Tax planning in Stuart, Florida offers unique opportunities for residents to maximize their savings. At Davies Wealth Management, we understand the importance of tailoring tax strategies to our local community’s needs.

Florida’s tax-friendly environment, combined with smart investment choices and expert guidance, can significantly reduce your tax burden. This blog post will explore effective tax planning techniques, investment strategies, and the benefits of working with local professionals to help you keep more of your hard-earned money.

How Can Stuart Residents Optimize Their Tax Planning?

Harnessing Florida’s Tax-Friendly Environment

Stuart residents benefit from Florida’s absence of state income tax. However, it’s important to note that a 2024 study found Florida residents with an income of $19,600 pay a larger share of their income in taxes compared to some other states. At Davies Wealth Management, we encourage our clients to use Florida’s tax advantages strategically. Consider how it impacts your overall financial picture, especially if you’re nearing retirement or contemplating relocation.

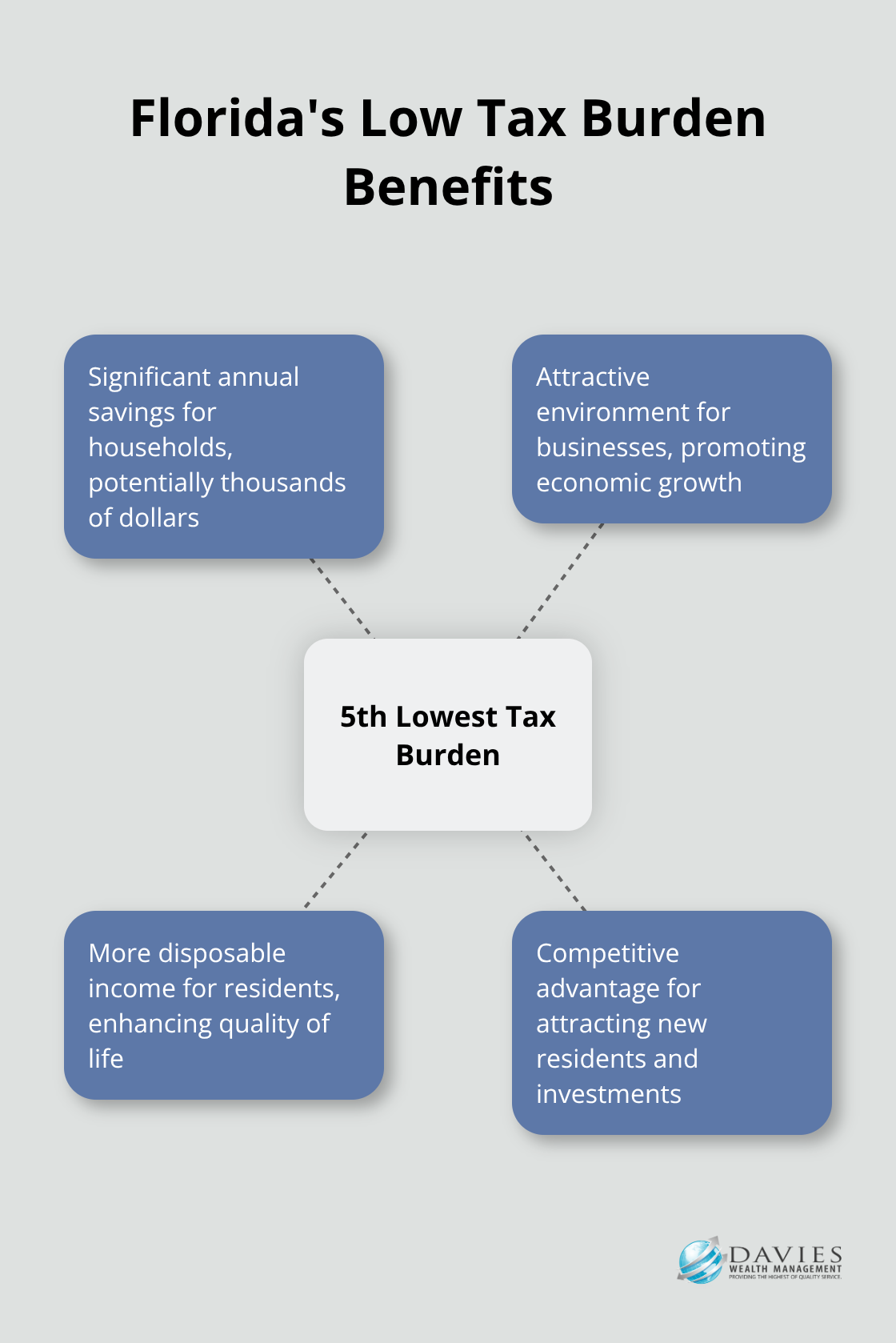

The Tax Foundation ranks Florida fifth-lowest in overall tax burden for residents and businesses. This favorable ranking translates into real dollars saved over time (potentially thousands annually for many households).

