At Davies Wealth Management, we’ve observed a significant shift in the investment landscape with the rise of digital assets. These innovative financial instruments are reshaping traditional wealth management strategies.

The integration of digital assets into investment portfolios presents both exciting opportunities and unique challenges for investors. In this post, we’ll explore how to effectively incorporate digital assets into your wealth management approach, ensuring you’re well-positioned for the future of finance.

Understanding Digital Assets in Wealth Management

Definition and Types of Digital Assets

Digital assets represent a new frontier in wealth management. These electronically-stored items of value can be owned, transferred, or traded. They include cryptocurrencies (such as Bitcoin and Ethereum), non-fungible tokens (NFTs), tokenized securities, and digital representations of traditional assets. The diversity of digital assets offers investors a wide range of options to consider for their portfolios.

Market Growth and Trends

The digital asset market has experienced explosive growth in recent years. 67% of institutional investors surveyed view digital assets as having a role in investment portfolios. This surge in interest stems from several factors:

- Potential for high returns

- Innovative underlying technology

- Desire for portfolio diversification

Major cryptocurrencies like Bitcoin and Ethereum have seen significant growth in trading volumes over the past years. This rapid expansion has attracted both individual and institutional investors, leading to increased adoption in wealth management strategies.

Regulatory Landscape

As digital assets gain prominence, regulators worldwide work to establish clear frameworks. In the United States, the Securities and Exchange Commission (SEC) has intensified its focus on digital assets, investigating cases of market manipulation and insider trading. On January 23, 2025, President Trump signed an Executive Order to promote US leadership in digital assets and financial technology.

In Europe, the Markets in Crypto Assets (MiCA) regulation nears completion. It aims to enhance investor protections and set requirements for the crypto market. These evolving regulations underscore the importance of working with experienced wealth management firms (like Davies Wealth Management) who stay informed about regulatory changes and can guide clients through the complexities of digital asset investments.

Portfolio Diversification Benefits

Digital assets offer unique diversification benefits due to their often uncorrelated performance with traditional investments. This characteristic makes them a valuable tool for risk management within a broader investment strategy. Incorporating a carefully considered allocation of digital assets can potentially enhance overall portfolio performance and reduce risk.

However, investors must approach digital asset investments with caution. The volatility of this market necessitates a thorough understanding of the risks involved and the implementation of robust risk management strategies. Working closely with financial advisors who have expertise in digital assets can help determine the appropriate allocation based on individual risk tolerance and financial goals.

As we move forward, it’s essential to consider the strategies for effectively incorporating digital assets into your wealth management approach. Let’s explore how to determine the right allocation and manage the unique risks associated with these innovative investments.

How to Integrate Digital Assets into Your Portfolio

Determining the Right Allocation

The appropriate allocation of digital assets in your portfolio depends on various factors, including your risk tolerance, investment goals, and overall financial situation. Fidelity Digital AssetsSM offers institutional investors a full-service enterprise-grade platform for securing and trading digital assets.

For individual investors, a conservative allocation (typically no more than 5% of your total portfolio) allows you to gain exposure to the potential upside of digital assets while limiting your overall risk exposure.

Leveraging Diversification Benefits

Digital assets can offer significant diversification benefits due to their low correlation with traditional asset classes. For instance, Bitcoin’s correlation with the S&P 500 surged from 51% pre-event to 69% within 60 days after a specific event, according to data from April 15, 2025. This correlation can help reduce overall portfolio volatility and potentially enhance risk-adjusted returns.

It’s important to diversify within the digital asset space as well. Consider a mix of established cryptocurrencies, emerging altcoins, and even tokenized traditional assets to spread your risk.

