At Davies Wealth Management, we understand the importance of financial planning and forecasting for long-term success. These essential practices form the backbone of sound financial management, guiding businesses and individuals toward their goals.

Financial planning and forecasting provide a roadmap for navigating economic uncertainties and capitalizing on opportunities. In this post, we’ll explore how these strategies can transform your financial future and equip you with the tools to make informed decisions.

What Are Financial Planning and Forecasting?

Financial planning and forecasting serve as essential tools for achieving long-term financial success. These practices form the foundation of sound financial management for both individuals and businesses.

Defining Financial Planning

Financial planning is the process of setting goals, developing strategies, and creating a roadmap to achieve financial objectives. It involves analyzing your current financial situation, identifying future needs, and implementing a plan to bridge the gap. The key components of comprehensive financial planning include financial goal setting, cash flow management, tax planning, and retirement planning.

Understanding Financial Forecasting

Financial forecasting predicts future financial outcomes based on historical data, market trends, and economic indicators. It allows individuals and businesses to anticipate potential financial scenarios and make informed decisions. A common type of forecasting in financial accounting involves using pro forma statements, which focus on a business’s future financial position.

Key Components of Effective Financial Planning

Effective financial planning encompasses several important elements:

- Assessment of Current Financial Situation: This provides a clear starting point for your financial journey by examining your assets, liabilities, income, and expenses.

- Goal Setting: Clearly defined objectives guide your financial decisions. These goals should be specific, measurable, achievable, relevant, and time-bound (SMART).

- Risk Management: This involves identifying potential financial risks and implementing strategies to mitigate them. Examples include maintaining an emergency fund, securing appropriate insurance coverage, and diversifying investments.

Short-Term vs. Long-Term Forecasting

Financial forecasting divides into short-term and long-term projections, each serving different purposes:

- Short-Term Forecasting: This typically covers periods up to one year and focuses on immediate financial needs. It helps businesses and individuals make day-to-day financial decisions and manage working capital effectively. Short-term forecasting aids in cash flow management, inventory planning, and budgeting.

- Long-Term Forecasting: Spanning several years or even decades, long-term forecasting is critical for strategic planning and major financial decisions. It assists in areas such as retirement planning, business expansion strategies, and long-term investment decisions.

Strong financial forecasting practices tend to lead to better financial outcomes, more stable cash flow, and better access to credit and investment. The combination of short-term and long-term forecasting in financial plans ensures that immediate financial needs are met while also working towards long-term objectives. This comprehensive approach sets the stage for exploring the numerous benefits that effective financial planning and forecasting can bring to individuals and businesses alike.

How Financial Planning and Forecasting Transform Your Finances

Empowering Informed Decision-Making

Financial planning and forecasting serve as powerful tools that revolutionize financial futures. These practices lead to significant improvements in financial health and decision-making processes. One of the most significant benefits is the ability to make better-informed decisions. A clear picture of the current financial situation and potential future scenarios equips individuals and businesses to allocate resources more effectively. A study by FPA provides evidence of the value of comprehensive financial planning over a self-directed retirement plan.

Mitigating Financial Risks

Financial planning and forecasting play a critical role in risk management. Anticipating potential financial challenges allows the development of strategies to mitigate these risks before they become serious problems. For instance, maintaining an emergency fund (as recommended by many financial advisors) can help buffer against unexpected expenses or income loss. The Federal Reserve reports that when faced with a hypothetical expense of $400, 63 percent of all adults in 2022 said they would have covered it exclusively using cash, savings, or a credit card paid off at the next statement.

Enhancing Stakeholder Communication

For businesses, financial planning and forecasting significantly improve communication with stakeholders and investors. Clear, data-driven financial projections instill confidence in a company’s direction and potential for growth. PwC’s Leading with Insights project foresight capability can deliver projected revenue flow with >95% predictability and reduces time to prediction by 65%.

Tailoring Strategies for Unique Situations

Financial planning and forecasting create a roadmap for financial futures. These practices provide clarity and direction needed to achieve financial goals for various situations:

- Individuals planning for retirement

- Professional athletes managing fluctuating incomes

- Business owners aiming for growth

Specialized firms (like Davies Wealth Management) create tailored financial plans that address the unique needs of each client, ensuring that financial strategies are as individual as the clients themselves.

Adapting to Market Changes

Effective financial planning and forecasting enable quick adaptation to market changes. This flexibility proves invaluable in today’s rapidly evolving economic landscape. Companies and individuals who regularly update their financial plans and forecasts can swiftly adjust their strategies in response to new opportunities or challenges. This proactive approach often results in better financial outcomes and increased resilience in the face of economic uncertainties.

The transformative power of financial planning and forecasting extends beyond mere number crunching. These practices lay the foundation for financial success and stability. The next section will explore practical strategies for implementing effective financial planning and forecasting in your personal or business finances.

