 million annually (particularly for equity-heavy packages that require sophisticated tax strategies). Your next step involves comprehensive market research with proxy data from comparable companies, then engagement with qualified advisors who specialize in executive compensation structures.

We at Davies Wealth Management work with executives to develop comprehensive wealth management solutions that optimize every component of their compensation packages while building long-term financial security. The executives who maximize their packages act decisively on tax optimization opportunities and negotiate from positions of strength backed by market data. These strategies compound over time and create substantial wealth differences that separate financially successful executives from those who simply collect paychecks.

Leave a Reply