At Davies Wealth Management, we understand the critical importance of preparing the next generation for wealth transfer. This process goes beyond simply passing on assets; it’s about equipping heirs with the knowledge and skills to manage and grow their inheritance responsibly.

Effective wealth transfer planning can significantly impact a family’s financial stability and legacy for generations to come. In this post, we’ll explore key strategies and tools to help you navigate this complex but essential process.

Why Wealth Transfer Planning Matters

The Staggering Scale of Wealth Transfer

Wealth transfer planning shapes a family’s financial future. The numbers are staggering: Cerulli projects that $84.4 trillion in assets will change hands through 2045, primarily affecting Generation X, millennials, and Gen Z. This massive transfer of wealth presents both opportunities and challenges for families.

Navigating Common Pitfalls

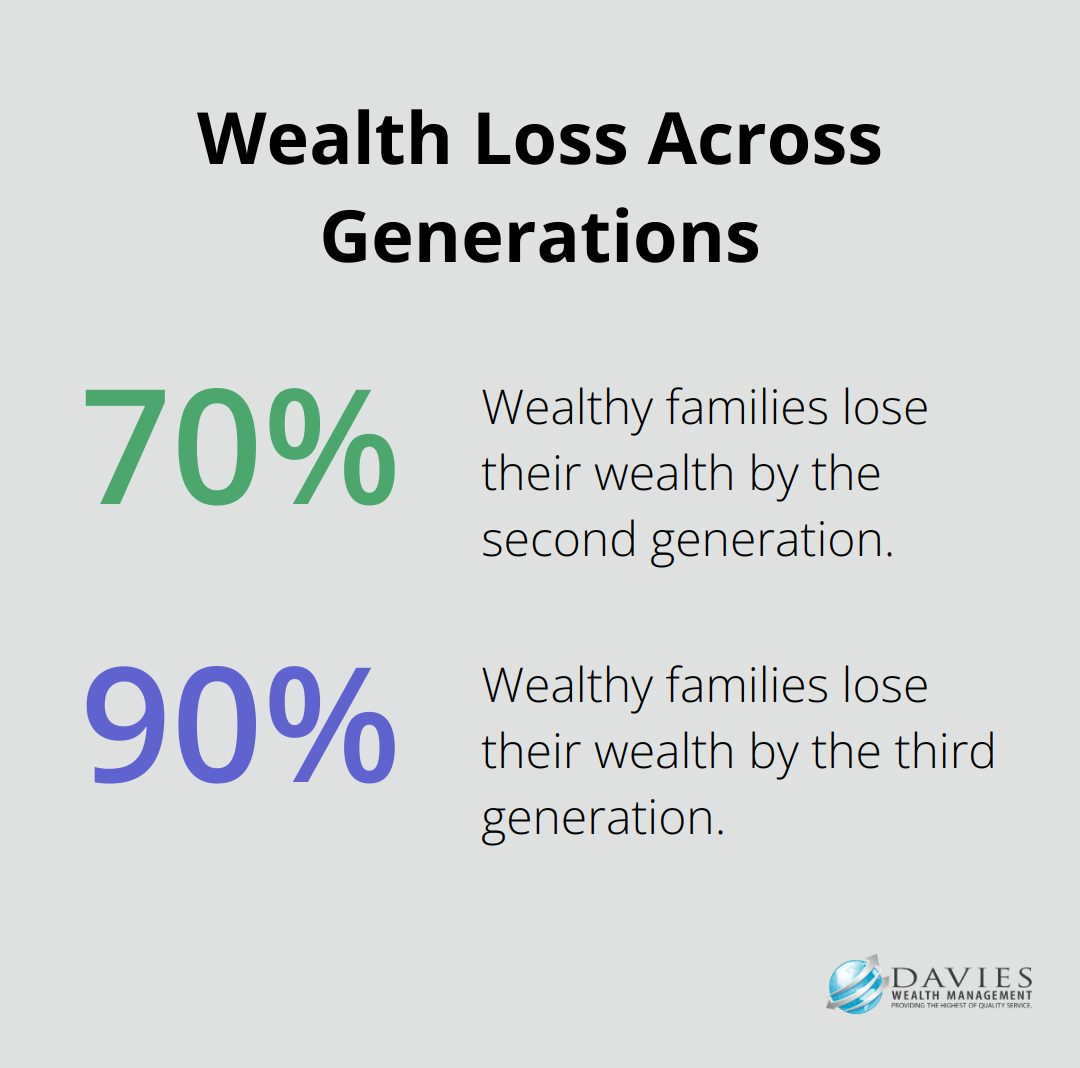

One of the biggest hurdles in wealth transfer is a lack of communication. A study revealed that 70% of wealthy families lose their wealth by the second generation, and 90% by the third. The primary reasons include poor communication, lack of heir preparation, and failure to establish family values.

