At Davies Wealth Management, we understand that reducing your income tax burden is a top priority for many individuals and families.

Implementing effective income tax reduction strategies can significantly impact your financial well-being.

This blog post will explore practical methods to lower your tax liability, from maximizing deductions to utilizing tax-advantaged accounts and implementing smart planning techniques.

By applying these strategies, you can keep more of your hard-earned money and work towards your long-term financial goals.

How to Maximize Your Tax Deductions

Standard vs. Itemized Deductions: Making the Right Choice

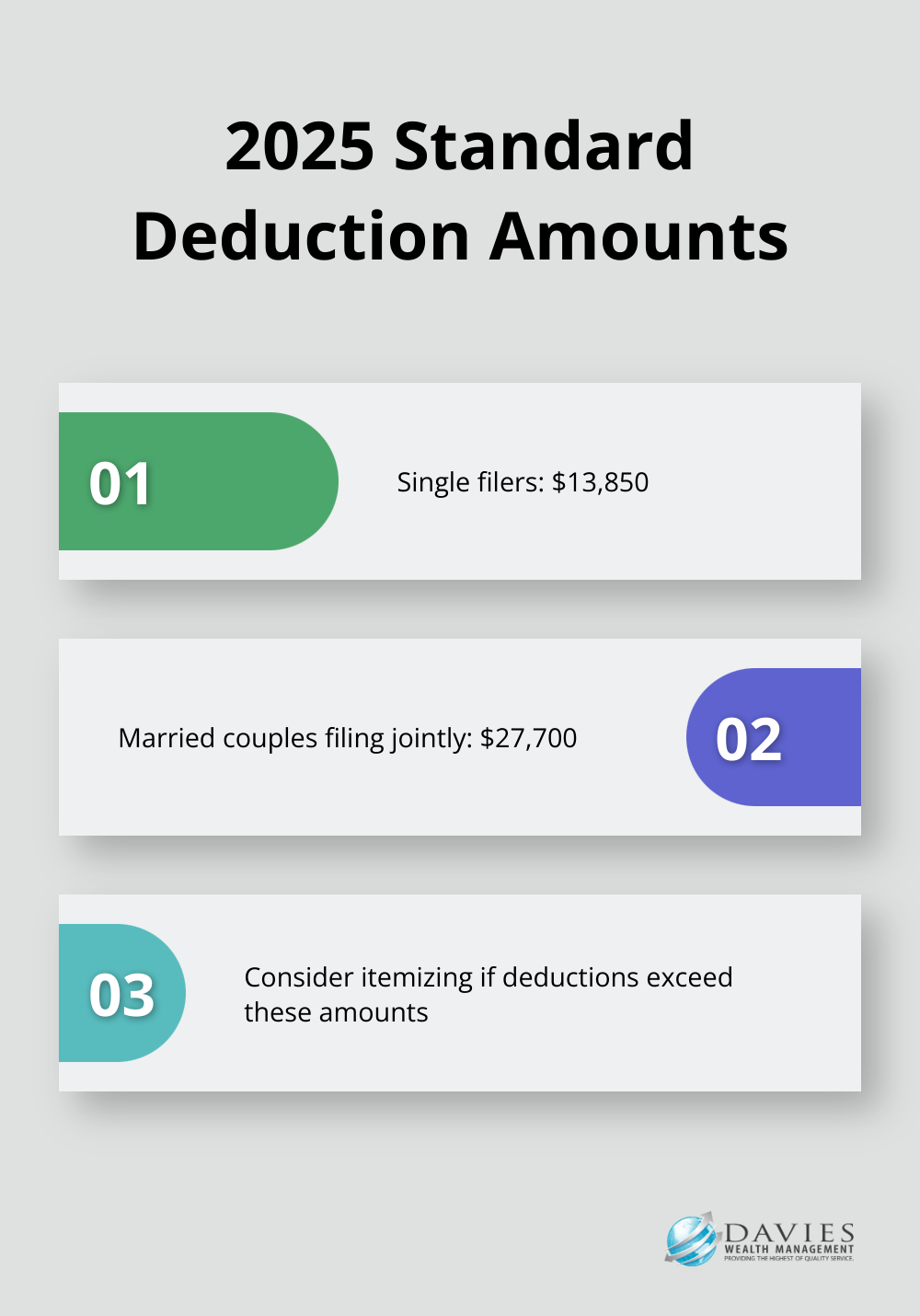

The first step to reduce your income tax burden is to decide between the standard deduction and itemizing. For the 2025 tax year, the standard deduction stands at $13,850 for single filers and $27,700 for married couples filing jointly. If your itemized deductions exceed these amounts, you should consider itemizing for greater tax savings.

Common Itemized Deductions to Consider

When you choose to itemize, several common deductions can quickly add up. You can deduct home mortgage interest on the first $750,000 ($375,000 if married filing separately) of indebtedness, as are property taxes (subject to a $10,000 cap on state and local tax deductions). Charitable contributions provide significant deductions, with cash donations generally deductible up to 60% of your adjusted gross income.

Medical expenses that exceed 7.5% of your adjusted gross income are deductible. This can be particularly beneficial for those with high healthcare costs. Don’t overlook often-missed medical expenses like mileage for doctor visits or health insurance premiums not paid through pre-tax payroll deductions.

