Tax-loss harvesting is a powerful strategy that can help investors reduce their tax burden and potentially improve their portfolio’s overall performance. At Davies Wealth Management, we’ve seen firsthand how this technique can benefit our clients’ long-term financial goals.

In this blog post, we’ll explore the ins and outs of tax-loss harvesting, from basic concepts to advanced techniques. We’ll also provide practical strategies to help you maximize your tax-loss harvesting opportunities and optimize your investment portfolio.

What Is Tax-Loss Harvesting?

The Basics of Tax-Loss Harvesting

Tax-loss harvesting is the timely selling of securities at a loss to offset the amount of capital gains tax owed from selling profitable assets. This strategic investment technique can reduce your tax liability while potentially improving your portfolio’s performance.

How Tax-Loss Harvesting Works

In practice, tax-loss harvesting identifies securities in your portfolio that have declined in value since purchase. These losses offset capital gains from other investments. For example, if you sold a stock for a $10,000 profit and another for a $7,000 loss, you’d only owe taxes on $3,000 of capital gains.

If your capital losses exceed your capital gains, you can use up to $3,000 of the excess to offset other income on your tax return. Any remaining losses can carry forward to future tax years, providing ongoing tax benefits.

Benefits of Tax-Loss Harvesting

Tax-loss harvesting offers substantial potential benefits. It reduces your tax burden, allowing you to keep more of your investment returns, which you can reinvest to compound over time. Tax-loss harvesting is a widely used strategy in the field of personal wealth management, often lauded for its potential to improve an investor’s after-tax returns.

Implementing Tax-Loss Harvesting Carefully

The IRS wash-sale rule prohibits claiming a loss on a security if you purchase the same or a similar security within 30 days before or after the sale. To avoid this, many investors replace the sold security with a similar (but not identical) investment to maintain their desired market exposure.

Considerations for Tax-Loss Harvesting

While tax-loss harvesting can be a powerful tool, it’s not suitable for every investor or situation. It’s most beneficial in taxable accounts and may not be appropriate for tax-advantaged accounts (like IRAs or 401(k)s). Your current and future tax rates play a key role in determining the long-term value of this strategy.

It’s worth noting that tax-loss harvesting doesn’t eliminate taxes; it defers them. When you sell an investment at a loss and buy a similar one, you’re lowering your cost basis, which could lead to larger capital gains in the future. However, the ability to reinvest the tax savings and potentially benefit from a step-up in basis at death often outweighs this consideration.

As we move forward, we’ll explore effective strategies to maximize your tax-loss harvesting opportunities and optimize your investment portfolio.

