The average wealth advisor charges between 0.5% and 2% of assets under management annually. For a $1 million portfolio, that’s $5,000 to $20,000 per year.

But is a wealth advisor worth it when you factor in potential tax savings, optimized returns, and strategic planning? We at Davies Wealth Management see clients regularly question this investment decision.

The answer depends on your financial complexity and long-term goals.

What Wealth Advisors Actually Do

Wealth advisors operate far beyond simple investment selection. They function as financial architects who restructure your entire wealth ecosystem. A Vanguard study found that advisors add approximately 3% annually to investor returns through disciplined strategies and behavioral coaching. This value comes from three core areas where advisors generate measurable impact.

Investment Management and Portfolio Optimization

Professional portfolio management involves sophisticated asset allocation models that most individual investors cannot execute effectively. Advisors use institutional-grade research and analytics to optimize risk-adjusted returns. They rebalance portfolios systematically, harvest tax losses, and adjust allocations based on market conditions. The Dalbar study shows that emotional investment decisions cost individuals significant returns, while advisors help clients avoid these costly behavioral mistakes during market volatility.

Tax Planning and Wealth Protection Strategies

Tax planning extends far beyond annual tax preparation. Wealth advisors implement strategies like Roth conversions during low-income years, charitable remainder trusts, and sophisticated gift techniques. Research shows clients who use professional tax strategies save an average of $840 annually compared to self-filers. For high-net-worth individuals, advisors coordinate with CPAs to minimize tax burdens through income timing, deferred compensation strategies, and multi-generational tax planning approaches.

Estate Planning and Legacy Management

Estate planning involves complex legal structures that protect and transfer wealth efficiently. Advisors coordinate with estate attorneys to establish trusts, minimize estate taxes, and structure business succession plans. They help clients navigate generation-skipping transfer taxes and establish charitable foundations. For families with significant assets, proper estate planning can save millions in taxes while it protects wealth from creditors and ensures smooth transfers to beneficiaries.

These comprehensive services come at a cost (typically 0.5% to 2% of assets under management annually). The question becomes whether these fees represent good value when weighed against the potential benefits and returns advisors generate.

