Strategic financial planning is the cornerstone of long-term financial success. It’s a comprehensive approach that goes beyond day-to-day money management, focusing on achieving your most important life goals.

At Davies Wealth Management, we’ve seen firsthand how a well-crafted financial strategy can transform lives and secure futures. This guide will walk you through the essential elements of effective financial planning, helping you create a roadmap for your financial journey.

What Is Strategic Financial Planning?

The Essence of Long-Term Financial Vision

Strategic financial planning uses data analysis, creative strategies, and team management to promote profitability, growth, and the long-term success of a business. It creates a roadmap for your financial future, aligning money management with long-term life goals. This approach can dramatically improve financial outcomes for individuals and families.

Strategic financial planning doesn’t just save money or invest wisely. It envisions your ideal future and uses financial tools to make that vision a reality. This could mean planning for early retirement, funding children’s education, or building a legacy for future generations.

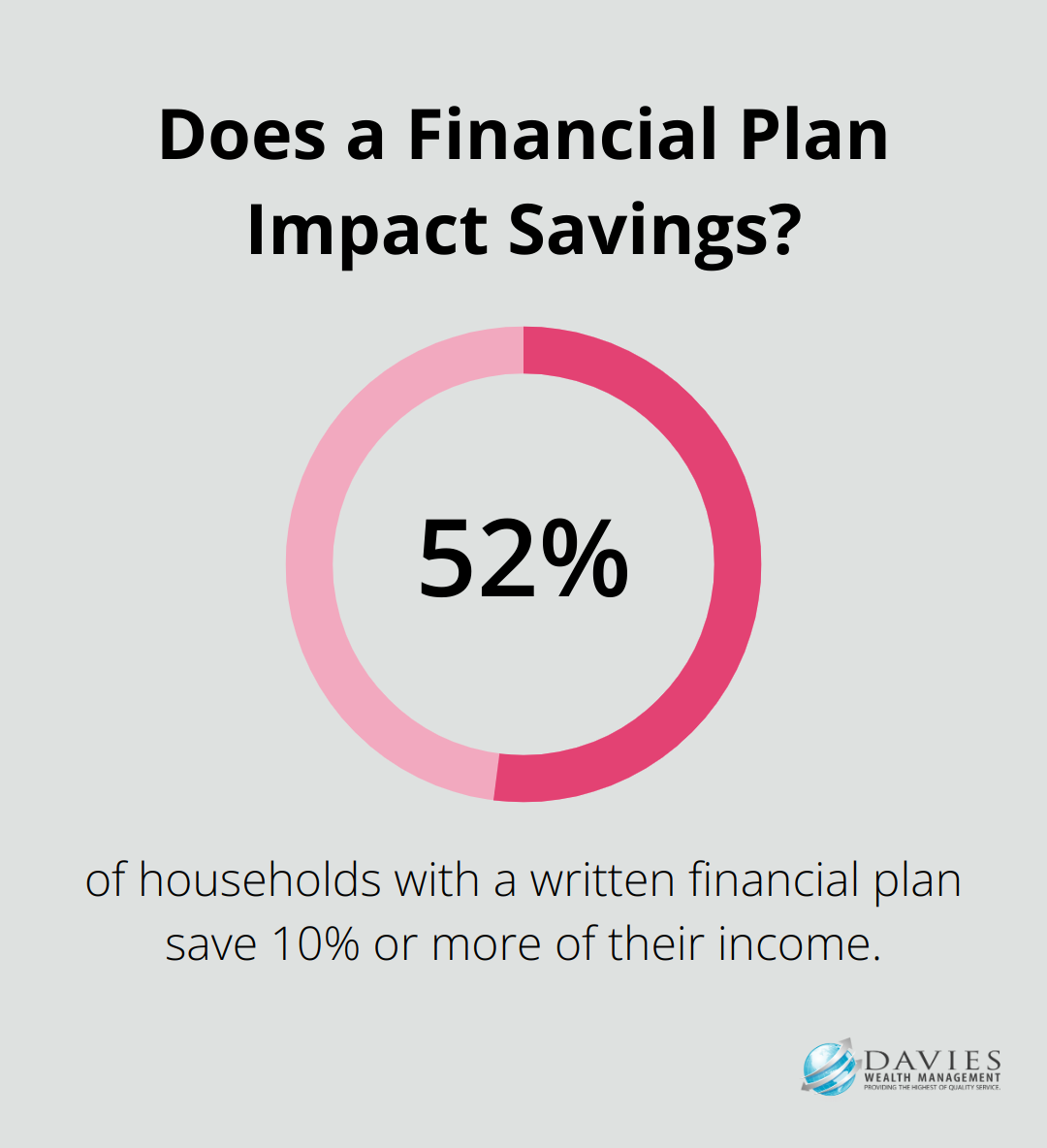

Studies show that 52% of households that have a written financial plan save 10% or more of their income, compared with 36% of those that do not. These individuals also report higher levels of financial stability and greater life satisfaction.

Key Components of a Robust Financial Strategy

A comprehensive financial strategy should include several key elements:

- Goal Setting: Clear, measurable financial objectives.

- Risk Assessment: Understanding risk tolerance and potential financial threats.

- Asset Allocation: Diversifying investments across various asset classes.