To avoid these pitfalls, families should start open discussions about wealth early. Parents can involve their children in age-appropriate financial decisions. This approach helps children develop a healthy relationship with money and understand the responsibilities that come with wealth.

Building a Lasting Legacy

Proper planning transcends the preservation of financial assets. It’s about instilling values and creating a lasting family legacy. Families can establish a mission statement that outlines shared values and goals. This statement serves as a guidepost for future generations, ensuring that wealth continues to reflect the family’s principles.

Preparing Heirs for Financial Responsibility

Education plays a key role in successful wealth transfer. Families can work with financial advisors who specialize in intergenerational wealth transfer to create a comprehensive education plan for heirs.

The Ongoing Nature of Wealth Transfer Planning

Wealth transfer planning is not a one-time event but an ongoing process. Regular family meetings, clear communication, and professional guidance form essential components of a successful strategy. Families who take proactive steps now can ensure that their wealth not only survives but thrives for generations to come.

As we move forward, let’s explore specific strategies for educating the next generation about wealth management. These practical approaches will help families prepare their heirs for the responsibilities that come with inherited wealth.

Empowering the Next Generation with Financial Wisdom

Early Financial Education

At Davies Wealth Management, we believe that financial education should start early. Financial education has been linked to lower debt levels, higher savings, and higher credit scores as children mature into adulthood. Children as young as five can grasp basic concepts of saving and spending. Parents can introduce these ideas through games and activities. A simple yet effective method involves using three jars labeled ‘Spend’, ‘Save’, and ‘Share’. This exercise helps children allocate their allowance or gift money, teaching them budgeting skills and the value of money.

As children grow older, parents should introduce more complex financial concepts. By ages 10-12, children can learn about compound interest, the stock market, and basic investing principles. Interactive online resources can make learning about investments engaging and fun for young minds.

Practical Money Management Skills

Teenagers benefit from hands-on experience in money management. Parents should consider opening a checking account for their teen and teach them how to balance a checkbook, use a debit card responsibly, and create a simple budget. Many banks offer teen-specific accounts with parental controls (providing a safe environment for learning).

