Becoming a successful financial advisor requires a unique blend of skills, knowledge, and dedication. At Davies Wealth Management, we’ve seen firsthand how the right strategies can make all the difference in this competitive field.

For those considering this career path, programs like the NFLPA Financial Advisor Registration Program offer valuable insights and credentials. In this post, we’ll explore the key elements that can help you thrive as a financial advisor and build a rewarding career.

How to Build a Strong Foundation as a Financial Advisor

Master the Essentials

The first step in building a strong foundation is to obtain the necessary certifications and qualifications. The Certified Financial Planner (CFP) designation is widely recognized and can significantly boost your credibility. Additionally, you should pursue specialized certifications like the Chartered Financial Analyst (CFA) or Certified Investment Management Analyst (CIMA) to deepen your expertise in specific areas.

Stay Ahead of the Curve

You must develop a deep understanding of financial markets and products. This goes beyond textbook knowledge. Inform yourself about market trends, economic indicators, and new financial products. Subscribe to industry publications, attend conferences, and participate in webinars. The Financial Planning Association (FPA) offers numerous resources and events that can help you stay current.

Hone Your People Skills

While technical knowledge is important, excellent communication and interpersonal skills are equally vital. As a financial advisor, you must explain complex concepts in simple terms and build trust with clients. Practice active listening and empathy. You can join a local Toastmasters club to improve your public speaking skills. A study by Vanguard examined investor preferences for financial advice and the perceived trade-offs between human and digital advice.

Leverage Technology

In today’s digital age, proficiency with financial planning software and customer relationship management (CRM) tools is non-negotiable. Familiarize yourself with popular platforms like eMoney Advisor or MoneyGuidePro. These tools can streamline your workflow and enhance the client experience.

Build a Professional Network

Networking is a powerful way to learn from experienced professionals and stay connected to industry trends. You should join professional organizations like the National Association of Personal Financial Advisors (NAPFA) or the Financial Planning Association (FPA). These organizations offer mentorship programs, conferences, and networking events that can accelerate your professional growth.

As you focus on these key areas, you’ll establish a solid foundation for your career as a financial advisor. The next step in your journey is to develop a strong client base, which we’ll explore in the following section.

How to Build a Thriving Client Base

Define Your Ideal Client

To build a thriving client base, you must first create a clear picture of your target market. Identify the types of clients you want to work with based on factors like age, profession, income level, and financial goals. For example, some advisors develop expertise in serving professional athletes, addressing their unique financial challenges.

Once you define your ideal client, tailor your services to meet their specific needs. This focused approach will help you stand out in a crowded market and attract the right clients for your practice.

Master the Art of Networking

Networking and client referrals are considered the most important methods for expanding your client base. Attend industry events, join professional associations, and participate in community activities where you’re likely to meet potential clients.

Don’t limit your focus to potential clients; build relationships with other professionals like accountants, lawyers, and real estate agents. These connections can lead to valuable referrals.

Harness the Power of Digital Marketing

In today’s digital age, a strong online presence is essential. According to a survey by Putnam Investments, 92% of financial advisors on social media acquire more clients on the platforms they use to promote their businesses. Start by creating a professional website that clearly communicates your services and expertise.

Use social media platforms like LinkedIn to share valuable content and engage with potential clients. Regular blog posts or video content can showcase your knowledge and help build trust with your audience.

Provide Exceptional Value

The best way to grow your client base is through satisfied clients who refer others to you. Focus on delivering outstanding service and tangible results for your existing clients.

Try offering free educational workshops or webinars to demonstrate your expertise and provide value to potential clients. This approach can help you build trust and credibility before someone becomes a paying client.

Leverage Technology

Embrace technology to streamline your client acquisition process. Use customer relationship management (CRM) software to track leads and manage client interactions.

Additionally, consider using automated marketing tools to nurture leads and stay in touch with potential clients. These tools can help you maintain consistent communication without overwhelming your schedule.

As you implement these strategies to build your client base, you’ll need to focus on providing exceptional service to retain and grow your relationships. Let’s explore how to deliver outstanding value to your clients in the next section.

How to Deliver Exceptional Financial Advisory Service

Personalize Your Approach

At Davies Wealth Management, we understand that exceptional service forms the foundation of a successful financial advisory practice. Each client has unique goals, risk tolerances, and financial situations. We recommend thorough initial consultations to understand your clients’ complete financial picture. Use risk assessment questionnaires and financial planning software to create personalized strategies.

For professional athletes, we recognize their unique needs (such as managing irregular income streams and planning for short career spans). We adapt our advice to address these specific challenges.

Commit to Continuous Learning

The financial landscape evolves constantly. Stay current with industry trends, regulatory changes, and new financial products. Allocate time each week for professional development. Read industry publications, attend webinars, or participate in advanced certification programs.

Ongoing education doesn’t just allow you to better serve your clients, it gives you a critical competitive edge. Advisors who actively expand their knowledge can enhance their expertise and demonstrate their dedication to providing the best possible advice to their clients.