Uncovering Often Overlooked Deductions

Many taxpayers miss out on lesser-known deductions that could further reduce their tax liability. For example, self-employed individuals can deduct health insurance premiums for themselves and their families. Additionally, contributions to a Health Savings Account (HSA) are tax-deductible and grow tax-free when used for qualified medical expenses.

Educators can deduct up to $300 for classroom supplies they purchase out of pocket. If you’ve moved for a new job, certain moving expenses may be deductible if you meet specific criteria. Even gambling losses can be deducted (but only to the extent of your gambling winnings).

Tax-Loss Harvesting: A Strategic Approach

For those who have experienced investment losses, tax-loss harvesting can lower your tax bill and better position your portfolio going forward. By selling investments at a loss, you can offset capital gains and potentially reduce your taxable income by up to $3,000 per year.

The Importance of Professional Guidance

Navigating the complex world of tax deductions can be challenging. Professional guidance (such as that provided by Davies Wealth Management) can help you identify all possible deductions, ensuring you’re not leaving money on the table. Expertise in tax-efficient strategies, particularly for individuals with complex financial situations like professional athletes, allows for maximization of deductions while maintaining compliance with tax laws.

As we move forward, it’s important to consider not just deductions, but also how to utilize tax-advantaged accounts to further reduce your tax burden. Let’s explore these powerful tools in the next section.