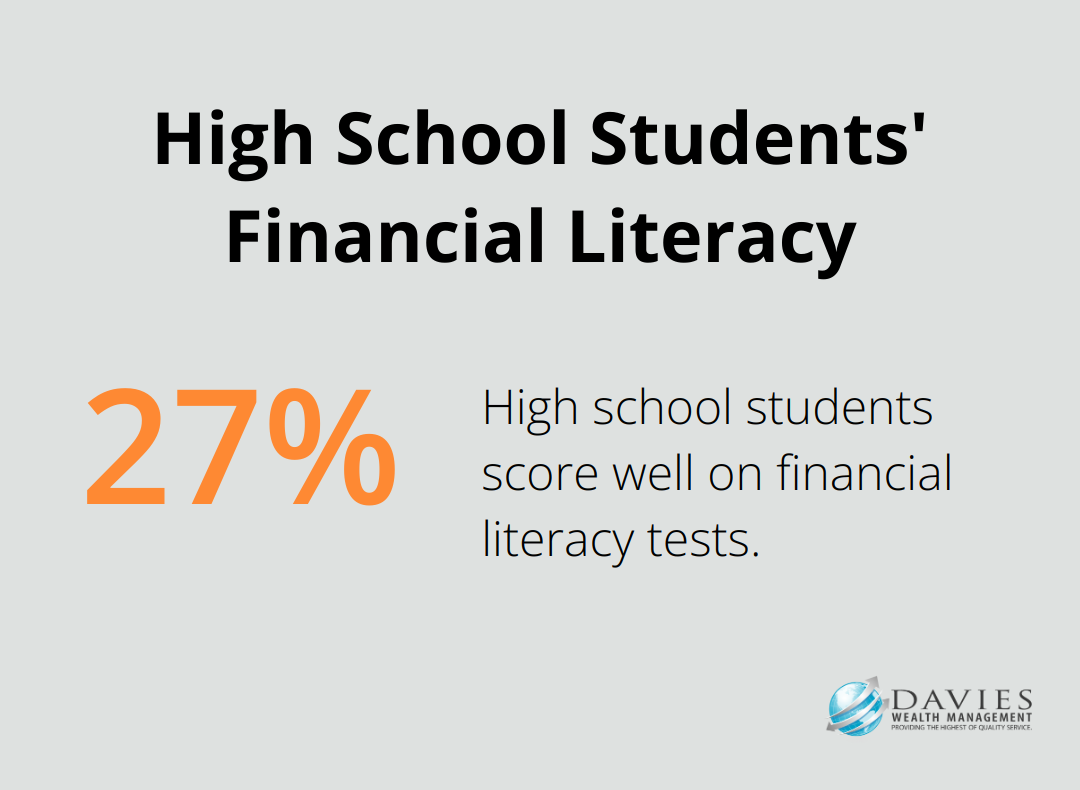

Parents should encourage their children to earn their own money through part-time jobs or entrepreneurial ventures. This real-world experience proves invaluable for understanding the effort required to earn and manage money. Young adults can benefit from early exposure to financial literacy. However, one study found that only 27% of high school students could score well on financial literacy tests.

Family Financial Discussions

Parents should include their children in age-appropriate family financial discussions. These conversations can involve explaining major financial decisions, discussing charitable giving, or reviewing the family budget. Such discussions help demystify money matters and prepare children for future financial responsibilities.

Regular family meetings to discuss financial topics can prove beneficial. Studies show that children whose parents discussed financial matters with them feel more confident about money management as adults.

Professional Guidance

Professional financial advisors can play a significant role in educating the next generation about wealth management. At Davies Wealth Management, we offer expertise in facilitating family discussions about finances, ensuring all generations participate in the wealth transfer process. Our experience in managing wealth for professional athletes and other high-net-worth individuals uniquely qualifies us to address complex financial situations in a family context.

The ultimate goal extends beyond passing on wealth; it involves instilling financial wisdom that will serve the next generation throughout their lives. These strategies set children up for long-term financial success and ensure that family wealth continues to grow for generations.

As we move forward, we’ll explore the legal and financial tools that can facilitate effective wealth transfer, complementing the educational strategies discussed in this chapter. Intergenerational wealth transfer strategies include lifetime financial gifts, education funding, and real estate transfers.