Implementing Risk Management Techniques

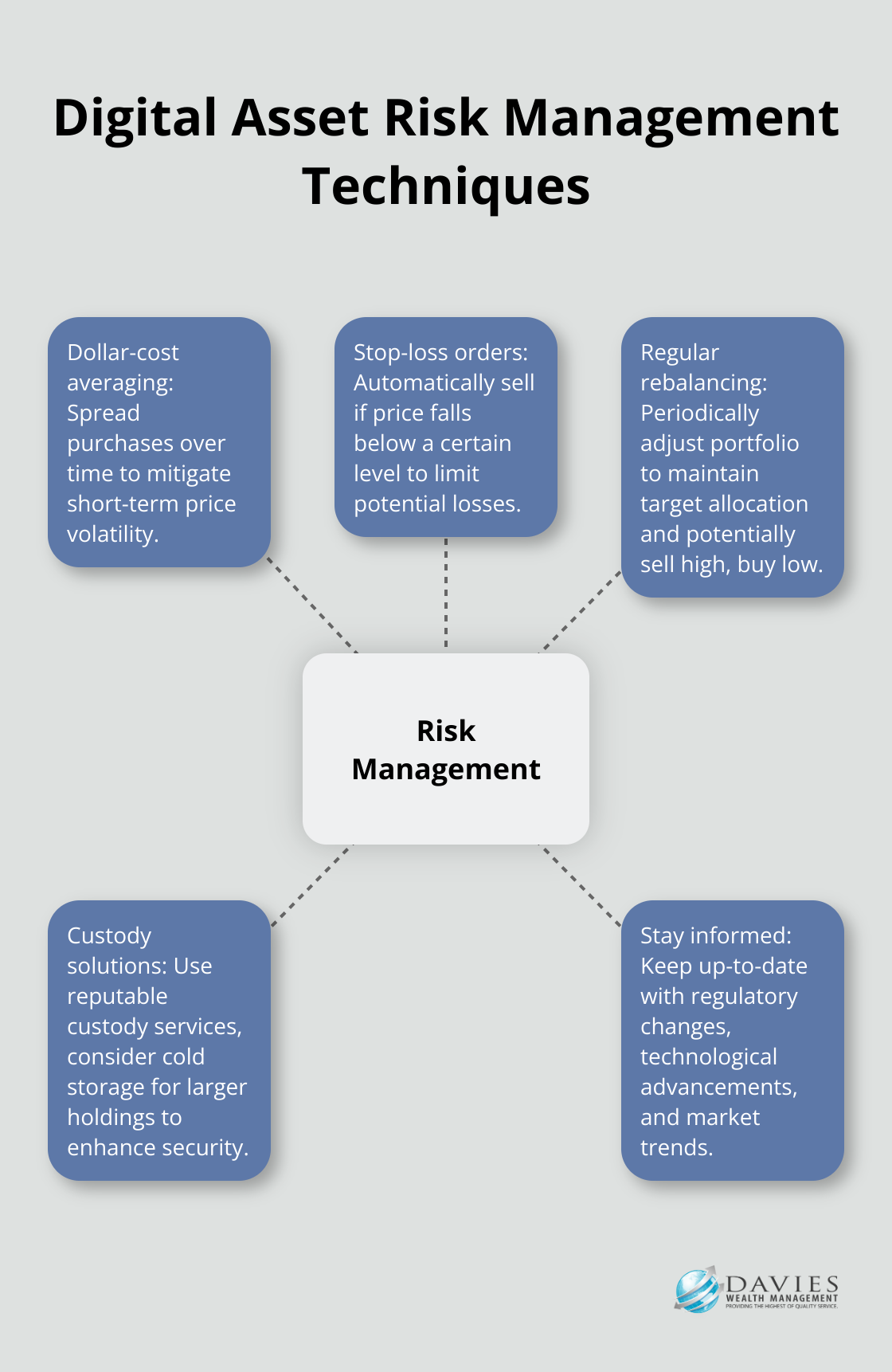

Managing risk is paramount when dealing with digital assets. Here are some practical risk management techniques to consider:

- Dollar-cost averaging: Spread your purchases over time instead of making a large, one-time investment. This strategy can help mitigate the impact of short-term price volatility.

- Stop-loss orders: Use these to automatically sell a digital asset if its price falls below a certain level, helping to limit potential losses.

- Regular rebalancing: As the value of your digital assets fluctuates, periodically adjust your portfolio to maintain your target allocation. This discipline can help you sell high and buy low.

- Custody solutions: Ensure the security of your digital assets by using reputable custody solutions. For larger holdings, consider cold storage options that keep your assets offline and less vulnerable to hacking.

- Stay informed: The digital asset landscape evolves rapidly. Keep up-to-date with regulatory changes, technological advancements, and market trends to make informed investment decisions.

Seeking Professional Guidance

The integration of digital assets into your portfolio requires careful consideration and expertise. Working with experienced professionals who understand both traditional and digital asset markets can provide valuable insights and help you navigate this complex landscape. According to a February 28, 2025 report, the best financial advisors include Zoe Financial, Vanguard Personal Advisor, Facet, Harness Wealth, Empower and Schwab Intelligent.

While digital assets offer exciting opportunities, they also come with unique risks. The next chapter will explore these challenges and considerations in more detail, helping you make informed decisions about incorporating digital assets into your wealth management strategy.

Navigating the Risks of Digital Asset Investments

At Davies Wealth Management, we provide our clients with a comprehensive understanding of both the opportunities and challenges associated with digital asset investments. The potential for high returns attracts many investors, but it’s important to approach this emerging asset class with caution and awareness.

