Executive compensation packages can be complex and multifaceted, often leaving even seasoned professionals puzzled.

At Davies Wealth Management, we understand the intricacies of these high-level remuneration structures and their impact on overall financial planning.

This guide will break down the key components of executive compensation, explore tax implications, and offer strategies for optimization to help you make informed decisions about your financial future.

What’s in an Executive Compensation Package?

Base Salary: The Foundation

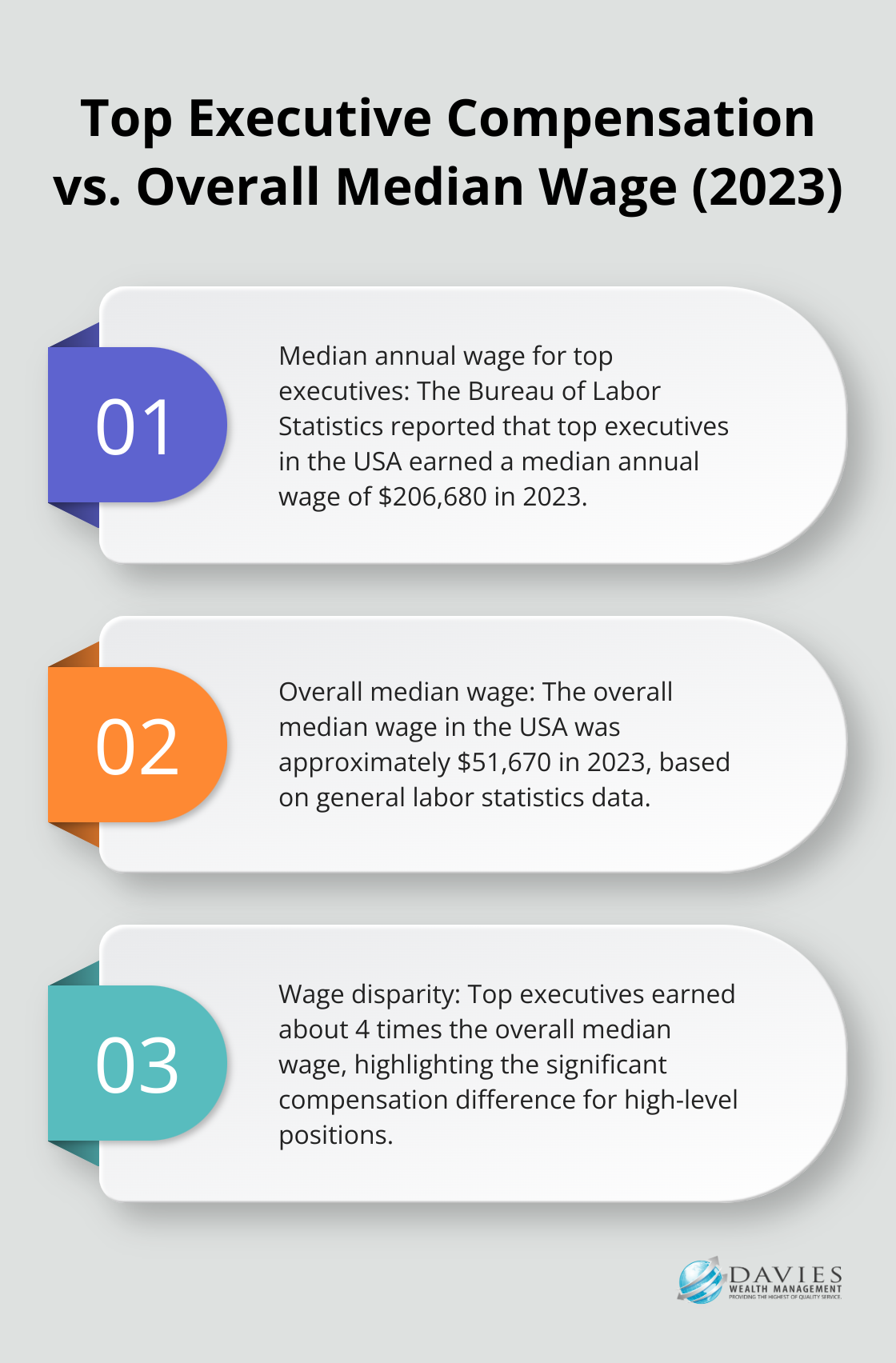

Executive compensation packages are complex financial structures designed to attract, retain, and motivate top-level talent. The base salary forms the cornerstone of an executive’s compensation. It’s the fixed amount an executive can count on, regardless of company performance. In 2023, the median annual wage for top executives in the USA was $206,680, according to the Bureau of Labor Statistics. However, this figure can vary widely based on factors such as company size, industry, and location.

Short-Term Incentives: Performance-Driven Rewards

Annual bonuses, or short-term incentives (STIs), are an important part of an executive’s total compensation. These are tied to specific performance metrics and motivate executives to meet annual targets. STIs can be based on financial metrics (like revenue growth or EBITDA) or non-financial metrics (such as customer satisfaction scores or sustainability goals).

Long-Term Incentives: Aligning with Shareholder Interests

Long-term incentives (LTIs) often form the largest portion of an executive’s compensation package. These can include:

- Stock Options: These give executives the right to purchase company stock at a predetermined price. The value lies in the potential for stock price appreciation.

- Restricted Stock Units (RSUs): These are grants of company stock that vest over time. Unlike stock options, RSUs have value even if the stock price doesn’t increase.

