Table of Contents

- Why Jupiter Island Residents Face Extra Scrutiny

- Step 1: File Your Declaration of Domicile in Martin County

- Step 2: Establish the 183-Day Rule (and Document Everything)

- Step 3: Transfer Your Legal Identity to Florida

- Step 4: Restructure Your Tax Life Around Your Florida Address

- Step 5: Anchor Your Estate Plan in Florida

- The Jupiter Island Advantage

If you're making the move to Jupiter Island, you're not just buying a home: you're making a statement. And when high-net-worth individuals make statements, state tax authorities in New York, California, Illinois, and Connecticut start paying very close attention.

Here's the reality: Jupiter Island properties routinely sell for $20 million to $50 million. That kind of wealth triggers automatic red flags with revenue departments in high-tax states. They know what you're doing: swapping a 13.3% California income tax rate or a 10.9% New York rate for Florida's zero percent: and they're not going to let you go without a fight.

The good news? Florida domicile is absolutely defensible if you follow the right steps. The bad news? One sloppy detail can cost you six or seven figures in back taxes, penalties, and legal fees during an audit.

Let's walk through the five non-negotiable steps to audit-proof your Jupiter Island move.

Why Jupiter Island Residents Face Extra Scrutiny

Jupiter Island isn't just any Florida town. It's consistently ranked as one of the wealthiest zip codes in America, with a median household income exceeding $200,000 and home values that routinely break records. When you establish domicile here, you're signaling to your former state that you've got the resources to minimize your tax bill: and they're going to scrutinize every piece of documentation you provide.

States like New York and California have entire divisions dedicated to residency audits. They'll review your credit card statements, cell phone records, utility bills, and even your social media posts to determine whether you're truly living in Florida or just pretending. According to recent data, residency audits have increased by over 30% in the past five years, with the average disputed tax bill exceeding $1 million for high-net-worth individuals.

That's why Jupiter Island residents need to go beyond the basics. You can't just file a Declaration of Domicile and call it a day. You need a comprehensive, documented strategy that leaves no room for interpretation.

