The world of cryptocurrency is rapidly evolving, and with it comes a complex web of regulations. At Davies Wealth Management, we understand the importance of staying ahead of these changes to protect our clients’ investments.

Crypto regulation is becoming increasingly sophisticated, with governments and financial institutions worldwide grappling with how to effectively oversee this digital asset class. This blog post will explore the current regulatory landscape, challenges faced by regulators, and emerging trends that investors should be aware of.

How Countries Regulate Cryptocurrency

United States: A Multi-Agency Approach

The United States adopts a multi-agency approach to cryptocurrency regulation. Under certain conditions, the SEC classifies crypto asset securities and other digital assets as securities, making them subject to federal regulations. The Commodity Futures Trading Commission (CFTC) views Bitcoin and other cryptocurrencies as commodities, overseeing futures and derivatives markets. This dual approach creates a complex regulatory environment for crypto investors and businesses to navigate.

European Union’s Unified Framework

The European Union takes a more unified approach with the Markets in Crypto-Assets (MiCA) regulation. This comprehensive framework will provide clarity and consistency across all EU member states. MiCA addresses issues such as consumer protection, market integrity, and financial stability. Under this regulation, crypto asset service providers must obtain licenses and adhere to strict operational standards. The first package will be launched in July 2023, with ESMA planning to publish the second package by October 2023.