Cost Analysis of Hiring a Wealth Advisor

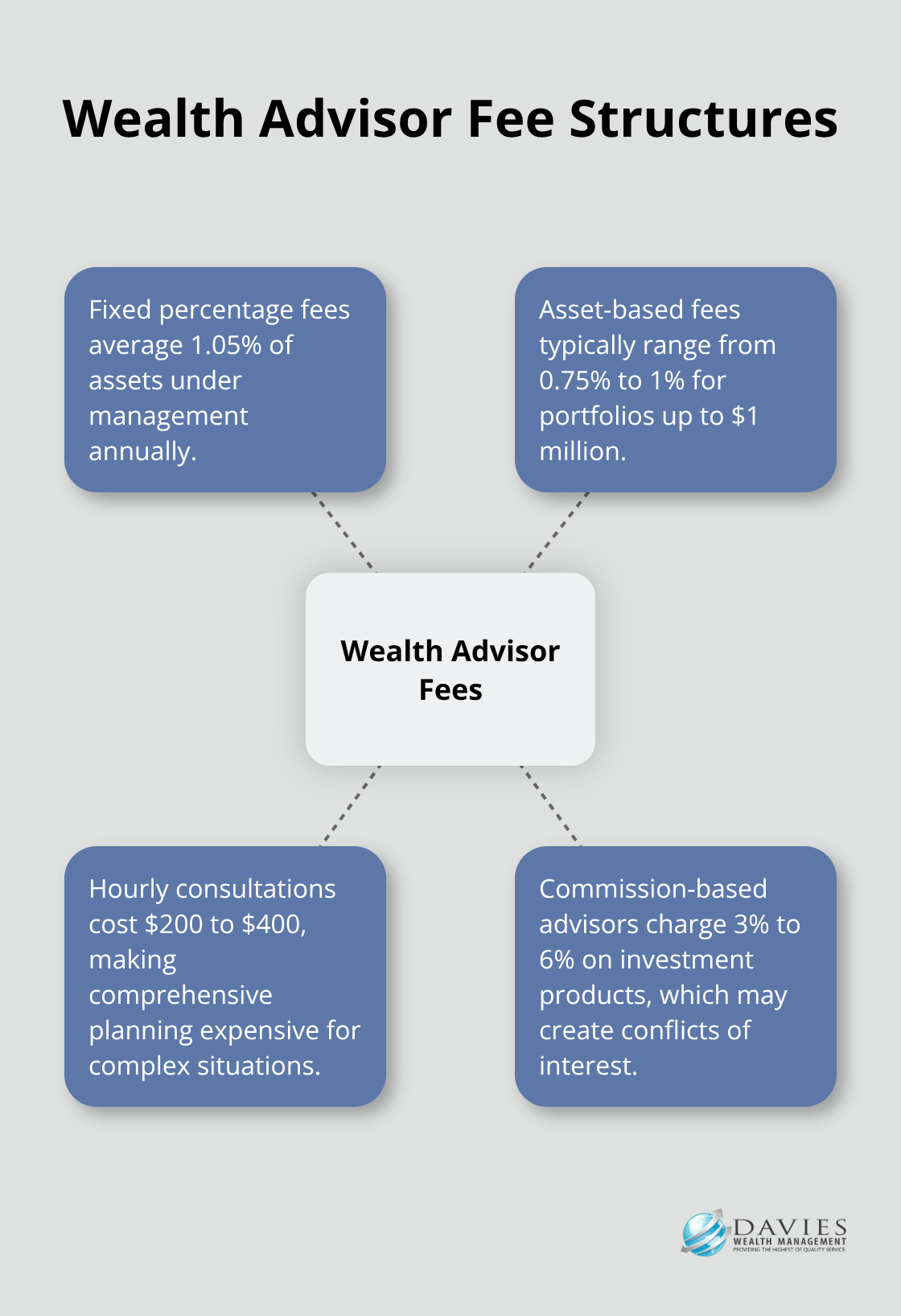

Wealth advisor fees require examination of both transparent charges and hidden expenses that impact your returns. The Envestnet 2024 State of Financial Planning study found that average fixed percentage fees reach 1.05%, while asset-based fees typically range from 0.75% to 1% for portfolios up to $1 million. For a $2 million portfolio, you’ll pay $15,000 to $20,000 annually in management fees alone. Hourly consultations cost $200 to $400, which makes comprehensive planning expensive for complex situations. Commission-based advisors charge 3% to 6% on investment products, which creates conflicts of interest that favor higher-fee investments over client outcomes.

Fee Structures and Typical Costs

Fee structures vary dramatically between advisors, which makes direct comparisons difficult. Asset-under-management fees appear straightforward but often exclude trading costs, fund expenses, and administrative charges. Kitces.com research shows that all-in costs frequently exceed stated fees by 0.3% to 0.7% annually. Fee-only fiduciaries eliminate commission conflicts but charge higher upfront fees for comprehensive planning. Calculate total annual costs (including underlying fund expenses, transaction fees, and custodial charges) before you commit to any advisor relationship.

Potential Returns vs Advisory Fees

Professional management must generate returns that exceed fees to justify costs. Research indicates advisors add value through behavioral coaching and strategic allocation, according to multiple industry studies. For a $1 million portfolio that pays 1% in fees, your advisor must generate at least $10,000 in additional value annually to break even. Tax optimization strategies alone save clients an average of $840 per year through professional tax planning versus self-filing.

Hidden Costs and Additional Expenses

The break-even calculation becomes favorable for portfolios around $1 million, where advisor expertise typically outweighs fee drag on long-term returns. However, additional expenses often surface after you sign agreements. Platform fees, custody charges, and third-party manager costs can add another 0.2% to 0.5% annually to your total expenses. These costs compound over time and significantly impact your net returns.

When you evaluate these costs against potential benefits, the decision becomes clearer for specific investor profiles and financial situations.

When You Should Consider a Wealth Advisor

The wealth advisor decision hinges on specific financial thresholds and complexity markers that make professional management profitable. Individuals with investable assets exceeding $1 million represent the sweet spot where advisor fees become justified through measurable value creation. The CFP Board reports that consumers with complex financial situations experience significantly higher confidence levels when working with professional advisors compared to self-directed investors.

Assets Above $1 Million Create Fee Efficiency

Portfolio size determines whether advisor fees drag down returns or enhance them. For accounts below $500,000, the 1% annual fee often exceeds the value generated through tax optimization and behavioral coaching. However, portfolios above $1 million benefit from institutional-grade investment strategies, sophisticated tax planning, and estate structuring that individual investors cannot access.

23% of affluent investors still prefer to pay advisors per transaction on a commission basis, according to Cerulli Associates research. Complex strategies require specialized expertise that justifies the cost structure for larger portfolios.

Life Transitions Demand Professional Guidance

Major financial events create complexity that overwhelms most individuals and demands immediate professional intervention. Business sales, inheritance windfalls, divorce settlements, and career transitions generate tax consequences and planning opportunities that require expert navigation.

Stock option exercises, retirement account rollovers, and insurance needs assessment during these transitions often save clients more than advisor fees through proper timing and execution of complex financial decisions.

Professional Athletes Face Unique Challenges

Professional athletes face particularly unique challenges with short career spans and fluctuating income streams that demand specialized planning approaches. Peak earnings at such a youthful stage of life can create significant challenges for retirement, estate, and asset protection planning.

Athletes need advisors who understand the complexities of deferred compensation, tax implications across multiple states, and wealth preservation strategies for careers that typically span less than a decade (with peak earning years even shorter).

High-Income Earners Need Tax Optimization

High-income professionals earning $500,000 or more annually face complex tax situations that benefit significantly from professional guidance. Tax optimization strategies include fully funding tax-advantaged accounts, considering Roth conversions, adding money to 529 accounts, donating more to charity, and reviewing investment strategies.

The value proposition becomes clear when tax savings exceed advisory fees, which frequently occurs for individuals in higher tax brackets who can implement sophisticated planning strategies.

Final Thoughts

The question “is a wealth advisor worth it” depends entirely on your financial complexity and asset level. For portfolios that exceed $1 million, the math works in your favor. Professional advisors generate measurable value through tax optimization, behavioral coaching, and sophisticated investment strategies that typically exceed their fees.

The break-even point becomes clear when you examine total costs against potential benefits. Advisors who add 3% annually through disciplined strategies easily justify 1% fees for larger portfolios (smaller accounts often face fee drag that outweighs advisory benefits). Your decision should focus on specific circumstances rather than general rules.

We at Davies Wealth Management provide comprehensive wealth management solutions that address complex financial situations. Our team works with high-income earners, professional athletes, and individuals who face major life transitions. The right wealth advisor becomes a strategic partner who adapts to your needs while protecting and growing your assets over decades.

Leave a Reply