- Performance Shares: These are stock awards that vest based on achieving specific long-term performance goals, often measured over a 3-5 year period.

Benefits and Perquisites: The Extra Edge

Executive benefits packages often go beyond standard employee offerings. These can include:

- Enhanced Health Insurance: Comprehensive coverage with lower deductibles and broader networks.

- Supplemental Executive Retirement Plans (SERPs): These provide additional retirement benefits beyond standard 401(k) plans.

- Executive Perks: These might include company cars, club memberships, or even personal use of corporate aircraft.

These perks can be attractive, but they often come with complex tax implications. It’s important to consider the total value of these benefits when evaluating a compensation package.

Understanding the intricacies of these components is vital for executives to maximize their compensation. Whether you’re a seasoned CEO or a rising star in your industry, navigating these complex packages requires expert guidance.

As we move forward, we’ll explore the tax implications of these various compensation components, which can significantly impact an executive’s overall financial picture.

Tax Implications of Executive Compensation

Ordinary Income vs. Capital Gains

Executive compensation packages significantly impact your take-home pay and long-term wealth accumulation. The distinction between ordinary income and capital gains is a key tax consideration. Your base salary and annual bonuses are taxed as ordinary income at rates up to 37% (as of 2023). In contrast, long-term capital gains from stock options or RSUs held for more than a year are taxed at a maximum rate of 20%. This difference can substantially affect your after-tax income.

For instance, an executive earning a $500,000 salary might pay up to $185,000 in federal income taxes. However, if $200,000 of that compensation came from long-term capital gains instead of salary, the tax bill could decrease by over $30,000. This underscores the importance of strategic compensation package structuring for tax efficiency.