- Tax Planning: Strategies to minimize tax liabilities and maximize after-tax returns.

- Estate Planning: Ensuring asset distribution according to your wishes.

For professional athletes, strategic financial planning also focuses on career transition planning and managing irregular income streams.

Beyond Short-Term Money Management

While day-to-day money management matters, strategic financial planning takes a broader view. It considers economic trends, market cycles, and life changes that could impact your financial future.

A short-term approach might focus on saving for next year’s vacation. A strategic approach considers how that vacation fits into your overall financial picture, balancing it with long-term goals like retirement savings.

The Role of Professional Guidance

Navigating complex financial decisions requires expertise. Professional financial advisors (like those at Davies Wealth Management) help clients ensure their short-term actions align with their long-term financial vision. Whether you’re a professional athlete planning for life after sports or a business owner looking to secure your family’s future, a strategic financial plan provides the roadmap needed for long-term financial success.

As we move forward, let’s explore the essential elements that make up an effective financial plan. These components will help you create a solid foundation for your financial future and achieve your long-term goals.

Building Your Financial Foundation

Goal Setting: The North Star of Your Financial Journey

Financial goals act as the guiding light for your financial decisions. They should be specific, measurable, achievable, relevant, and time-bound (SMART). SMART financial goals can help you achieve financial freedom.