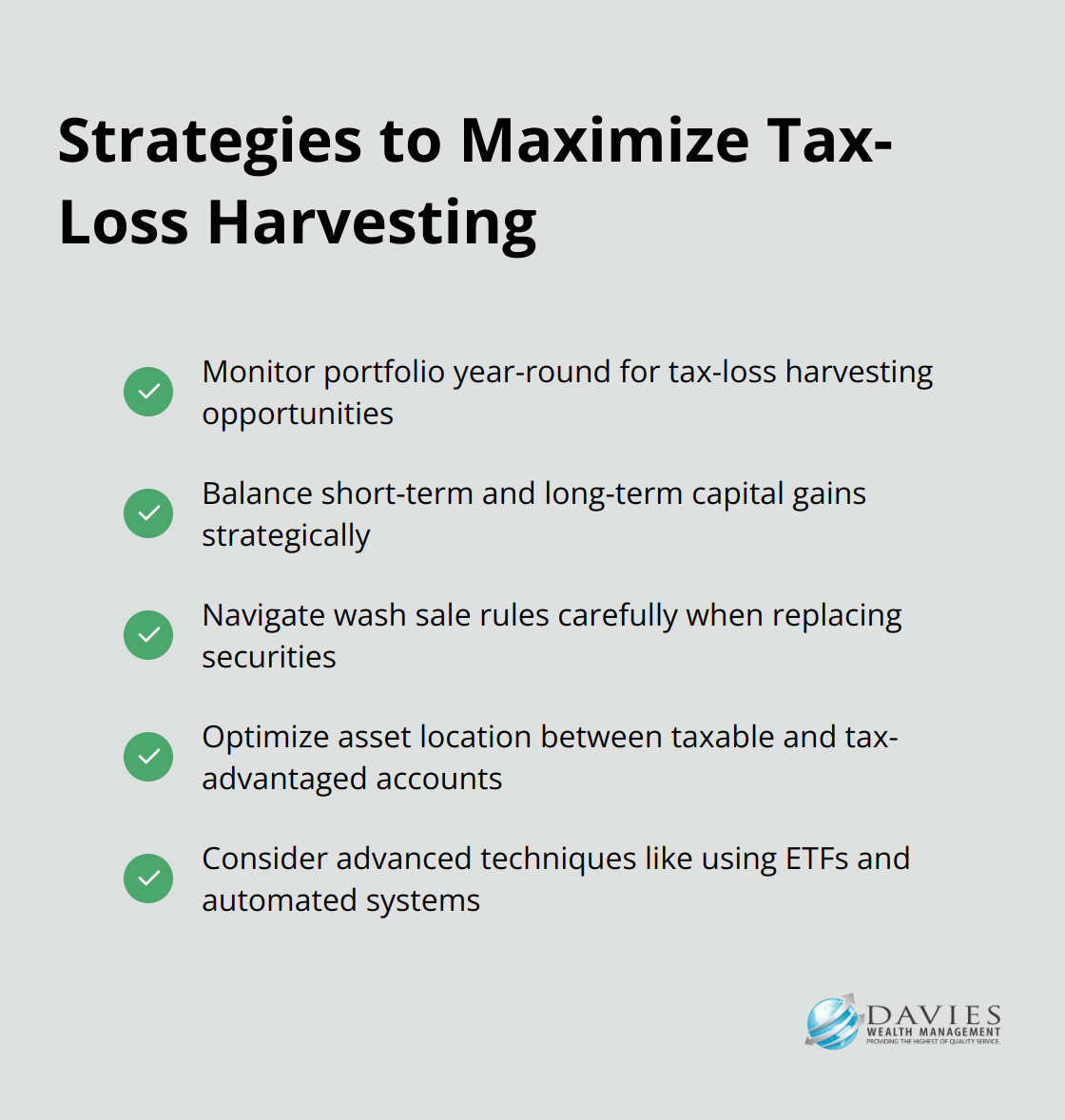

How to Maximize Tax-Loss Harvesting Opportunities

At Davies Wealth Management, we have developed effective strategies to help our clients make the most of tax-loss harvesting opportunities. Here’s how you can optimize this powerful tax-saving technique in your investment portfolio.

Year-Round Monitoring

Don’t limit your tax-loss harvesting efforts to December. Market volatility creates opportunities throughout the year. Daily harvest screening, reinvesting tax savings, and making ongoing contributions can help investors who pursue this strategy. Set up alerts or review your portfolio regularly to identify potential losses you can harvest.

Strategic Capital Gains Management

Balance short-term and long-term capital gains for effective tax-loss harvesting. Try to offset short-term gains with short-term losses to maximize your tax savings.

Wash Sale Rule Navigation

The IRS wash sale rule significantly impacts tax-loss harvesting. This rule prohibits claiming a loss on a security if you purchase the same or a substantially identical security within 30 days before or after the sale. If you do a wash-sale, the IRS requires that you add your disallowed loss to the cost of the new securities you’ve purchased to create your new basis. To maintain your desired market exposure while avoiding a wash sale, replace the sold security with a similar but not identical investment.

Asset Location Optimization

The location of your assets can significantly impact the effectiveness of your tax-loss harvesting strategy. Focus your tax-loss harvesting efforts on taxable accounts, as tax-advantaged accounts (like IRAs and 401(k)s) don’t benefit from this strategy. Additionally, place tax-inefficient investments (such as high-yield bonds) in tax-advantaged accounts and more tax-efficient investments (like index funds) in taxable accounts. This approach, known as asset location, can enhance the overall tax efficiency of your portfolio.

