At Davies Wealth Management, we understand the unique financial challenges professional athletes face during their careers and beyond.

The transition from active play to athlete retirement can be a daunting prospect, especially when it comes to managing finances.

This blog post explores essential strategies for athletes to secure their financial future, from budgeting and investment diversification to building a strong support team.

Why Athletes Face Unique Financial Challenges

Professional athletes navigate a financial landscape unlike any other profession. Their careers present distinct hurdles that can significantly impact long-term financial stability.

The Sprint of Athletic Careers

Most professional sports careers are remarkably short. The average NFL career lasts 3.3 years, according to the NFL Players’ Association. This brief window of high earnings puts immense pressure on athletes to maximize their income and plan for a future that arrives much sooner than in traditional careers.

The Income Rollercoaster

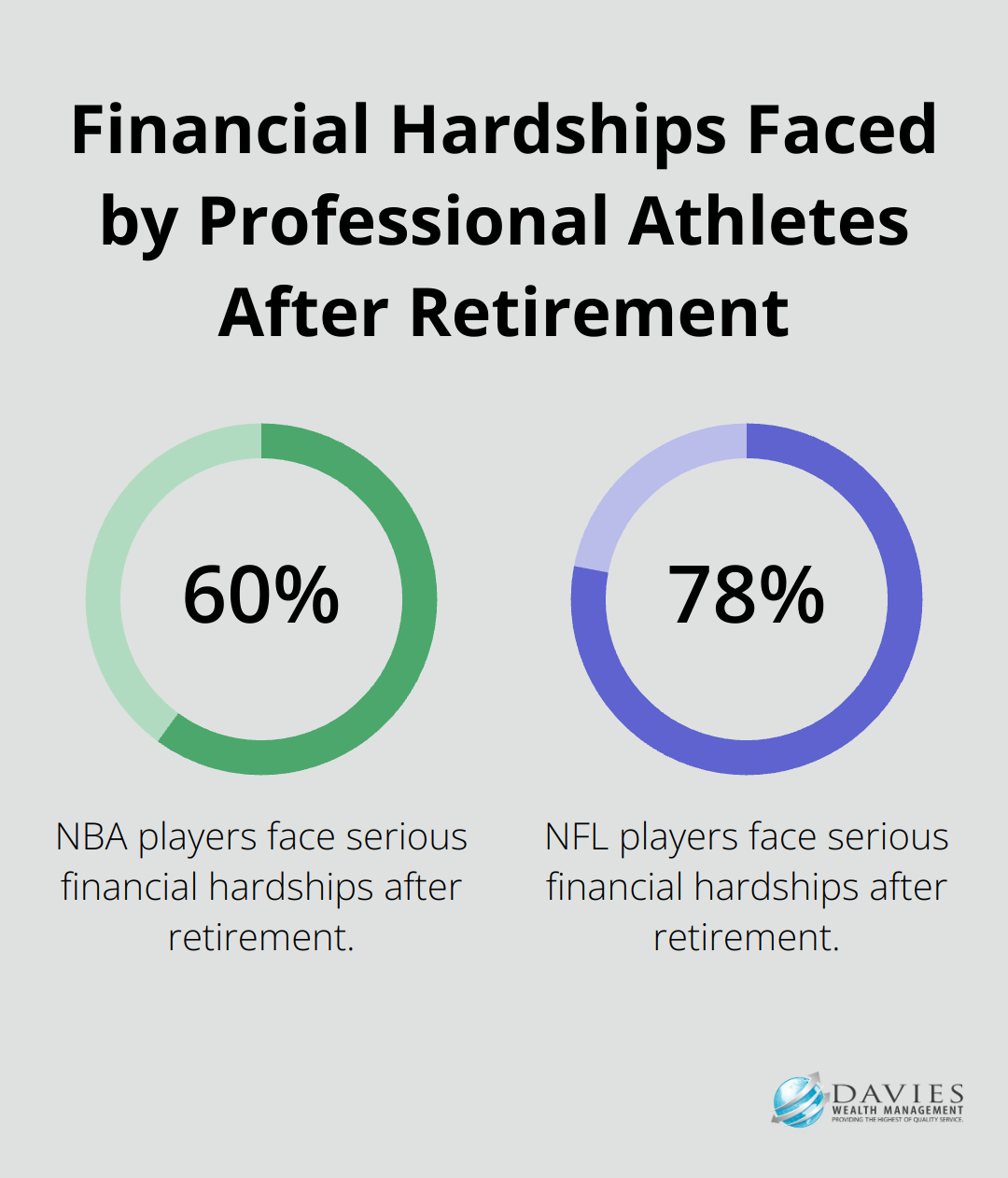

Athletes’ incomes often prove as unpredictable as their playing schedules. Salaries can fluctuate wildly based on performance, injuries, or team changes. A Sports Illustrated article reports that 60% of NBA players face serious financial hardships after retirement. This statistic underscores the critical need for robust financial planning.

The Spending Spotlight

The culture surrounding professional sports often encourages lavish spending. Athletes face pressure to maintain a certain lifestyle (designer clothes, luxury cars, etc.). This environment can lead to poor financial decisions. According to the same Sports Illustrated article, 78% of NFL players face serious financial hardships after retirement.

The Education Gap

Many athletes enter their professional careers straight from college or even high school, often lacking the financial education needed to manage sudden wealth. This knowledge gap can lead to mismanagement of funds and vulnerability to financial predators.

The Injury Wild Card

Career-ending injuries pose a constant threat in professional sports. This risk factor necessitates comprehensive insurance coverage and contingency planning.