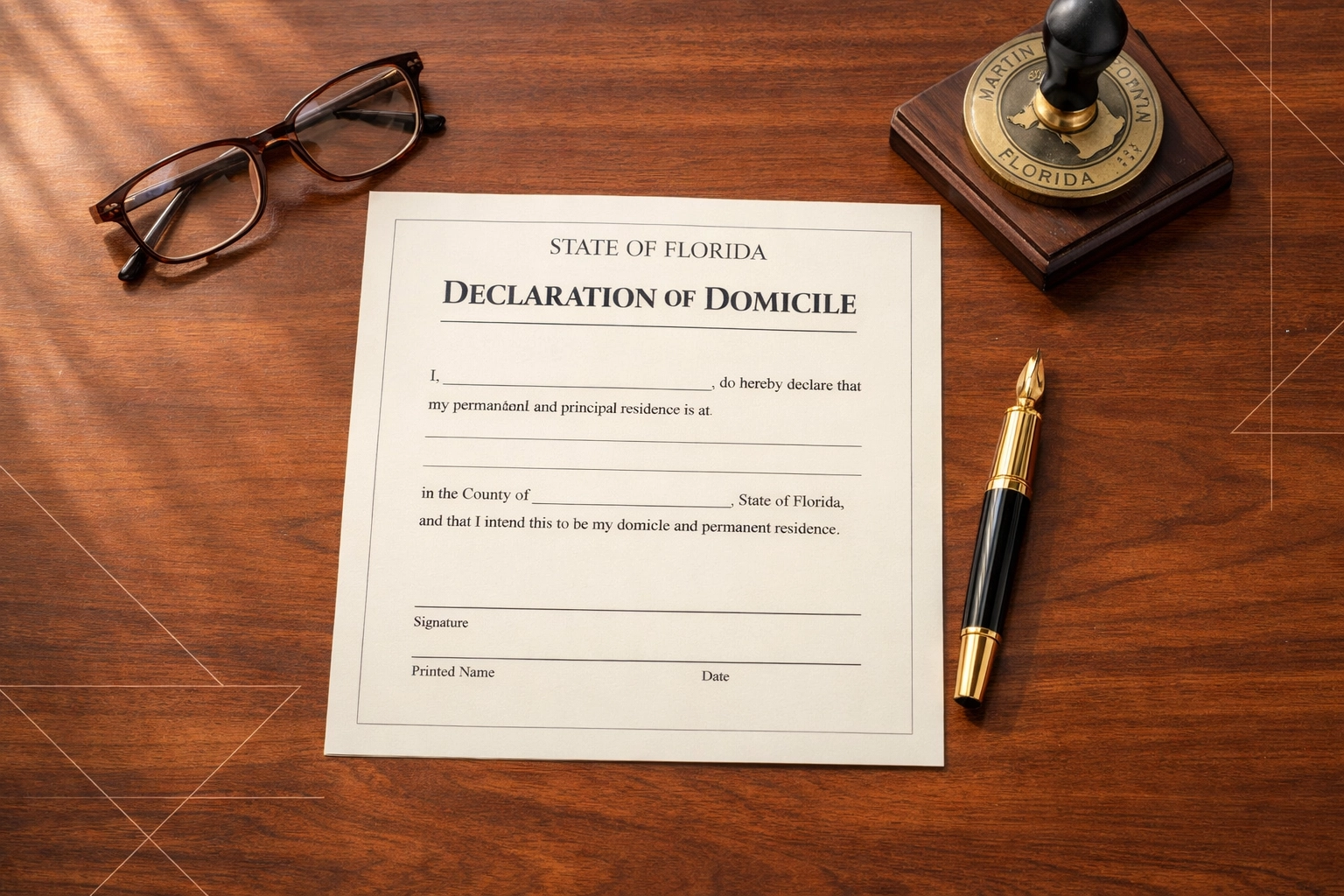

Step 1: File Your Declaration of Domicile in Martin County

This is your starting line. The Declaration of Domicile is a sworn legal document filed with the Clerk of the Circuit Court in Martin County that formally declares your intent to make Florida your permanent home.

Here's what makes this document so powerful: You can only have one legal domicile. By filing this declaration, you're creating an official record that Florida: not New York, not California: is your primary legal residence. This document carries weight in court proceedings and tax disputes.

How to do it right:

- File in person or electronically with the Martin County Clerk's office in Stuart

- Include your full legal name, your Jupiter Island property address, and the date you established residency

- Have the document notarized

- Keep a certified copy for your records

Most importantly, file this within 30 days of your physical move to Florida. Delays create questions about your intent, which is exactly what auditors look for.

Step 2: Establish the 183-Day Rule (and Document Everything)

This is where most people slip up. Florida doesn't have an official "183-day rule" on the books, but state tax authorities in your former state absolutely do. New York, California, and Connecticut all use some variation of the 183-day statutory residency test: if you spend more than 183 days in their state during the tax year, they can claim you as a resident regardless of where you filed your Declaration of Domicile.

Your Jupiter Island strategy:

- Spend at least 183 days (six months and one day) physically present in Florida each year

- Keep a detailed calendar tracking every day you're in Florida versus other states

- Save hotel receipts, flight records, and credit card statements showing Florida purchases

- Document your presence at local Jupiter events, country clubs, or charitable functions

Pro tip: If you own property in another state, make sure your Florida home is your primary residence: not just a vacation house. This means your Florida property should be larger, more valuable, or more extensively furnished than any other home you own.

Some of our clients at Davies Wealth Management keep a simple spreadsheet with check-ins and check-outs from their Jupiter Island home. It sounds tedious, but during a residency audit, that spreadsheet becomes your most valuable asset.

