Tax planning in Stuart, Florida is a powerful tool for maximizing your savings and securing your financial future. At Davies Wealth Management, we understand the unique tax landscape of our local community and its impact on your wealth.

Our expertise in tax planning strategies can help you navigate the complexities of Florida’s tax system, ensuring you take advantage of every opportunity to reduce your tax burden.

In this guide, we’ll explore effective tax planning techniques tailored specifically for Stuart residents, empowering you to make informed decisions about your finances and build long-term wealth.

How Stuart’s Tax Landscape Shapes Your Financial Future

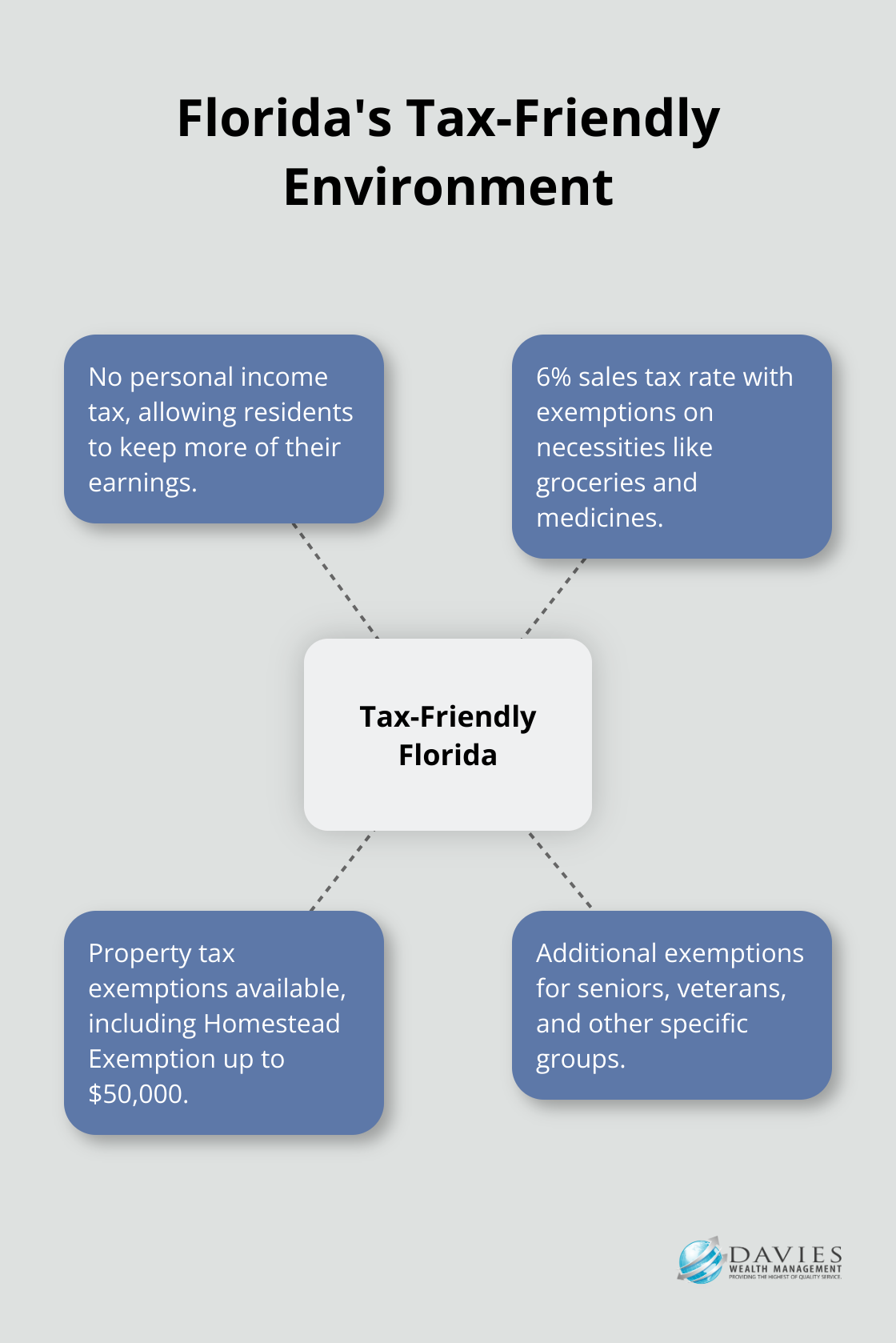

Florida’s Tax-Friendly Environment

Stuart residents benefit from Florida’s unique tax landscape. As one of seven states with no personal income tax, Florida allows its residents to keep more of their earnings. This tax-friendly environment makes Florida particularly attractive for older workers and retirees.