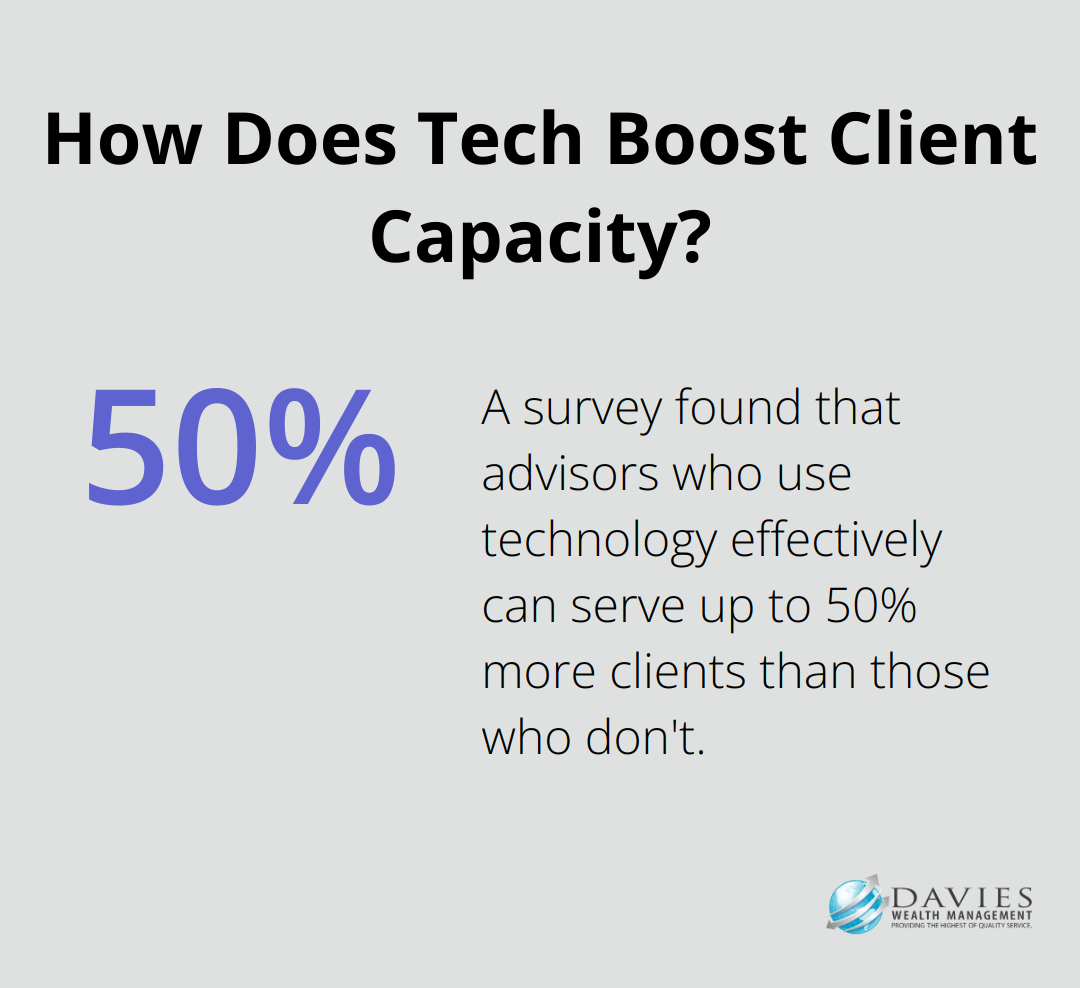

Enhance Service with Technology

Technology can significantly improve your service delivery. Implement a robust customer relationship management (CRM) system to track client interactions, preferences, and important dates. Use financial planning software to create detailed projections and scenarios for your clients.

A survey by Financial Planning Association found that advisors who use technology effectively can serve up to 50% more clients than those who don’t. Technology can streamline processes and enhance client communication.

Communicate Clearly

Financial concepts can be complex, but your explanations shouldn’t be. Practice explaining financial strategies in simple, jargon-free language. Conduct regular check-ins with clients, whether through quarterly reviews or monthly newsletters, to maintain open lines of communication.

Implement a client feedback system. Financial advisors can boost client retention by setting expectations, incorporating metrics and taking action on feedback.

Provide Comprehensive Solutions

Exceptional service often extends beyond traditional financial advice. Be prepared to connect clients with other professionals like estate attorneys or tax specialists when needed. This holistic approach to wealth management can set you apart from competitors.

At Davies Wealth Management, we often collaborate with other professionals to provide comprehensive solutions for our clients, especially when dealing with complex situations like those faced by professional athletes or business owners.

Final Thoughts

The journey to become a successful financial advisor requires a multifaceted approach. Education, certifications, and client service excellence form the foundation of a thriving advisory practice. The NFLPA Financial Advisor Registration Program offers valuable insights for those looking to specialize in serving professional athletes.

Continuous learning and adaptation are essential in the ever-changing financial landscape. New regulations, products, and technologies emerge regularly, making ongoing education a necessity. Aspiring advisors should pursue their goals with unwavering commitment, understanding that building a successful practice takes time and perseverance.

Focus on developing your unique value proposition to set yourself apart in the industry. Cultivate strong relationships with your clients, always prioritize their interests, and provide clear, actionable advice. For more insights on wealth management and financial advisory services, visit our website at Davies Wealth Management.

Leave a Reply