Powerful Tools for Effective Wealth Transfer

Trusts: A Cornerstone of Estate Planning

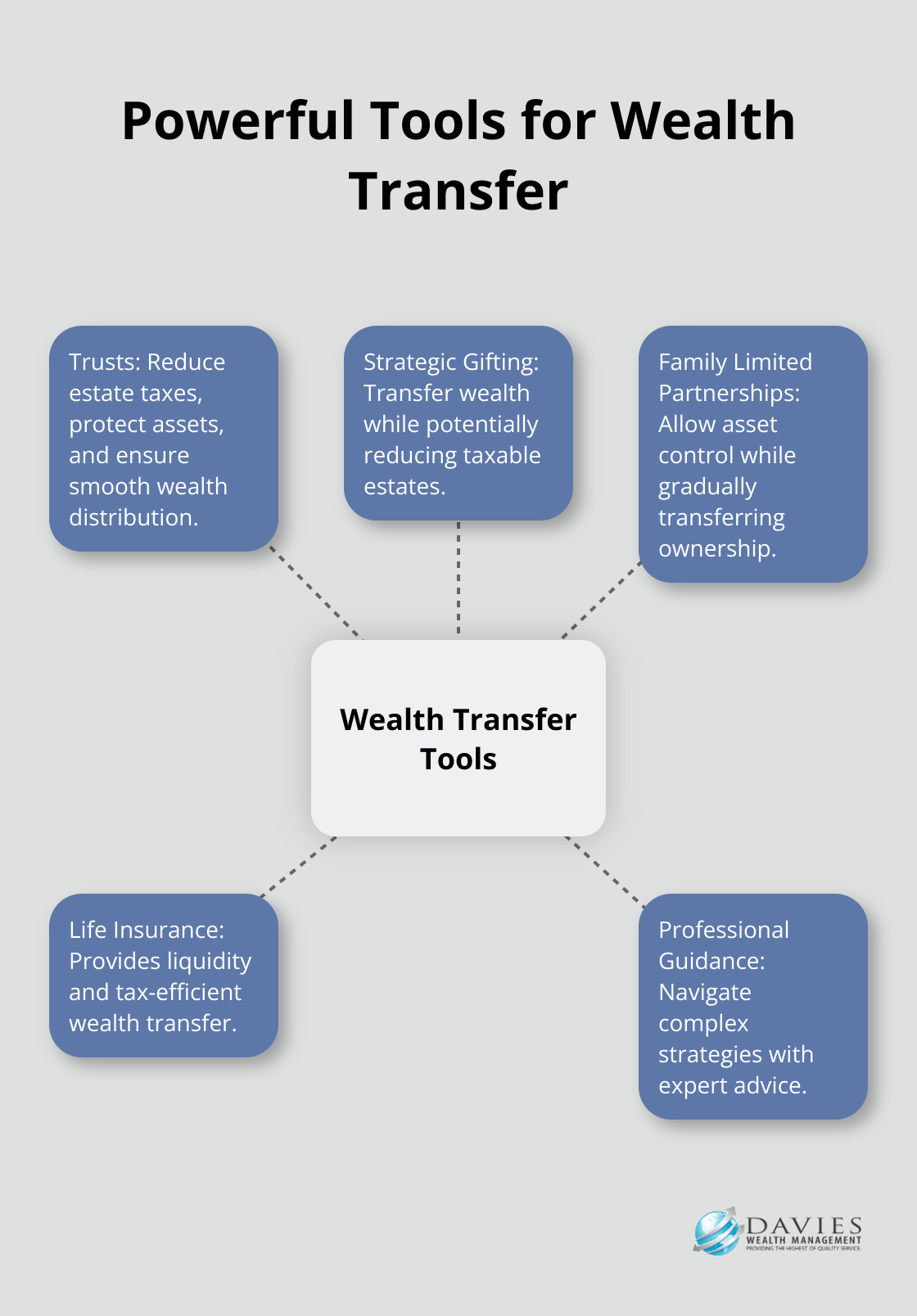

Trusts offer powerful tools for wealth transfer. Setting up a particular kind of trust is an option to help ensure the transfer of wealth between generations without incurring a large tax bill. They help reduce estate taxes, protect assets from creditors, and ensure wealth distribution according to specific instructions. Revocable living trusts allow asset control during one’s lifetime while providing smooth transfer upon death. Irrevocable trusts can minimize estate taxes (as assets placed in these trusts are no longer part of the taxable estate). Special needs trusts ensure beneficiaries receive inheritances without losing eligibility for government benefits.

Strategic Gifting: More Than Just Generosity

Gifting strategies effectively transfer wealth while potentially reducing taxable estates. As of 2025, the annual gift tax exclusion allows gifts up to $19,000 per recipient without triggering gift tax reporting. Married couples have the ability to double this amount. Gifting appreciated assets can be particularly beneficial, transferring future appreciation out of the estate. Recipients may benefit from a step-up in basis, potentially minimizing capital gains tax upon asset sale.

Family Limited Partnerships: A Business Approach to Wealth Transfer

Family Limited Partnerships (FLPs) serve as excellent tools for business owners transferring wealth to the next generation. FLPs allow asset control maintenance while gradually transferring ownership to children or other family members. FLPs offer potential valuation discounts, as limited partnership interests (typically not easily marketable and lacking control) can often be valued at less than their pro-rata share of partnership assets. This can result in significant gift and estate tax savings.

Life Insurance: Protection and Tax Efficiency

Life insurance plays a vital role in many wealth transfer strategies. It provides liquidity to pay estate taxes, equalizes inheritances among heirs, or funds buy-sell agreements in family businesses. Irrevocable Life Insurance Trusts (ILITs) prove particularly useful. The purpose of an Irrevocable Life Insurance Trust is to exclude the value of the life insurance death benefit from your gross taxable estate.

Professional Guidance: Navigating Complex Strategies

The effectiveness of these tools depends on specific situations and goals. Working with experienced professionals guides individuals through the complexities of wealth transfer planning. Whether you’re a business owner, a professional athlete, or simply looking to secure your financial future, seeking expert advice can help navigate these important decisions.

Final Thoughts

Preparing the next generation for wealth transfer requires a multifaceted approach. Families must start financial education early, instilling crucial money management skills and values in their children. This knowledge forms the foundation for responsible wealth stewardship and helps ensure the family’s financial legacy endures.

Legal and financial tools play vital roles in crafting a robust wealth transfer plan. Trusts, strategic gifting, family limited partnerships, and life insurance can help minimize tax implications while distributing wealth according to family wishes. These instruments, when used judiciously, contribute to the preservation and growth of family assets across generations.

At Davies Wealth Management, we specialize in guiding families through the intricate process of wealth transfer. Our expertise extends to serving professional athletes, addressing their unique financial challenges. For personalized guidance on your wealth transfer journey, we invite you to explore our services at Davies Wealth Management.

Leave a Reply