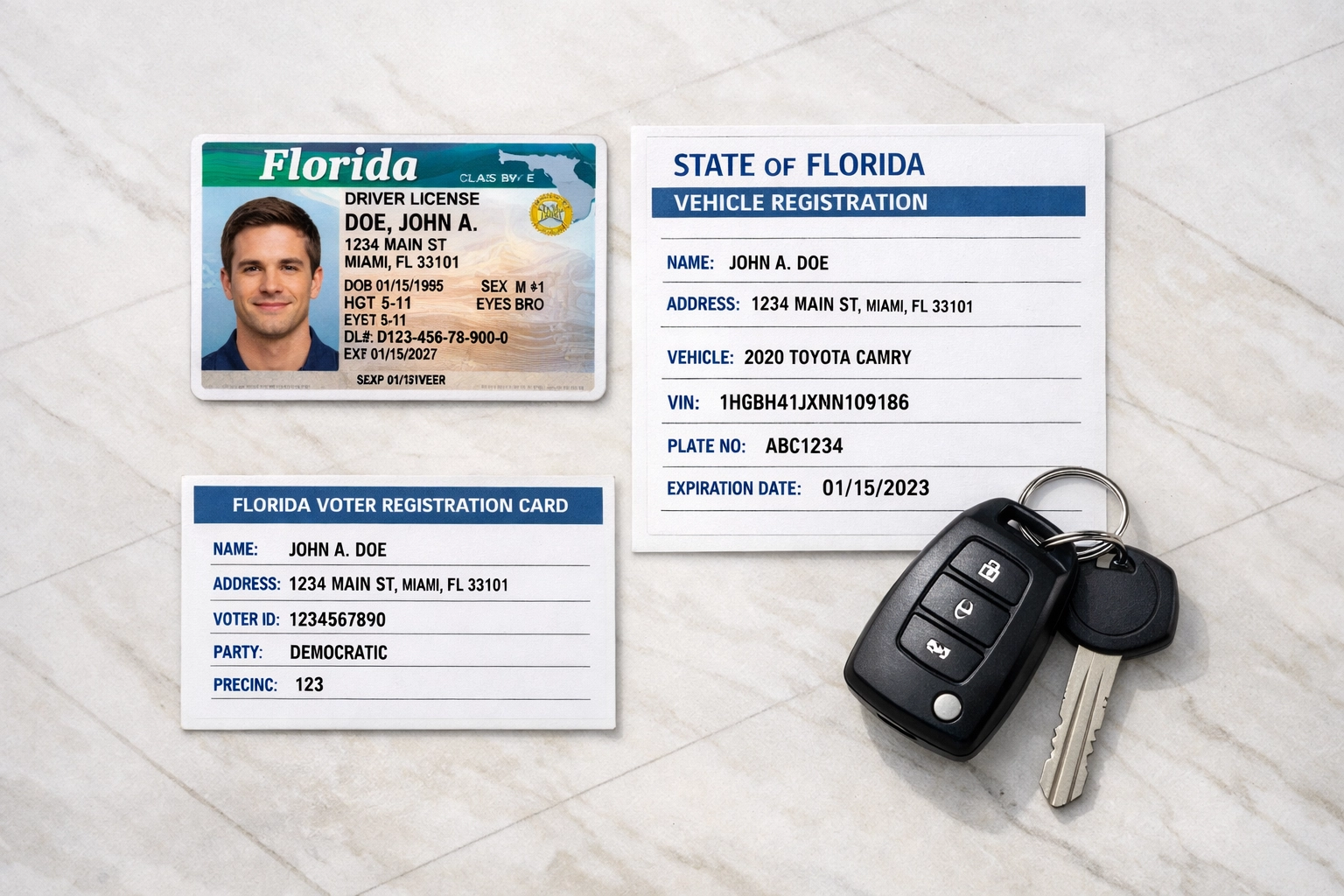

Step 3: Transfer Your Legal Identity to Florida

This step is all about creating an official paper trail that screams "Florida resident" to anyone who looks at your records.

Here's your checklist:

-

Florida driver's license – Surrender your old state license and obtain a Florida license within 10 days of establishing residency. The Florida Department of Highway Safety and Motor Vehicles requires proof of identity, Social Security number, and two proofs of residential address.

