At Davies Wealth Management, we understand that building lasting financial success requires more than just accumulating assets. Wealth structuring is the key to creating a robust financial foundation that can weather market fluctuations and life changes.

This strategic approach involves organizing your assets, investments, and financial plans to maximize growth potential while minimizing risks and tax liabilities. In this post, we’ll explore how to structure your wealth for long-term success, providing you with practical strategies and insights to secure your financial future.

What is Wealth Structuring?

The Essence of Wealth Structuring

Wealth structuring represents a comprehensive approach to organize financial resources for optimal growth, protection, and longevity. This process proves essential for anyone serious about building and maintaining wealth over time.

Key Components of a Solid Wealth Structure

A robust wealth structure typically includes several vital elements:

- Strategic Asset Allocation: This involves distributing investments across various vehicles, such as stocks, bonds, real estate, and other assets. The specific allocation depends on individual goals, risk tolerance, and time horizon.

- Tax-Efficient Strategies: Utilizing tax-advantaged accounts (e.g., 401(k)s and IRAs) or employing sophisticated techniques like tax-loss harvesting can significantly impact returns.

- Risk Management: This encompasses not only investment diversification but also appropriate insurance coverage. A recent study revealed that 51 percent of Americans report owning at least one life insurance policy, indicating stable coverage levels over recent years.

Beyond Basic Financial Planning

While basic financial planning typically focuses on budgeting and saving, wealth structuring adopts a more holistic and long-term view. It considers factors such as estate planning, business succession (where applicable), and strategies for wealth transfer to future generations.

For instance, professional athletes (a group with unique financial circumstances) require specialized wealth structuring. Their strategies might include plans for managing irregular income, preparing for a potentially short career span, and leveraging endorsement opportunities.

