Digital assets have transformed how Stuart residents build and preserve wealth. Bitcoin reached $73,000 in 2024, while the total cryptocurrency market cap exceeded $2.3 trillion.

We at Davies Wealth Management see growing demand for professional guidance in this complex landscape. Florida’s favorable tax environment makes strategic digital asset planning even more valuable for local investors.

What Counts as Digital Wealth Today

Digital Assets Beyond Cryptocurrency

Digital wealth extends far beyond Bitcoin and Ethereum. Your Robinhood portfolio, digital bank accounts, PayPal balances, and NFT collections represent digital assets that require active management. The IRS treats cryptocurrency as property, which means every transaction triggers taxable events.

Stuart residents who hold digital assets must track cost basis and periods for each transaction. Smart investors maintain detailed records with platforms like CoinTracker or Koinly to calculate capital gains accurately. Traditional investment accounts accessed through apps like Fidelity or Charles Schwab also fall under digital wealth management and require secure access protocols plus regular oversight.

Florida’s Digital Asset Advantage

Florida provides significant advantages for digital asset holders through zero state income tax and favorable estate laws. The Florida Fiduciary Access to Digital Assets Act allows designated fiduciaries to access your digital accounts upon death or incapacity, but only if you properly document these preferences beforehand.

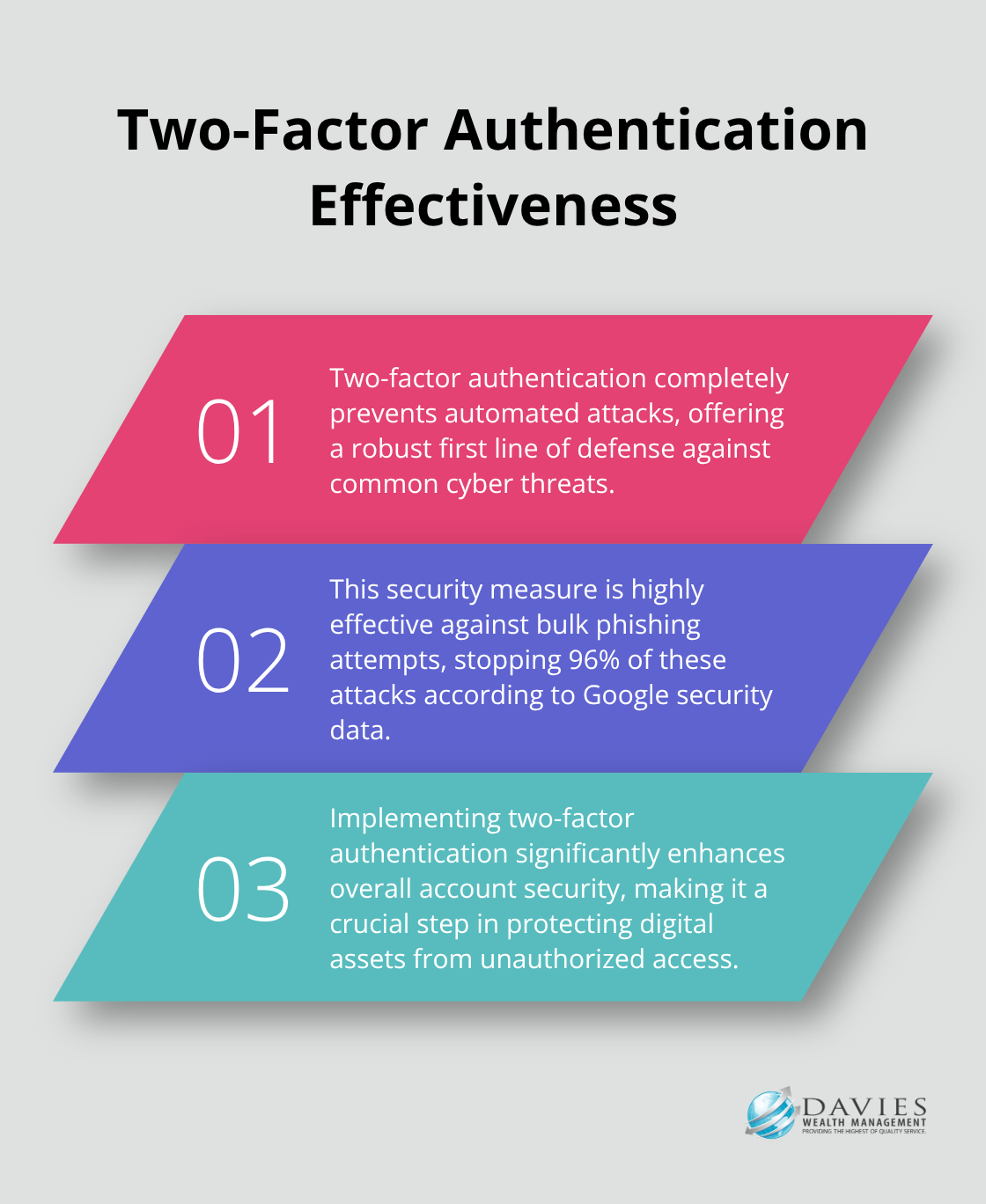

Ultra-high-net-worth families face unique risks (38% lack cybersecurity strategies according to Campden Wealth research). Two-factor authentication prevents 100% of automated attacks and 96% of bulk phishing attempts based on Google security data. Stuart residents should implement password managers like LastPass and monitor accounts daily for unauthorized activity, as the FBI reported 847,376 complaints in 2021.

Security Protocols That Matter

Password managers generate and store complex passwords that protect your digital wealth from cyber threats. Virtual private networks (VPNs) encrypt your data when you access accounts on public Wi-Fi networks. Regular software updates patch 60% of vulnerabilities that cybercriminals exploit according to 2019 breach data.

Professional wealth managers understand these security requirements and help clients implement comprehensive protection strategies. The next step involves choosing specific approaches to grow and protect your digital asset portfolio through proven investment techniques.