While Florida imposes a 6% sales tax rate, necessities like groceries and medicines remain exempt, which eases the burden on everyday expenses. It’s important to note that local sales taxes may be added in some areas, potentially increasing the total rate. Stuart residents should familiarize themselves with their local rates for accurate budgeting.

Property Tax Considerations in Stuart

Florida’s property taxes can be significant, but several exemptions offer relief to Stuart homeowners. The Homestead Exemption can reduce property tax liabilities on primary residences. Property owners in Florida may be eligible for exemptions and additional benefits that can reduce their property tax liability.

Additional exemptions exist for specific groups:

- Widows and widowers who haven’t remarried can claim an exemption

- Senior citizens (65 and older) may qualify for extra exemptions in certain counties

- Veterans with service-connected disabilities may be eligible for additional exemptions

The Power of Proactive Tax Planning

Stuart’s unique tax environment demands proactive planning. Effective tax strategies often result in savings that exceed planning fees. This approach requires year-round vigilance, not just year-end scrambling.

A review of past tax returns can uncover missed deductions and errors, potentially leading to substantial tax savings. Many clients have identified overlooked opportunities that resulted in significant financial benefits.

Florida offers various tax incentives for businesses, including corporate income tax incentives and sales and use tax incentives. These can prove particularly beneficial for Stuart residents who own businesses or contemplate starting one.

Leveraging Local Expertise

To maximize the benefits of Stuart’s tax landscape, working with professionals who understand local nuances proves invaluable. Tax professionals who regularly attend seminars and pursue continuous education stay current with the most effective tax planning strategies for Stuart residents.

This local expertise allows for the creation of tailored strategies that take full advantage of Stuart’s unique tax environment. From maximizing property tax exemptions to navigating business incentives, a knowledgeable tax professional can help Stuart residents optimize their tax situation and build long-term wealth.

As we move forward, let’s explore specific tax planning strategies that Stuart residents can employ to further reduce their tax burden and increase their savings.

Smart Tax Strategies for Stuart Residents

Maximizing Local Tax Benefits

Stuart’s unique tax environment offers several opportunities for savvy residents. The absence of state income tax is just the beginning. We recommend a thorough exploration of property tax exemptions. The Homestead Exemption can reduce your property tax liability by up to $50,000. Senior citizens may qualify for additional exemptions worth up to $50,000 in certain counties. Veterans with service-connected disabilities might be eligible for a $5,000 exemption.

Don’t overlook less common exemptions. Widows and widowers who haven’t remarried can claim a $500 exemption. Blind residents are also eligible for a $500 exemption. These may seem small, but they accumulate over time.