How Tax-Advantaged Accounts Can Reduce Your Tax Bill

The Power of Retirement Account Contributions

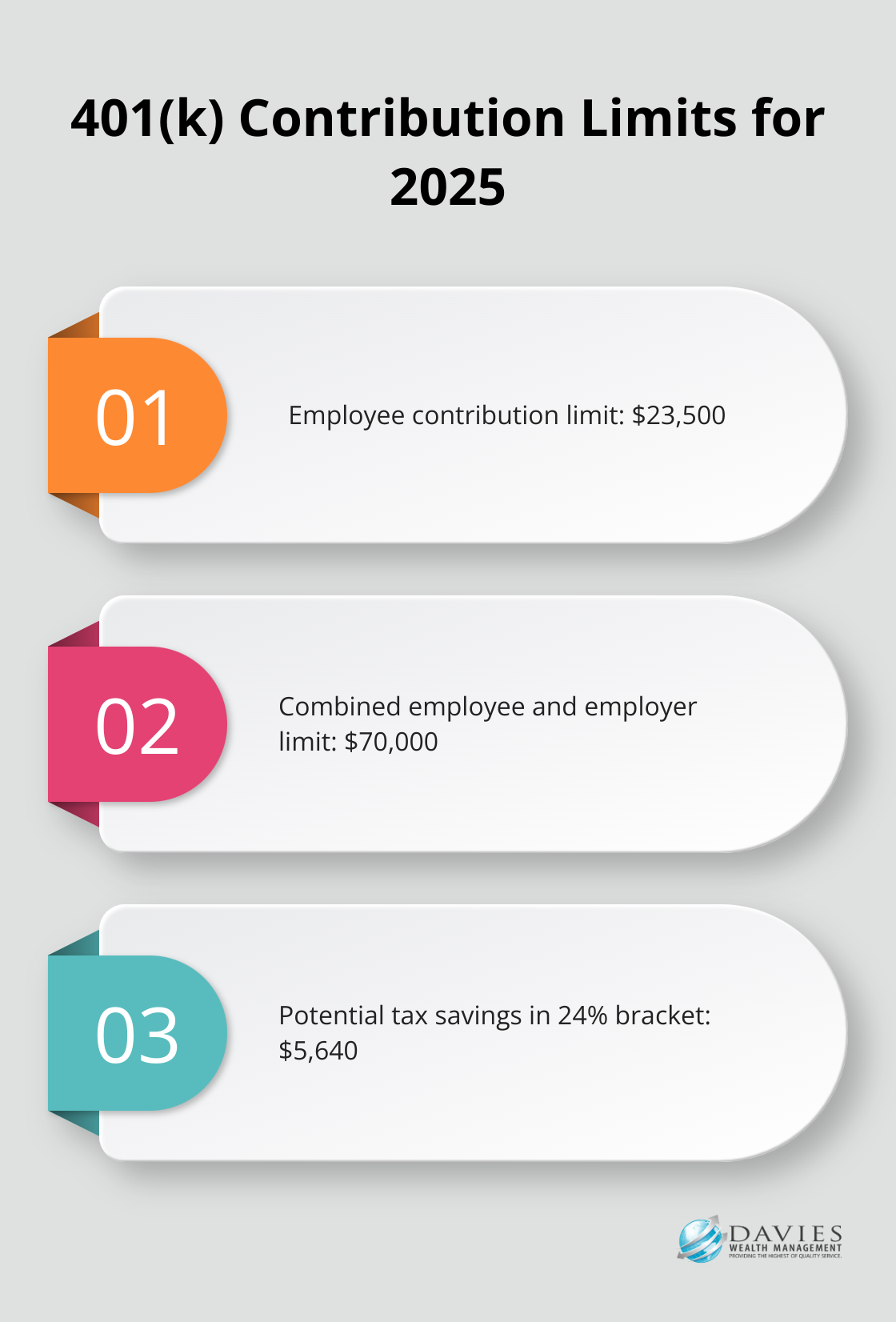

Tax-advantaged accounts offer a robust strategy to reduce your income tax burden while building wealth for the future. Traditional 401(k) plans and Individual Retirement Accounts (IRAs) allow pre-tax dollar contributions, which lower your taxable income for the year. In 2025, you can contribute up to $23,500 to 401(k) plans, with a combined employee and employer contribution limit of $70,000.

Maximizing these accounts can lead to substantial tax savings. For instance, if you fall within the 24% tax bracket and contribute the full $23,500 to your 401(k), you could potentially save $5,640 in taxes for the year. While traditional accounts provide upfront tax benefits, Roth accounts offer tax-free withdrawals in retirement (which may prove advantageous depending on your expected future tax rate).

The Triple Tax Advantage of HSAs

Health Savings Accounts (HSAs) present a unique triple tax advantage: account contributions are pre-tax, earnings are tax-free, and withdrawals for qualified medical expenses are tax-free. For 2025, individuals with high-deductible health plans can contribute up to $4,150, while families can contribute up to $8,300 (those 55 and older can add an extra $1,000 catch-up contribution).

HSAs don’t follow a “use it or lose it” policy. Unused funds roll over year to year, potentially growing tax-free for decades. This feature makes HSAs an excellent vehicle for both reducing current tax liability and saving for future healthcare costs. Some financial experts even recommend HSAs as supplementary retirement accounts due to their tax efficiency.