Alternative Minimum Tax Considerations

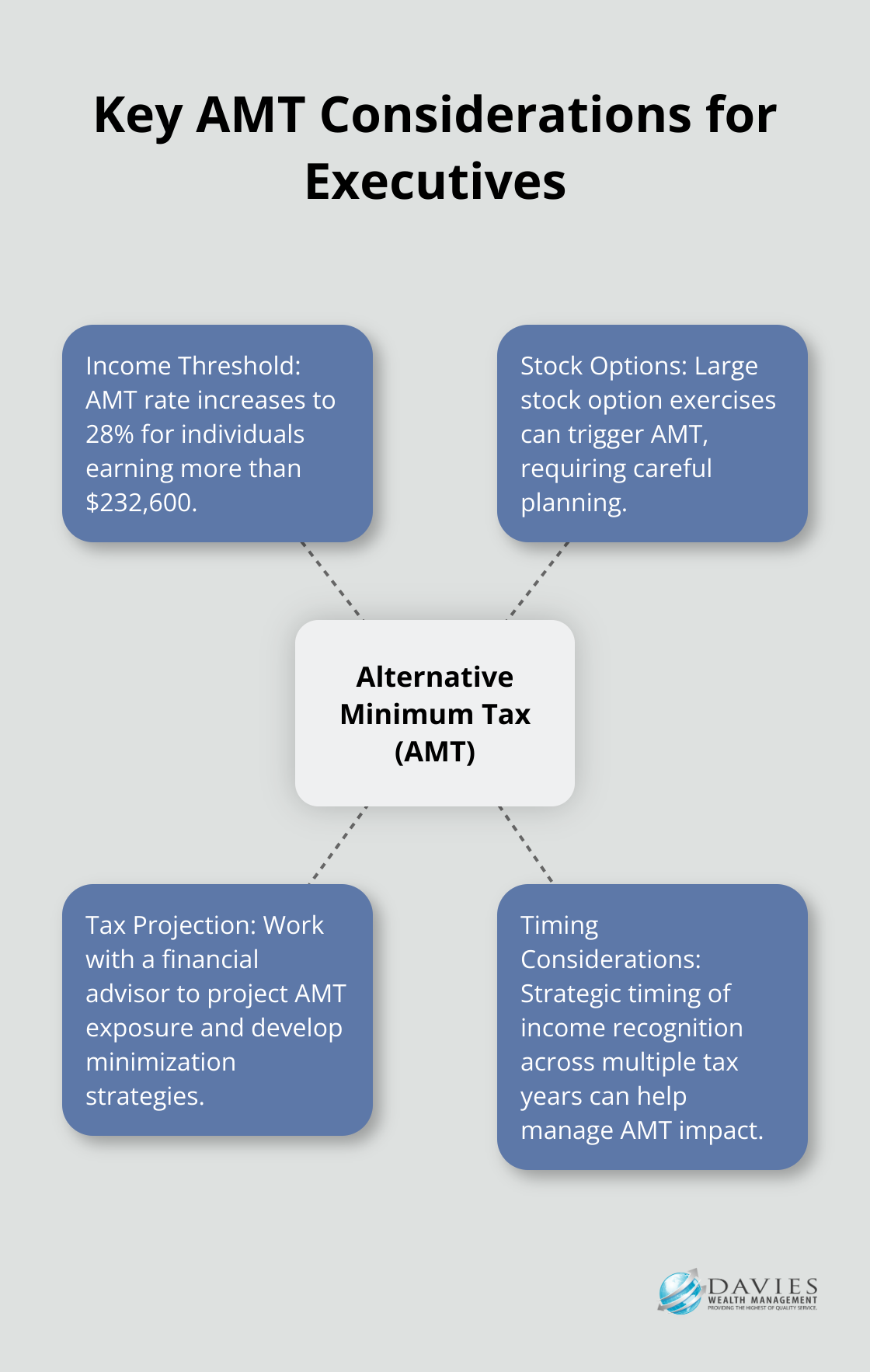

The Alternative Minimum Tax (AMT) presents another potential challenge for high-earning executives. The AMT ensures that high-income individuals pay a minimum amount of tax, regardless of deductions. Large stock option exercises or other forms of non-cash compensation can trigger it.

If a person earns more than $232,600, the AMT tax rate goes up to 28 percent. The AMT exemption is the amount of income taxpayers can exempt from AMT calculations.

To avoid unexpected tax bills, you should work with a financial advisor who can help project your AMT exposure and develop strategies to minimize its impact. This might involve careful timing of stock option exercises or strategic income recognition across multiple tax years.

Deferred Compensation Rules

Deferred compensation plans can postpone taxes on a portion of your income. However, these plans come with strict rules under Section 409A of the Internal Revenue Code. Section 409A delineates a comprehensive regime for the taxation and regulation of nonqualified deferred compensation. Rule violations can result in immediate taxation of the deferred amount plus a 20% penalty.

Moreover, deferred compensation is subject to the company’s creditors’ claims, meaning you could lose this money if the company faces financial difficulties. You must carefully weigh the tax benefits against the potential risks before participating in a deferred compensation plan.