How to Implement Effective Financial Planning and Forecasting

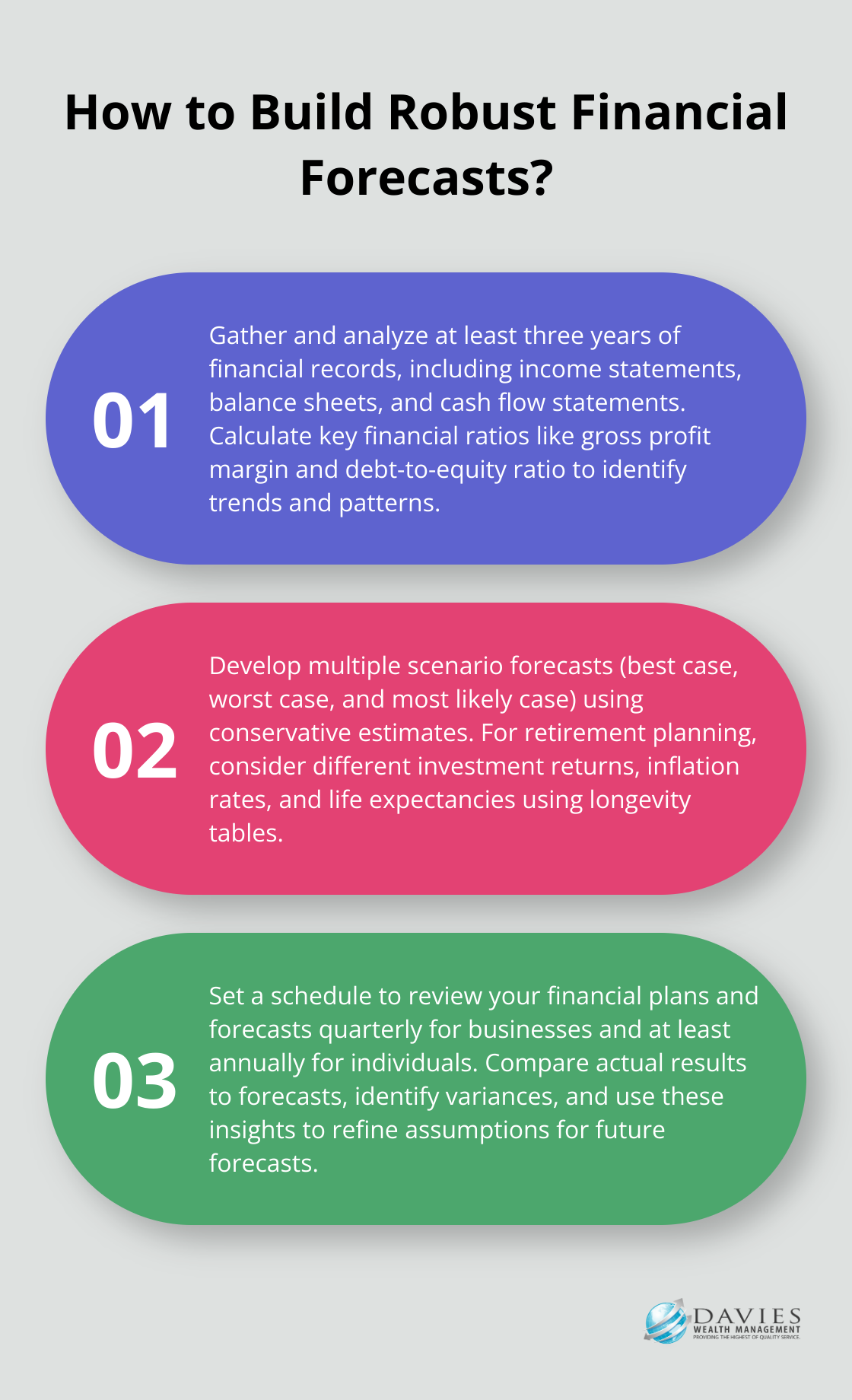

Gather and Analyze Historical Financial Data

The foundation of any solid financial plan or forecast is accurate historical data. Start by collecting at least three years of financial records, including income statements, balance sheets, and cash flow statements. For individuals, this might include bank statements, investment records, and tax returns.

Once you have this data, analyze it for trends and patterns. Look for seasonal fluctuations in income or expenses, identify your biggest cost drivers, and calculate key financial ratios. For businesses, focus on metrics like gross profit margin, current ratio, and debt-to-equity ratio.