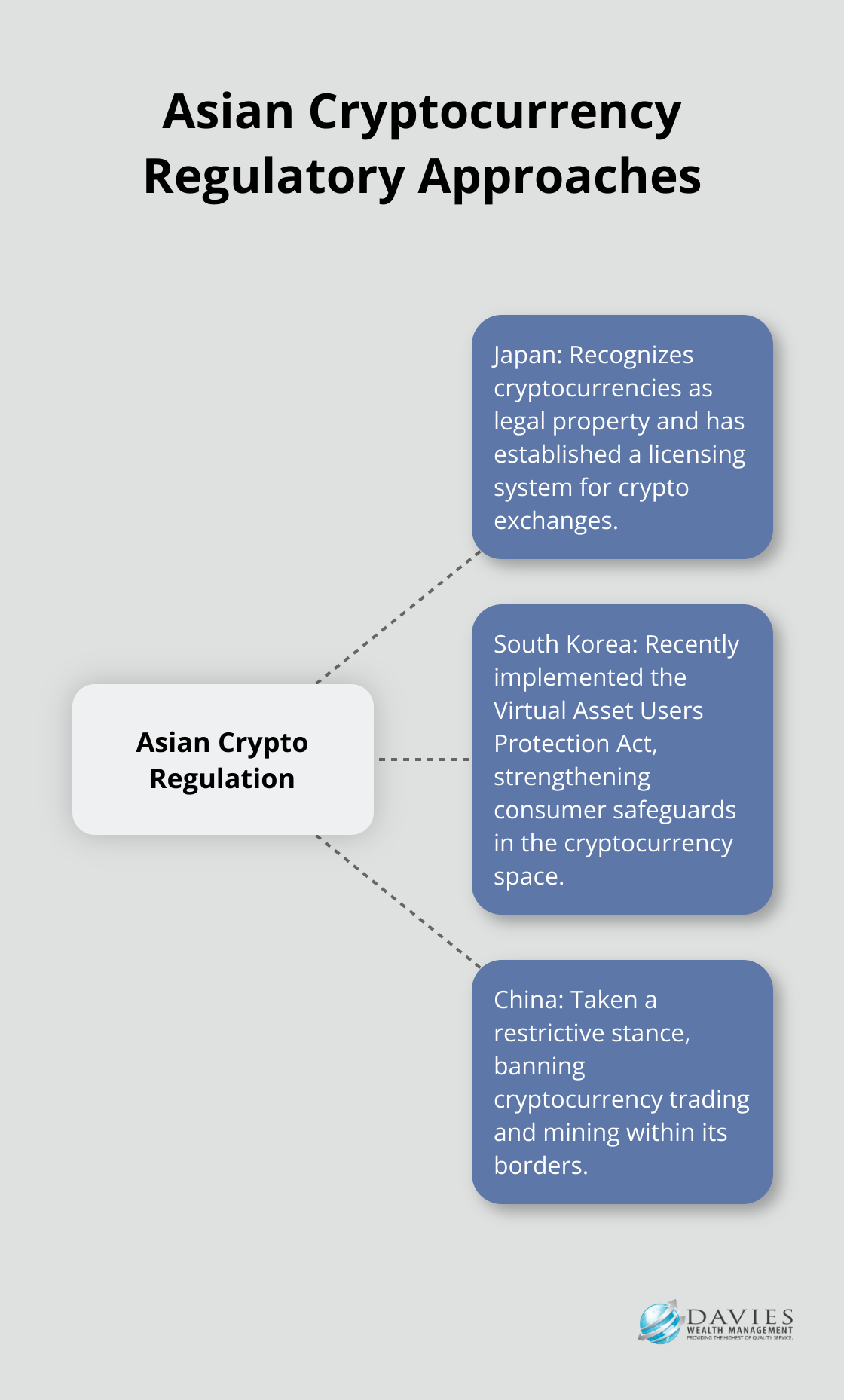

Asian Regulatory Landscape

Asia presents a diverse regulatory landscape for cryptocurrencies:

- Japan recognizes cryptocurrencies as legal property and has established a licensing system for crypto exchanges.

- South Korea recently implemented the Virtual Asset Users Protection Act, which strengthens consumer safeguards in the cryptocurrency space.

- China has taken a restrictive stance, banning cryptocurrency trading and mining within its borders.

These contrasting approaches highlight the global diversity in cryptocurrency regulation.

Key Regulatory Bodies and Their Roles

Several regulatory bodies shape the cryptocurrency landscape:

- The Financial Action Task Force (FATF), an intergovernmental organization, provides global guidelines for combating money laundering and terrorist financing in the crypto sector. The FATF has been closely monitoring developments in the cryptosphere and has issued global, binding standards to prevent the misuse of virtual assets for money laundering.

- The U.S. Financial Crimes Enforcement Network (FinCEN) focuses on enforcing anti-money laundering (AML) and know-your-customer (KYC) requirements for cryptocurrency businesses.

These organizations play a crucial role in establishing standards and ensuring compliance within the cryptocurrency industry.

The regulatory landscape for cryptocurrencies continues to evolve rapidly. Investors and businesses must stay informed about these changes to navigate the market successfully. As we move forward, it’s important to understand the challenges regulators face in overseeing this dynamic and decentralized asset class.

Why Regulating Cryptocurrency Challenges Regulators

The Decentralization Dilemma

Cryptocurrency regulation presents unique challenges that traditional financial systems don’t face. The decentralized nature of blockchain technology (the foundation of most cryptocurrencies) makes it difficult for regulators to identify a single point of control or responsibility. This decentralization offers benefits like increased security and transparency, but it also complicates regulatory efforts.

The Jurisdictional Puzzle

One of the most significant hurdles in cryptocurrency regulation is the issue of jurisdiction. Cryptocurrencies operate on a global scale, transcending national borders with ease. This creates a complex web of legal and regulatory challenges. For example, a transaction might involve a sender in the United States, a receiver in Japan, and be processed on servers located in various other countries. Which country’s laws apply? How can regulators effectively oversee such transactions?

This jurisdictional ambiguity has led to regulatory arbitrage, where businesses set up operations in countries with more lenient regulations. While crypto markets do not currently pose a risk to financial stability in most jurisdictions, adoption of crypto assets tends to be higher in countries with less regulatory oversight. This trend not only complicates regulatory efforts but also potentially exposes investors to higher risks.

The Innovation Race

The rapid pace of technological advancement in the cryptocurrency space often outpaces regulatory efforts. New cryptocurrencies, tokens, and blockchain applications emerge frequently, each potentially requiring unique regulatory considerations. The rise of decentralized finance (DeFi) platforms has created new challenges for regulators. These platforms operate without traditional intermediaries, making it difficult to apply existing financial regulations.

The Innovation-Protection Balance

Regulators face a delicate balancing act between fostering innovation and protecting consumers and financial stability. Overly strict regulations could stifle the potential benefits of blockchain technology and cryptocurrency, while insufficient oversight could lead to market manipulation, fraud, and financial instability.