The Impact of Proper Wealth Structuring

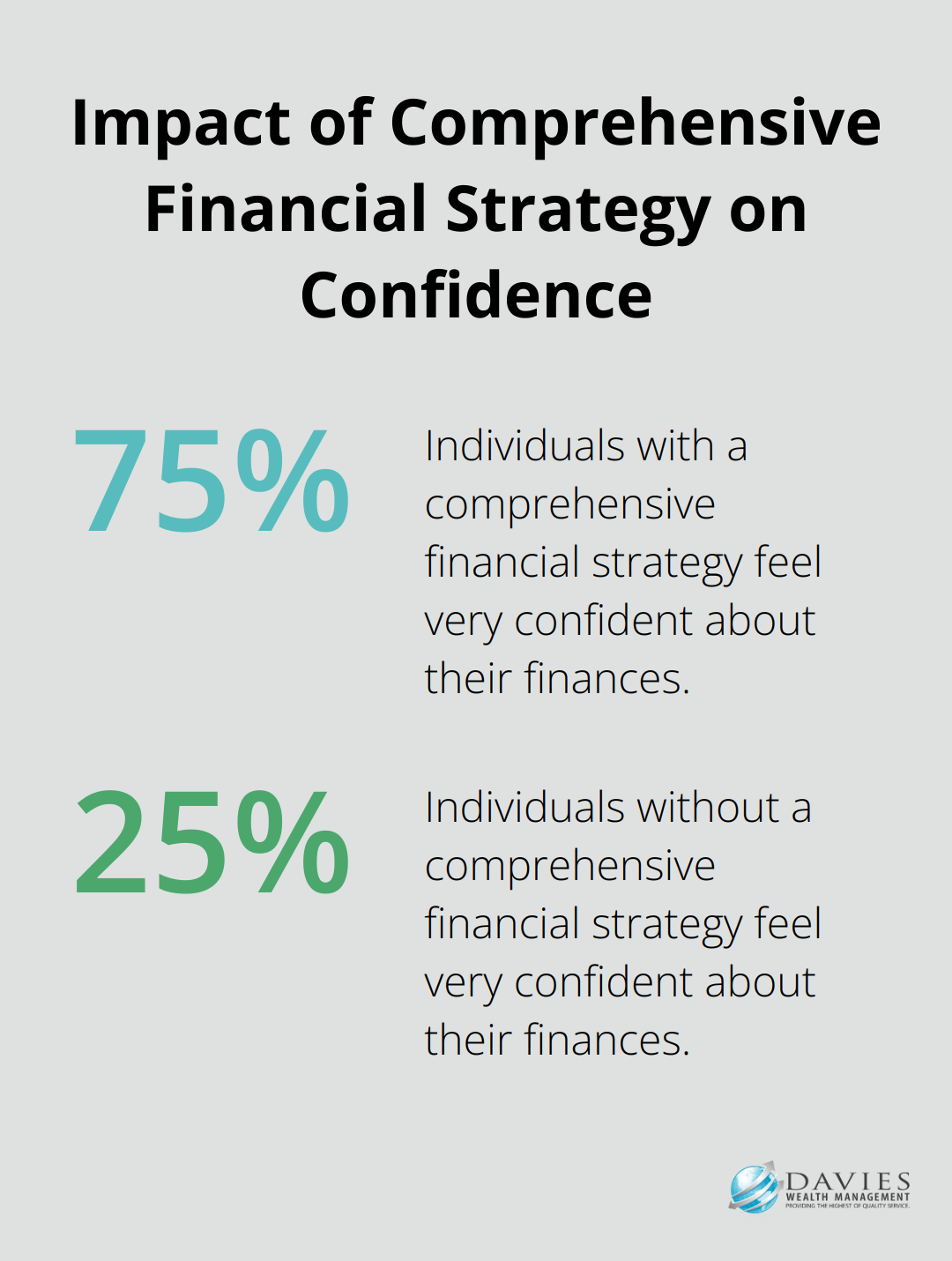

Effective wealth structuring can significantly influence long-term financial success. A study by Merrill Lynch found that individuals with a comprehensive financial strategy were three times more likely to feel “very confident” about their finances compared to those without a plan.

Moreover, proper structuring helps protect wealth from market volatility, unforeseen life events, and potential legal challenges. It’s not just about growing wealth; it’s about preserving it for the long term.

As we move forward, we’ll explore specific strategies for effective wealth structuring, providing you with actionable steps to enhance your financial future. These strategies will help you navigate the complex landscape of wealth management and set you on a path to long-term financial success.

Implementing Effective Wealth Structuring Strategies

Diversification: The Cornerstone of Wealth Protection

Diversification stands as one of the most powerful tools in wealth structuring. Spreading investments across various asset classes and geographical regions can potentially reduce risk while capturing growth opportunities.

A Vanguard study revealed that a globally diversified portfolio outperformed a U.S.-only portfolio in 44% of calendar years from 1970 to 2021. This fact underscores the importance of looking beyond domestic markets for investment opportunities.

Professional athletes (who often have concentrated wealth from their careers) find diversification particularly important. Davies Wealth Management works closely with athletes to create investment strategies that balance current income needs with long-term wealth preservation.

Leveraging Tax-Efficient Investment Vehicles

Maximizing after-tax returns plays a critical role in effective wealth structuring. Tax-efficient investment vehicles help you keep more of what you earn.

Municipal bonds are commonly tax-free at the federal level but can be taxable at state or local income tax levels or under certain circumstances. The Securities Industry and Financial Markets Association reported that the municipal bond market reached $4 trillion in outstanding debt as of 2021, highlighting its significance in investment portfolios.

Exchange-traded funds (ETFs) present another tax-efficient strategy. These investment vehicles often have lower turnover rates compared to actively managed mutual funds, potentially resulting in fewer taxable events for investors.

The Role of Estate Planning in Wealth Transfer

Estate planning forms a crucial aspect of wealth structuring that many overlook. A well-structured estate plan ensures wealth transfer according to your wishes while potentially minimizing tax implications.

Recent data shows that of the estate plans made in 2021, 75.12% were wills, 18.78% were trusts, and 6.1% of people nominated a guardian for their young children. This highlights the importance of comprehensive estate planning.

High-net-worth individuals may benefit from advanced estate planning techniques such as irrevocable trusts. These trusts can help protect assets from creditors and potentially reduce estate tax liabilities.

Risk Management and Insurance Strategies

Effective wealth structuring also involves comprehensive risk management. This includes not only investment diversification but also appropriate insurance coverage.

Recent data shows that 51% of Americans report owning at least one life insurance policy, indicating stable coverage levels over recent years. However, many individuals remain underinsured or lack coverage in critical areas such as disability or long-term care.

A holistic approach to risk management should consider various insurance types (life, disability, property, liability) to protect against unforeseen events that could derail financial plans.

Tailoring Strategies to Unique Circumstances

Wealth structuring strategies should adapt to individual circumstances. For instance, business owners may need to consider succession planning and strategies to protect business assets. Professional athletes might require plans for managing irregular income and preparing for potentially short career spans.

The next chapter will explore how to align your wealth structure with your specific goals and life stages, ensuring your financial strategy evolves as your circumstances change.

How to Personalize Your Wealth Structure

Define Your Financial Objectives

The first step to personalize your wealth structure involves a clear definition of your short-term and long-term financial objectives. You might save for a home purchase in the next five years, plan for retirement in 20 years, or focus on building a legacy for future generations.