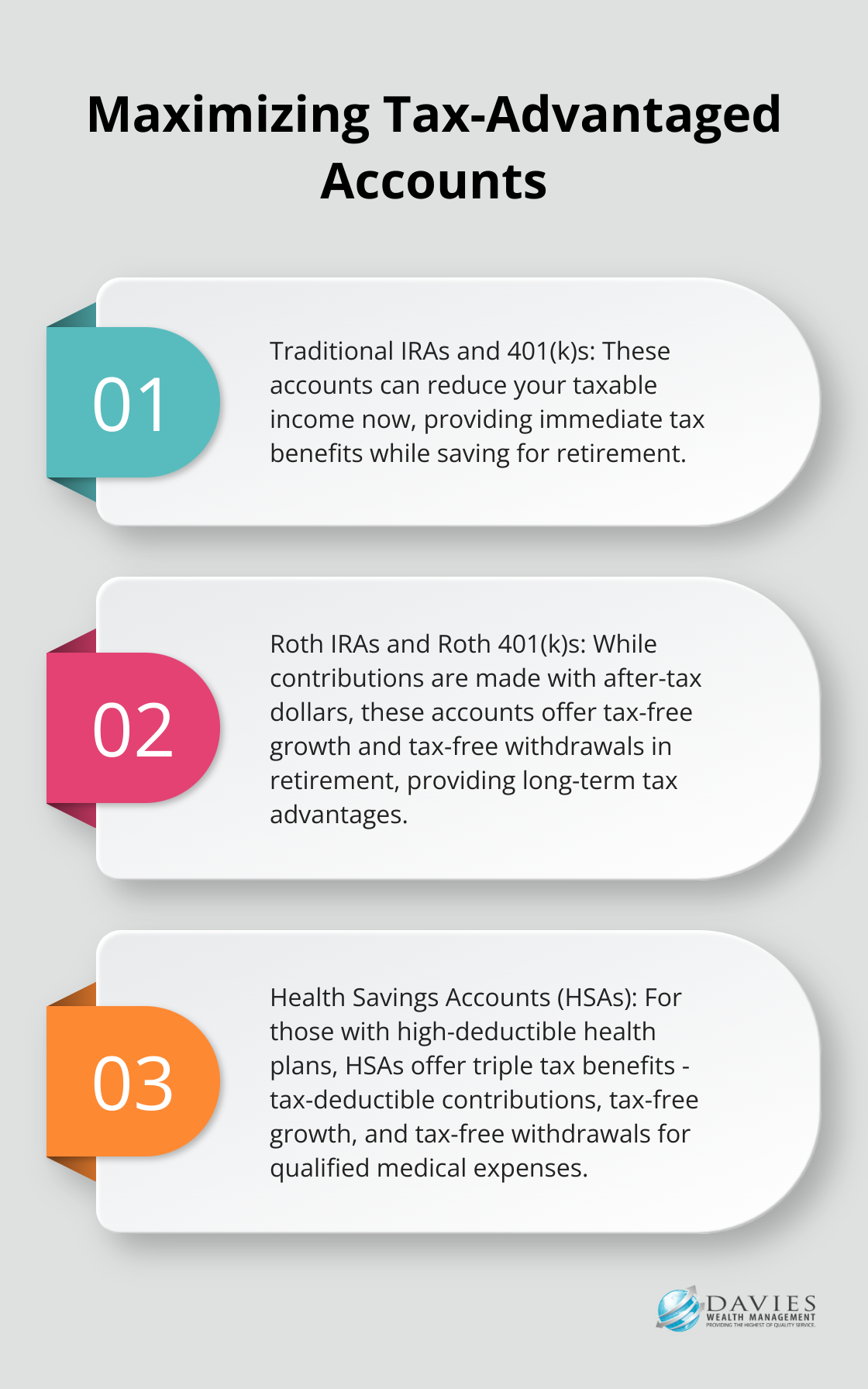

Leveraging Tax-Advantaged Accounts

While Florida doesn’t have a state income tax, federal taxes still apply. We advise our clients to maximize contributions to tax-advantaged accounts. Traditional IRAs and 401(k)s can reduce your taxable income now, while Roth options offer tax-free growth for the future.

For Stuart residents with high-deductible health plans, Health Savings Accounts (HSAs) offer triple tax benefits: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. This often-overlooked opportunity can lead to significant tax savings and future healthcare cost management.

Strategic Investment Approaches

Investment strategy plays a key role in tax efficiency. We recommend consideration of municipal bonds, which can provide tax-free income at the federal level and, for Florida residents, at the state level as well. This can particularly benefit high-income earners in Stuart who want to reduce their tax burden.

For taxable investment accounts, we often suggest a tax-loss harvesting strategy. This involves selling investments at a loss to offset capital gains, potentially reducing your tax liability. It’s a complex strategy that requires careful execution, but when done correctly, it can yield substantial tax savings.