For instance, the SEC’s approach to cryptocurrency regulation has received criticism from some as overly cautious, potentially hampering innovation in the U.S. crypto market. On the other hand, countries like Singapore have adopted a more balanced approach, implementing a regulatory sandbox that allows for controlled experimentation with new financial technologies.

As the regulatory landscape continues to evolve, investors must stay informed about these issues to make sound investment decisions in the cryptocurrency space. The next section will explore emerging trends in cryptocurrency regulation and their potential impact on the market.

What’s New in Crypto Regulation?

The cryptocurrency regulatory landscape continues to evolve rapidly, with new trends emerging that will significantly impact investors and businesses in the space. We monitor these developments closely to ensure our clients can navigate the changing environment effectively.

Stricter Consumer Protection Measures

Regulators worldwide now focus more on protecting cryptocurrency investors. The U.S. Securities and Exchange Commission (SEC) has increased efforts to stop fraudulent initial coin offerings (ICOs) and unregistered securities. As of year-end 2022, monetary penalties against digital-asset market participants totaled approximately $2.61 billion, of which $242 million was related to SEC enforcement actions.

These actions remind investors to conduct thorough due diligence before participating in any cryptocurrency investment. We advise clients to stick with well-established cryptocurrencies and platforms that have a track record of compliance with regulatory requirements.

Enhanced AML and KYC Requirements

Anti-money laundering (AML) and know-your-customer (KYC) regulations have become more stringent in the crypto space. The Financial Action Task Force (FATF) has issued guidelines that require virtual asset service providers (VASPs) to implement robust AML/KYC procedures.

For investors, this translates to more thorough identity verification processes when opening accounts on cryptocurrency exchanges. While this might appear cumbersome, it represents a positive step towards legitimizing the crypto industry and reducing its association with illicit activities.