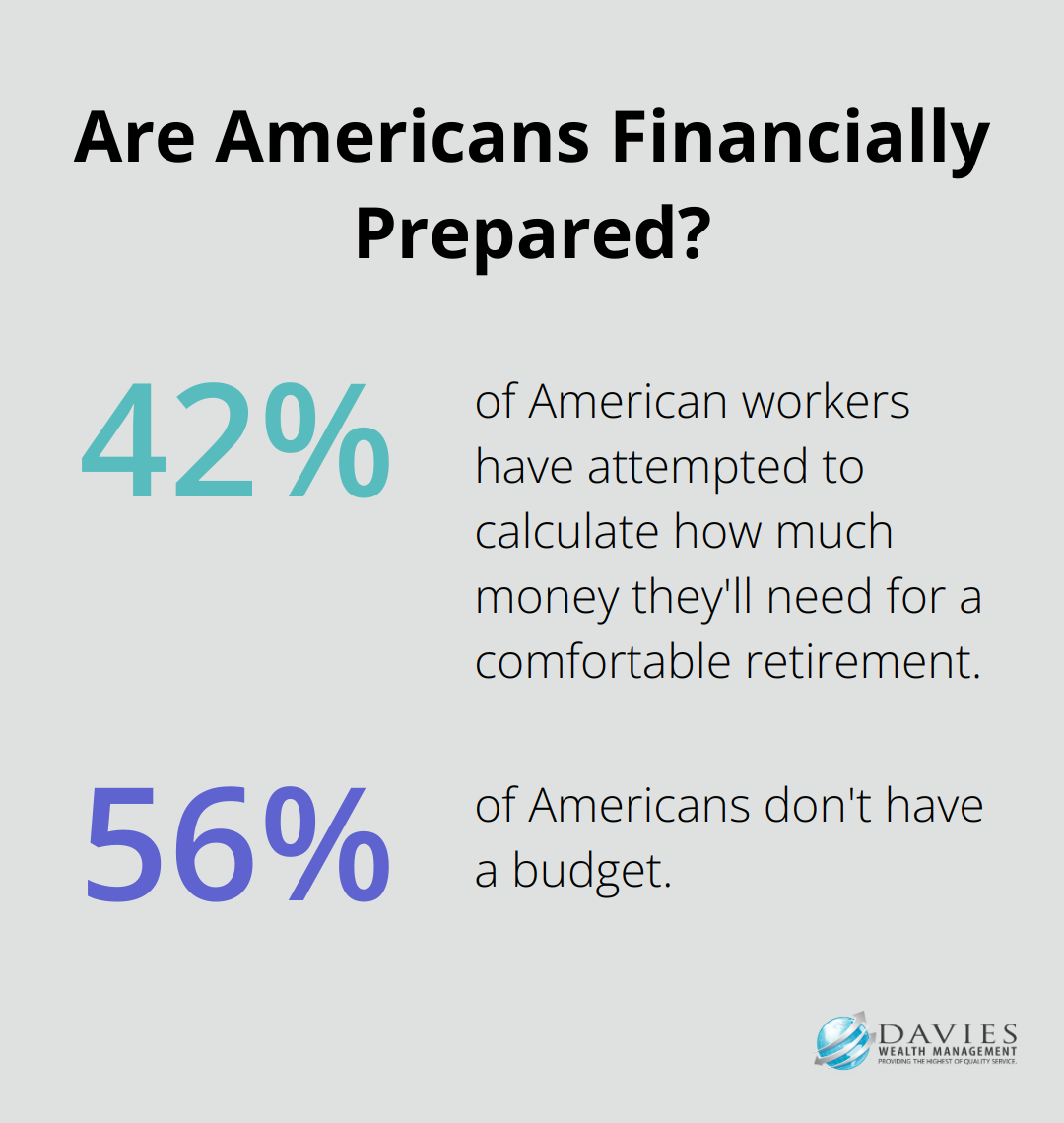

A study by the Employee Benefit Research Institute reveals that only 42% of American workers have attempted to calculate how much money they’ll need for a comfortable retirement. This lack of planning can result in financial insecurity in later years. Setting clear goals creates a roadmap for your financial future and increases your chances of success.

Financial Analysis: Understanding Your Current Position

Before you chart a course for the future, you must understand where you stand today. This involves a thorough analysis of your income, expenses, assets, and liabilities. Tools like personal finance software can help track spending patterns and identify areas for improvement.

The National Foundation for Credit Counseling found that 56% of Americans don’t have a budget. Without this basic financial tool, making informed decisions about saving and spending becomes challenging. Regular financial check-ups (ideally quarterly) can help you stay on track and make necessary adjustments.

Risk Management: Protecting Your Financial Future

No financial plan is complete without a robust risk management strategy. This includes appropriate insurance coverage (life, health, disability, property), an emergency fund, and strategies to mitigate investment risk.

Having a reserve fund for financial shocks can help you avoid relying on other forms of credit or loans that can turn into debt. For professional athletes, who may have irregular income streams, a larger cushion of 12-18 months is often recommended.