How Should Stuart Residents Structure Digital Portfolios

Portfolio Allocation That Works

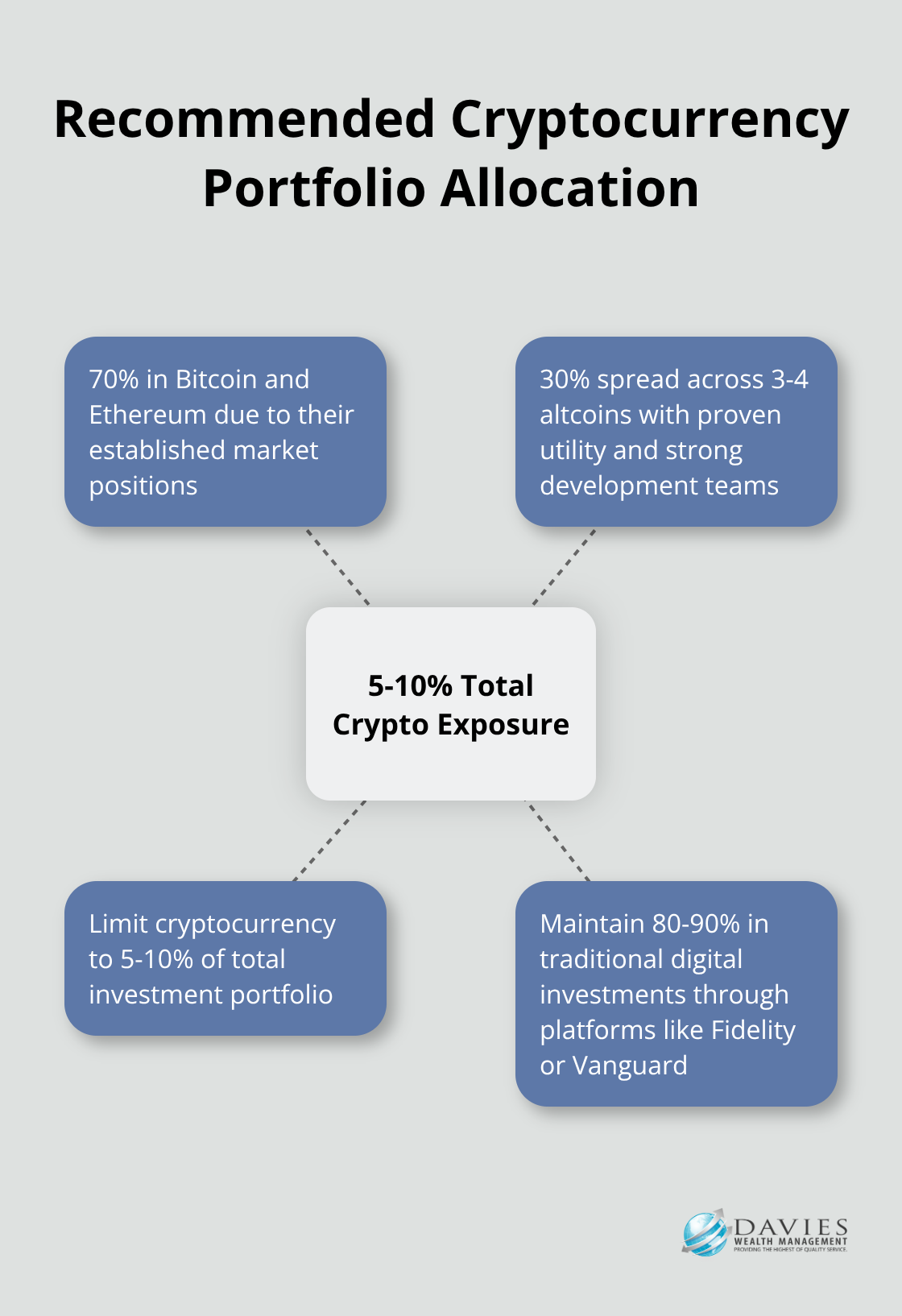

Stuart residents need specific allocation targets for digital assets within their overall wealth strategy. We recommend that investors limit cryptocurrency exposure to 5-10% of total investment portfolios, with Bitcoin and Ethereum that comprise 70% of crypto holdings due to their established market positions. The remaining 30% should spread across 3-4 altcoins with proven utility and strong development teams.

Traditional digital investments through platforms like Fidelity or Vanguard should represent 80-90% of your digital wealth. Investors should maintain broad market index funds and sector-specific ETFs. Quarterly rebalances prevent crypto volatility from derailing long-term financial goals, especially important given Bitcoin’s volatility characteristics compared to traditional assets.

Tax Strategy for Florida Residents

Florida’s zero state income tax creates unique opportunities for cryptocurrency investors who implement strategic timing. Short-term crypto gains face federal rates up to 37%, while long-term holdings (over 12 months) qualify for capital gains rates of 0%, 15%, or 20% based on income levels.

Tax-loss harvesting becomes powerful when you sell losing positions to offset gains, then repurchase after 30 days to avoid wash-sale rules. Professional tax software like TurboTax Premier or FreeTaxUSA handles cryptocurrency reporting requirements, but complex portfolios need CPAs familiar with digital asset regulations. Stuart investors should document every transaction with cost basis and dates, as the IRS requires detailed reporting on Form 8949 and Schedule D.

Estate Planning for Digital Assets

The Florida Fiduciary Access to Digital Assets Act requires explicit documentation of digital asset access preferences, but most Stuart residents skip this step. Create detailed inventories that list all cryptocurrency exchange accounts, digital wallets, hardware devices, and access credentials stored in secure locations your executor can access.

Multisignature wallets require multiple private keys for transactions (providing security during your lifetime while allowing designated beneficiaries access through properly structured estate plans). Professional estate attorneys familiar with digital assets should draft specific language that covers cryptocurrency, NFTs, and online investment accounts to prevent probate complications that could lock heirs out of valuable assets for months or years.