Customized Tax Planning

Tax planning is not a one-size-fits-all approach. Your unique financial situation, goals, and risk tolerance all play a role in determining the most effective tax strategy for you. Professional guidance can help you navigate these complexities and maximize your savings in Stuart’s unique tax landscape.

The Importance of Local Expertise

To fully capitalize on Stuart’s tax landscape, working with professionals who understand local nuances proves invaluable. Tax professionals who regularly attend seminars and pursue continuous education stay current with the most effective tax planning strategies for Stuart residents. This local expertise allows for the creation of tailored strategies that take full advantage of Stuart’s unique tax environment (from maximizing property tax exemptions to navigating business incentives).

As we move forward, let’s explore how working with a Stuart-based tax professional can further enhance your financial strategy and help you achieve your long-term financial goals.

Working with a Stuart-based Tax Professional: Maximizing Local Expertise

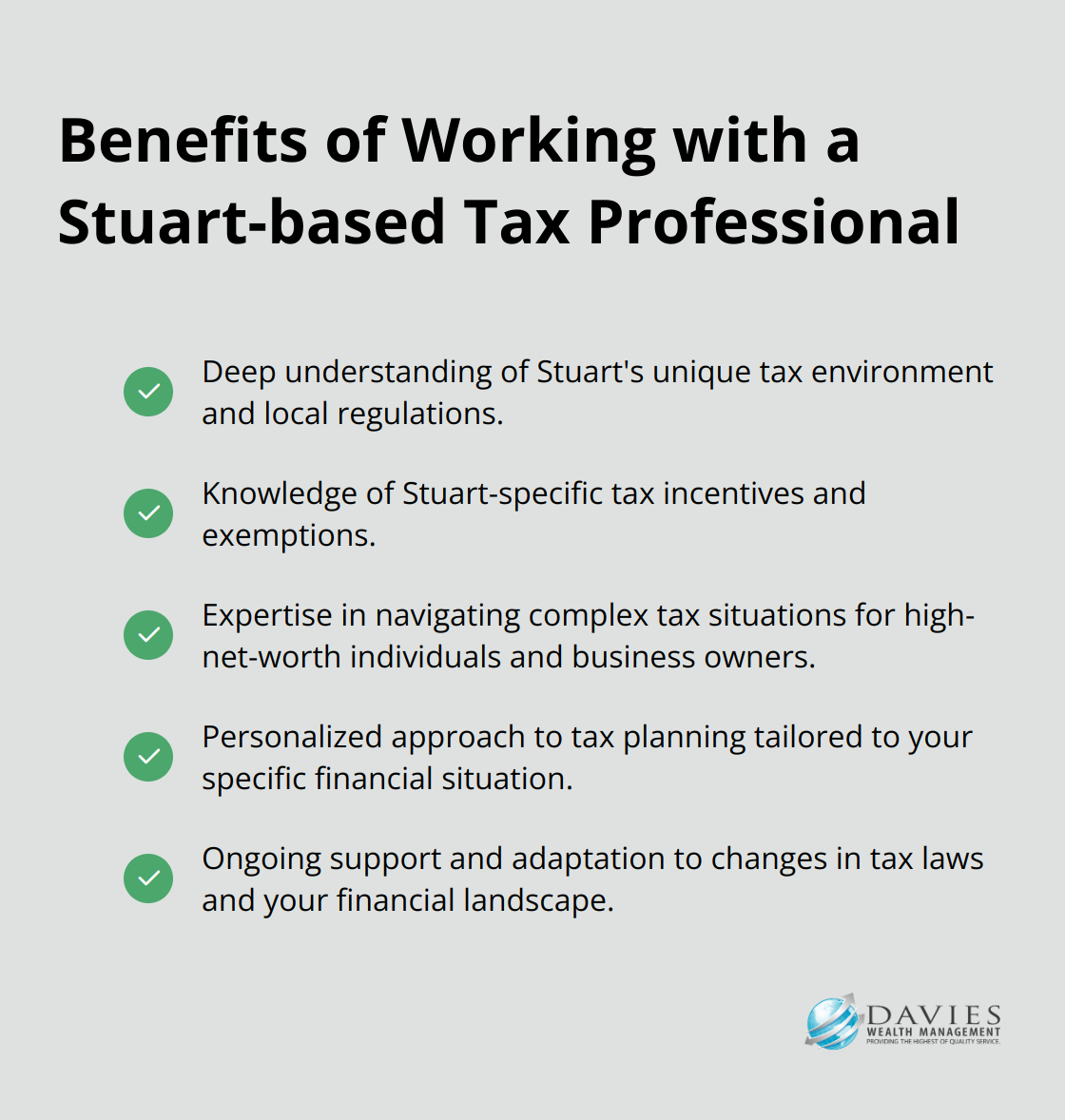

The Value of Local Knowledge

Tax planning in Stuart, Florida requires a deep understanding of both state and local regulations. Stuart’s tax environment differs from other parts of Florida. While the state doesn’t impose an income tax, local property taxes can be substantial. A tax professional with intimate knowledge of Stuart’s property tax exemptions can help you maximize your savings. They’ll know which exemptions you qualify for and how to apply them effectively.

Local experts also stay updated on Stuart-specific tax incentives. For example, Martin County (where Stuart is located) introduced new tax incentives for businesses in certain industries in 2022. The Rural Job Tax Credit Program offers a tax credit for eligible businesses to create new jobs. A local tax professional would be aware of these opportunities and could help you leverage them to your advantage.

Navigating Complex Tax Situations

Tax planning becomes particularly complex for high-net-worth individuals and business owners in Stuart. Local tax professionals understand the intricacies of Florida’s corporate tax structure and can guide you through strategies to minimize your tax burden.

Florida’s Corporate Income Tax rate stands at 5.5% as of 2023. However, various credits and exemptions exist that a local expert can help you utilize. They might suggest strategies like timing your income recognition or structuring your business in a way that maximizes tax efficiency within Florida’s specific framework.

Personalized Approach to Tax Planning

