At Davies Wealth Management, we understand the delicate nature of high-value estate planning. Estate disputes can tear families apart, leaving lasting emotional scars and depleting financial resources.

Preventing these conflicts requires careful planning, open communication, and strategic asset distribution. In this post, we’ll explore effective strategies to safeguard family harmony while managing substantial wealth transfers.

Why Clear Communication Matters in Estate Planning

The Power of Family Meetings

Clear communication forms the foundation of successful high-value estate planning. Regular family meetings about finances serve as a powerful tool for fostering transparency. These gatherings provide a platform to discuss wealth management strategies, estate plans, and any changes that may affect beneficiaries. Communicating your estate plan and ensuring your family understands your long-term wishes is important. Initiating these conversations early and consistently can significantly reduce the risk of disputes.

Addressing Potential Conflicts Proactively

One effective strategy involves the anticipation and addressing of potential conflicts before they escalate. For instance, if you plan an unequal distribution of assets, explain your reasoning to your heirs. This approach can help mitigate resentment and misunderstandings. It’s also important to discuss the management of shared assets (such as family businesses or vacation homes) to align expectations and prevent future disagreements.

The Importance of Explaining Estate Decisions

When you craft your estate plan, documenting the rationale behind your decisions is crucial. This documentation serves two purposes: it provides clarity for your beneficiaries and can serve as evidence of your intentions should any legal challenges arise. Open communication creates understanding and prevents conflicts when addressing wealth distribution, particularly in complex family dynamics.

Documenting Your Wishes

Clear documentation of your wishes in a will and other legal documents can avoid ambiguity in the distribution of assets. This step is particularly important for high-value estates, where the stakes are often higher and the potential for conflict greater. Professional guidance from an experienced estate planning professional helps draft legally sound documents tailored to unique circumstances. Proper legal documentation is a necessary part of estate planning that helps avoid confusion, ambiguity, and potential legal disputes.

Fostering Understanding and Preserving Family Harmony

Effective communication about your estate plan isn’t just about conveying information-it’s about fostering understanding and preserving family harmony. Open dialogue can prevent misunderstandings and conflicts that often arise during wealth transfers. This approach ensures that your legacy is one of financial security and strong family bonds.

As we move forward, let’s explore strategies for equitable distribution, which can further help prevent family conflicts in high-value estate planning.

Balancing Fairness in Asset Distribution

Tailoring Distribution to Individual Circumstances

At Davies Wealth Management, we recognize that equitable asset distribution prevents family conflicts in high-value estate planning. Fairness doesn’t always equate to equal division, and this nuance proves crucial for preserving family harmony.

When you plan your estate, consider each beneficiary’s unique situation. A child with special needs might require more financial support than their siblings. A family member who has significantly contributed to the family business might deserve a larger share. Acknowledging these differences allows you to create a distribution plan that truly reflects your family’s dynamics and needs.

