At Davies Wealth Management, we understand the critical role that contract negotiations play in an athlete’s financial future. Sports contracts have become increasingly complex, with various components that can significantly impact an athlete’s earning potential.

In this post, we’ll explore strategies for maximizing athlete earnings through strategic contract negotiations. From understanding the current landscape to leveraging performance incentives, we’ll provide insights to help athletes secure their financial success both on and off the field.

What’s in an Athlete’s Contract?

Base Salary and Performance Bonuses

Professional sports contracts form the foundation of an athlete’s financial future. The base salary provides financial stability, but it’s just the beginning. Performance bonuses can significantly boost an athlete’s earnings. In the NFL, players can earn $500,000 for getting five sacks, increasing to $700,000 and $900,000 with eight and nine sacks, respectively.

Contract Types Across Sports

Different sports employ unique contract structures. The NBA ties max contracts to a percentage of the salary cap, allowing top players to earn upwards of $40 million per year. MLB contracts often include opt-out clauses, providing players flexibility to renegotiate or enter free agency. The NHL uses a two-way contract system for players who split time between the NHL and minor leagues.

Guaranteed Money and Signing Bonuses

Guaranteed money in a contract holds paramount importance. In Spotrac’s breakdown of NFL contracts, the guaranteed sum is below the theoretical value of the agreement about 90% of the time. Signing bonuses, typically guaranteed, offer immediate financial security. Recent NFL contracts have included signing bonuses exceeding $20 million.

Recent Trends in Athlete Compensation

A shift towards shorter contracts with higher annual values has emerged, especially in the NBA and MLB. This trend allows players to re-enter free agency more frequently and capitalize on rising salary caps. Additionally, an increasing focus on incentive-laden contracts ties compensation more closely to performance.

Another notable trend involves the rise of player options and early termination clauses. The current collective bargaining agreement (CBA) between MLB and the MLB Players Association runs through the 2026 season, which means discussions about potential changes to these provisions are still a ways off.

Understanding these complex contract structures requires expert guidance. Professional financial advisors help athletes navigate these intricacies, ensuring they not only comprehend their contracts but also maximize their earning potential throughout their careers.

As we move forward, we’ll explore how athletes can prepare effectively for these high-stakes contract negotiations, setting the stage for financial success both on and off the field.

How to Prepare for Contract Negotiations

Assessing Your True Market Value

The first step in preparation involves a comprehensive assessment of your market value. This assessment extends beyond mere statistics. You must consider your overall impact on the team, your potential for growth, and your marketability off the field.

In the NFL, a quarterback’s value isn’t solely determined by passing yards. Factors like leadership qualities, ability to read defenses, and even social media following can influence market value. The NFL Players Association provides valuable resources for players to understand their market worth.