Impact on Retirement Planning

Executive compensation structures can significantly influence retirement planning. High-income executives often face limitations on traditional retirement savings vehicles like 401(k)s due to contribution limits and income restrictions. This necessitates creative planning to ensure adequate retirement savings.

Non-qualified deferred compensation plans, backdoor Roth IRA contributions, and after-tax 401(k) contributions (with subsequent in-plan Roth conversions) are strategies that can help executives maximize their retirement savings while managing current tax liabilities. A backdoor Roth conversion provides another way for high-income earners to fund a Roth account. With this two-step strategy, you would first make contributions to a traditional IRA and then convert those funds to a Roth IRA.

Understanding these tax implications is essential for maximizing the value of your executive compensation package. While the potential tax savings can be significant, navigating these complex rules requires expert guidance. In the next section, we’ll explore strategies for optimizing your executive compensation to balance current income needs with long-term wealth building goals.

How Executives Can Maximize Their Compensation

Prepare for Compensation Package Negotiations

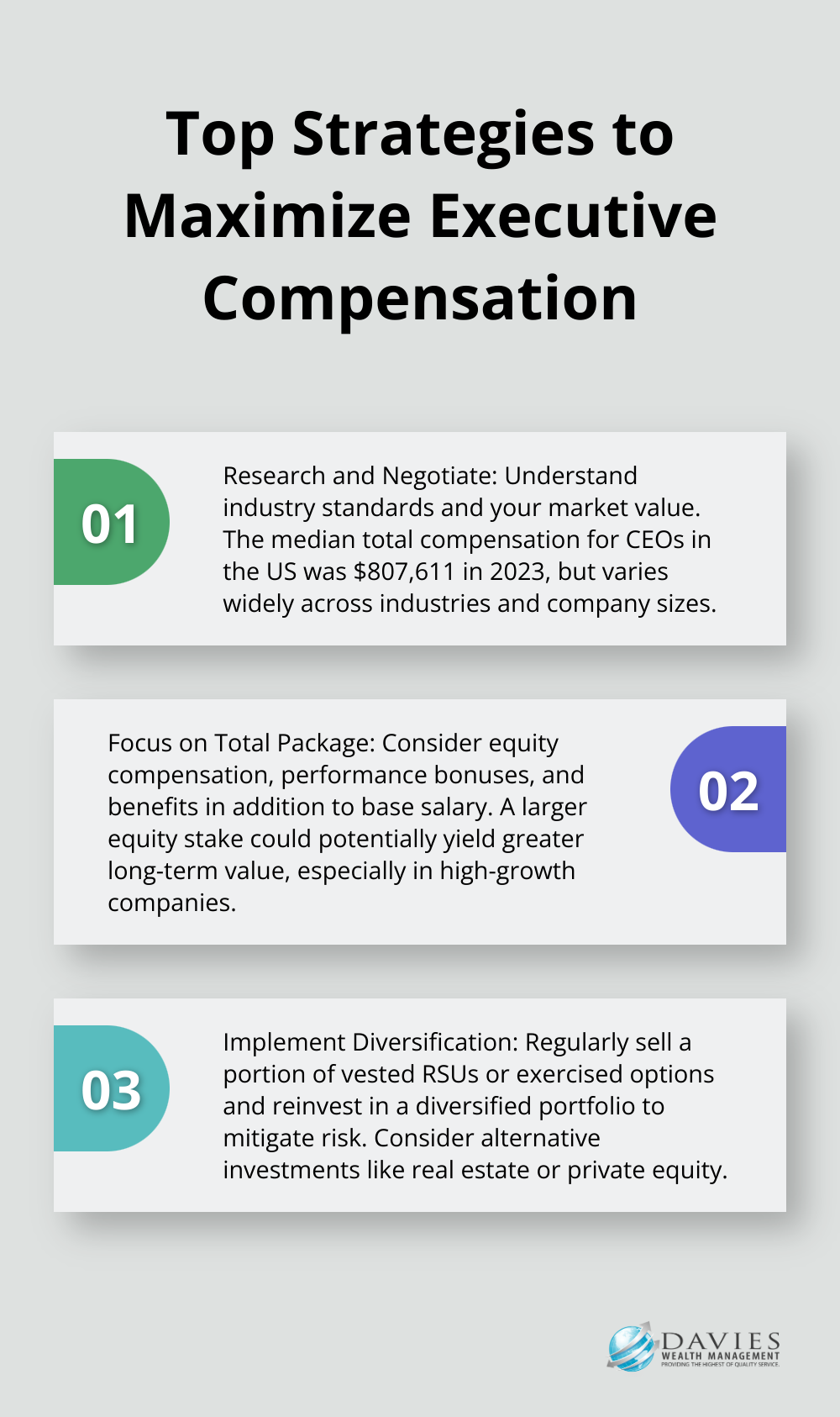

Executives who want to optimize their compensation packages must prepare thoroughly before entering negotiations. Research industry standards for similar positions to understand your market value. The Economic Research Institute reports that CEOs in the United States earned a median total compensation of $807,611 in 2023 (this figure varies widely across industries and company sizes).

Focus on the entire package, not just base salary. Consider equity compensation, performance bonuses, and benefits. Negotiating a larger equity stake could potentially yield greater long-term value than a higher base salary, especially in high-growth companies.

Time Stock Option Exercises Strategically

The timing of stock option exercises can significantly impact an executive’s financial position. A staged approach to exercising options can help spread out tax liabilities and potentially take advantage of lower tax brackets in certain years. For example, if you anticipate a lower income year due to a sabbatical or reduced bonus, that might be an opportune time to exercise some options.

Be aware of your company’s trading windows and insider trading rules. Many companies restrict when executives can trade company stock to avoid the appearance of insider trading. Plan your exercises well in advance to ensure compliance with these regulations.

Implement a Diversification Strategy