Understanding these unique challenges forms the foundation for creating a solid financial plan. The next section will explore essential strategies that athletes can employ to overcome these hurdles and secure their financial future.

Winning Strategies for Athletes’ Financial Success

Professional athletes face unique financial challenges, but with the right game plan, they can secure their financial future. We’ve developed strategies tailored to the specific needs of athletes, ensuring they’re prepared for life both on and off the field.

Create a Comprehensive Budget

The first step in any solid financial plan is to create a comprehensive budget. For athletes, this means accounting for both the highs of active seasons and the lows of off-seasons or potential injuries. We recommend that athletes allocate at least 50% of after-tax income to savings and investments. This may seem high, but the average career span in many sports is less than a decade.

A practical tip: Use budgeting apps like Mint or YNAB to track expenses in real-time. These tools can help identify areas of overspending and provide insights into financial habits.

Diversify Your Investment Portfolio

Diversification is key to long-term financial stability. Many pro athletes invest in the stock market, often favoring index funds for long-term growth. These funds track market indexes like the S&P 500.

NBA player Andre Iguodala has successfully diversified his portfolio by investing in tech startups, demonstrating how athletes can leverage their networks to access unique investment opportunities.

Establish a Robust Emergency Fund

The unpredictable nature of sports careers necessitates a substantial emergency fund. This volatility makes it difficult to create a stable long-term financial plan, leaving athletes vulnerable to unexpected expenses and financial challenges.

Invest in Post-Career Education

Planning for life after sports is essential. A 2019 study found that athletes who plan their retirement well in advance are more likely to enjoy success in their sporting careers. We encourage athletes to allocate funds for continuing education or skill development courses. This investment in yourself can pay dividends long after your sports career ends.

Leverage Tax-Efficient Strategies

Athletes often face complex tax situations due to playing in multiple states or countries. Working with tax professionals who understand these nuances is important. Strategies like setting up a loan-out company or maximizing retirement account contributions can lead to significant tax savings.

These strategies form the foundation of a strong financial plan for athletes. The next chapter will explore how to build a robust financial team to support these strategies and ensure long-term success.

Assembling Your Financial Dream Team

Professional athletes need more than raw talent and dedication to succeed financially. They need a team of experts working behind the scenes to protect their wealth and plan for the future. A strong financial team is essential for long-term success in the world of professional sports.

The Quarterback: Your Financial Advisor

Your financial advisor should be the cornerstone of your financial team. Look for someone with specific experience working with professional athletes. They should understand the unique challenges you face, such as irregular income streams and short career spans.

A good advisor will help you create a comprehensive financial plan that covers budgeting, investing, retirement planning, and risk management. They should also coordinate with other members of your financial team to ensure everyone works towards the same goals.

When selecting an advisor, don’t let flashy promises or celebrity endorsements sway you. Instead, look for credentials like Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA). These designations indicate a high level of education and ethical standards.

The Defensive Line: Tax Professionals

Professional athletes often face complex tax situations due to playing in multiple states or countries. A skilled tax professional can help you navigate these waters and potentially save you thousands of dollars.

Look for a Certified Public Accountant (CPA) with experience in sports finance. They can help you with strategies like setting up a loan-out company or maximizing retirement account contributions to reduce your tax burden.

The IRS scrutinizes high-income individuals closely. A good tax professional can assist in navigating through windfalls, investment opportunities, and tax obligations effectively.

The Offensive Line: Legal Counsel

Legal counsel is essential for contract negotiations and estate planning. A sports attorney can help you understand the fine print in your contracts and negotiate better terms. They can also assist with setting up trusts and other legal structures to protect your assets.

For estate planning, consider working with an attorney who specializes in this area. They can help you create a will, set up trusts, and plan for the transfer of your wealth to future generations.

The Special Teams: Career Counselors

Career counselors play a vital role in preparing athletes for life after sports. These professionals can help you identify transferable skills, explore new career paths, and develop strategies for a successful transition out of professional athletics.

A good career counselor will work with you to create a post-sports career plan (including education and skill development opportunities). They can also help you build a professional network outside of sports, which is invaluable for future career prospects.

The Head Coach: Wealth Management Firm

A reputable wealth management firm (like Davies Wealth Management) can serve as the head coach of your financial team, coordinating the efforts of your various financial professionals. They can provide comprehensive wealth management solutions tailored to the unique needs of professional athletes.

A top-tier wealth management firm will offer services such as investment management, retirement planning, tax-efficient strategies, and estate planning. They should have experience working with professional athletes and understand the complexities of managing wealth in the sports industry.

Final Thoughts

Professional athletes face unique financial challenges that require careful planning and expert guidance. The journey from active play to athlete retirement demands sound financial strategies implemented early and consistently. Athletes must create comprehensive budgets, diversify investments, and establish emergency funds to secure their financial future.

Building a strong financial team proves paramount to long-term success in the world of sports finance. Athletes should select trustworthy financial advisors, engage tax professionals, and consult legal counsel to safeguard their financial well-being. Career counselors also play a vital role in preparing athletes for life after sports, helping them identify transferable skills and explore new career paths.

At Davies Wealth Management, we specialize in creating tailored wealth management solutions that address the unique needs of athletes (from managing irregular income to planning for athlete retirement). We strive to help athletes build, protect, and transfer their wealth with confidence. Visit Davies Wealth Management to learn how we can help you achieve your financial goals and secure a prosperous future beyond your athletic career.

Leave a Reply