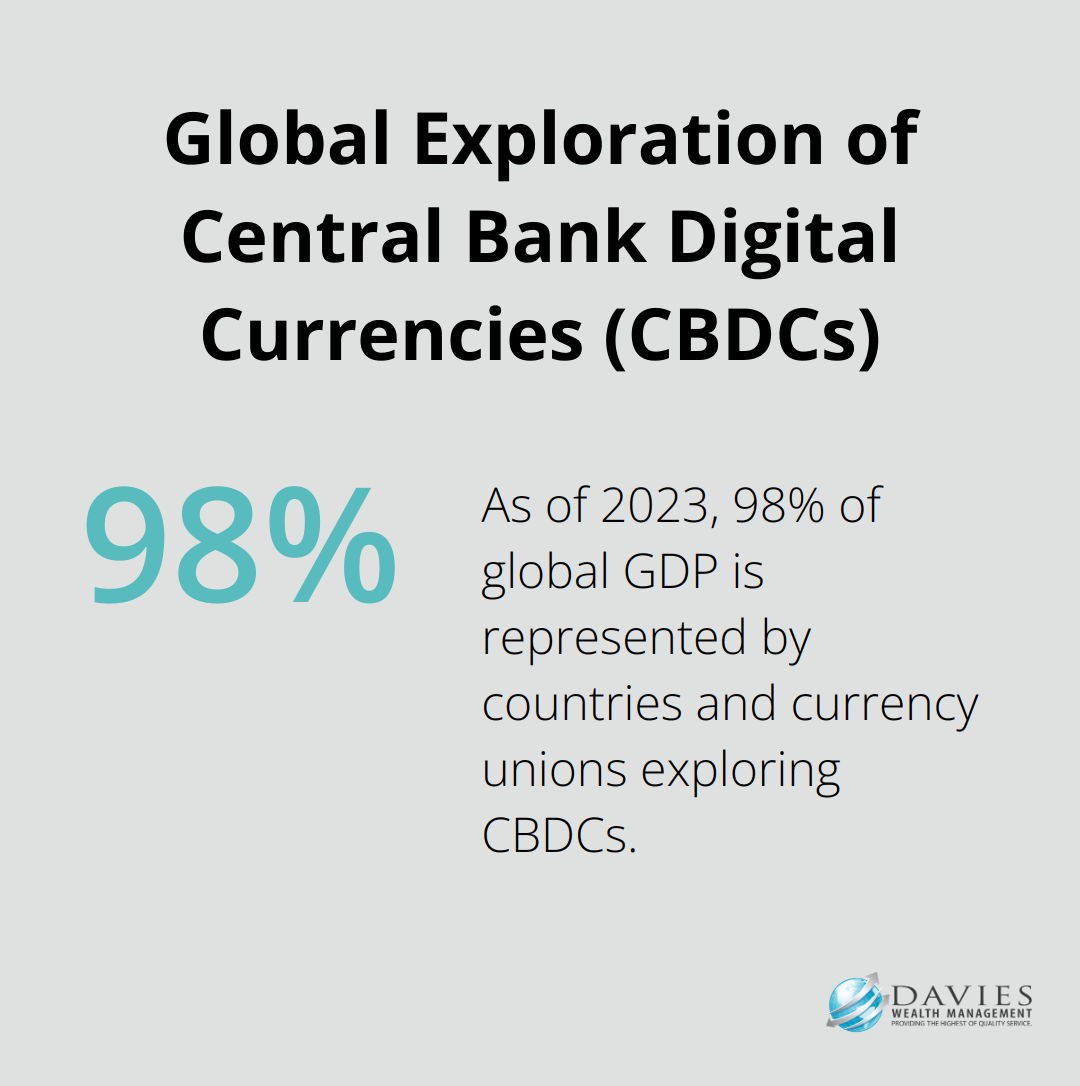

The Rise of Central Bank Digital Currencies

Central Bank Digital Currencies (CBDCs) have gained traction globally. As of 2023, 137 countries and currency unions, representing 98% of global GDP, are exploring CBDCs. China leads the charge with its digital yuan, already in use in several cities.

The introduction of CBDCs could significantly impact the cryptocurrency market. They may provide a government-backed alternative to private cryptocurrencies, potentially affecting demand for existing digital assets. Investors should monitor CBDC developments in their respective countries and consider how they might impact their cryptocurrency portfolios.

Regulatory Clarity for DeFi and NFTs

Regulators now turn their attention to decentralized finance (DeFi) platforms and non-fungible tokens (NFTs). These emerging sectors of the crypto ecosystem present unique challenges for regulators due to their decentralized nature and novel use cases.

The SEC has signaled increased scrutiny of DeFi platforms, particularly those offering lending or yield-generating services. For NFTs, regulators try to determine whether certain tokens should be classified as securities. This evolving regulatory landscape may impact the growth and adoption of these innovative technologies.

Cross-Border Collaboration

Recognizing the global nature of cryptocurrencies, regulators worldwide have increased their collaborative efforts. International bodies such as the Financial Stability Board (FSB) and the International Organization of Securities Commissions (IOSCO) work towards developing consistent regulatory approaches across jurisdictions.

This trend towards regulatory harmonization aims to reduce regulatory arbitrage and create a more stable global crypto ecosystem. On July 17, 2023, the FSB finalized a global regulatory framework for crypto-asset activities, publishing recommendations that constitute a regulatory and supervisory approach to address risks in crypto-asset activities while harnessing potential benefits of the technology.

Final Thoughts

The cryptocurrency landscape and its regulatory environment continue to evolve rapidly. Crypto regulation impacts market stability, investor protection, and overall market dynamics. Increased oversight can provide greater security and legitimacy, potentially attracting more institutional investors and stabilizing prices.

We expect the regulatory landscape for cryptocurrencies to continue its rapid evolution. Governments and financial institutions will likely develop more nuanced and targeted regulations as they gain a better understanding of blockchain technology and its applications. The future of cryptocurrency regulation will involve a balance between fostering innovation and protecting investors.

At Davies Wealth Management, we understand the complexities of navigating the ever-changing world of cryptocurrency investments. Our team stays informed about the latest regulatory developments to provide our clients with guidance on how these changes may affect their investment strategies. We help you make informed decisions in line with your financial goals, whether you’re a seasoned crypto investor or just beginning to explore this asset class.

Leave a Reply