A study by the Employee Benefit Research Institute found that only 42% of American workers have calculated how much money they’ll need for a comfortable retirement. This statistic underscores the importance of setting clear, quantifiable goals.

Once you identify your objectives, you can align your investments with your risk tolerance and financial goals for long-term wealth preservation and growth. For a near-future home purchase, you might prioritize more liquid, lower-risk investments. For long-term retirement growth, you might opt for a more aggressive investment strategy with a higher allocation to stocks.

Adapt to Different Life Stages

Your wealth structure should evolve as you progress through different life stages. In your 20s and 30s, you might focus on building a strong financial foundation through consistent savings and aggressive investing. The Bureau of Labor Statistics reports that individuals aged 25-34 save an average of 7.3% of their income.

As you enter your 40s and 50s, your focus might shift towards maximizing retirement contributions and potentially helping children with education expenses. The average 401(k) balance for Americans aged 50-59 is $174,100 (according to Fidelity Investments).

In your 60s and beyond, wealth preservation and income generation become more critical. This might involve adjusting your asset allocation to include more fixed-income investments and implementing strategies for required minimum distributions from retirement accounts.

Address Unique Circumstances

Certain life situations require specialized wealth structuring approaches. For business owners, integrating personal and business financial planning is essential. This might involve strategies like setting up a SEP IRA or solo 401(k) for retirement savings, or implementing a succession plan for the eventual transfer or sale of the business.

Professional athletes face unique challenges due to their potentially short career spans and irregular income. Specialized wealth management can help athletes structure their wealth to provide long-term financial security. This often involves smart investing strategies during peak earning years to maximize their limited time for earnings, diversified investments to create multiple income streams, and comprehensive insurance coverage to protect against career-ending injuries.

Conduct Regular Reviews

Your wealth structure isn’t static. Regular reviews and adjustments are essential to ensure your strategy remains aligned with your goals and current circumstances. A survey by Schwab found that 65% of Americans who work with a financial advisor review their financial plan at least quarterly.

Try to schedule comprehensive reviews at least annually, with more frequent check-ins if you experience significant life changes (such as marriage, divorce, or career transitions). These reviews should assess your progress towards your goals, evaluate the performance of your investments, and consider any necessary adjustments to your strategy.

Final Thoughts

Wealth structuring empowers individuals to secure their financial future through strategic asset organization. This approach maximizes growth potential while minimizing risks and tax liabilities. Effective wealth structuring incorporates diversification, tax-efficient strategies, estate planning, and risk management to create a robust financial foundation.

Your financial strategy must adapt to your unique circumstances, goals, and life stage. Professional guidance can help navigate the complexities of financial planning, tax laws, and investment strategies. Davies Wealth Management specializes in creating comprehensive wealth management solutions tailored to individual needs.

Take action on your financial future now. Define your goals, assess your current financial situation, and explore strategies to protect and grow your wealth. Regular reviews will ensure your wealth structure aligns with your evolving needs and circumstances.

✅ BOOK AN APPOINTMENT TODAY: https://davieswealth.tdwealth.net/appointment-page

===========================================================

SEE ALL OUR LATEST BLOG POSTS: https://tdwealth.net/articles

If you like the content, smash that like button! It tells YouTube you were here, and the Youtube algorithm will show the video to others who may be interested in content like this. So, please hit that LIKE button!

Don’t forget to SUBSCRIBE here: https://www.youtube.com/channel/UChmBYECKIzlEBFDDDBu-UIg

✅ Contact me: TDavies@TDWealth.Net

====== ===Get Our FREE GUIDES ==========

Retirement Income: The Transition into Retirement: https://davieswealth.tdwealth.net/retirement-income-transition-into-retirement

Beginner’s Guide to Investing Basics: https://davieswealth.tdwealth.net/investing-basics

✅ Want to learn more about Davies Wealth Management, follow us here!

Website:

Podcast:

Social Media:

https://www.facebook.com/DaviesWealthManagement

https://twitter.com/TDWealthNet

https://www.linkedin.com/in/daviesrthomas

https://www.youtube.com/c/TdwealthNetWealthManagement

Lat and Long

27.17404889406371, -80.24410438798957

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

772-210-4031

#Retirement #FinancialPlanning #wealthmanagement

DISCLAIMER

The content provided by Davies Wealth Management is intended solely for informational purposes and should not be considered as financial, tax, or legal advice. While we strive to offer accurate and timely information, we encourage you to consult with qualified retirement, tax, or legal professionals before making any financial decisions or taking action based on the information presented. Davies Wealth Management assumes no liability for actions taken without seeking individualized professional advice.

Leave a Reply