Diversification: The Key to Long-Term Investment Success

Diversification forms a cornerstone of sound investment strategy. It involves spreading investments across various asset classes to balance risk and potential returns. A diversified portfolio can be built with Vanguard ETFs, based on statistical analysis of historical data.

A mix of stocks, bonds, real estate, and alternative investments is typically recommended. The exact allocation depends on individual factors such as age, risk tolerance, and financial goals. Regular rebalancing ensures your portfolio stays aligned with your target allocation as market conditions change.

As we move forward, let’s explore how to implement and monitor your financial plan effectively. This next step will transform your financial foundation into actionable strategies for long-term success.

Turning Your Financial Plan into Reality

From Strategy to Action

The implementation of a strategic financial plan marks the transition from theory to practice. This phase transforms your carefully crafted strategy into concrete actions and measurable progress. At Davies Wealth Management, we guide clients through this critical stage and have identified key steps to ensure success.

The first step in implementing your financial plan is to prioritize your goals. While your plan may encompass various objectives, it’s important to focus on the most critical ones initially. For example, if building an emergency fund is a top priority, allocate a specific percentage of your income towards this goal before addressing other financial targets.

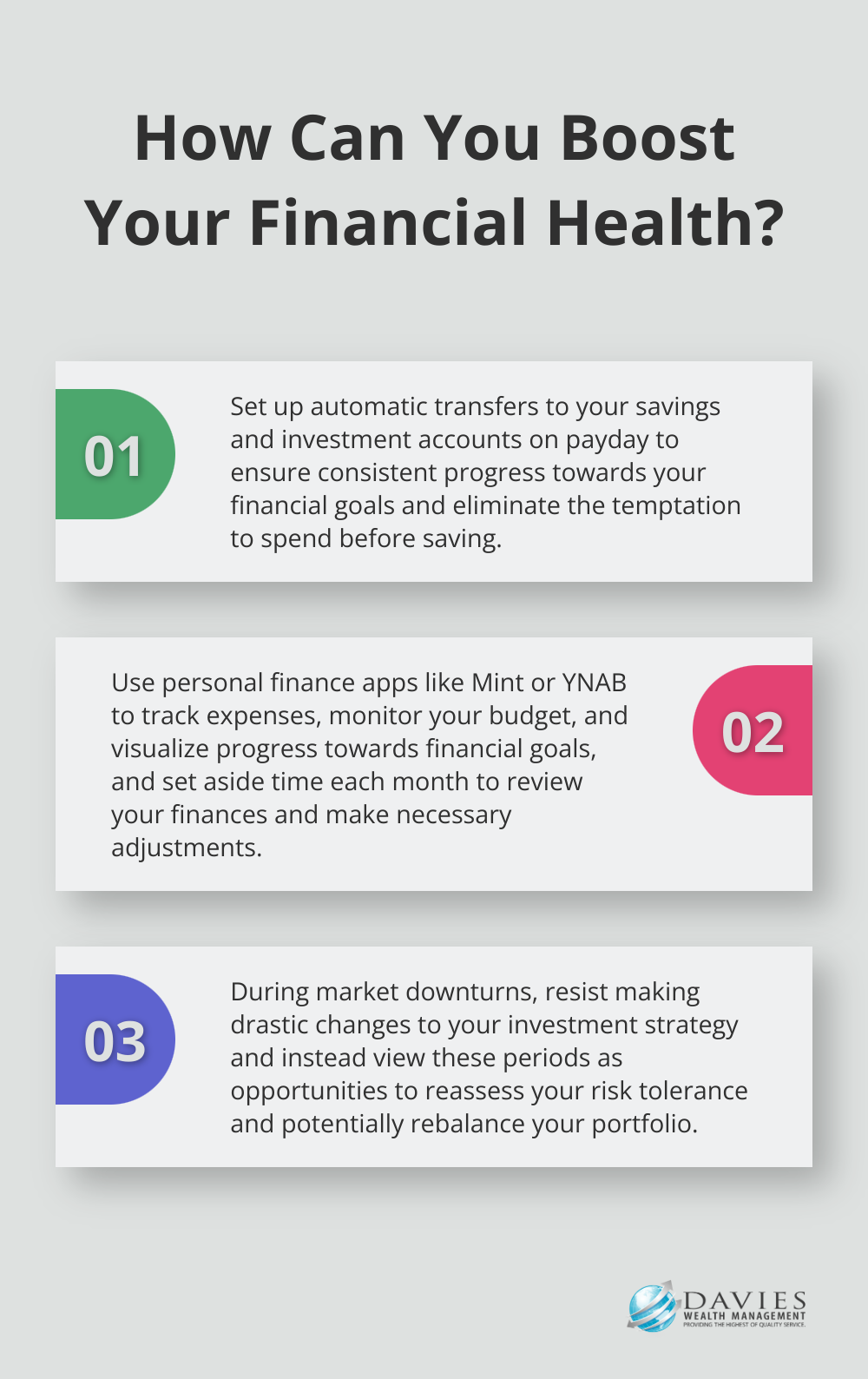

Next, automate your financial processes wherever possible. Set up automatic transfers to your savings and investment accounts on payday. This simple step eliminates the temptation to spend before saving and ensures consistent progress towards your goals.

Tools for Tracking Financial Success

Monitoring your financial progress is essential for long-term success. Numerous tools simplify this process. Personal finance apps (such as Mint or YNAB) can help you track expenses, monitor your budget, and visualize your progress towards financial goals.

For investment tracking, platforms like Personal Capital offer comprehensive portfolio analysis tools. These can help you monitor your asset allocation, track performance, and identify areas that may need rebalancing.

Regular check-ins are vital. Set aside time each month to review your finances. During these sessions, assess your progress, identify any discrepancies, and make necessary adjustments. This habit of regular financial review can significantly impact your long-term financial health.

Adapting to Change