Advanced Tax-Loss Harvesting Techniques

For investors seeking to further optimize their tax-loss harvesting strategy, several advanced techniques exist. These include using ETFs for tax-loss harvesting, implementing automated tax-loss harvesting systems, and pairing tax-loss harvesting with charitable giving strategies. These advanced methods can potentially enhance the benefits of tax-loss harvesting and provide additional tax advantages.

As we move forward, we will explore these advanced tax-loss harvesting techniques in more detail, providing you with a comprehensive understanding of how to leverage this strategy to its fullest potential.

Advanced Tax-Loss Harvesting Strategies

ETFs as Tax-Loss Harvesting Tools

Exchange-Traded Funds (ETFs) offer unique advantages for tax-loss harvesting. ETFs can be more tax efficient compared to traditional mutual funds. Generally, holding an ETF in a taxable account will generate less tax liabilities. Unlike mutual funds, ETFs allow intraday trading, which provides more flexibility in timing harvesting activities. Many ETFs track similar (but not identical) indexes, making them ideal for maintaining market exposure while avoiding wash sale rules.

For example, an investor who sells an S&P 500 index fund at a loss could immediately purchase an ETF tracking the Russell 1000 index. This maintains broad market exposure while realizing a tax loss. The key is to select ETFs that are similar enough to maintain the investment strategy but different enough to comply with IRS regulations.

Automated Tax-Loss Harvesting Systems

Technology has revolutionized tax-loss harvesting. Automated systems monitor portfolios daily, identify and execute tax-loss harvesting opportunities as they arise. The value of automated tax-loss harvesting is less about the automation itself, and more about capturing losses under the right circumstances.

Automated systems can be particularly effective for larger portfolios with diverse holdings, where manual monitoring would take too much time and potentially miss opportunities. However, these systems are not a one-size-fits-all solution. They require careful setup and ongoing oversight to ensure alignment with overall financial strategy and risk tolerance.

