Cryptocurrency ownership has surged to over 50 million Americans, yet most fail to include these digital assets in their estate plans. This oversight can lead to permanent loss of valuable holdings for beneficiaries.

We at Davies Wealth Management see families struggling with crypto estate planning complexities daily. Proper planning protects your digital wealth and provides clear inheritance pathways for loved ones.

Understanding Cryptocurrency Assets in Estate Planning

Types of Cryptocurrency Holdings to Consider

Cryptocurrency holdings extend far beyond Bitcoin and Ethereum. Your estate plan must account for staking rewards, DeFi protocol tokens, NFTs, and yield positions. The IRS treats all cryptocurrencies as property, which means each transaction triggers potential capital gains tax events. Professional athletes often hold diverse crypto portfolios that include governance tokens from platforms like Uniswap and Compound, which generate rewards that complicate valuation.

Valuation Creates Major Headaches

Cryptocurrency values fluctuate dramatically within hours, which creates valuation nightmares for estate plans. Bitcoin lost 65% of its value in 2022, while some altcoins dropped over 90%. Estate executors face the challenge to determine fair market value at the time of death, especially for illiquid tokens or those locked in staking contracts. The IRS requires valuation at death for tax purposes, but many digital assets trade on obscure exchanges with limited price discovery.

Tax Implications Hit Hard

Inherited cryptocurrency receives a stepped-up basis, which potentially saves beneficiaries significant capital gains taxes. However, the decedent’s estate may owe taxes if crypto holdings exceed federal exemption limits. State taxes add complexity, with some states like Florida having no inheritance tax while others impose significant levies. Cryptocurrency held in retirement accounts (like traditional IRAs) faces different tax treatment, with beneficiaries required to take distributions within 10 years under current rules.

Documentation Requirements

Estate executors need comprehensive records to handle cryptocurrency transfers properly. Courts require proof of ownership through wallet addresses, transaction histories, and private key access methods. Many crypto holders store assets across multiple platforms and wallets, which makes complete documentation essential for beneficiaries. The probate process treats digital assets similarly to traditional property, but access methods differ significantly from conventional bank accounts or investment portfolios.

These complexities highlight why strategic approaches become necessary when you incorporate digital assets into your comprehensive estate plan.

