Dentists face unique financial challenges that require tailored investment strategies. At Davies Wealth Management, we understand the complexities of balancing practice ownership, student debt, and personal financial goals.

Our guide to investment strategies for dentists offers practical solutions to maximize returns while navigating the specific financial landscape of the dental profession. We’ll explore diversification tactics, tax-efficient approaches, and long-term wealth-building strategies designed to help dentists secure their financial future.

The Financial Tightrope of Dentistry

High Income, High Debt

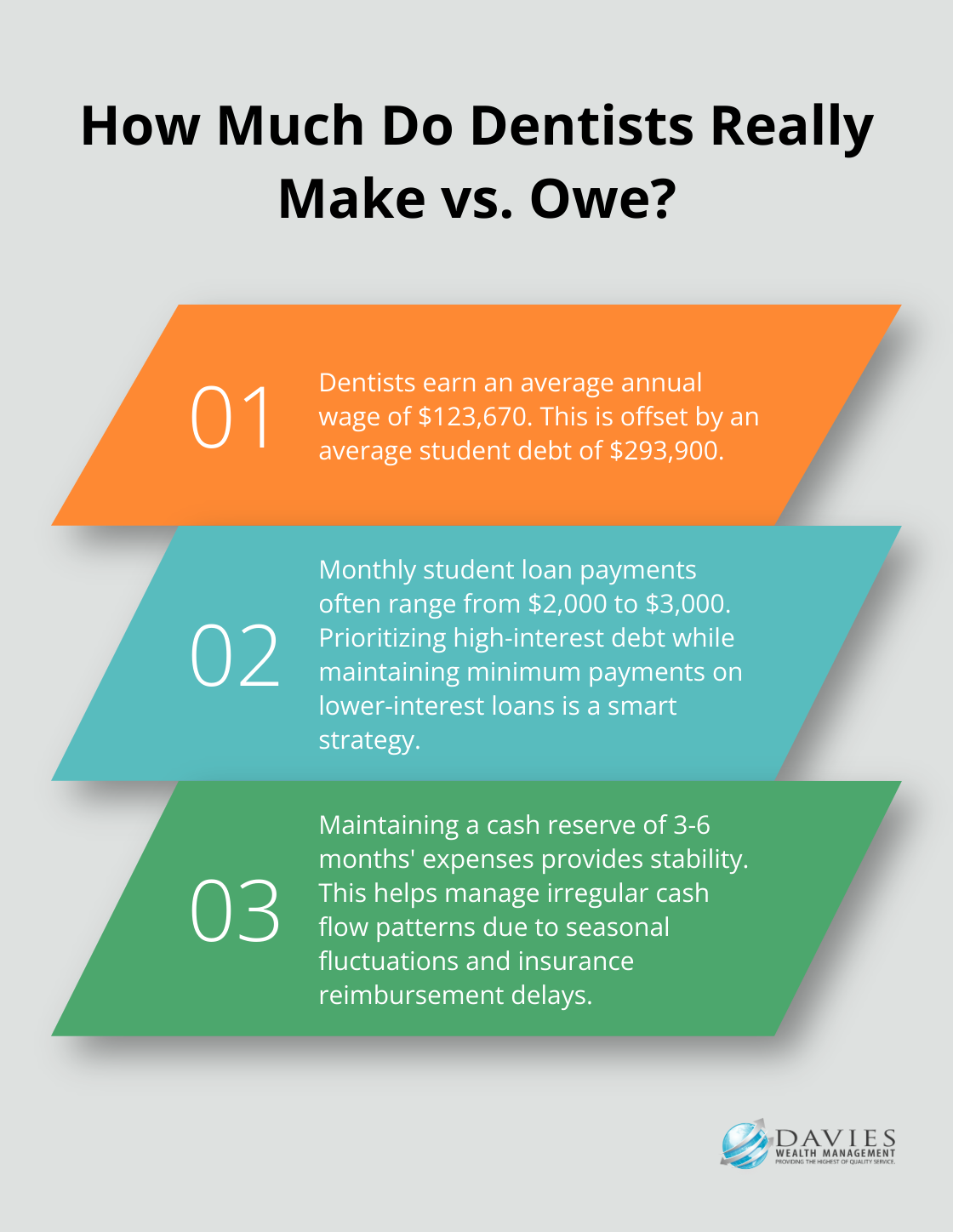

Dentists navigate a unique financial landscape. The U.S. Bureau of Labor Statistics reports an average annual wage of $123,670 for dentists. However, this impressive figure is offset by an average student debt of $293,900, according to the American Dental Education Association. This stark contrast creates a complex financial journey for dental professionals.

The Debt Challenge

Student loans cast a long shadow over the early years of a dentist’s career. Monthly payments often range from $2,000 to $3,000, requiring strategic income allocation. A smart approach involves prioritizing high-interest debt while maintaining minimum payments on lower-interest loans. This strategy allows for faster debt reduction without neglecting other financial objectives.

Cash Flow Management

Practice ownership introduces additional financial complexities. Unlike salaried professionals, dentists experience irregular cash flow patterns. Seasonal fluctuations, insurance reimbursement delays, and equipment investments can create financial strain. To combat this, maintaining a cash reserve of 3-6 months’ expenses provides stability during lean periods and allows for strategic investments when opportunities arise.

