At Davies Wealth Management, we believe in the transformative power of wealth coaching. This personalized approach goes beyond traditional financial advising, offering a comprehensive strategy to reshape your financial future.

Wealth coaching provides ongoing support, accountability, and expert guidance to help you achieve your financial goals. It’s not just about managing money; it’s about creating a roadmap for long-term financial success and peace of mind.

What Is Wealth Coaching?

The Essence of Wealth Coaching

Wealth coaching represents a comprehensive approach to financial management that surpasses traditional financial advising. It focuses on your entire financial picture, not just investments. This approach involves the creation of a tailored roadmap that aligns with your unique goals, values, and life circumstances. Wealth coaching addresses all aspects of your financial life, including budgeting, debt management, tax planning, and even your relationship with money.

Beyond Traditional Financial Advising

Traditional financial advisors typically concentrate on managing investments and providing general financial advice. Wealth coaches, however, take a more holistic approach. They explore your personal goals, habits, and behaviors around money to create a comprehensive strategy for long-term financial success.

For instance, a traditional advisor might recommend a diversified investment portfolio based on your risk tolerance. A wealth coach, on the other hand, would also help you understand your spending patterns, develop better financial habits, and align your financial decisions with your life goals.

The Transformative Benefits

Working with a wealth coach can lead to significant improvements in your financial life. According to the Unbiased 2023 Financial Confidence Survey, only 25% of adults consider themselves extremely confident about their finances.

Clients who engage in wealth coaching often report numerous benefits:

- Clarity and Direction: Wealth coaches help define clear, achievable financial goals and create a step-by-step plan to reach them.

- Improved Financial Behavior: Through ongoing coaching, clients develop better money habits and make more informed financial decisions.

- Comprehensive Strategy: The approach addresses all aspects of a client’s financial life, ensuring no stone remains unturned in optimizing wealth.

- Accountability: Regular check-ins and progress tracking keep clients motivated and on track towards their financial objectives.

- Expertise and Support: Clients gain access to extensive knowledge and experience (particularly valuable in complex areas like tax planning or estate management).

Specialized Wealth Coaching for Professional Athletes

For professional athletes, specialized wealth management services can be particularly impactful. These services address the unique financial challenges athletes face, such as short career spans and fluctuating income. Tailored strategies help athletes manage their current wealth and secure their long-term financial future beyond their playing years.

As we move forward, it’s important to understand how the wealth coaching process unfolds. The next section will outline the steps involved in this transformative journey, from initial assessment to ongoing support and plan adjustments.