Professional Management Considerations

Complex digital portfolios require professional oversight to navigate tax implications and security protocols effectively. Wealth management firms that specialize in digital assets understand the technical requirements and regulatory landscape that individual investors often miss. These professionals help clients implement comprehensive strategies that balance growth potential with risk management across traditional and digital asset classes.

How Do You Choose a Digital Wealth Manager

Essential Credentials and Experience

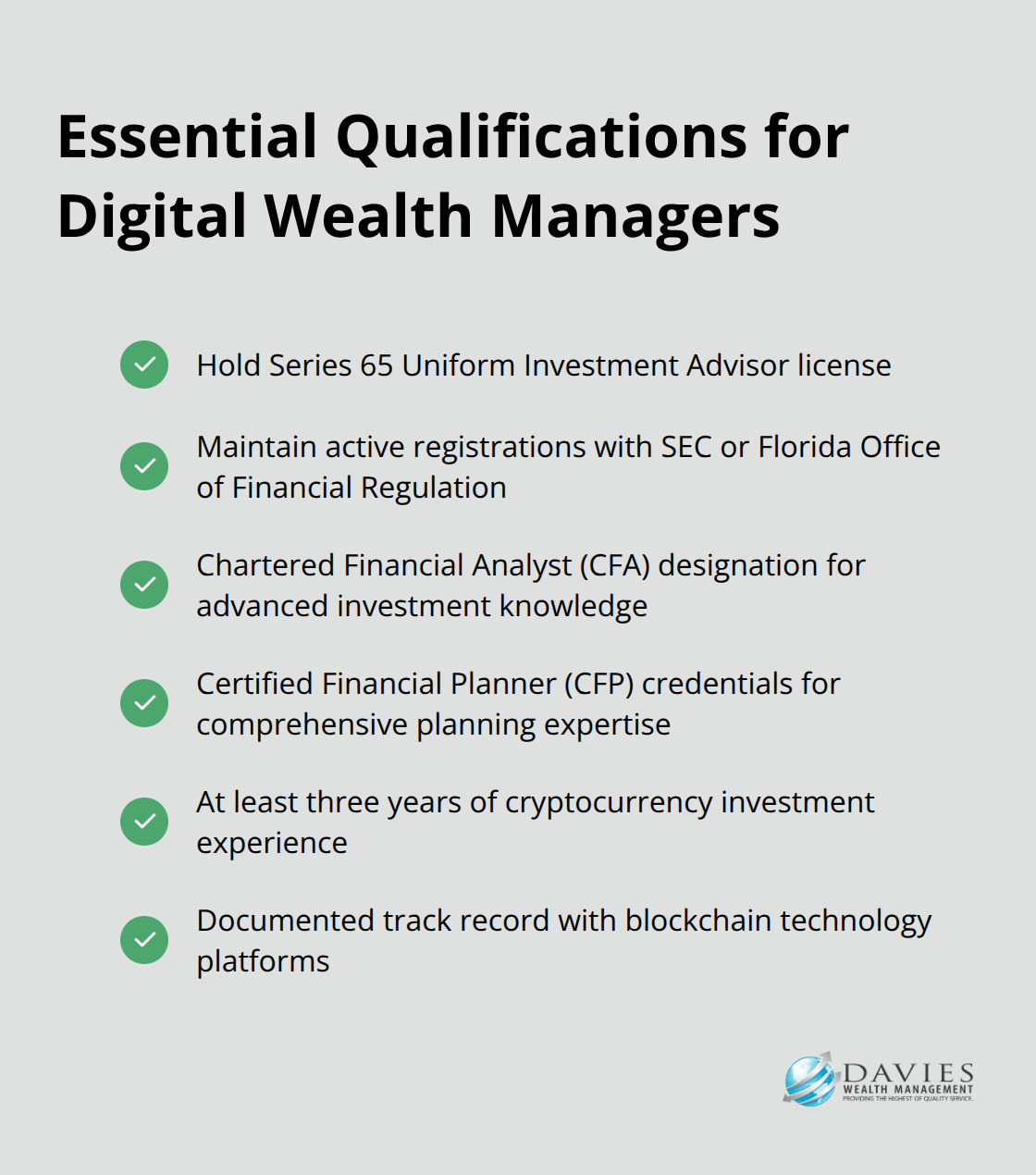

Stuart residents need wealth managers who hold Series 65 Uniform Investment Advisor licenses and maintain active registrations with the SEC or Florida Office of Financial Regulation. Chartered Financial Analyst (CFA) designations demonstrate advanced investment knowledge, while Certified Financial Planner (CFP) credentials show comprehensive planning expertise. Managers who specialize in digital assets should have at least three years of cryptocurrency investment experience and documented track records with blockchain technology platforms.

Professional firms must carry errors and omissions insurance coverage to protect clients from advisor mistakes. Request proof of insurance and verify regulatory compliance through FINRA BrokerCheck database searches. Managers who understand Florida’s Fiduciary Access to Digital Assets Act requirements and maintain relationships with cryptocurrency-experienced CPAs provide comprehensive service that individual investors cannot replicate alone.

Critical Questions for Potential Partners

Ask prospective managers about their specific cryptocurrency allocation strategies and risk management protocols. Firms should explain how they handle private key storage, multisignature wallet implementation, and security audit procedures for digital asset custody. Request detailed fee structures that separate management fees from transaction costs, as some firms charge excessive premiums for cryptocurrency trades that clients can execute directly at lower costs.

Demand references from existing clients who hold similar digital asset portfolios and verify the firm’s cybersecurity protocols through independent third-party audits. Professional managers should provide written investment policy statements that outline rebalance triggers, tax-loss harvest strategies, and estate plan integration for digital assets. Firms that cannot answer technical questions about blockchain technology or cryptocurrency tax reports lack the expertise Stuart residents need for complex digital wealth management.

Warning Signs to Avoid