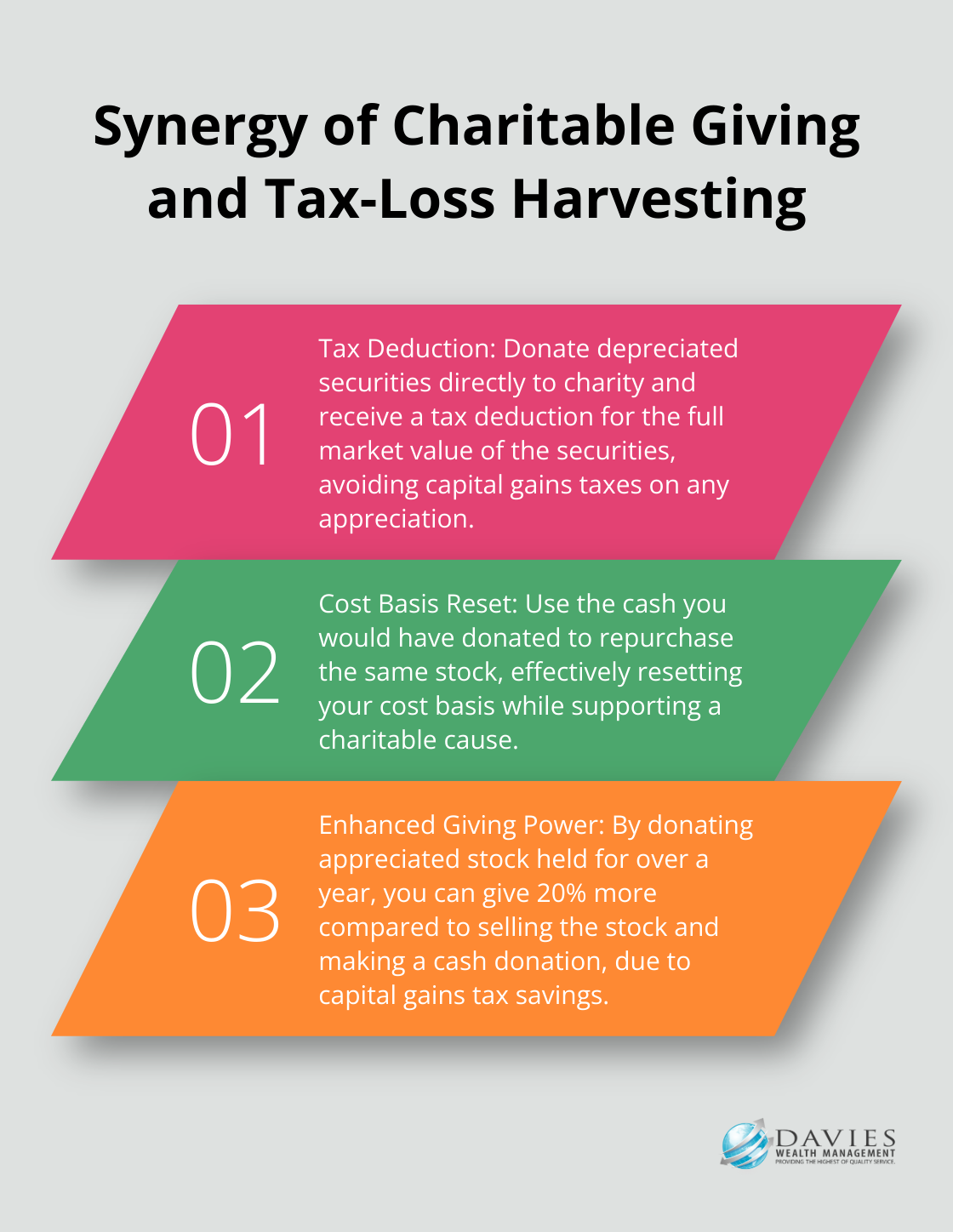

Charitable Giving and Tax-Loss Harvesting Synergy

The combination of tax-loss harvesting with charitable giving creates powerful tax benefits. Instead of selling depreciated securities, investors can donate them directly to charity. This strategy allows a tax deduction for the full market value of the securities while avoiding capital gains taxes on any appreciation.

For instance, if an investor bought a stock for $10,000 that’s now worth $8,000, donating it directly to charity would allow an $8,000 deduction. The investor could then use the $10,000 cash they would have donated to repurchase the same stock, effectively resetting their cost basis while supporting a cause they care about.

This approach is particularly effective for highly appreciated securities. By donating stock that has appreciated for more than a year, you are actually giving 20 percent more than if you sold the stock and then made a cash donation.

Tax-Loss Harvesting in Volatile Markets

Tax-loss harvesting in volatile markets presents both challenges and opportunities. Market downturns often create more harvesting opportunities, but they also require careful navigation to avoid emotional decision-making.

During periods of high volatility, it’s important to maintain a long-term perspective. While realizing losses can provide immediate tax benefits, it’s essential not to compromise the overall investment strategy.

One effective strategy in volatile markets is to focus on harvesting losses in specific sectors or asset classes that have underperformed, while maintaining overall portfolio balance. This approach allows the capture of tax benefits without significantly altering risk exposure.

Final Thoughts

Tax-loss harvesting empowers investors to optimize portfolios and reduce tax liabilities. This strategy allows investors to realize losses, offset capital gains, and potentially enhance after-tax returns. The benefits extend to portfolio rebalancing, maintaining market exposure, and supporting charitable causes.

Professional guidance proves invaluable when navigating the complexities of tax-loss harvesting. At Davies Wealth Management, we help our clients implement sophisticated tax-loss harvesting strategies tailored to their unique financial situations. Our expertise assists in avoiding wash sales, complying with IRS regulations, and integrating this approach with broader financial goals.

The long-term impact of effective tax-loss harvesting on portfolio performance can significantly improve investment outcomes. This strategy offers tax deferral, compounded growth on reinvested tax savings, and improved risk-adjusted returns. Investors who consistently apply tax-loss harvesting across market cycles may benefit from ongoing opportunities to manage tax liabilities and optimize their investments.

Leave a Reply