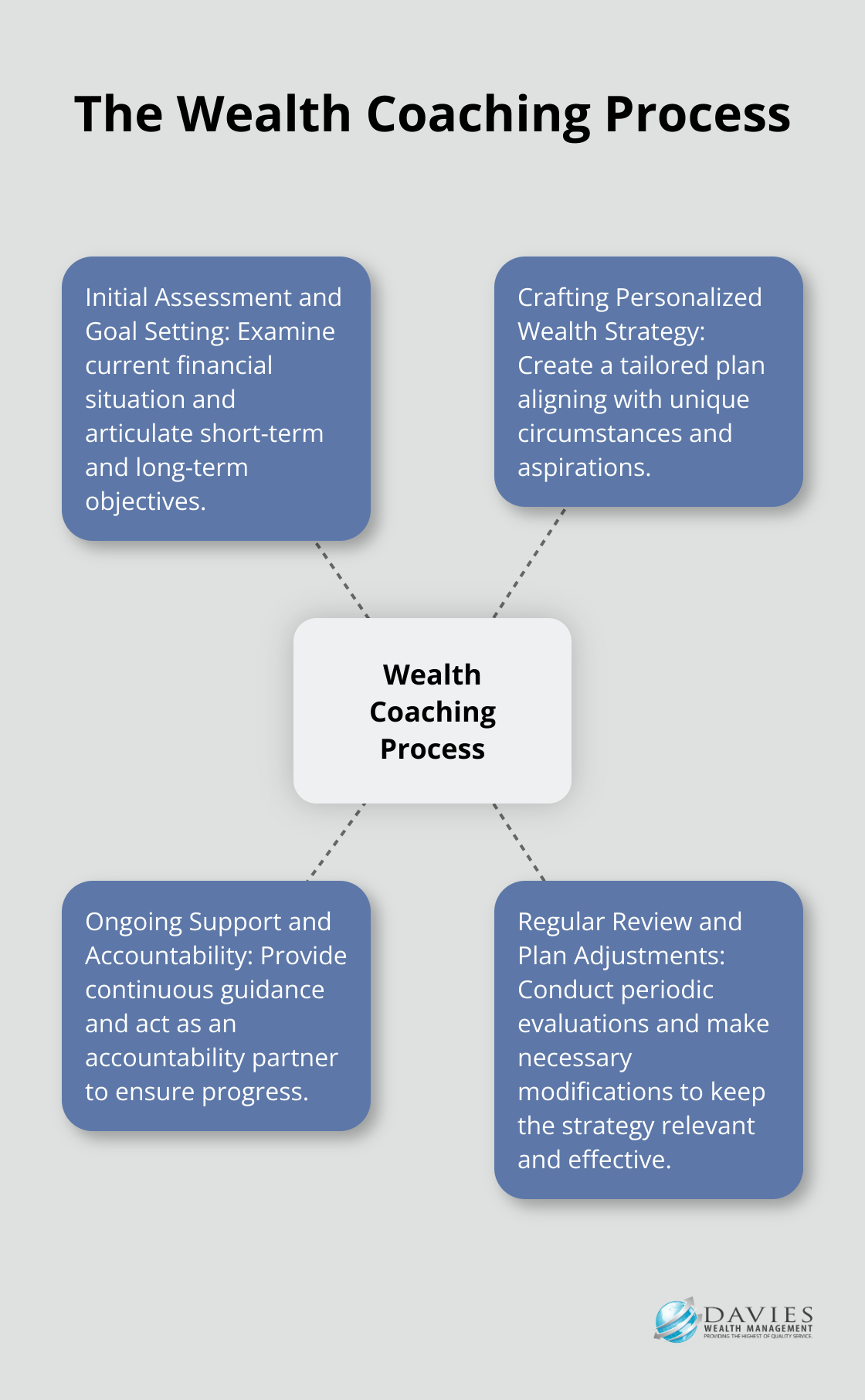

How the Wealth Coaching Process Works

Initial Assessment and Goal Setting

The wealth coaching journey starts with a comprehensive financial assessment. We examine your current financial situation, including income, expenses, assets, and liabilities. This step provides a clear picture of your financial standing.

During this phase, we focus on setting goals. We help you articulate your short-term and long-term financial objectives. These may include buying a home, funding your children’s education, or planning for retirement. For professional athlete clients, we pay special attention to goals related to post-career financial stability.

Crafting Your Personalized Wealth Strategy

Based on the initial assessment and your defined goals, we create a tailored wealth strategy. This strategy is not a generic solution but a carefully crafted plan that aligns with your unique circumstances and aspirations.

Your personalized strategy might include a mix of investment recommendations, tax planning techniques, retirement planning strategies, and risk management solutions. For professional athletes, we might focus on creating a strategy that addresses the challenges of a short career span and fluctuating income (which are common in the sports industry).

Ongoing Support and Accountability

Wealth coaching is not a one-time event but a continuous process. We provide constant support and act as your accountability partner to ensure you stay on track with your financial goals.

This support includes regular check-ins, where we discuss your progress, address any concerns, and provide guidance on financial decisions. We also offer educational resources to enhance your financial literacy, which empowers you to make informed decisions about your wealth.

Regular Review and Plan Adjustments

Financial markets change, life circumstances evolve, and goals may shift over time. We conduct regular reviews of your wealth strategy and make necessary adjustments.

These reviews allow us to assess the performance of your investments, evaluate the effectiveness of tax strategies, and ensure your wealth plan remains aligned with your current goals and life situation. For professional athlete clients, these reviews are particularly important as we navigate the transition from active playing career to post-retirement financial stability.

The wealth coaching process is dynamic and adaptable. It ensures that your wealth strategy remains relevant, effective, and aligned with your evolving financial goals. This comprehensive approach provides you with the tools, knowledge, and support to achieve lasting financial success. In the next section, we’ll explore the key areas that wealth coaching addresses to transform your financial future.

What Does Comprehensive Wealth Coaching Cover?

Investment Strategy and Portfolio Management

At Davies Wealth Management, we create investment strategies tailored to your goals, risk tolerance, and time horizon. We focus on diversified portfolios that balance risk and potential returns. A personalized investment strategy is a tailored approach to managing your wealth and achieving your financial goals.

For professional athlete clients, we implement strategies that account for unique income patterns in sports careers. This includes a mix of conservative and growth-oriented investments to provide both stability and long-term wealth accumulation.

Retirement Planning and Pension Optimization

Retirement planning forms a cornerstone of wealth coaching. A comprehensive retirement plan should define specific goals, such as when you want to retire, the lifestyle you wish to maintain, and estimated expenses. We help you calculate your retirement savings needs and develop strategies to reach that goal. This includes optimizing pension plans and exploring additional retirement savings vehicles (like IRAs and 401(k)s).

For athletes, we create robust retirement plans that account for potentially shorter career spans. We recommend higher savings rates during peak earning years and explore alternative investment options to ensure financial security post-retirement.

Tax Efficiency and Estate Planning

Tax efficiency plays a key role in wealth accumulation. Our wealth coaches employ various strategies to minimize your tax burden legally. This might include tax-loss harvesting, strategic asset location, and utilizing tax-advantaged accounts.

Estate planning is another critical area we address. We help you create a comprehensive plan to protect your assets and ensure their distribution according to your wishes. This includes strategies for minimizing estate taxes and setting up trusts when appropriate.

Debt Management and Credit Optimization

Effective debt management can significantly impact your overall financial health. We work with you to develop strategies for paying down high-interest debt and improving your credit score. This can lead to better loan terms and increased financial flexibility in the future.

Risk Management and Insurance Planning

Protecting your wealth is just as important as growing it. We assess your risk exposure and recommend appropriate insurance coverage (including life, disability, and long-term care insurance). This guide explores key insights on how to build financial security through thoughtful and comprehensive insurance planning.

Final Thoughts

Wealth coaching transforms financial futures. At Davies Wealth Management, we witness significant improvements in our clients’ financial lives through this comprehensive approach. Our holistic solution addresses every aspect of finances, from investment strategies to tax planning, surpassing traditional financial advice.

The benefits of wealth coaching extend beyond wealth accumulation. It aligns financial decisions with life goals and values, leading to greater financial confidence and peace of mind. Our ongoing support and accountability help clients stay on track with their financial objectives (even as life circumstances change).

Davies Wealth Management offers personalized, comprehensive wealth management solutions. Our experienced professionals guide individuals, families, business owners, and professional athletes towards financial security and success. We invite you to explore wealth coaching with us and take control of your financial future today.

Leave a Reply