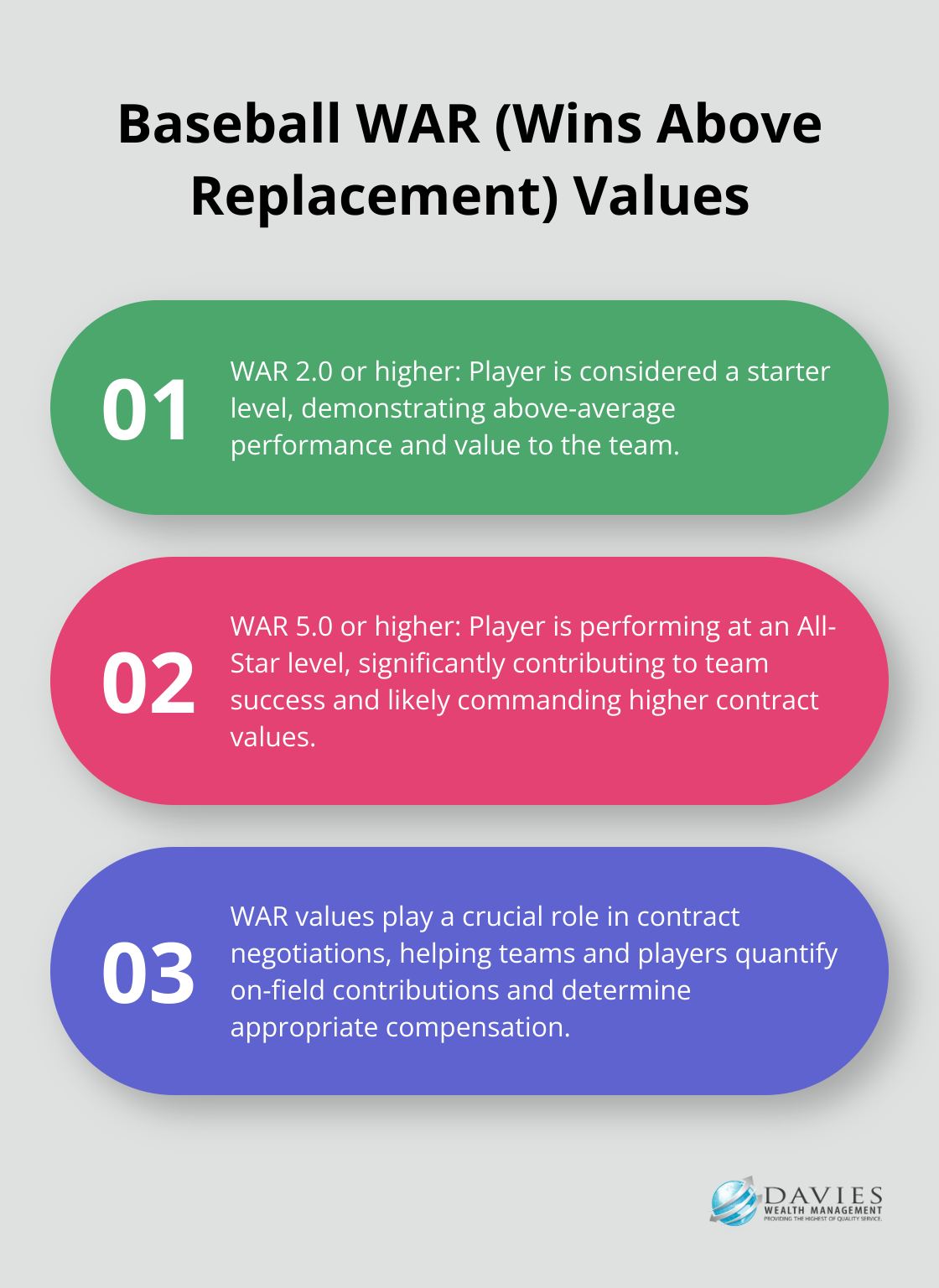

Performance metrics play a crucial role, but they’re not the only factor. In baseball, advanced statistics like WAR (Wins Above Replacement) have become increasingly important in contract negotiations. According to FanGraphs, a player with a WAR of 2.0 or higher is considered a starter, while 5.0+ is All-Star level.

Building Your Dream Team

No athlete should enter negotiations alone. A strong negotiation team typically includes an agent, a financial advisor, and potentially a lawyer. Each member brings unique expertise to the table.

Your agent should have a proven track record in your sport. For instance, Scott Boras negotiated a record-breaking seven-year, $126 million contract with the San Francisco Giants for Barry Zito in 2006.

A financial advisor from a reputable firm can provide invaluable insights into the long-term implications of different contract structures. They can help you understand how various clauses might affect your financial future. (Davies Wealth Management excels in this area, offering specialized expertise for professional athletes.)

Crafting Your Negotiation Strategy

With your team in place and a clear understanding of your value, it’s time to develop a negotiation strategy. This should include your minimum acceptable terms, your ideal scenario, and several fallback positions.

Consider the case of NBA star LeBron James. He’s known for signing shorter contracts to maintain flexibility and leverage. James could opt out of his contract and attempt to negotiate up to his maximum salary or sign with another team.

Your strategy should also account for non-monetary factors. Playing time, role on the team, and even location can be important negotiating points. NBA player Jimmy Butler, for instance, prioritized team culture and fit in his move to the Miami Heat in 2019.

Staying Informed and Prepared

Preparation is an ongoing process. You must stay informed about league trends, salary cap projections, and comparable player contracts. The more informed you are, the stronger your position at the negotiating table will be.

Professional financial advisors can provide valuable insights and keep you updated on relevant industry changes.

As we move forward, we’ll explore how to maximize your contract value through strategic negotiation tactics and leveraging various contract components.

How to Maximize Your Contract Value

Leverage Performance Bonuses

Performance bonuses can significantly increase your income. NFL players have earned millions through performance-based pay, with some nearly doubling their salaries. When you negotiate, push for realistic yet challenging performance targets. This approach demonstrates your confidence and commitment to excellence. However, avoid setting unreachable goals that could leave money on the table. A balanced approach ensures you receive rewards for exceptional performance without sacrificing guaranteed income.

Explore Endorsement Opportunities

Endorsements can often surpass your on-field earnings. The top 50 highest-earning athletes collected an estimated $4.23 billion in 2025, setting a new record. While not every athlete will reach these heights, even lesser-known players can benefit from strategic endorsement deals.

Start by building your personal brand on social media. Platforms like Instagram and Twitter can showcase your personality and increase your marketability. Next, align yourself with brands that match your values and appeal to your fan base. This authenticity will make you more attractive to potential sponsors and can lead to longer-lasting, more lucrative partnerships.

Secure Long-Term Financial Stability

While big numbers grab headlines, true financial security comes from smart structuring of your contract. Try to negotiate for guaranteed money over flashy total values. In the NFL (where contracts aren’t fully guaranteed), this is particularly important. Kirk Cousins’ fully guaranteed three-year, $84 million contract with the Minnesota Vikings in 2018 included a $3 million signing bonus and annual workout bonuses of $500,000.

Also, think beyond your playing career. Negotiate for provisions that support your long-term financial health. This could include contributions to retirement accounts, continued health insurance coverage, or even post-career job opportunities within the organization.

Seek Expert Financial Guidance

Professional athletes face unique financial challenges (including short career spans, fluctuating income, and potential earnings from endorsements and contracts). A specialized financial advisor can provide invaluable insights into contract structures that maximize both immediate earnings and long-term financial security.

When choosing a financial advisor, look for firms with expertise in athlete finances. Davies Wealth Management, for example, offers specialized services for professional athletes, helping them navigate complex negotiations and create comprehensive financial strategies.

Final Thoughts

Sports contracts require a strategic approach and expert guidance. Athletes who understand their market value, build a strong negotiation team, and develop a clear strategy will maximize their earnings. Performance bonuses, endorsement opportunities, and long-term financial stability are key components of successful contract negotiations.

Professional financial guidance proves essential in this process. The complexities of sports contracts, combined with unique financial challenges athletes face, make specialized advice invaluable. A knowledgeable financial advisor will help athletes make informed decisions about contract structures, investment strategies, and long-term financial planning.

Davies Wealth Management supports professional athletes through every stage of their financial journey. We understand the nuances of sports contracts and provide tailored advice to help athletes maximize their earnings and secure their financial future. Our team offers comprehensive wealth management solutions, including investment management, retirement planning, and tax-efficient strategies.

Leave a Reply