A personalized approach to tax planning yields the best results. Generic strategies often fall short; instead, a tailored approach to each client’s unique situation proves most effective. This might involve analyzing your investment portfolio for tax-loss harvesting opportunities, advising on the tax implications of real estate transactions in Stuart, or helping you structure your retirement withdrawals to minimize tax impact.

Ongoing Support and Adaptation

Effective tax planning is an ongoing process, not a one-time event. As your financial situation evolves and tax laws change, your strategy should adapt accordingly. Working with a local tax professional ensures you have a partner who understands both your personal financial landscape and the broader tax environment of Stuart, Florida.

Choosing the Right Tax Professional

When selecting a tax professional in Stuart, look for someone with a proven track record of success in the local area. They should demonstrate a thorough understanding of Florida’s tax laws (including recent changes) and have experience working with clients in similar financial situations to yours.

Consider professionals who offer comprehensive financial services, as tax planning often intersects with other areas of wealth management. For instance, Davies Wealth Management provides a range of financial services, including tax planning, which allows for a more holistic approach to your financial strategy.

Final Thoughts

Tax planning in Stuart, Florida provides unique opportunities for residents to maximize their savings and secure their financial future. The state’s tax-friendly environment, including no personal income tax and various property tax exemptions, allows Stuart residents to significantly reduce their tax burden. Effective strategies such as maximizing deductions, using tax-advantaged accounts, and implementing tax-efficient investment approaches can lead to substantial long-term benefits.

Proper tax planning sets the foundation for long-term financial success, allowing you to retain more of your hard-earned money and allocate it towards your financial goals. Whether you save for retirement, plan for your children’s education, or build wealth for future generations, a well-executed tax strategy can accelerate your progress and provide peace of mind. Tax planning in Stuart, Florida requires local expertise to navigate the nuances of state and local regulations effectively.

Davies Wealth Management offers comprehensive financial services, including tailored tax planning strategies for individuals, families, and businesses in Stuart. Our team of experts can help you create a personalized plan that aligns with your financial goals and takes full advantage of Stuart’s unique tax landscape (including recent changes to local regulations). We recommend you seek professional guidance to optimize your tax situation and position yourself for long-term financial success in Stuart, Florida.

Leave a Reply