Immediate Tax Savings with FSAs

Flexible Spending Accounts (FSAs) allow you to set aside pre-tax dollars for healthcare or dependent care expenses. While FSAs typically have a “use it or lose it” policy, they provide immediate tax savings. For 2025, the healthcare FSA contribution limit is $3,300.

FSA contributions reduce your taxable income dollar-for-dollar. If you fall within the 22% tax bracket and contribute the full $3,300 to a healthcare FSA, you could save $726 in taxes. However, you must estimate your expenses accurately to avoid forfeiting unused funds at year-end.

Strategic Use of Tax-Advantaged Accounts

The strategic use of tax-advantaged accounts can significantly impact your overall financial picture. Professional athletes, for example, often face unique financial situations that can benefit greatly from these accounts. Their short career spans and fluctuating income make it essential to maximize tax savings while building a strong financial foundation for the future.

As we move forward, it’s important to consider that tax-advantaged accounts form just one part of a comprehensive tax reduction strategy. The next section will explore additional smart tax planning techniques to further minimize your tax burden and enhance your financial well-being.

Smart Tax Planning Techniques

Master Tax Loss Harvesting

Tax-loss harvesting allows you to sell investments that are down, replace them with reasonably similar investments, and then offset realized investment gains. This strategy involves selling investments that have declined in value to offset capital gains from other investments.

The wash-sale rule prohibits repurchasing the same or substantially identical security within 30 days before or after the sale. To maintain your investment strategy, replace the sold security with a similar (but not identical) one.

Time Income and Expenses Strategically

The timing of your income and expenses can substantially impact your tax bill. Self-employed individuals or those with control over income receipt should consider deferring income to the following year if they expect to be in a lower tax bracket. Conversely, accelerating income into the current year could benefit those anticipating a higher bracket next year.

For expenses, bunch deductions into a single tax year. If your itemized deductions are close to the standard deduction threshold, make two years’ worth of charitable contributions in one year to exceed the threshold and maximize your deductions.

Leverage Charitable Giving for Tax Benefits

Charitable giving supports causes you care about and provides significant tax benefits. One strategy involves donating appreciated securities instead of cash. This allows you to avoid capital gains tax on the appreciation while still claiming the full market value as a charitable deduction.

For those over 70½, Qualified Charitable Distributions (QCDs) can be counted toward satisfying your required minimum distributions (RMDs) for the year, as long as certain rules are met. Donating is a great option for those who don’t need the income from their RMDs.

Another option is to establish a Donor-Advised Fund (DAF). You can take an immediate tax deduction when you make a charitable contribution to your DAF, reducing your tax liability. DAFs allow you to recommend grants to charities over time.

Utilize Advanced Tax Strategies

Professional athletes and high-income earners can benefit from advanced tax strategies. These might include setting up a personal corporation (to take advantage of corporate tax rates), utilizing like-kind exchanges for real estate investments, or exploring opportunities in Qualified Opportunity Zones.

Seek Professional Guidance

Tax laws change frequently, and individual financial situations can be complex. Professional guidance (from firms like Davies Wealth Management) can help you identify all possible tax-saving opportunities. Experts in tax-efficient strategies, particularly for individuals with complex financial situations, can maximize savings while maintaining compliance with tax laws.

Final Thoughts

Effective income tax reduction strategies can significantly impact your financial well-being. Maximizing deductions, utilizing tax-advantaged accounts, and employing smart planning techniques will help you keep more of your hard-earned money. These strategies, combined with strategic timing of income and expenses and careful tax-loss harvesting, can optimize your tax situation.

Professional guidance becomes invaluable when navigating complex and ever-changing tax laws. At Davies Wealth Management, we create tailored, comprehensive wealth management solutions that address the specific needs of our clients. Our expertise in tax-efficient strategies allows us to maximize tax savings while ensuring compliance with current laws.

Proactive tax planning sets up a robust financial framework that supports your long-term goals. As your financial situation evolves and tax laws change, your strategies should adapt accordingly. For personalized advice on how to implement these strategies and optimize your financial plan, we invite you to explore our services at Davies Wealth Management.

Leave a Reply