Avoid managers who promise guaranteed returns on cryptocurrency investments or claim they can time market movements perfectly. Legitimate professionals acknowledge that Bitcoin dropped significantly from its peaks and emphasize long-term strategies over short-term speculation. Firms that pressure clients into purchase of proprietary investment products or charge upfront fees before service provision often prioritize their profits over client outcomes.

Red flags include managers who lack proper regulatory registrations, refuse to provide written fee disclosures, or cannot explain their fiduciary responsibilities under Florida law. Advisors who recommend concentration of more than 15% of total portfolios in cryptocurrencies or suggest investment in obscure altcoins without established market positions create unnecessary risks for Stuart residents who build sustainable wealth.

Due Diligence Process

Conduct thorough background checks on potential wealth managers through state regulatory databases and professional association websites. Verify their education credentials directly with universities and certification bodies (many fraudulent advisors fabricate qualifications). Schedule multiple meetings to assess their communication style and technical knowledge before you commit to any management agreements.

Request sample portfolio reports and performance data from similar client accounts, though past performance does not guarantee future results. Professional firms should provide transparent fee schedules, clear termination procedures, and detailed service agreements that outline exactly what services they will provide for your digital asset portfolio management needs.

Final Thoughts

Digital assets represent a fundamental shift in wealth creation for Stuart residents. The cryptocurrency market reached $2.3 trillion and demonstrates blockchain technology’s permanent impact on investment portfolios. Florida’s zero state income tax and favorable digital asset laws create unique advantages that smart investors capture through proper planning and professional guidance.

Stuart residents who implement comprehensive digital wealth strategies position themselves for long-term financial success. Proper portfolio allocation, tax-efficient timing, and robust security protocols protect against volatility and cyber threats that challenge individual investors. The Florida Fiduciary Access to Digital Assets Act requires specific documentation that most people overlook without professional assistance (making expert guidance valuable for compliance).

We at Davies Wealth Management help clients navigate the complexities of traditional and digital asset management. Our personalized approach addresses cryptocurrency taxation, estate planning requirements, and security protocols that protect digital wealth from cyber threats. Davies Wealth Management provides the expertise Stuart residents need to build, protect, and transfer digital wealth successfully across generations.

Leave a Reply