Dual Financial Planning

Dentists must juggle both personal and business finances simultaneously. This dual focus necessitates a comprehensive approach. On the personal side, building a diversified investment portfolio balances risk and potential returns. For the practice, reinvesting a portion of profits into technology and staff development drives long-term growth.

Seeking Specialized Guidance

The financial intricacies of dentistry require specialized knowledge. Many dentists find value in partnering with financial advisors who understand the unique challenges of the profession. These experts can provide tailored strategies for debt management, cash flow optimization, and long-term wealth building (while considering both personal and practice finances).

As we move forward, we’ll explore specific investment strategies that can help dentists maximize their returns and secure their financial future. These approaches take into account the unique financial position of dental professionals and offer practical solutions for building wealth.

How Dentists Can Diversify Their Investments

Balancing Practice and Personal Investments

Dentists must allocate their resources wisely between practice investments and personal portfolios. We recommend reinvesting 20-30% of practice profits back into the business, while directing a similar percentage towards personal investments. This strategy prevents over-reliance on the practice as the sole wealth source.

Real Estate Opportunities in Healthcare

The healthcare real estate sector presents compelling options for dentists. Medical office sector shows resilience with high-income returns and low volatility, being unaffected by economic downturns and remote work. Investing in a property that houses your own practice can yield both rental income and potential appreciation. Dentists should also consider other healthcare-related properties, such as urgent care centers or specialized medical facilities, which often offer stable returns due to long-term leases common in the healthcare sector.

Alternative Investment Options

While traditional stocks and bonds form most portfolios’ foundation, alternative investments can provide additional diversification and potentially higher returns. Private equity funds focused on healthcare technology or dental service organizations (DSOs) offer industry-specific investment opportunities. These funds typically require higher minimum investments (often $250,000 or more) but can provide returns that outpace public markets. Private equity funds returned an average of 14.3% per year, compared to 7.8% for the S&P 500 index considering the past decade.

Hedge funds present another option, albeit with higher fees and potential liquidity constraints. When considering hedge funds, dentists should look for those with a track record of consistent returns and transparent fee structures. Alternative investments should typically comprise no more than 10-20% of the overall portfolio due to their higher risk profile.

The Power of Index Funds

For dentists who prefer a more hands-off approach, low-cost index funds offer broad market exposure with minimal effort. For example, total market index funds can have expense ratios as low as 0.03%. This passive investment strategy can form the portfolio’s core, allowing dentists to focus on their practice while still benefiting from market growth.

Tailoring Your Diversification Strategy

Diversification strategies should align with individual risk tolerance, time horizon, and overall financial goals. Spreading investments across various asset classes and sectors can potentially reduce risk and maximize returns, setting the stage for long-term financial success. As we move forward, we’ll explore tax-efficient investment approaches that can further enhance a dentist’s financial strategy.