Maximizing Local Tax Breaks and Deductions

While Florida’s lack of state income tax stands out, numerous other local tax advantages exist. The Homestead Exemption reduces property tax liability for primary residences in Stuart. To qualify, you must declare Florida as your permanent residence.

Additional benefits exist for specific groups:

- Residents aged 65 or older may qualify for an extra homestead exemption (up to $50,000, depending on local regulations).

- Veterans, particularly those with service-connected disabilities, can access substantial property tax exemptions.

- In some cases, disabled veterans may receive complete exemption from property taxes.

Smart Retirement Account Management

Retirement accounts offer powerful tax advantages, which Florida’s tax-friendly environment amplifies. We often recommend our clients maximize contributions to tax-advantaged accounts like 401(k)s and IRAs. These contributions can significantly reduce your current tax bill while setting you up for a more secure retirement.

For those over 50, catch-up contributions allow even more savings. In 2023, individuals can contribute an additional $7,500 to their 401(k) plans and an extra $1,000 to their IRAs. This strategy not only boosts retirement savings but also provides immediate tax relief.

Strategic Charitable Giving

Charitable giving supports causes you care about and serves as a powerful tax planning tool. In Stuart, many clients implement donor-advised funds and qualified charitable distributions to maximize their tax benefits while supporting their philanthropic goals.

If you’re over 70½, you can make qualified charitable distributions directly from your IRA to eligible charities. Each year, an IRA owner can exclude from gross income up to $100,000 of these QCDs. This strategy satisfies your required minimum distribution (RMD) without increasing your taxable income. It reduces your tax burden while supporting causes you care about (a true win-win situation).

Year-Round Tax Planning

Effective tax planning requires an ongoing process, not just a once-a-year event. Regular reviews of your financial situation can help you identify new opportunities to reduce your tax burden. This proactive approach ensures you keep more of your hard-earned money working for you.

As we move forward, let’s explore how smart investment strategies can further minimize your tax liability and boost your overall financial health.

How Smart Investing Reduces Your Tax Burden

At Davies Wealth Management, we believe intelligent investment strategies play a key role in minimizing tax liability and maximizing wealth accumulation. Our approach combines tax-efficient investment vehicles, strategic asset allocation, and timely tax-loss harvesting to help our clients in Stuart, FL keep more of their hard-earned money.

Tax-Efficient Investment Vehicles

One of the most effective ways to reduce your tax burden is to utilize tax-efficient investment vehicles. Municipal bonds offer tax-free income at both federal and state levels. This makes them particularly attractive for high-income earners in Stuart. Benefits to investors in municipal bonds include the fact that interest on such bonds generally is exempt from federal income tax and may also be exempt from state income tax.

Exchange-traded funds (ETFs) are another tax-efficient option. Unlike mutual funds, ETFs typically generate fewer capital gains distributions, resulting in lower tax bills for investors.

Asset Location for Tax Efficiency

Asset location is a critical yet often overlooked aspect of tax-efficient investing. This strategy involves placing investments in accounts where they’ll incur the least amount of taxes. We often recommend holding high-yield bonds and real estate investment trusts (REITs) in tax-advantaged accounts like IRAs or 401(k)s. These investments generate significant taxable income, which can be sheltered in tax-deferred or tax-free accounts.

Conversely, growth stocks or index funds that pay little to no dividends are often better suited for taxable accounts. When held long-term, these investments benefit from preferential capital gains tax rates.

Tax-Loss Harvesting Techniques

Tax-loss harvesting is a powerful technique for reducing current-year tax liability. This strategy involves selling investments that have declined in value to realize losses, which can then offset capital gains or up to $3,000 of ordinary income per year. Any excess losses can be carried forward to future tax years.

Betterment’s tax loss harvesting approaches tax-efficiency holistically, seeking to optimize transactions, including customer activity.

It’s important to note that tax-loss harvesting requires careful execution to avoid running afoul of wash sale rules. These rules prohibit claiming a loss on a security if you purchase a “substantially identical” security within 30 days before or after the sale.

Roth Conversion Considerations

For many of our clients in Stuart, Roth conversions present an opportunity to reduce future tax liability. This strategy involves converting traditional IRA assets to a Roth IRA, paying taxes on the converted amount now in exchange for tax-free growth and withdrawals in retirement.