Volatility: A Double-Edged Sword

The digital asset market has historically been known for its price fluctuations. However, recent data suggests that this perception might be changing. For instance, Bitcoin was actually less volatile than 92 of the S&P 500 stocks in October of 2023 when using the 90-day realized historical volatility figures. This indicates that the volatility of digital assets might be comparable to or even lower than some traditional stocks.

Setting strict stop-loss orders can help limit potential losses. However, it’s important to note that in fast-moving markets, these orders may not always execute at the exact price you set.

Security: Protecting Your Digital Wealth

The security of digital assets is a top concern. To protect your digital wealth, we strongly advise using hardware wallets for long-term storage of significant holdings. These physical devices store your private keys offline, making them much less vulnerable to online attacks.

For actively traded assets, only use reputable exchanges with robust security measures. Look for platforms that offer two-factor authentication, cold storage for the majority of funds, and insurance against theft.

Tax Implications: Navigating Complex Waters

The tax landscape for digital assets is complex and evolving. As of April 23, 2025, the IRS states that you may have to report transactions involving digital assets such as cryptocurrency and NFTs on your tax return. Keeping detailed records of all your digital asset transactions is essential for accurate tax reporting.

Some investors have faced unexpected tax bills due to misunderstanding these rules. To avoid such situations, we recommend using specialized crypto tax software to automatically track and categorize your transactions.

Be aware of potential changes in tax regulations. It’s essential to stay informed about regulatory changes that may affect your digital asset investments.

Risk Management Strategies

To effectively manage the risks associated with digital asset investments, consider the following strategies:

- Diversify your digital asset holdings across different types of cryptocurrencies and blockchain projects.

- Regularly rebalance your portfolio to maintain your desired asset allocation.

- Stay informed about market trends, technological developments, and regulatory changes in the digital asset space.

- Use reputable custody solutions to secure your digital assets.

- Consider working with a financial advisor who has expertise in both traditional and digital asset investments.

Final Thoughts

Digital assets have emerged as a significant force in the wealth management landscape. Their integration into investment portfolios offers unique opportunities for diversification and potential returns. However, investors must approach this new asset class with a well-informed strategy and a clear understanding of the associated risks.

The future of digital assets in wealth management looks promising. With increasing institutional adoption and evolving regulatory frameworks, these assets will likely play a more prominent role in investment strategies. As the market matures, more sophisticated investment products and services tailored to digital assets may become available, potentially making them more accessible and manageable for a broader range of investors.

The complexity and rapidly changing nature of digital assets underscore the importance of professional guidance. At Davies Wealth Management, we specialize in helping our clients navigate both traditional and digital asset investments. Our team stays up-to-date with the latest developments in this dynamic field, ensuring that our clients can make informed decisions about incorporating digital assets into their wealth management strategies.

✅ BOOK AN APPOINTMENT TODAY: https://davieswealth.tdwealth.net/appointment-page

===========================================================

SEE ALL OUR LATEST BLOG POSTS: https://tdwealth.net/articles

If you like the content, smash that like button! It tells YouTube you were here, and the Youtube algorithm will show the video to others who may be interested in content like this. So, please hit that LIKE button!

Don’t forget to SUBSCRIBE here: https://www.youtube.com/channel/UChmBYECKIzlEBFDDDBu-UIg

✅ Contact me: TDavies@TDWealth.Net

====== ===Get Our FREE GUIDES ==========

Retirement Income: The Transition into Retirement: https://davieswealth.tdwealth.net/retirement-income-transition-into-retirement

Beginner’s Guide to Investing Basics: https://davieswealth.tdwealth.net/investing-basics

✅ Want to learn more about Davies Wealth Management, follow us here!

Website:

Podcast:

Social Media:

https://www.facebook.com/DaviesWealthManagement

https://twitter.com/TDWealthNet

https://www.linkedin.com/in/daviesrthomas

https://www.youtube.com/c/TdwealthNetWealthManagement

Lat and Long

27.17404889406371, -80.24410438798957

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

772-210-4031

#Retirement #FinancialPlanning #wealthmanagement

DISCLAIMER

The content provided by Davies Wealth Management is intended solely for informational purposes and should not be considered as financial, tax, or legal advice. While we strive to offer accurate and timely information, we encourage you to consult with qualified retirement, tax, or legal professionals before making any financial decisions or taking action based on the information presented. Davies Wealth Management assumes no liability for actions taken without seeking individualized professional advice.

Leave a Reply