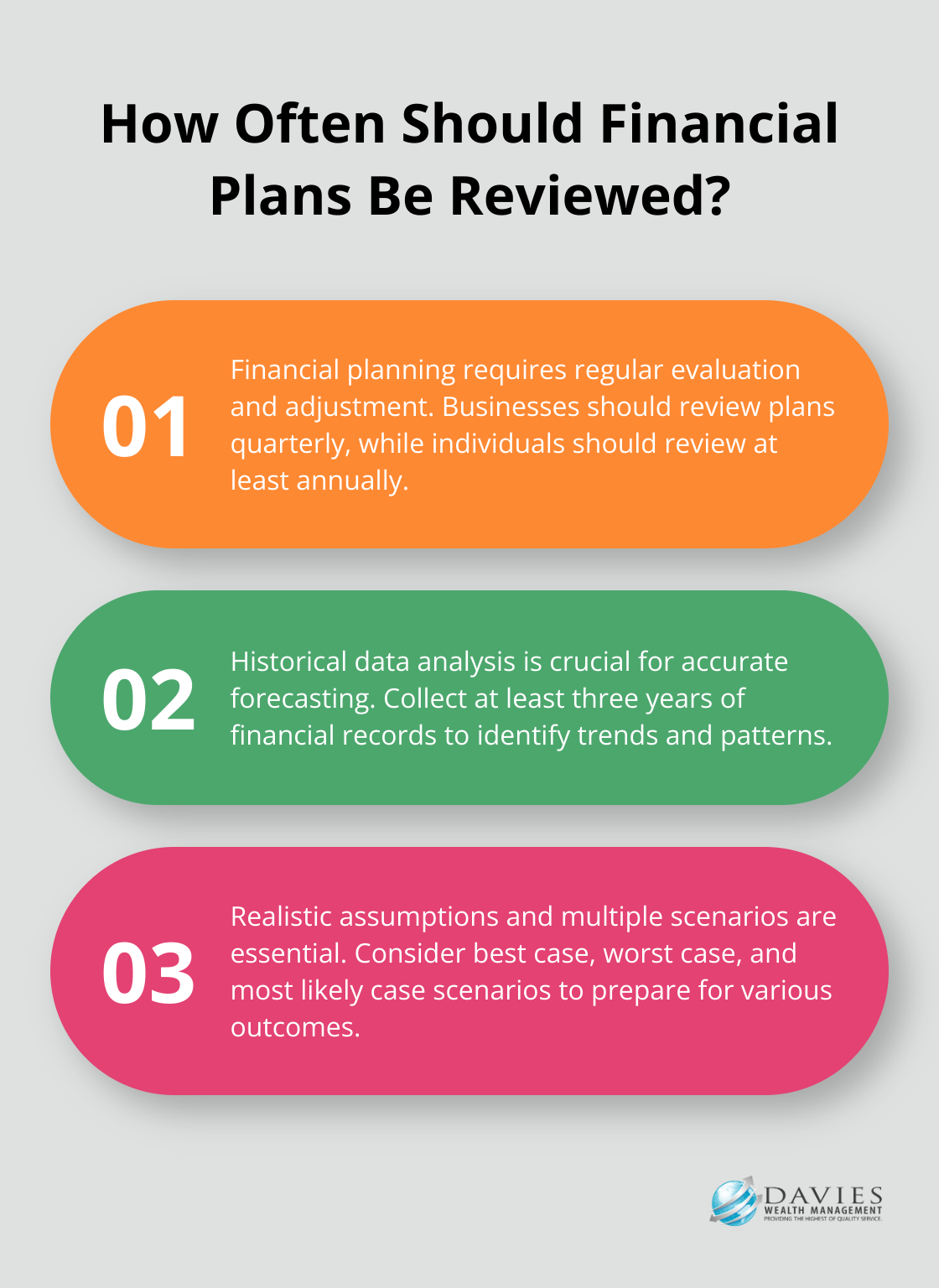

Develop Realistic Assumptions and Scenarios

With your historical data as a foundation, make educated guesses about the future. Be conservative in your estimates to avoid overly optimistic projections. Consider multiple scenarios – best case, worst case, and most likely case – to prepare for various outcomes.

For example, if you plan for retirement, consider scenarios with different investment returns, inflation rates, and life expectancies. Longevity tables (provided by actuarial organizations) can help with these projections.

Utilize Financial Modeling Tools

While spreadsheets can be useful for basic forecasting, more sophisticated tools can provide deeper insights. Many clients benefit from professional-grade financial modeling software that can help businesses understand performance, forecast future situations, and make data-driven decisions.

For those just starting out, personal finance apps can help with personal financial planning. For businesses, enterprise planning platforms offer robust forecasting capabilities.

Regular Review and Adjustment

Financial planning and forecasting is an iterative process requiring regular evaluation and adjustment. Set a schedule to review your plans and forecasts – quarterly for businesses, and at least annually for individuals.

During these reviews, compare your actual results to your forecasts. Identify any significant variances and understand why they occurred. Use these insights to refine your assumptions and improve the accuracy of future forecasts.

The goal isn’t perfect prediction, but rather to create a flexible framework that can guide your financial decisions. These strategies will equip you to navigate your financial future with confidence.

Final Thoughts

Financial planning and forecasting provide essential tools for navigating the complex world of finance. These practices create a roadmap for individuals and businesses to achieve their financial goals, manage risks, and adapt to changing market conditions. The importance of financial planning and forecasting cannot be overstated, as they serve as the foundation for long-term financial success.

Financial planning and forecasting enable you to anticipate challenges, seize opportunities, and build a secure financial future. You can make informed decisions, allocate resources efficiently, and communicate clearly with stakeholders through these practices. Regular review and adjustment of your plans and forecasts ensure they remain relevant and effective in the face of changing circumstances.

At Davies Wealth Management, we understand the critical role that comprehensive financial planning and forecasting play in achieving your financial objectives. Our team of experts provides personalized wealth management solutions tailored to your unique needs and goals. We guide you every step of the way, whether you want to secure your retirement, manage your wealth as a professional athlete, or grow your business.

Leave a Reply