Over-concentration in a single stock poses substantial risks. The Vanguard Asset Allocation Model uses inputs like an investor’s risk tolerance, investment horizon, and asset-class preferences to assess risk-return trade-offs and generate a range of portfolio options.

Try to implement a systematic diversification strategy. This might involve regularly selling a portion of vested RSUs or exercised options and reinvesting the proceeds in a diversified portfolio. The specific strategy will depend on your overall financial situation, risk tolerance, and long-term goals.

Consider diversification beyond the stock market. Alternative investments such as real estate, private equity, or even passion investments like art can provide additional avenues for wealth accumulation and risk mitigation.

Seek Expert Guidance

These complex compensation structures require expert guidance to develop optimal strategies. Work with financial advisors who have specific experience with executive compensation packages. They can provide tailored advice that aligns with your unique financial situation and goals.

If you’re considering working with a wealth management firm, Davies Wealth Management offers expertise in navigating complex executive compensation packages. Our team understands the intricacies of these high-level remuneration structures and their impact on overall financial planning.

Review and Adjust Regularly

Optimizing executive compensation is an ongoing process. Conduct regular reviews and adjustments to your strategy to ensure it continues to align with your evolving financial objectives and changes in tax laws or company policies. A proactive and strategic approach to your compensation package can maximize its value and secure your financial future.

Final Thoughts

Executive compensation packages require a deep understanding of various components and tax implications. From base salaries to long-term equity awards, each element impacts an executive’s overall financial picture. The tax landscape surrounding these packages includes considerations such as ordinary income versus capital gains treatment and alternative minimum tax rules.

A strategic approach maximizes the value of executive compensation. This includes thorough preparation for package negotiations and careful timing of stock option exercises. Professional guidance proves invaluable when dealing with executive compensation (our team at Davies Wealth Management specializes in helping executives navigate these complex financial waters).

Long-term financial planning forms a critical aspect of managing executive compensation. It involves careful consideration of retirement planning, estate planning, and tax-efficient strategies. Davies Wealth Management offers expertise to help you make informed decisions about your financial future, ensuring your executive compensation package serves as a powerful tool for achieving lasting financial security.

Leave a Reply