The Power of Explanation in Unequal Distributions

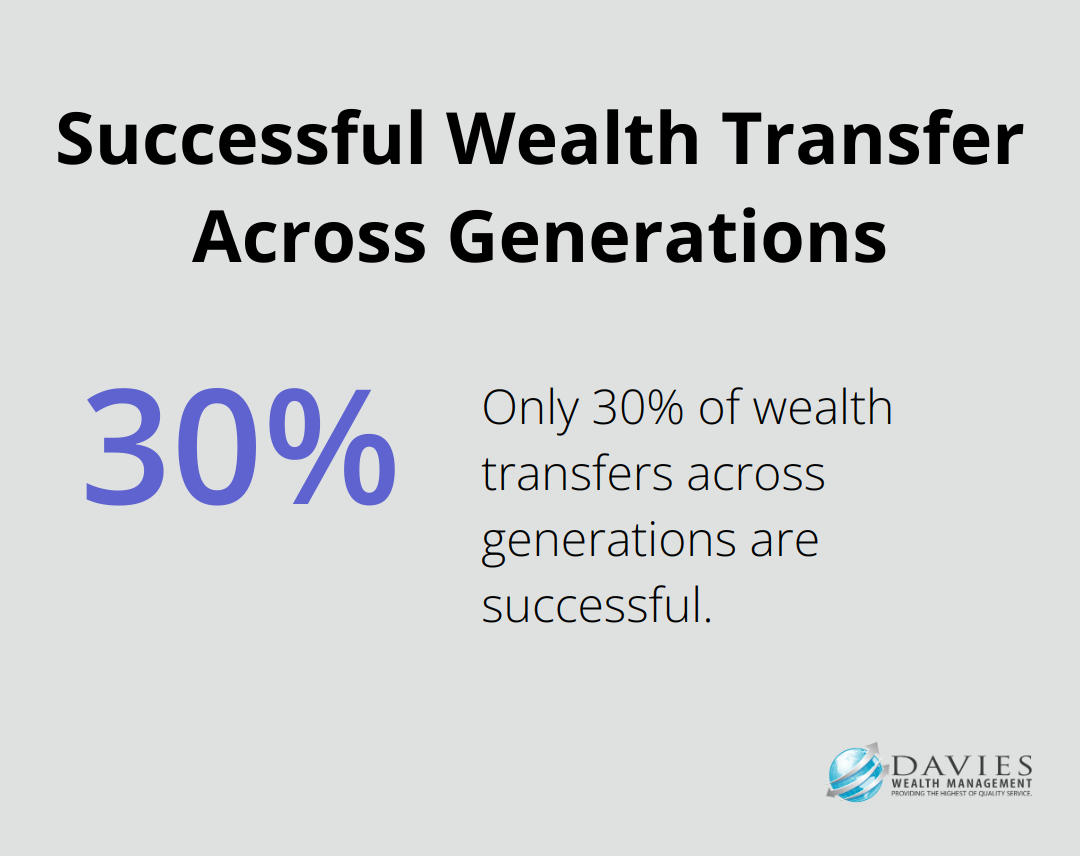

If you decide on an unequal distribution, clear communication becomes even more important. A study found that the successful transfer of wealth across generations is as low as 30 percent. To avoid this, document your reasoning for each decision. This documentation provides clarity for your beneficiaries and can serve as evidence of your intentions should any legal challenges arise.

Leveraging Trusts for Complex Asset Allocation

For high-value estates with complex assets, trusts offer invaluable tools. They provide flexibility in asset distribution and help manage tax implications. For example, a discretionary trust allows the trustee to distribute income and assets based on beneficiaries’ changing needs over time. This approach proves particularly useful when dealing with family businesses or investment portfolios that require ongoing management.

Addressing Unique Family Situations

Professional athletes (a key focus area for Davies Wealth Management) often face unique financial challenges. An athlete’s privacy and estate strategy should be guided by an experienced estate planning attorney, a licensed financial professional, and a tax advisor. In these cases, tailored trust structures can help manage sudden wealth and ensure long-term financial security.

Balancing Flexibility and Control

While trusts offer flexibility, they also allow you to maintain a degree of control over how your assets are used. You can set conditions for distributions (e.g., reaching certain age milestones or achieving specific life goals), ensuring your wealth supports your family’s long-term well-being.

The goal of equitable distribution isn’t to create identical outcomes for all beneficiaries, but to create a fair plan that honors your wishes and maintains family harmony. Considering individual needs, communicating clearly, and utilizing appropriate financial tools creates an estate plan that stands the test of time and preserves your family’s wealth and relationships. As we move forward, let’s explore how professional guidance and mediation can further enhance your estate planning process.