Life is unpredictable, and your financial plan should be flexible enough to adapt to changing circumstances. Major life events such as marriage, the birth of a child, or a career change can significantly impact your financial situation and goals.

When faced with such changes, revisit your financial plan promptly. Reassess your goals, adjust your budget, and realign your investment strategy if necessary. For instance, the arrival of a child might necessitate an increase in your life insurance coverage or the start of a college savings fund.

Economic shifts can also impact your financial plan. During market downturns, resist the urge to make drastic changes to your investment strategy. Instead, view these periods as opportunities to reassess your risk tolerance and potentially rebalance your portfolio.

The Role of Professional Guidance

While self-management is possible, the complexities of financial planning often benefit from professional expertise. A study by Vanguard found that working with a financial advisor can potentially increase returns by about 3% per year.

Financial advisors specialize in navigating complex financial landscapes. For professional athletes, whose careers often involve unique financial challenges, this expertise can be particularly valuable. They help manage irregular income streams, plan for post-career transitions, and optimize tax strategies for high-earning years.

Implementing a financial plan is an ongoing process. It requires commitment, regular attention, and the flexibility to adapt to life’s changes. With the right tools, consistent effort, and professional guidance when needed, you can transform your financial strategy into a roadmap for long-term financial success.

Final Thoughts

Strategic financial planning shapes your future and builds the foundation for financial security. It requires commitment, but the rewards are substantial. You position yourself for a more secure financial future when you set clear goals, conduct thorough analysis, manage risks, and diversify investments.

Now is the time to take action. Assess your current financial situation, define your goals, and implement your plan. Don’t hesitate to seek professional guidance – the expertise of a financial advisor can prove invaluable in navigating complex financial landscapes.

At Davies Wealth Management, we help individuals, families, and businesses achieve their financial goals through tailored wealth management solutions. Our team understands the unique challenges faced by different professionals (including athletes) and provides personalized advice to ensure your financial success. Take a step towards securing your financial future by embracing strategic financial planning and partnering with experienced professionals.

Leave a Reply