Roth conversions can be particularly beneficial if you expect to be in a higher tax bracket in retirement or if you want to leave a tax-free inheritance to your heirs.

The key to successful Roth conversions is timing. We often recommend executing conversions in years when your income is lower, or when market downturns have temporarily depressed the value of your IRA assets.

Implementing these investment strategies requires careful planning and ongoing management. Smart investing can significantly reduce your tax burden, but it’s only one piece of the puzzle. The next chapter will explore how working with a local tax professional in Stuart, FL can further enhance your tax planning efforts and help you achieve your financial goals.

Why Local Tax Expertise Matters in Stuart

The Value of Stuart-Specific Knowledge

Local tax professionals possess invaluable insights into Stuart’s unique tax landscape. They understand the intricacies of the County Property Appraiser’s office procedures, which can be crucial when applying for homestead exemptions or contesting property valuations. This local expertise often translates into substantial savings for Stuart residents.

Selecting Your Stuart Tax Advisor

When choosing a tax professional in Stuart, look for someone with a proven track record of success in our community. Ask potential advisors about their experience with local tax issues, such as navigating Stuart’s Community Redevelopment Agency (CRA) tax increment financing or understanding the tax implications of owning property in flood zones.

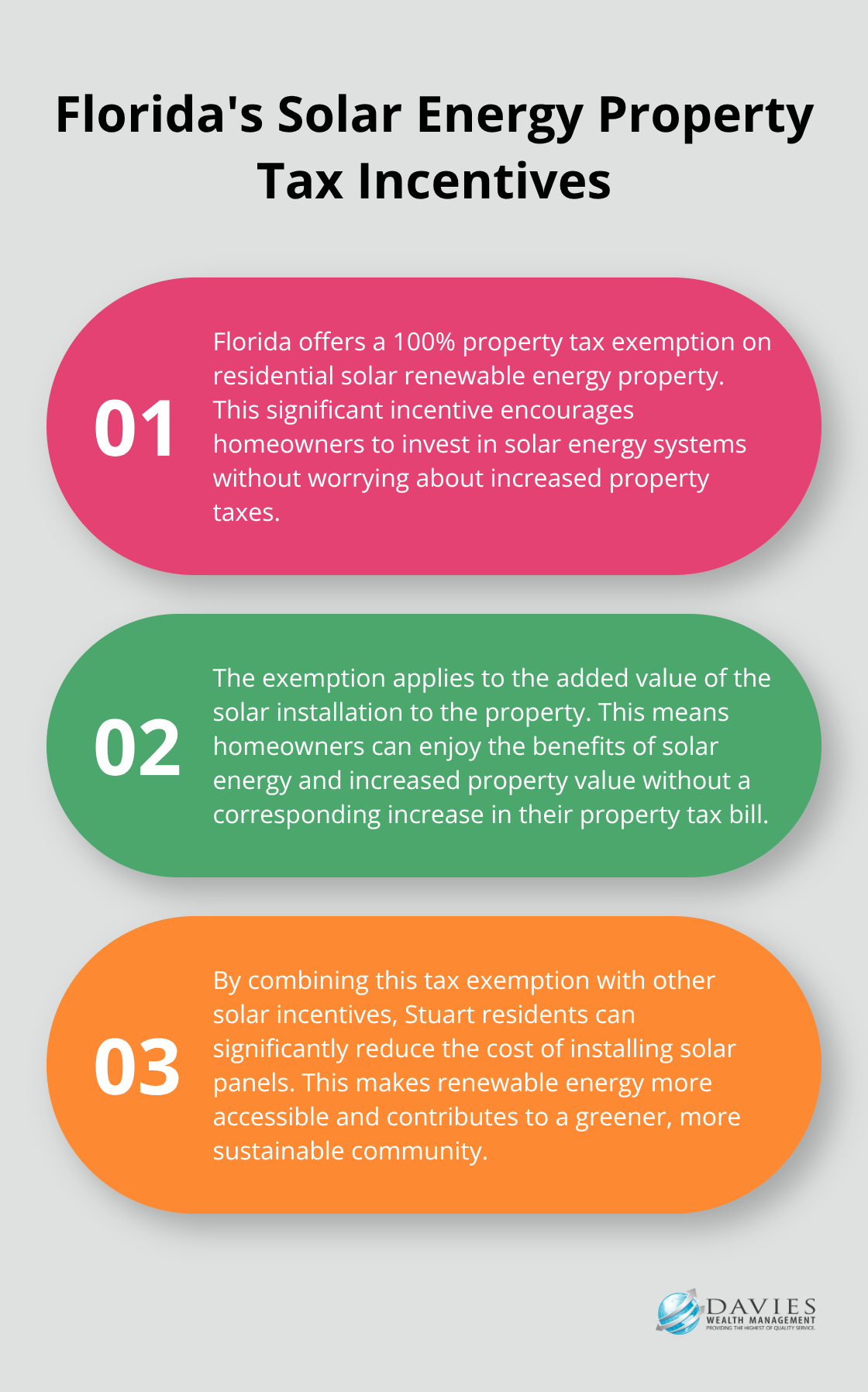

It’s also important to find an advisor who stays current with Florida’s ever-changing tax laws. For example, Florida offers a 100% property tax exemption on residential solar renewable energy property. A local tax professional would know these changes and could help you capitalize on such opportunities.

The Power of Year-Round Tax Planning

Effective tax planning isn’t a once-a-year event; it’s an ongoing process. A local tax professional can provide year-round support, helping you make informed decisions that impact your tax situation. This proactive approach can lead to significant savings.

Year-end tax planning can be as simple as planning ahead, but there are considerations you should make now. In Stuart, this year-round approach might involve strategies like timing the sale of your boat to maximize capital gains treatment or structuring your real estate investments to take advantage of Florida’s favorable tax laws for rental properties.

Synergy Between Tax and Financial Planning

The most effective tax strategies align with your overall financial goals. That’s why it’s important for your tax professional to work in tandem with your financial advisor. Many local tax professionals have established strong relationships with financial advisors, allowing for seamless coordination of tax and investment strategies.

This collaborative approach can yield significant benefits. For example, a coordinated effort between a tax professional and financial advisor could implement a Roth conversion strategy that takes advantage of a temporary dip in income due to a sabbatical (resulting in substantial long-term tax savings for the client).