Tax Strategies to Boost Your Dental Practice Returns

Maximize Retirement Account Contributions

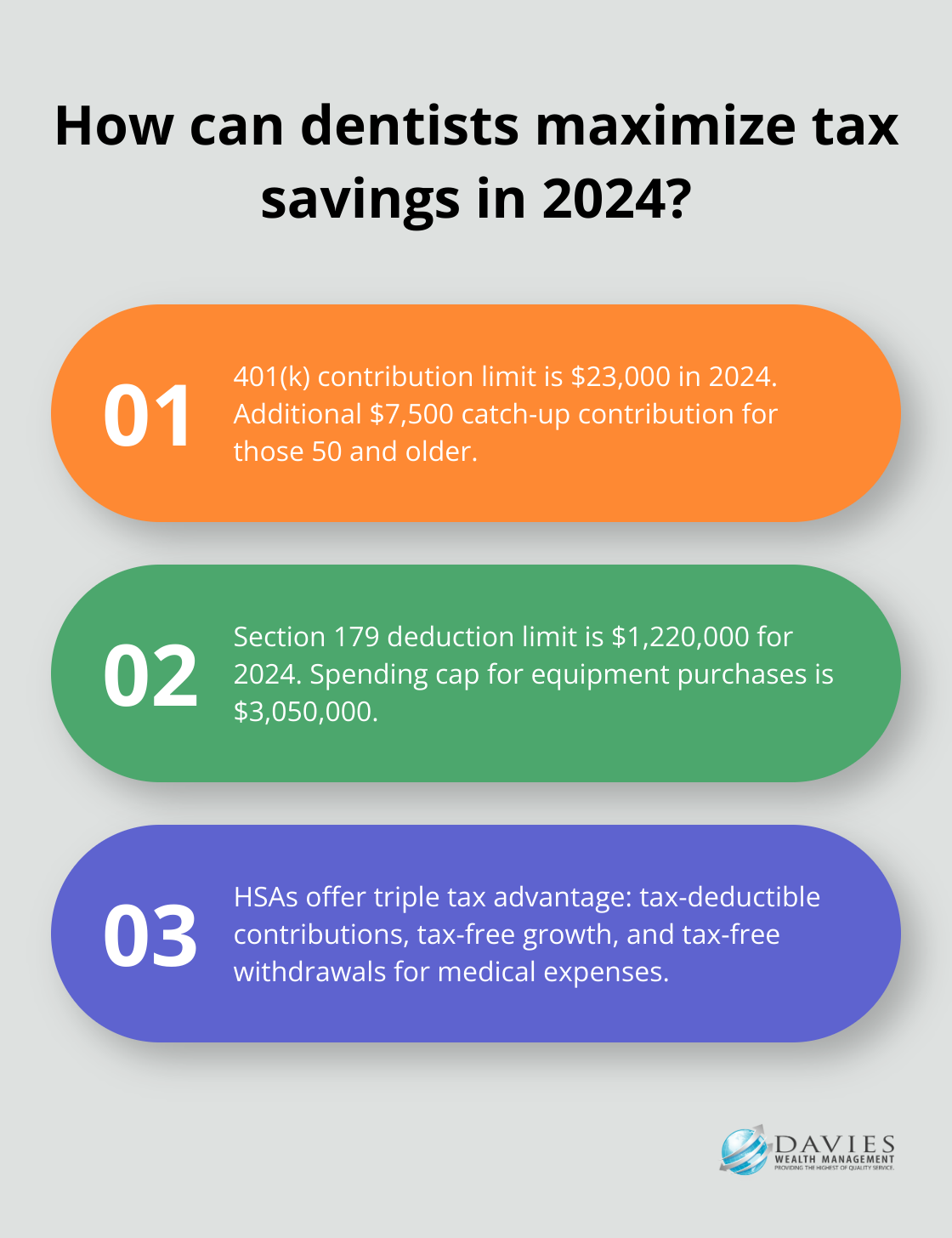

Dentists can enhance their financial position through strategic tax planning. The contribution limit for 401(k) plans in 2024 is $23,000, with an additional $7,500 catch-up contribution for those 50 and older. For solo 401(k) plans, the total contribution limit (including employer contributions) can reach up to $69,000. Maxing out these accounts reduces taxable income while building a substantial retirement nest egg.

High-income earners like dentists should consider a backdoor Roth IRA. This strategy involves making a non-deductible contribution to a traditional IRA and immediately converting it to a Roth IRA. The result? Tax-free growth and withdrawals in retirement.

Utilize Section 179 Deductions for Equipment

Dental practices require significant investment in equipment and technology. The IRS Section 179 deduction allows businesses to deduct the full purchase price of qualifying equipment in the year of acquisition, rather than depreciating it over time. For 2024, the deduction limit stands at $1,220,000, with a spending cap of $3,050,000. This can lead to substantial tax savings for dentists investing in new chairs, X-ray machines, or practice management software.

When financing equipment purchases, a tax-advantaged loan structure can provide additional benefits. Proper loan structuring potentially allows deductions for both interest payments and equipment depreciation, further reducing tax liability.

Implement Tax-Loss Harvesting

Tax-loss harvesting is the strategy of selling an investment that has declined in value in the short term, and replacing the investment with a highly similar investment. For dentists with diversified investment portfolios, this proves particularly effective in years of high practice income when minimizing overall tax burden becomes a priority.

Consider this example: If you realize $20,000 in capital gains from selling a successful investment, you could sell underperforming investments with $20,000 in losses to offset those gains entirely. This strategy requires careful timing and consideration of wash sale rules (which prohibit repurchasing a substantially identical security within 30 days).

Explore Health Savings Accounts (HSAs)

Health Savings Accounts offer a triple tax advantage for dentists. Contributions are tax-deductible, grow tax-free, and can be withdrawn tax-free for qualified medical expenses. HSAs serve as an excellent long-term savings vehicle, as unused funds roll over year to year and can be invested for potential growth.

Consider a Defined Benefit Plan

For high-earning dentists looking to accelerate retirement savings, a defined benefit plan presents a powerful option. You may contribute, usually on a pre-tax basis, up to the annual maximum of $23,000 for 2024 ($30,500 if age 50+) in addition to your 403(b) plan contributions. While more complex to administer, defined benefit plans can dramatically reduce current tax liability while rapidly building retirement wealth.

Final Thoughts

Investment strategies for dentists require a multifaceted approach that addresses the unique financial landscape of the profession. Dentists should implement a diversified investment portfolio to balance the demands of practice ownership with personal wealth accumulation. This includes exploring opportunities in healthcare real estate, considering alternative investments, and leveraging index funds for broad market exposure.

Tax-efficient strategies play a vital role in maximizing returns. Dentists should take full advantage of retirement account contributions, utilize Section 179 deductions for practice equipment, and explore tax-loss harvesting to optimize their financial position. Health Savings Accounts and defined benefit plans offer additional avenues for tax-advantaged savings and long-term wealth building.

The complexity of these financial strategies underscores the importance of seeking professional guidance. At Davies Wealth Management, we provide tailored financial advice to healthcare professionals (including dentists). Our expertise can help you navigate the intricacies of investment management, tax planning, and retirement strategies specific to your career path.

Leave a Reply