Navigating Complex Estates with Expert Guidance

The Value of Specialized Estate Planning Attorneys

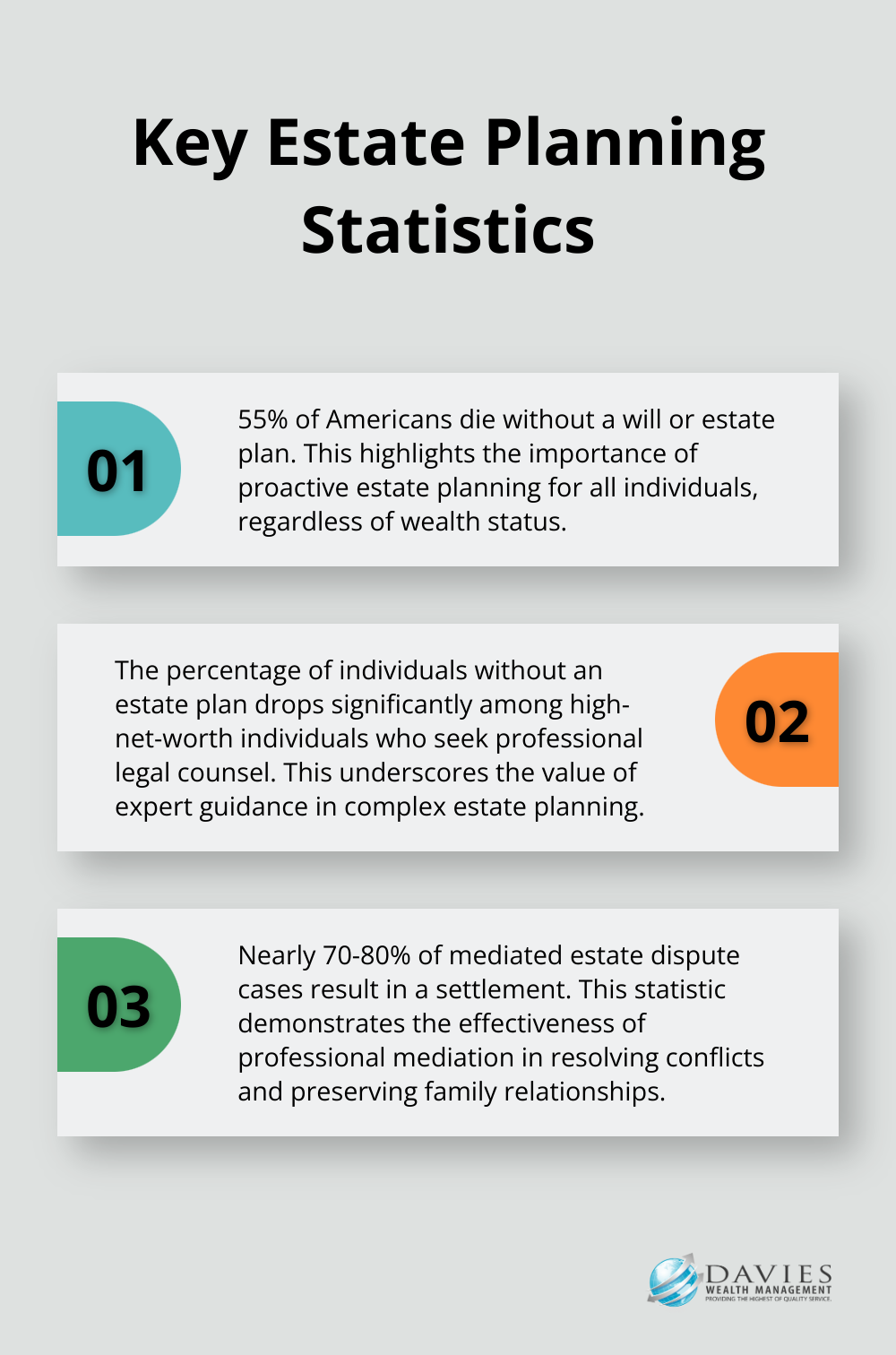

Estate planning is essential for high-net-worth individuals because with greater wealth comes greater complexity and higher stakes. Experienced estate planning attorneys bring invaluable expertise to craft comprehensive estate plans that address complex assets, tax implications, and family dynamics. A survey by the American Bar Association reveals that 55% of Americans die without a will or estate plan. This percentage drops significantly among high-net-worth individuals who seek professional legal counsel.

Estate planning attorneys help navigate state-specific laws, create tailored trusts, and implement strategies to minimize estate taxes. They ensure that estate plans align with overall financial goals and family values.

The Impact of Family Business Consultants

For families with substantial business assets, family business consultants play a vital role in estate planning. These specialists understand the unique challenges of transferring business ownership and help develop succession plans that satisfy both business and family needs.

Integrating estate planning and succession planning is an important issue to address for family companies. Family business consultants can significantly improve these odds by addressing potential conflicts before they arise and creating a clear roadmap for business succession.

The Effectiveness of Professional Mediation

Conflicts can sometimes arise during the estate planning process or after a wealth transfer occurs. In these situations, professional mediators prove invaluable. Mediation offers a confidential, less adversarial alternative to litigation, helping families resolve disputes while preserving relationships.

The success rate of mediation in resolving estate disputes is impressive. Statistics show that nearly 70-80% of mediated cases result in a settlement, highlighting the effectiveness of this approach.

The Role of Financial Advisors

Financial advisors (such as those at Davies Wealth Management) work closely with a network of experienced attorneys, consultants, and mediators to provide comprehensive support throughout the wealth transfer journey. They help create estate plans that not only protect assets but also preserve family harmony for generations to come.

Tailored Solutions for Professional Athletes

Professional athletes face unique financial challenges (including short career spans and fluctuating income). Specialized financial advisors understand these complexities and provide personalized financial planning strategies. These strategies help athletes manage current wealth and secure long-term financial futures beyond their playing years.

Final Thoughts

Preventing family conflicts in high-value estate planning requires a multifaceted approach. Clear communication, proactive conflict resolution, and equitable distribution strategies form the foundation for preserving both wealth and relationships. Professional guidance from experienced estate planning attorneys, family business consultants, and mediators proves invaluable in navigating the complexities of high-value estates.

Estate disputes can tear families apart, leaving lasting emotional scars and depleting financial resources. Proactive planning protects financial assets and safeguards the emotional well-being of future generations. Seeking professional advice is not just beneficial-it’s essential for those dealing with high-value estates.

At Davies Wealth Management, we specialize in comprehensive wealth management solutions, including estate planning strategies for high-net-worth individuals and professional athletes. Our team works with experienced professionals to align your estate plan with your financial goals and family values. We help you build, protect, and transfer your wealth with confidence.

Leave a Reply