In Stuart, where many residents have complex financial situations involving multiple income streams, investment properties, and retirement accounts, this synergy between tax and financial planning is particularly valuable. It ensures that every financial decision is made with a full understanding of its tax implications, maximizing your overall financial efficiency.

Final Thoughts

Tax planning in Stuart, Florida offers unique opportunities for residents to maximize their savings. A strategic approach can lead to significant financial growth through the use of local deductions, smart investment strategies, and Florida’s tax-friendly environment. We recommend a comprehensive review of your current financial situation as the first step in optimizing your tax strategy.

Our team at Davies Wealth Management specializes in tax planning for Stuart, Florida residents. We understand the specific tax landscape of our community and can help you navigate its complexities. Our experts can develop a tailored strategy that aligns with your overall financial goals (while considering your unique circumstances).

Effective tax planning adapts to changing life circumstances and evolving tax laws. We encourage you to stay proactive in your approach to ensure your tax planning efforts continue to support your financial success. Contact Davies Wealth Management today to take the next step in your tax planning journey.

✅ Schedule a Personalized Appointment

Take the next step in your financial journey by booking a private consultation:

https://davieswealth.tdwealth.net/appointment-page

Explore Our Latest Insights

Stay informed with our most recent articles on retirement, investing, and wealth management:

https://tdwealth.net/articles/

Stay Connected on YouTube

If you find our content valuable, a quick “like” goes a long way in helping others discover it.

https://www.youtube.com/channel/UChmBYECKIzlEBFDDDBu-UIg

Have Questions? Get in Touch

Reach out directly at: TDavies@TDWealth.Net

Download Our Complimentary Guides

Gain clarity and confidence in your financial planning with our free resources:

- Retirement Income: Transition Into Retirement

- https://davieswealth.tdwealth.net/retirement-income-transition-into-retirement

- Beginner’s Guide to Investing Basics

- https://davieswealth.tdwealth.net/investing-basics

Connect with Davies Wealth Management

Website: https://tdwealth.net

Podcast: https://1715tcf.com

Follow Us on Social Media:

- Facebook https://www.facebook.com/DaviesWealthManagement

- X (Twitter) https://x.com/TDWealthNet

- LinkedIn https://www.linkedin.com/in/daviesrthomas

- YouTube https://www.youtube.com/c/TdwealthNetWealthManagement

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

(772) 210-4031

Lat/Long: 27.17404889406371, -80.24410438798957

⚠️ Disclaimer

The information provided by Davies Wealth Management is for educational purposes only and should not be interpreted as financial, tax, or legal advice. We recommend consulting qualified professionals before making financial decisions. Davies Wealth Management is not liable for any actions taken without personalized guidance.

Leave a Reply