-

Voter registration – Register to vote in Martin County. This is a public record that demonstrates your intent to participate in Florida civic life.

-

Vehicle and boat registration – Register all motor vehicles, recreational vehicles, and watercraft in Florida. If you're docking a yacht in Jupiter, make sure it's registered with the state of Florida.

-

Professional licenses – If you hold any professional licenses (medical, legal, real estate), transfer them to Florida or obtain Florida reciprocity.

Each of these steps creates an official government record linking you to Florida. Tax auditors review these records first when building their case, so leaving any of them incomplete gives them ammunition.

Step 4: Restructure Your Tax Life Around Your Florida Address

This is the most financially consequential step: and the one that triggers the most audits.

Federal tax returns:

File your Form 1040 using your Jupiter Island address as your primary residence. This signals to the IRS (and your former state) that Florida is now your tax home.

State tax filings:

If you're moving from a state with income tax, you need to file a part-year resident return for the year you moved. This return should clearly show the date you changed domicile and allocate income accordingly. Then, send a formal letter to your former state's tax authority notifying them that you've become a Florida resident.

Here's where it gets tricky: Some states (like New York) require you to file a nonresident return if you have income sourced to that state: even after you move. For example, if you're a business owner with operations in New York, or you rent out a property there, you'll still owe New York tax on that specific income. Work with a tax professional to ensure you're filing correctly.

Financial account transfers:

Move your primary bank accounts, brokerage accounts, and credit card billing addresses to your Florida residence. This doesn't mean you need to close every account in your former state, but your primary financial relationships should be anchored in Florida. Many of our clients work with firms that specialize in tax-loss harvesting strategies to offset gains while making these transitions.

Social Security and Medicare:

Update your address with the Social Security Administration. If you're enrolled in Medicare, notify them of your address change to ensure you're assigned to the correct Florida region.

Step 5: Anchor Your Estate Plan in Florida

Your estate planning documents are some of the strongest evidence of domicile intent. That's because they're forward-looking: they demonstrate where you intend to be in the future, not just where you are today.

What you need to do:

-

Hire a Florida attorney – Work with an estate planning attorney licensed in Florida to draft or update your Will, Trust, and Power of Attorney documents. These documents should explicitly state that you are a resident of Florida and that Florida law governs the interpretation and administration of your estate.

-

Include a domicile clause – Add language to your Will or Trust that reads something like: "I am domiciled in the State of Florida and it is my intent that Florida law shall govern the administration of my estate."

-

Review beneficiary designations – Update beneficiary designations on life insurance policies, retirement accounts, and annuities to reflect your Florida residency.

-

Transfer titled assets – If you own real estate in other states, consider whether it makes sense to transfer those properties into a Florida-based trust. This can simplify estate administration and reinforce your Florida domicile status.

We've talked extensively about estate planning strategies on the Davies Wealth Management podcast, particularly for families navigating the complexities of multi-state asset transfers. If you're dealing with a portfolio over $10 million, this step becomes even more critical.

The Jupiter Island Advantage

Here's the best part: Once you've completed these five steps, you're not just protecting yourself from a tax audit: you're positioning yourself to take full advantage of everything Jupiter Island offers.

Zero state income tax means more capital to invest, more flexibility in your portfolio strategy, and more control over your long-term wealth-building plan. For a high-net-worth family earning $2 million annually, moving from California to Florida can save $266,000 per year in state income tax alone. Over a decade, that's $2.66 million: enough to fund an entire generation's education or seed a family foundation.

But those benefits only materialize if you do the work upfront. Every detail matters. Every document counts. And every day you spend in Florida strengthens your case.

If you're making the move to Jupiter Island and want to ensure your domicile strategy is bulletproof, we can help. At Davies Wealth Management, we work with families navigating complex residency changes, multi-state tax filings, and the estate planning strategies that protect generational wealth. The stakes are too high to leave anything to chance.

Leave a Reply