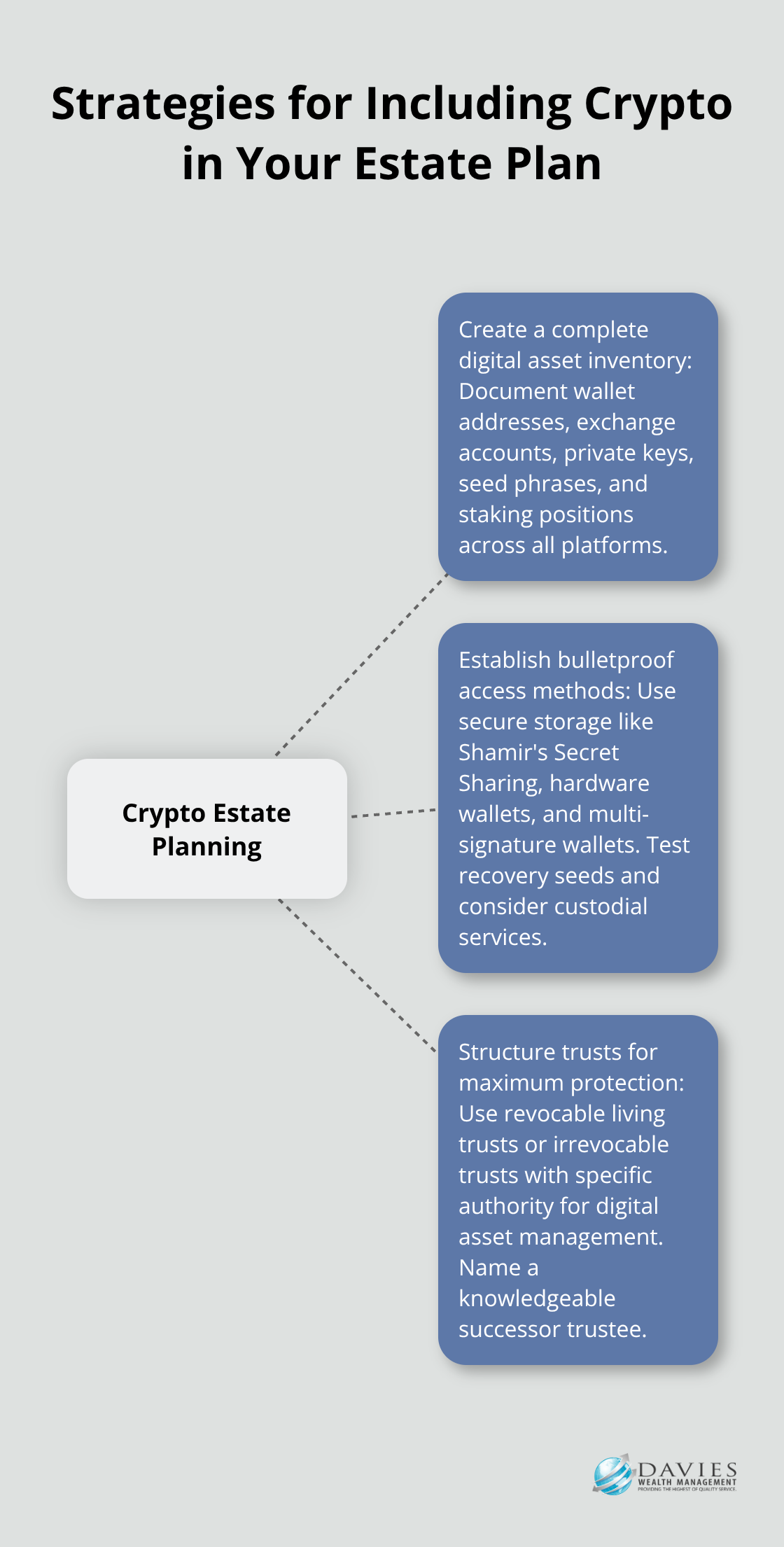

Strategies for Including Crypto in Your Estate Plan

Create a Complete Digital Asset Inventory

Your crypto estate plan starts with a comprehensive inventory that documents every digital asset you own. Record wallet addresses, exchange accounts, private keys, seed phrases, and any staking positions across all platforms. Include specific details on where seed phrases or private keys are stored and how they can be retrieved, as without these your assets become inaccessible.

Document the recovery process for each wallet and exchange account, including two-factor authentication methods and backup codes. Many investors store assets across multiple platforms like Coinbase, Binance, and hardware wallets such as Ledger or Trezor, which requires detailed access instructions for each platform. Update this inventory quarterly as you acquire new assets or change storage methods, because outdated information renders your entire plan worthless.

Establish Bulletproof Access Methods

Traditional password managers cannot handle the complexity of cryptocurrency access requirements. Store private keys and seed phrases in multiple secure locations using methods like Shamir’s Secret Sharing, which splits a secret like a Bitcoin private key into multiple parts called shares among trusted individuals. Never store complete access information in a single location, as significant amounts of Bitcoin tokens remain permanently lost due to inadequate access planning.

Hardware wallets provide superior security but require specific inheritance protocols. Test your recovery seeds while alive to verify they work correctly, as technology failures occur at the worst possible times. Custodial services like Coinbase Custody offer institutional-grade security with built-in inheritance features, though many crypto purists resist giving up self-custody control. Multi-signature wallets require coordination among multiple parties but provide excellent security for high-value holdings.

Structure Trusts for Maximum Protection

Revocable living trusts offer superior privacy and avoid probate complications for cryptocurrency holdings. Structure your trust to grant specific authority for digital asset management, as generic trust language often fails to address crypto-specific requirements. Professional athletes frequently use irrevocable trusts to manage large crypto positions while minimizing estate taxes (especially when holdings exceed federal exemption limits).

Name a successor trustee who understands cryptocurrency technology and market dynamics, as traditional bank trustees typically lack digital asset expertise. Include detailed instructions for handling volatile assets, such as whether to hold or liquidate positions based on market conditions. Florida’s digital assets are governed by the Fiduciary Access Act, requiring you to create an inventory and include them in a will or trust with digital legacy planning.

These protective strategies for incorporating crypto assets into your estate plan form the foundation of effective crypto estate planning, but even the best plans fail when common mistakes derail the process.

Common Pitfalls and How to Avoid Them

Private Key Disasters Strike Without Warning

Approximately 20% of all Bitcoin tokens remain permanently lost due to inadequate access plans, which represents significant unrecoverable wealth. Hardware wallet manufacturer Ledger reports that 25% of their customers lose access to devices within five years, yet most never test their recovery processes.

The most devastating mistake involves storage of private keys or seed phrases in single locations that become inaccessible after death. Families lose six-figure crypto assets because the deceased stored everything on a single encrypted hard drive without shared access methods. Single points of failure destroy more crypto wealth than market crashes (making redundant storage systems absolutely essential for any serious crypto holder).

Documentation Failures Create Legal Nightmares

Inadequate record maintenance transforms crypto assets into digital ghosts that courts cannot recognize or transfer. Estate executors need wallet addresses, exchange account information, transaction histories, and detailed access instructions to prove ownership during probate proceedings.

Many crypto holders maintain mental notes about their assets rather than written documentation, which becomes worthless when they pass away. Courts require comprehensive proof of ownership through blockchain transaction records and private key control, not just password lists or vague references to crypto investments.

Asset Updates Fall Behind Technology

Professional athletes often hold assets across multiple platforms and wallets, which makes complete documentation the difference between successful wealth transfer and permanent loss. The rapid pace of digital asset innovation makes outdated information dangerous for beneficiaries who need current access methods to recover assets.

Update your crypto inventory monthly rather than quarterly. New DeFi protocols launch weekly, staking rewards accumulate automatically, and wallet software updates change access procedures without notice. Static documentation fails when technology evolves faster than your record maintenance schedule. Financial planning strategies help avoid these common pitfalls through systematic approaches to wealth preservation.

Final Thoughts

Crypto estate planning demands systematic execution across three areas: comprehensive documentation, secure access protocols, and regular maintenance schedules. Your digital asset inventory must capture every wallet, exchange account, and staking position with detailed recovery instructions that beneficiaries can follow without technical expertise. Professional guidance becomes essential when crypto holdings represent significant wealth.

Estate attorneys who specialize in digital assets understand the complex intersection of technology, tax law, and probate procedures that generic legal advice cannot address. We at Davies Wealth Management work with families to integrate cryptocurrency holdings into comprehensive wealth management strategies. Professional athletes often hold diverse digital asset portfolios alongside traditional investments (which require specialized planning approaches).

The digital asset landscape evolves rapidly, with new protocols and custody solutions that emerge monthly. Your estate plan must adapt to technological changes while maintaining robust security measures. Davies Wealth Management provides ongoing support to keep your crypto estate planning current with market developments and regulatory changes.

Leave a Reply